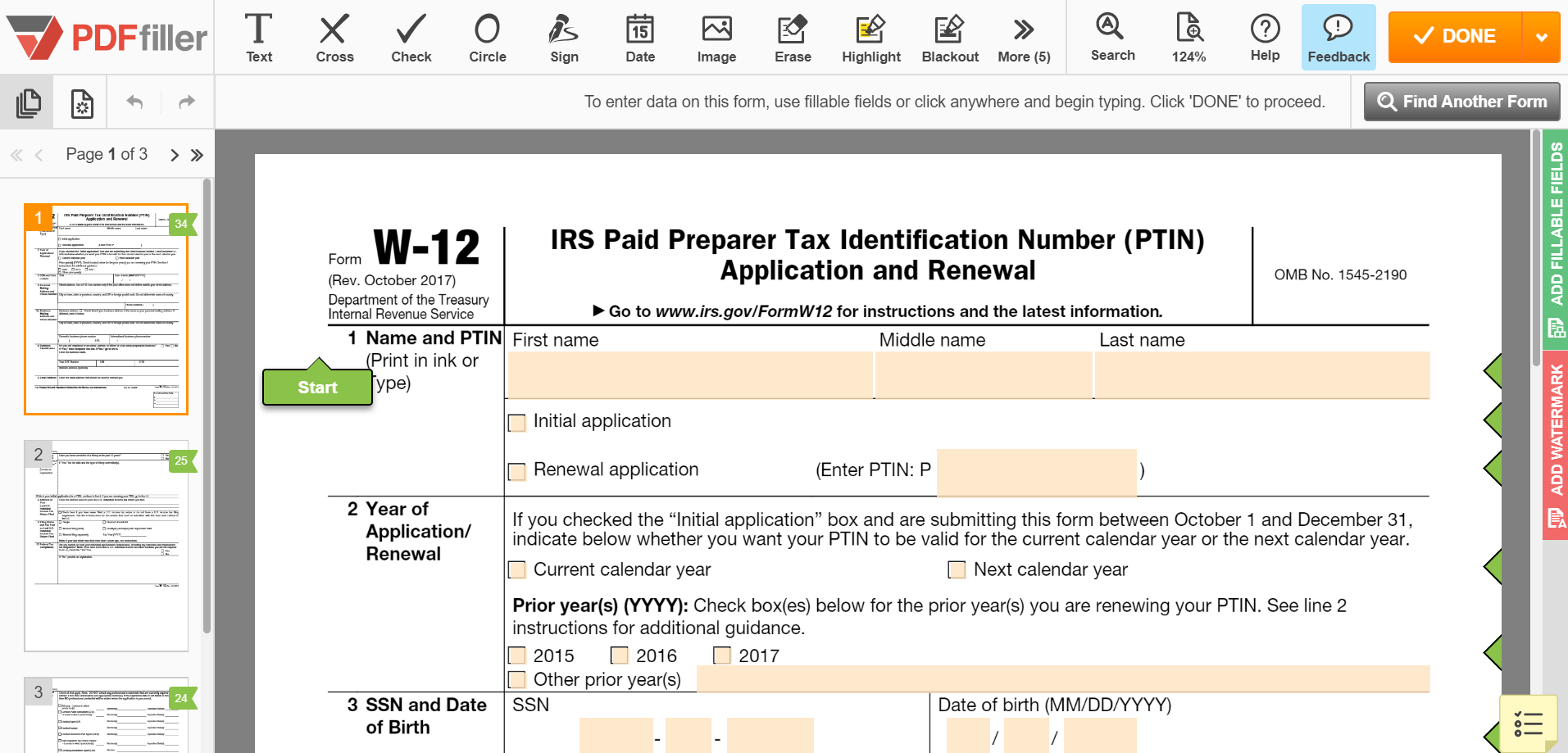

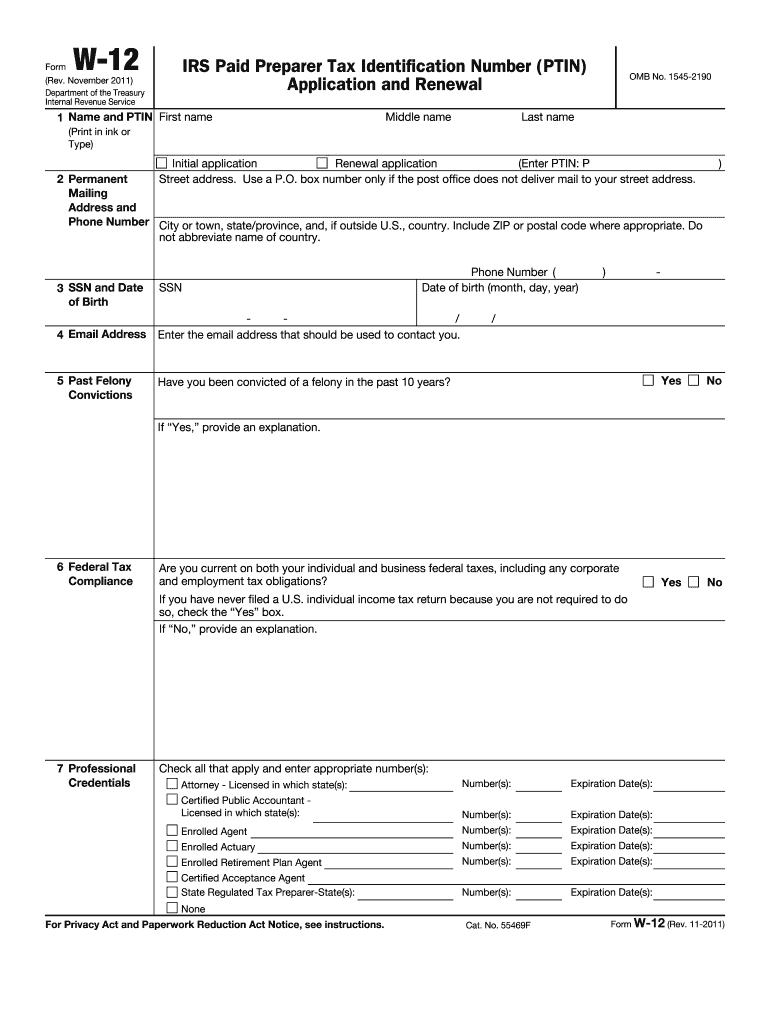

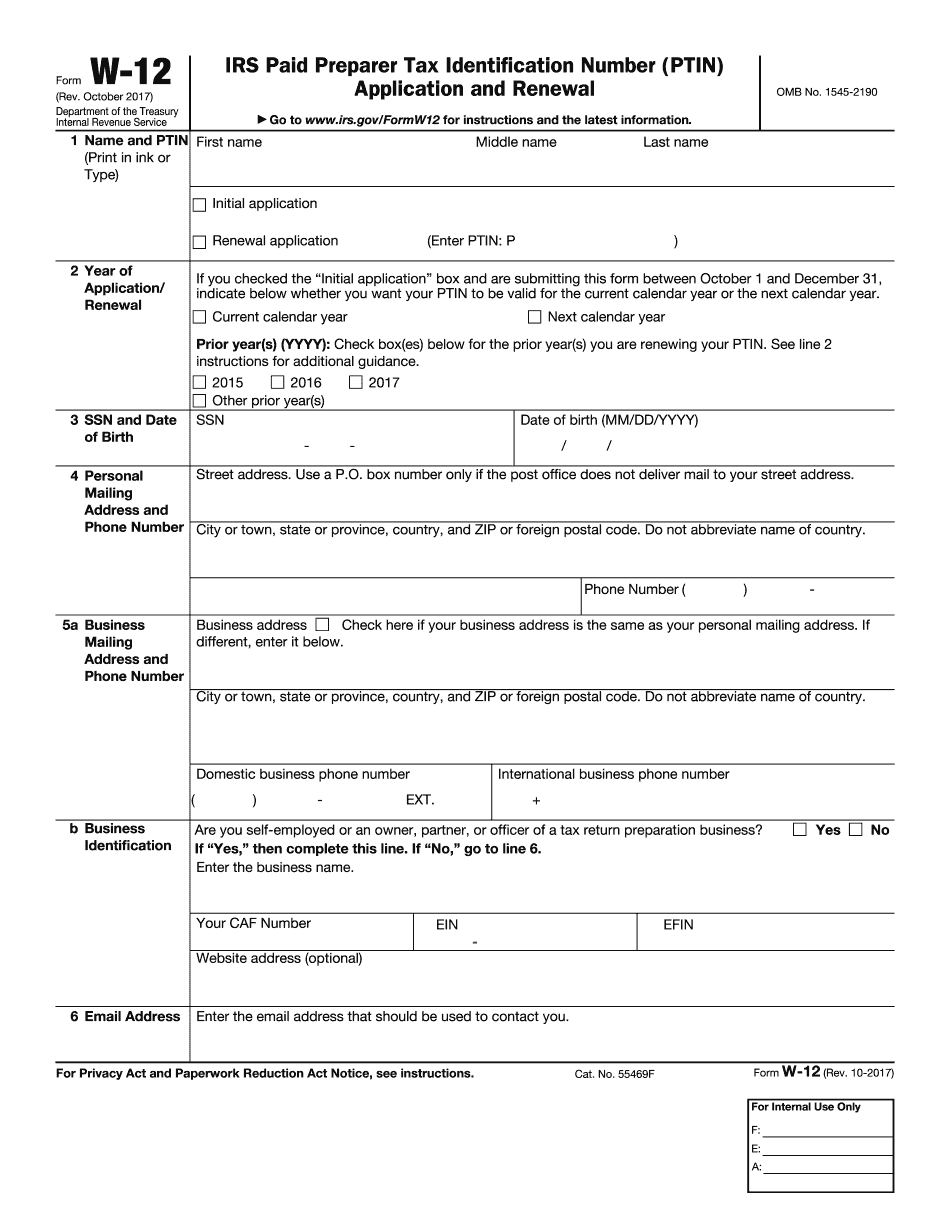

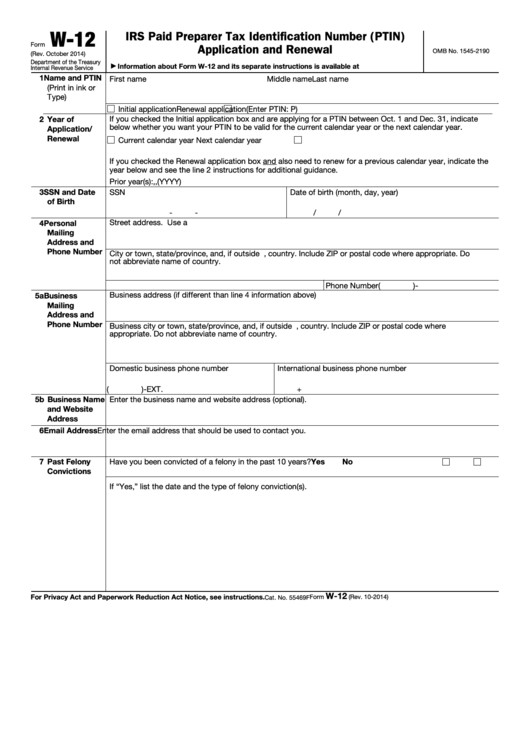

W 12 Form

W 12 Form - Web the preparer tax identification number (ptin) is an identification number that all paid tax return preparers must use on u.s. October 2017) department of the treasury internal revenue service. Allow 4 to 6 weeks for processing of ptin. Irs tax professional ptin processing center po box 380638 san antonio, tx 78268 note: Get everything done in minutes. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Federal tax returns or claims. Irs paid preparer tax identification number \(ptin\) application and renewal keywords: Irs paid preparer tax identification number (ptin) application and renewal. Form w12, preparer tax identification number application and renewal is the tax form for applying or renewing ptin numbers.

