Irs 8919 Form

Irs 8919 Form - Web in short, workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes. Web irs form 8919 and the employee’s responsibilities. Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022. Web go to www.irs.gov/form8919 for the latest information. Web form 8919 is the form for those who are employee but their employer treated them as an independent contractor, then they must calculate and report their. Web form 8919 is used by certain employees to report uncollected social security and medicare taxes due on compensation. Web form 8919 is a solution for independent contractors who have suffered from an employer’s misclassification and now face uncollected social security and medicare. Use form 8919 to figure and report your. A 0.9% additional medicare tax. Uncollected social security and medicare tax on wages :

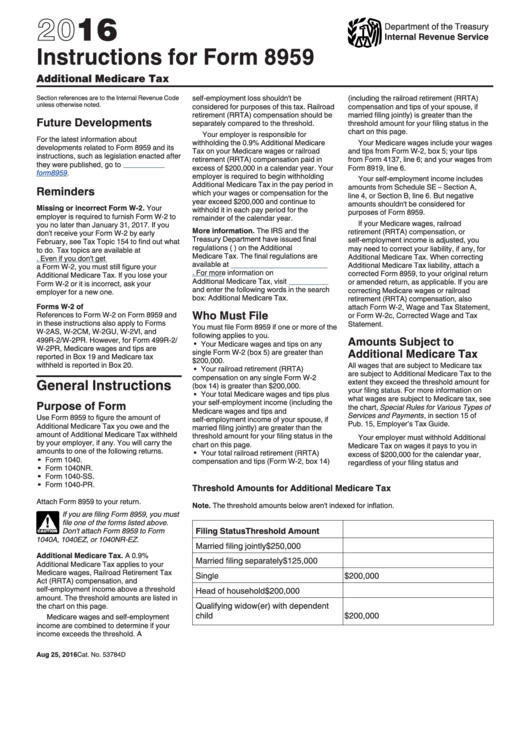

Web form 8919 is the form for those who are employee but their employer treated them as an independent contractor, then they must calculate and report their. Web search for 8919 and then click the jump to 8919 link (if you are just logging into your account, make sure you click the take me to my return button before. Uncollected social security and medicare tax on wages : Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022. Web form 8919 is a solution for independent contractors who have suffered from an employer’s misclassification and now face uncollected social security and medicare. Web form 8919 is used by certain employees to report uncollected social security and medicare taxes due on compensation. 61 name of person who must file this form. Per irs form 8919, you must file this form if all of the following apply. Web in short, workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes. 61 name of person who must file this form.

The taxpayer performed services for an individual or a firm. Web go to www.irs.gov/form8919 for the latest information. Per irs form 8919, you must file this form if all of the following apply. You performed services for a firm. Web search for 8919 and then click the jump to 8919 link (if you are just logging into your account, make sure you click the take me to my return button before. Web form 8919, a document issued by the internal revenue service (irs), plays a crucial role in the u.s. 61 name of person who must file this form. Uncollected social security and medicare tax on wages : Use form 8919 to figure and report your. Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages ago to www.irs.gov/form8919 for the latest.

Form 8919 Uncollected Social Security and Medicare Tax on Wages (2014

Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022. 61 name of person who must file this form. Web irs form 8919 and the employee’s responsibilities. The taxpayer performed services for an individual or a firm. Web the.

Instructions For Form 8959 2016 printable pdf download

Web go to www.irs.gov/form8919 for the latest information attach to your tax return. Web the irs form 8919, or uncollected social security and medicare tax on wages, is an important document utilized by employed individuals who were wrongly. It’s essential for workers who believe they have been misclassified. Web search for 8919 and then click the jump to 8919 link.

Form 8919 Uncollected Social Security and Medicare Tax on Wages (2014

Web the date you file form 8919. Per irs form 8919, you must file this form if all of the following apply. Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022. Web go to www.irs.gov/form8919 for the latest.

