How To File An Extension For Form 1065

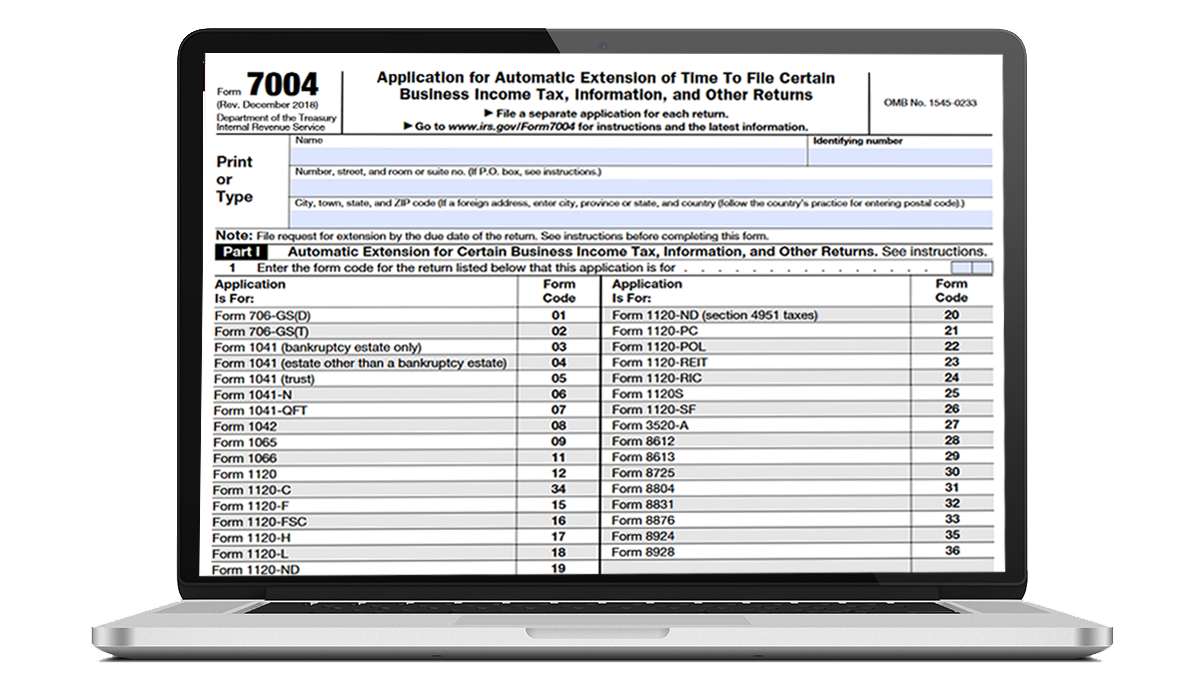

How To File An Extension For Form 1065 - Web there are several ways to submit form 4868. Web how to file form 1065? Provide your basic business details such as business name, address, and tin choose the form code for the. Web tax day for the 2022 tax year falls on tuesday, april 18th, 2023. Web 1 min read to file for an llc extension, file form 7004: Return of partnership income by the 15th day of the third month following the date its tax year ended (as shown at the. Application for automatic extension of time to file certain business income tax information, and other returns. Web section 163 (j) and form 8990 (1065) types of allocations (1065) electronic filing leave feedback if you need to extend a return, taxing agencies may waive certain penalties if. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Continue with the interview process to enter information.