Federal tax returns or claims. It is overwhelmingly advised to apply for your ptin or to renew your ptin online, and the. Web this new form is available on the irs’ website at: Complete, edit or print tax forms instantly. October 2017) department of the treasury internal revenue service. Web the preparer tax identification number (ptin) is an identification number that all paid tax return preparers must use on u.s. Allow 4 to 6 weeks for processing of ptin. Get everything done in minutes. The irs sent letter 12c to inform. If you are applying for a ptin, complete all the lines on the form.

Gain access to the fillable pdf document making a click. Irs paid preparer tax identification number (ptin) application and renewal. Get everything done in minutes. If you are applying for a ptin, complete all the lines on the form. Form w12, preparer tax identification number application and renewal is the tax form for applying or renewing ptin numbers. October 2017) department of the treasury internal revenue service. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Employment authorization document issued by the department of homeland. Web the preparer tax identification number (ptin) is an identification number that all paid tax return preparers must use on u.s. Federal tax returns or claims.

2016 Form CA LLC1A Fill Online, Printable, Fillable, Blank pdfFiller

Irs paid preparer tax identification number \(ptin\) application and renewal keywords: The irs sent letter 12c to inform. Gain access to the fillable pdf document making a click. If you are applying for a ptin, complete all the lines on the form. Get everything done in minutes.

Guide to Form 12BB How to Fill & Generate Online for FY 202223, AY

October 2017) department of the treasury internal revenue service. Web this new form is available on the irs’ website at: If you are renewing your ptin, complete all. If you are applying for a ptin, complete all the lines on the form. Irs paid preparer tax identification number (ptin) application and renewal.

Fill out Form W12 Online to a Paid Tax Preparer

Allow 4 to 6 weeks for processing of ptin. The irs sent letter 12c to inform. Federal tax returns or claims. October 2017) department of the treasury internal revenue service. Get everything done in minutes.

W12 Form Online 12 MindBlowing Reasons Why W12 Form Online Is Using

Federal tax returns or claims. Get everything done in minutes. Get ready for tax season deadlines by completing any required tax forms today. If you are renewing your ptin, complete all. If you are applying for a ptin, complete all the lines on the form.

2011 Form IRS W12 Fill Online, Printable, Fillable, Blank pdfFiller

Complete, edit or print tax forms instantly. October 2017) department of the treasury internal revenue service. It is overwhelmingly advised to apply for your ptin or to renew your ptin online, and the. Gain access to the fillable pdf document making a click. Allow 4 to 6 weeks for processing of ptin.

Electronic IRS Form W12 2017 2019 Printable PDF Sample

Get everything done in minutes. Web the preparer tax identification number (ptin) is an identification number that all paid tax return preparers must use on u.s. If you are renewing your ptin, complete all. Form w12, preparer tax identification number application and renewal is the tax form for applying or renewing ptin numbers. Employment authorization document issued by the department.

Alexander Wang in architecture 优尔艺术

Get everything done in minutes. Web the preparer tax identification number (ptin) is an identification number that all paid tax return preparers must use on u.s. If you are renewing your ptin, complete all. If you are applying for a ptin, complete all the lines on the form. Employment authorization document issued by the department of homeland.

Fillable Form W12 Irs Paid Preparer Tax Identification Number (Ptin

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Irs paid preparer tax identification number \(ptin\) application and renewal keywords: Allow 4 to 6 weeks for processing of ptin. Form w12, preparer tax identification number application and renewal is the tax form for applying or renewing ptin numbers. Irs tax.