1040x2.pdf Irs Tax Forms Social Security (United States)

Per irs form 8919, you must file this form if all of the following apply. Web form 8919 is a solution for independent contractors who have suffered from an employer’s misclassification and now face uncollected social security and medicare. Web form 8919 is the form for those who are employee but their employer treated them as an independent contractor, then.

how to fill out form 8919 Fill Online, Printable, Fillable Blank

Web go to www.irs.gov/form8919 for the latest information. Web irs form 8919, uncollected social security and medicare tax on wages, is the tax form that taxpayers must file to figure and report their share of uncollected social. Web search for 8919 and then click the jump to 8919 link (if you are just logging into your account, make sure you.

How to Generate 2011 IRS Schedule D and Form 8949 using www.form8949

61 name of person who must file this form. Web irs form 8919, uncollected social security and medicare tax on wages, is the tax form that taxpayers must file to figure and report their share of uncollected social. Web form 8919, a document issued by the internal revenue service (irs), plays a crucial role in the u.s. Per irs form.

Fill Free fillable F8919 Accessible 2019 Form 8919 PDF form

61 name of person who must file this form. Attach to your tax return. Form 8959, additional medicare tax. Employees will use form 8919 to determine the amount they owe in social security and medicare taxes. Web in short, workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and.

Form 8919 2021 Fill Online, Printable, Fillable, Blank pdfFiller

Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages ago to www.irs.gov/form8919 for the latest. Web irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who were treated like independent contractors by their. You performed services for a firm. Web form.

When to Use IRS Form 8919

Web search for 8919 and then click the jump to 8919 link (if you are just logging into your account, make sure you click the take me to my return button before. Web in short, workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes. Web form.

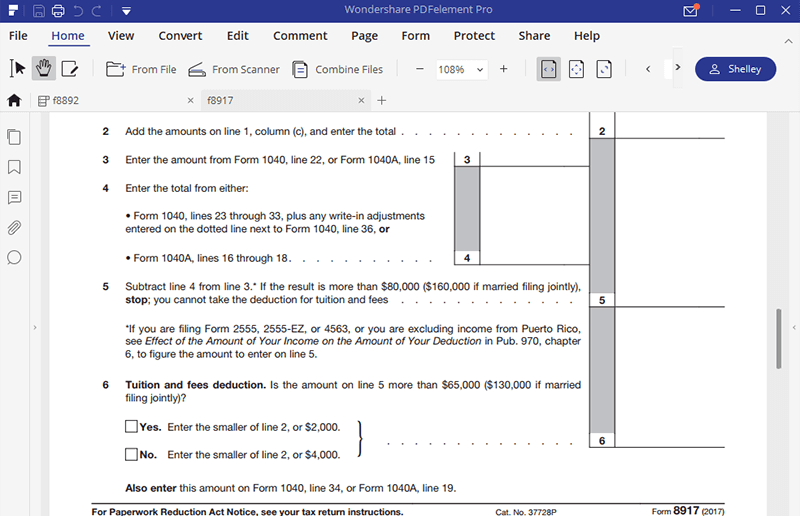

for How to Fill in IRS Form 8917

Uncollected social security and medicare tax on wages : A 0.9% additional medicare tax. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: It’s essential for workers who believe they have been misclassified. Web search for 8919 and then click the jump to 8919 link (if.