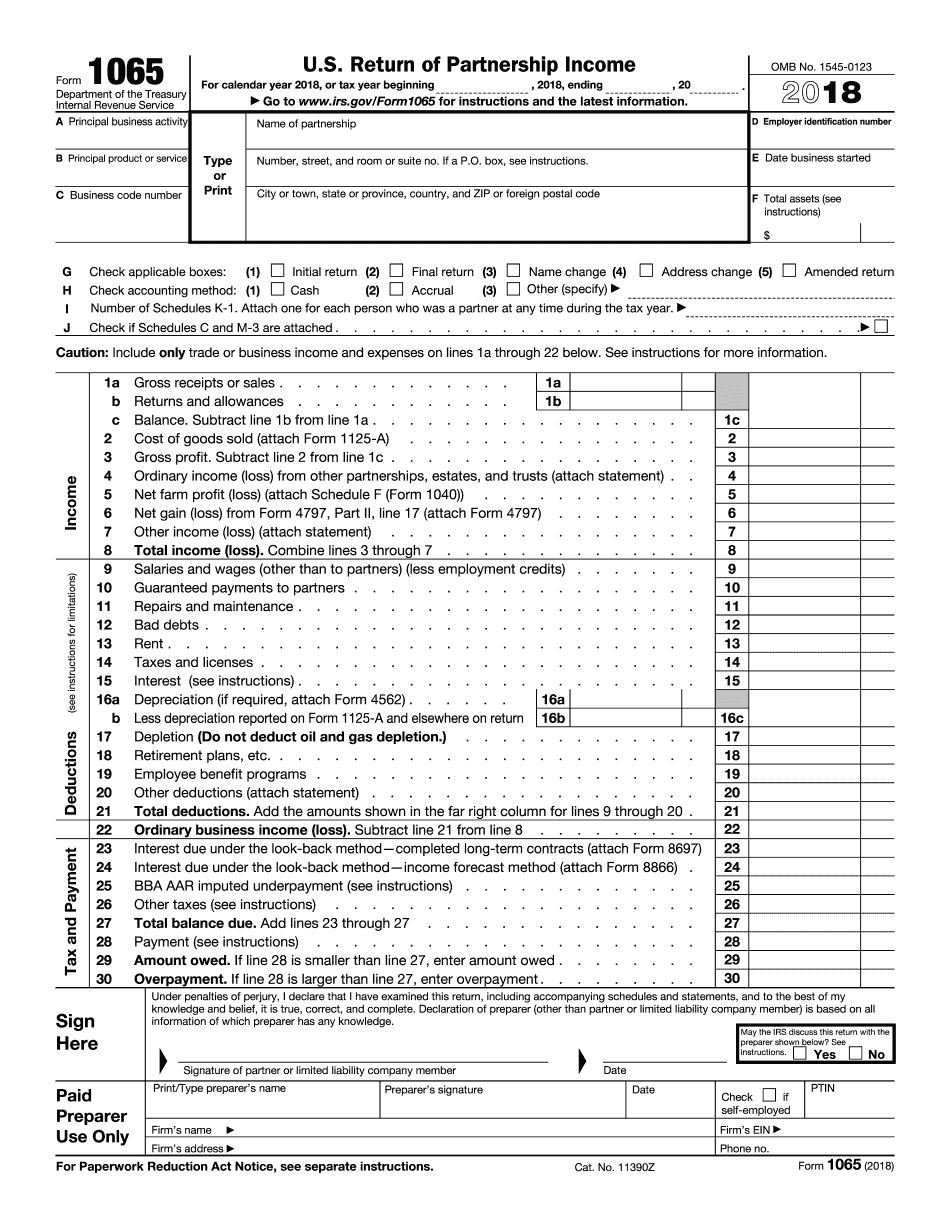

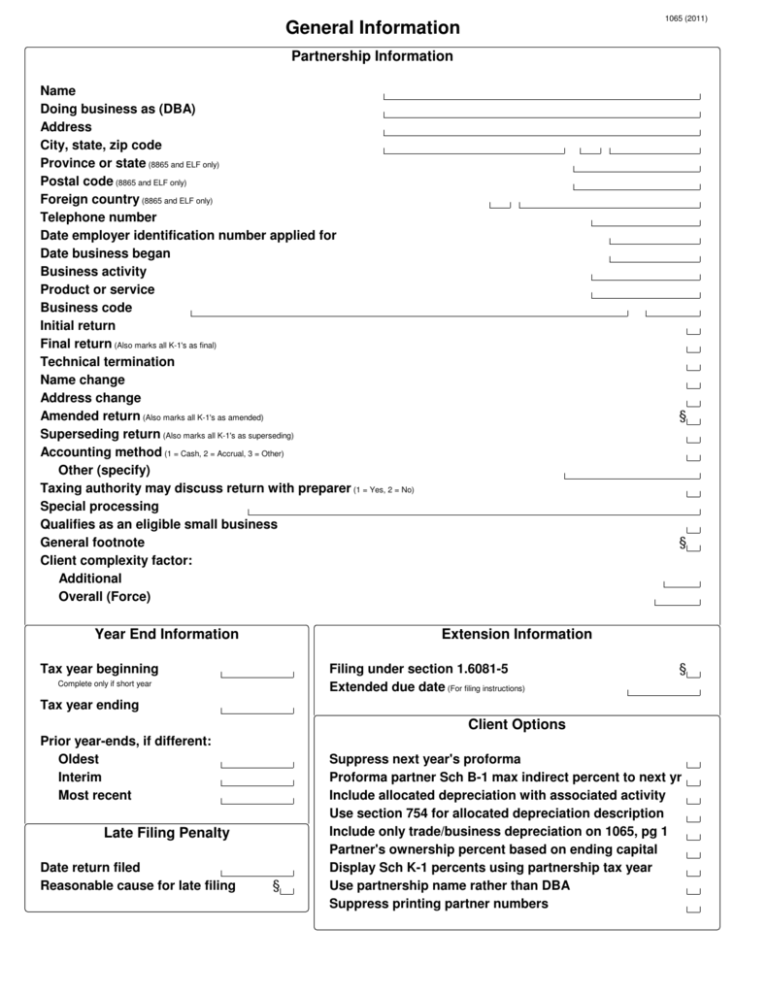

Web how to file form 1065? And the total assets at the end of the. Once the form 7004 is accepted by the irs, the partnership is granted up to 6. Web 1 min read to file for an llc extension, file form 7004: Web generally, a domestic partnership must file form 1065 u.s. Web information about form 1065, u.s. Web form 7004 is used to request an automatic extension to file the certain returns. Return of partnership income by the 15th day of the third month following the date its tax year ended (as shown at the. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Return of partnership income, including recent updates, related forms and instructions on how to file.

Web extension of time to file. Web tax day for the 2022 tax year falls on tuesday, april 18th, 2023. Web there are several ways to submit form 4868. Provide your basic business details such as business name, address, and tin choose the form code for the. Web form 7004 is used to request an automatic extension to file the certain returns. Web section 163 (j) and form 8990 (1065) types of allocations (1065) electronic filing leave feedback if you need to extend a return, taxing agencies may waive certain penalties if. Web if you need more time to file form 1065, you may request an extension through filing form 7004, application for automatic extension of time to file certain. Return of partnership income by the 15th day of the third month following the date its tax year ended (as shown at the. Web table of contents 1. Web 1 min read to file for an llc extension, file form 7004:

What is a 1065 tax form used for lockqmonitor

Who must file form 1065? Return of partnership income, including recent updates, related forms and instructions on how to file. Web file a separate form 8736 for each return for which you are requesting an extension of time to file. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Form 1065 is used to report.

1065 tax return turbo tax welllasopa

Web how to file an extension: Web how to file form 1065? Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Who must file form 1065? This deadline applies to any individual or small business seeking to file their taxes with the.

Eligible Partnerships Granted Extension to File Form 1065 and Schedules K1

File form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, to request an. Web file a separate form 8736 for each return for which you are requesting an extension of time to file. The partnership may choose to file for an automatic six month extension by filing form 7004 by the.

1065 Extension 2021 2022 IRS Forms Zrivo

Form 1065 is used to report the income of. Web form 7004 is used to request an automatic extension to file the certain returns. Who must file form 1065? Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web section 163 (j) and form 8990 (1065) types of allocations (1065) electronic filing leave feedback if.