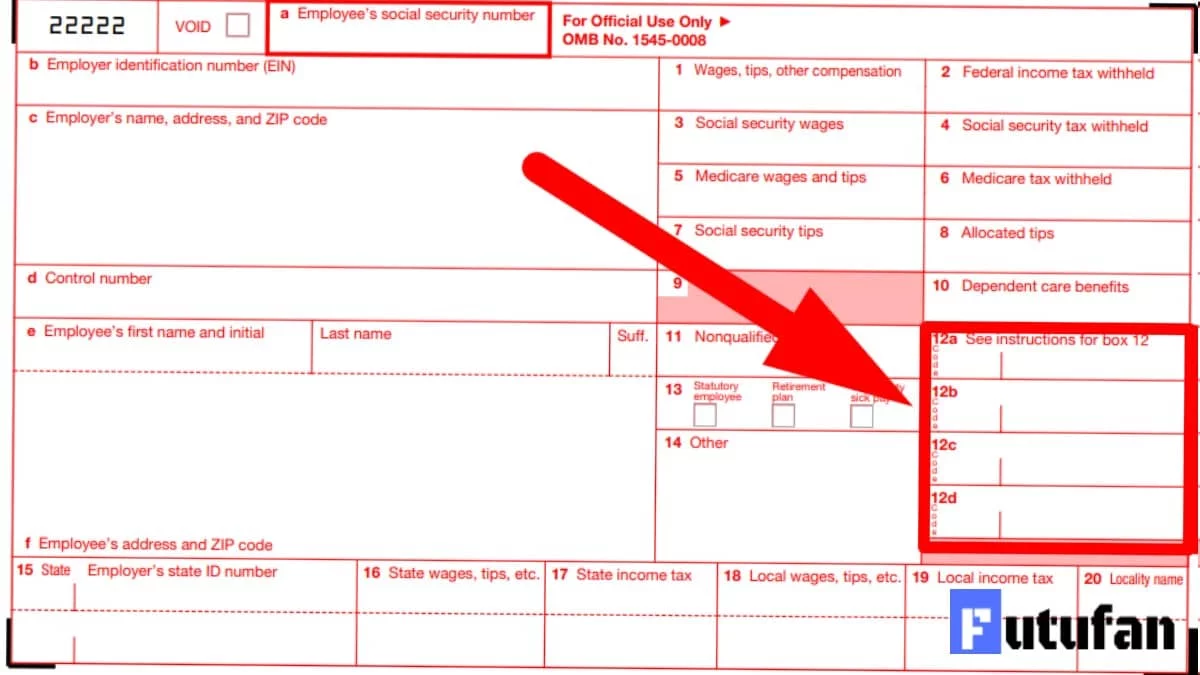

W2 12 Codes

Allow 4 to 6 weeks for processing of ptin. Irs paid preparer tax identification number (ptin) application and renewal. Irs paid preparer tax identification number \(ptin\) application and renewal keywords: Irs tax professional ptin processing center po box 380638 san antonio, tx 78268 note: Check out how easy it is to complete and esign documents online using fillable templates and.

12 Form For 12 Ten Precautions You Must Take Before Attending 12 Form

If you are applying for a ptin, complete all the lines on the form. Irs paid preparer tax identification number (ptin) application and renewal. The irs sent letter 12c to inform. Irs tax professional ptin processing center po box 380638 san antonio, tx 78268 note: Federal tax returns or claims.

If You Are Renewing Your Ptin, Complete All.

Get ready for tax season deadlines by completing any required tax forms today. Allow 4 to 6 weeks for processing of ptin. Federal tax returns or claims. Web this new form is available on the irs’ website at:

Get Everything Done In Minutes.

Complete, edit or print tax forms instantly. Irs paid preparer tax identification number (ptin) application and renewal. If you are applying for a ptin, complete all the lines on the form. Employment authorization document issued by the department of homeland.

It Is Overwhelmingly Advised To Apply For Your Ptin Or To Renew Your Ptin Online, And The.

Irs tax professional ptin processing center po box 380638 san antonio, tx 78268 note: Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. October 2017) department of the treasury internal revenue service. Gain access to the fillable pdf document making a click.

Irs Paid Preparer Tax Identification Number \(Ptin\) Application And Renewal Keywords:

Web the preparer tax identification number (ptin) is an identification number that all paid tax return preparers must use on u.s. The irs sent letter 12c to inform. Form w12, preparer tax identification number application and renewal is the tax form for applying or renewing ptin numbers.