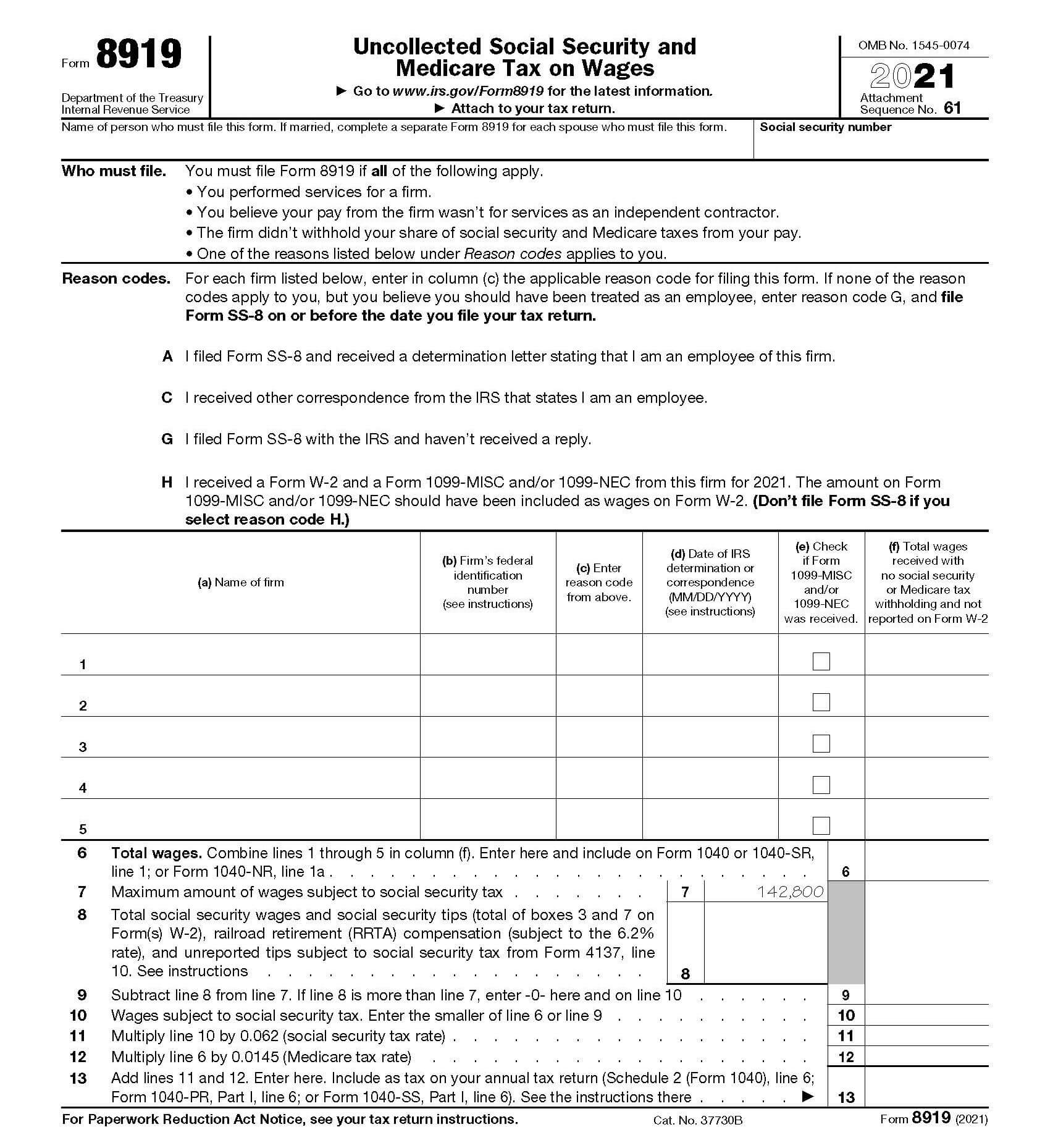

Form 8959, Additional Medicare Tax.

Web irs form 8919, uncollected social security and medicare tax on wages, is the tax form that taxpayers must file to figure and report their share of uncollected social. Per irs form 8919, you must file this form if all of the following apply. A 0.9% additional medicare tax. Web go to www.irs.gov/form8919 for the latest information attach to your tax return.

Web Form 8919 Is The Form For Those Who Are Employee But Their Employer Treated Them As An Independent Contractor, Then They Must Calculate And Report Their.

Web form 8919 is a solution for independent contractors who have suffered from an employer’s misclassification and now face uncollected social security and medicare. Web irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who were treated like independent contractors by their. Employees will use form 8919 to determine the amount they owe in social security and medicare taxes. Web the date you file form 8919.

Web In Short, Workers Must File Form 8919, Uncollected Social Security And Medicare Tax On Wages, If They Did Not Have Social Security And Medicare Taxes.

Web search for 8919 and then click the jump to 8919 link (if you are just logging into your account, make sure you click the take me to my return button before. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: You performed services for a firm. 61 name of person who must file this form.

Web Form 8919 Is Used By Certain Employees To Report Uncollected Social Security And Medicare Taxes Due On Compensation.

Web the irs form 8919, or uncollected social security and medicare tax on wages, is an important document utilized by employed individuals who were wrongly. Web go to www.irs.gov/form8919 for the latest information. 61 name of person who must file this form. Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022.