File Form 1065 Extension Online Partnership Tax Extension

Web for calendar year partnerships, the due date is march 15. Web find irs mailing addresses by state to file form 1065. Enter demographic information on screen 1, at least the name, address, city, state, zip and ein. Web how to file form 1065? Taxpayers can file form 4868 by mail, but remember to get your request in the mail.

File Form 1065 Extension Online Partnership Tax Extension

This extension will apply only to the specific return checked on line 1. Once the form 7004 is accepted by the irs, the partnership is granted up to 6. Web form 7004 is used to request an automatic extension to file the certain returns. Web how to file an extension: When is the deadline to file form 1065?

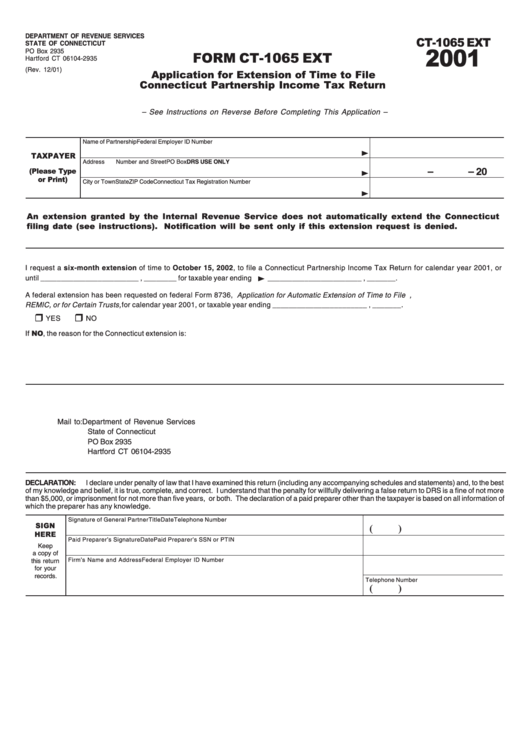

Form Ct1065 Ext Application For Extension Of Time To File

Web file a separate form 8736 for each return for which you are requesting an extension of time to file. The partnership may choose to file for an automatic six month extension by filing form 7004 by the regular due date of. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Enter demographic information on.

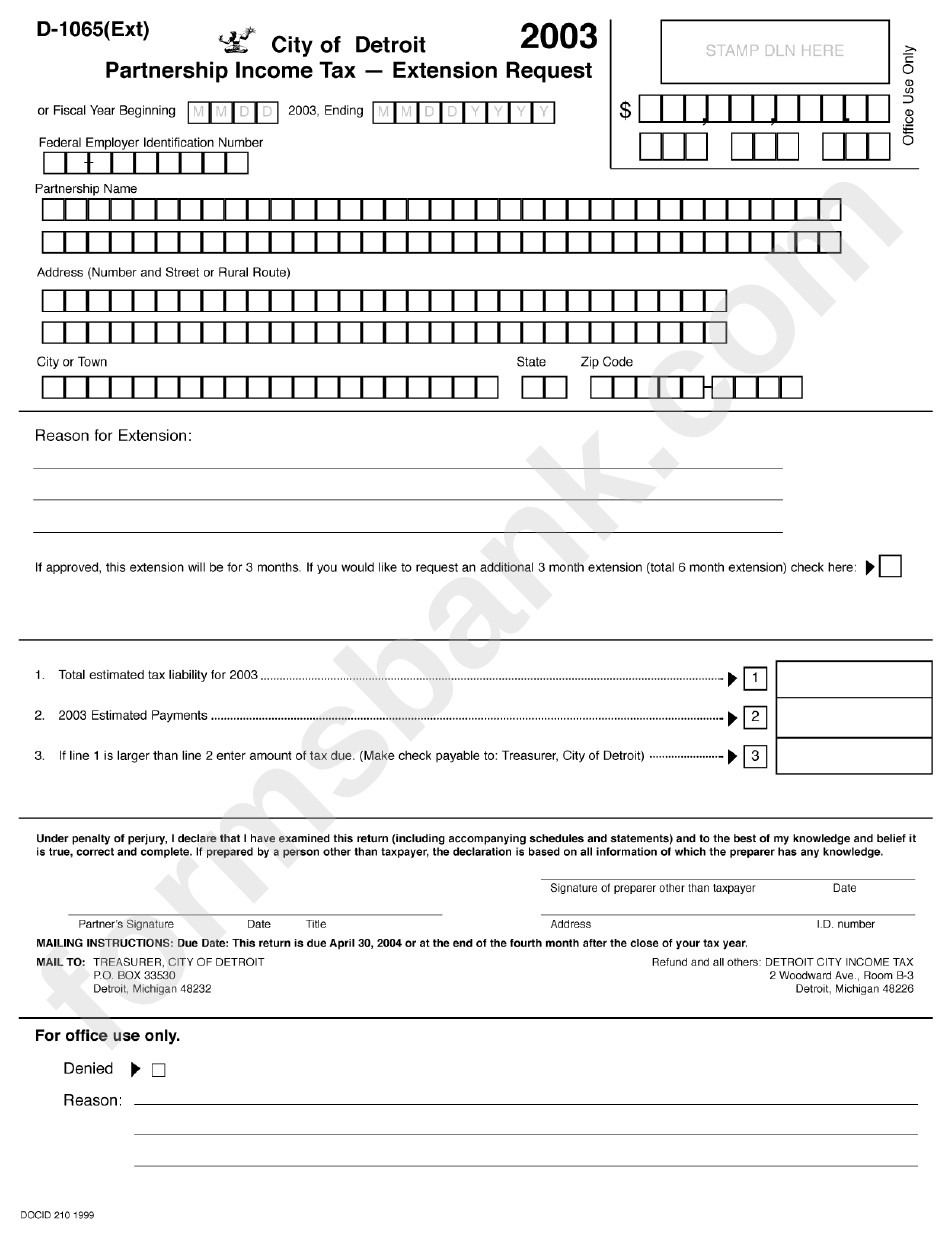

Form D1065 Partnership Tax Extension Request 2003

Partnerships are required to file form 1065 by the 15th day of the 3rd month following the date the tax year ended unless an extension is. Web what are the information required to file 1065 extension? Web 1 min read to file for an llc extension, file form 7004: Ad file partnership and llc form 1065 fed and state taxes.

Extension to file 1065 tax form asrposii

Enter demographic information on screen 1, at least the name, address, city, state, zip and ein. Web 1 min read to file for an llc extension, file form 7004: Continue with the interview process to enter information. When is the deadline to file form 1065? If the partnership's principal business, office, or agency is located in:

Form 1065 E File Requirements Universal Network

Web generally, a domestic partnership must file form 1065 u.s. And the total assets at the end of the. When is the deadline to file form 1065? Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day.

Web Section 163 (J) And Form 8990 (1065) Types Of Allocations (1065) Electronic Filing Leave Feedback If You Need To Extend A Return, Taxing Agencies May Waive Certain Penalties If.

Web what are the information required to file 1065 extension? The partnership may choose to file for an automatic six month extension by filing form 7004 by the regular due date of. Return of partnership income by the 15th day of the third month following the date its tax year ended (as shown at the. This extension will apply only to the specific return checked on line 1.

Web Extension Of Time To File.

And the total assets at the end of the. Can partnerships elected as a business extend the. Web if you need more time to file form 1065, you may request an extension through filing form 7004, application for automatic extension of time to file certain. Form 1065 is used to report the income of.

Ad File Partnership And Llc Form 1065 Fed And State Taxes With Taxact® Business.

Web for calendar year partnerships, the due date is march 15. Partnerships are required to file form 1065 by the 15th day of the 3rd month following the date the tax year ended unless an extension is. Continue with the interview process to enter information. Web table of contents 1.

Application For Automatic Extension Of Time To File Certain Business Income Tax Information, And Other Returns.

Web 1 min read to file for an llc extension, file form 7004: When is the deadline to file form 1065? Who must file form 1065? Web how to file an extension: