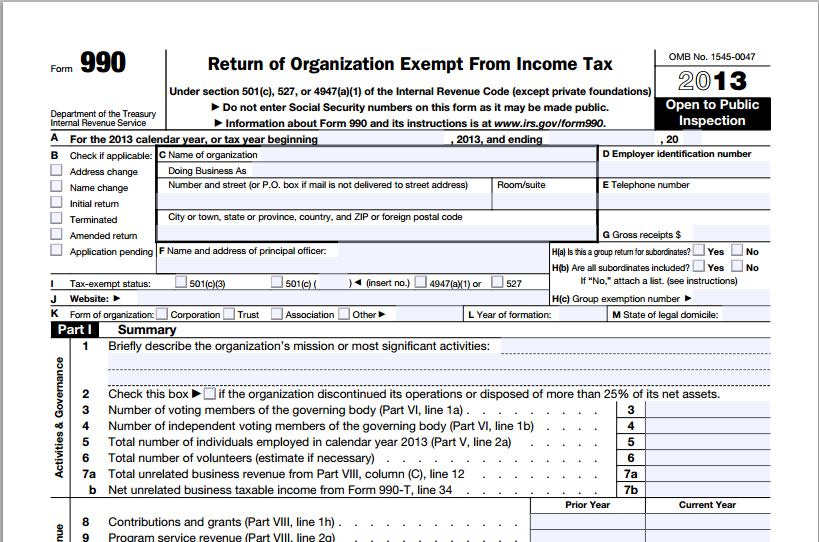

Turbotax Form 990 Ez

Turbotax Form 990 Ez - (nearly all the remaining organizations were required to report only minimal information. Download or email irs 990ez & more fillable forms, register and subscribe now! Web no, unfortunately, turbotax does not support form 990 and its variants. Release dates vary by state. How do i file it electronically through intuit?. Ad get ready for tax season deadlines by completing any required tax forms today. Form 990, return of organization exempt from income tax; Verification routines ensure your return is accurate and complete. Request for taxpayer identification number (tin) and certification. Only available for returns not prepared by h&r block.

The following links can offer additional. Ad download or email irs 990ez & more fillable forms, register and subscribe now! Web no, unfortunately, turbotax does not support form 990 and its variants. Form 990, return of organization exempt from income tax; (nearly all the remaining organizations were required to report only minimal information. Verification routines ensure your return is accurate and complete. Web enter amount of tax imposed on organization managers or disqualified persons during the year under sections 4912, 4955, and 4958 section 501(c)(3), 501(c)(4), and 501(c)(29). How do i file it electronically through intuit?. Ad get ready for tax season deadlines by completing any required tax forms today. Request for transcript of tax return.

Web enter amount of tax imposed on organization managers or disqualified persons during the year under sections 4912, 4955, and 4958 section 501(c)(3), 501(c)(4), and 501(c)(29). How do i file it electronically through intuit?. Request for taxpayer identification number (tin) and certification. (nearly all the remaining organizations were required to report only minimal information. Ad download or email irs 990ez & more fillable forms, try for free now! Ad download or email irs 990ez & more fillable forms, register and subscribe now! Only available for returns not prepared by h&r block. Download or email irs 990ez & more fillable forms, register and subscribe now! Release dates vary by state. Request for transcript of tax return.

How Do I Avoid Form 990EZ Penalties?

Ad download or email irs 990ez & more fillable forms, register and subscribe now! Request for taxpayer identification number (tin) and certification. Download or email irs 990ez & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. Ad get ready for tax season deadlines by completing any required tax forms today.

Form 990 Preparation Service 501(c)(3) Tax Services in Tampa

Web no, unfortunately, turbotax does not support form 990 and its variants. Complete, edit or print tax forms instantly. (nearly all the remaining organizations were required to report only minimal information. Ad get ready for tax season deadlines by completing any required tax forms today. After all, your form 990 is the face of your.

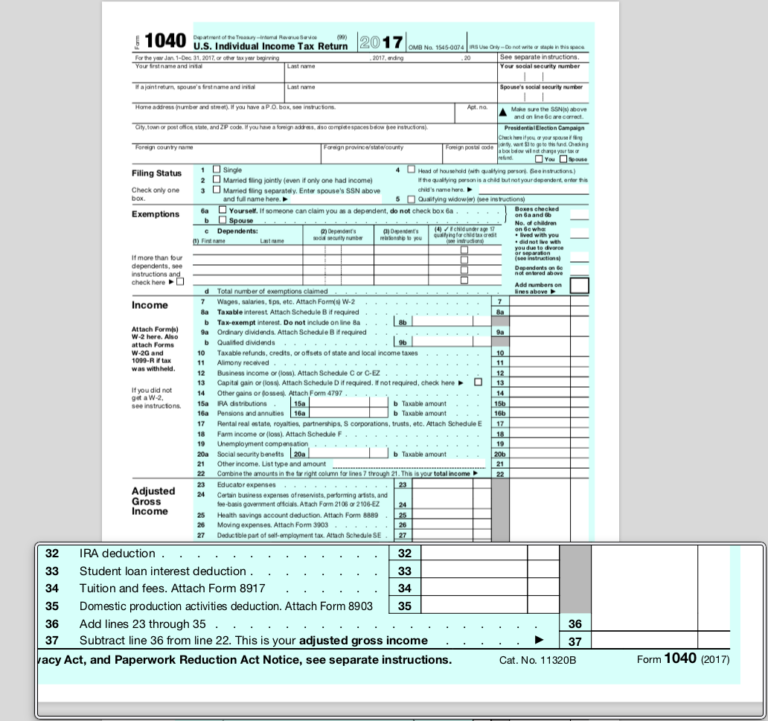

I Am Trying To Find My Agi Number Please Help TurboTax 2021 Tax Forms

Release dates vary by state. Form 990, return of organization exempt from income tax; Was the organization controlled directly or indirectly at any time during the tax year by one or more disqualified. Request for taxpayer identification number (tin) and certification. Request for transcript of tax return.

TurboTax 10 tax tips for filing an amended return

Release dates vary by state. (nearly all the remaining organizations were required to report only minimal information. Verification routines ensure your return is accurate and complete. May the irs discuss this return with the preparer shown below. I would recommend contacting a local professional.

2008 form 990ez

After all, your form 990 is the face of your. Form 990, return of organization exempt from income tax; Download or email irs 990ez & more fillable forms, register and subscribe now! Web no, unfortunately, turbotax does not support form 990 and its variants. Ad download or email irs 990ez & more fillable forms, try for free now!

File 990EZ Online Efile 990 Short Form 990EZ Filing Deadline

The following links can offer additional. Verification routines ensure your return is accurate and complete. Download or email irs 990ez & more fillable forms, register and subscribe now! After all, your form 990 is the face of your. Web enter amount of tax imposed on organization managers or disqualified persons during the year under sections 4912, 4955, and 4958 section.

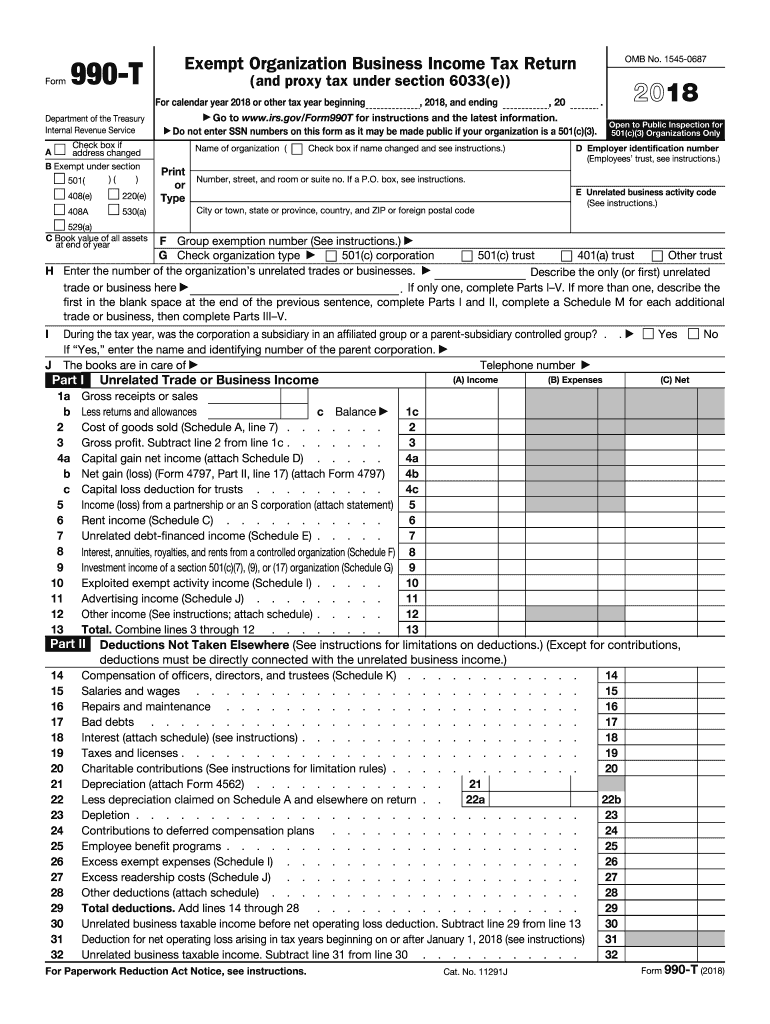

990 t Fill out & sign online DocHub

Request for taxpayer identification number (tin) and certification. Download or email irs 990ez & more fillable forms, register and subscribe now! (nearly all the remaining organizations were required to report only minimal information. Verification routines ensure your return is accurate and complete. Complete, edit or print tax forms instantly.

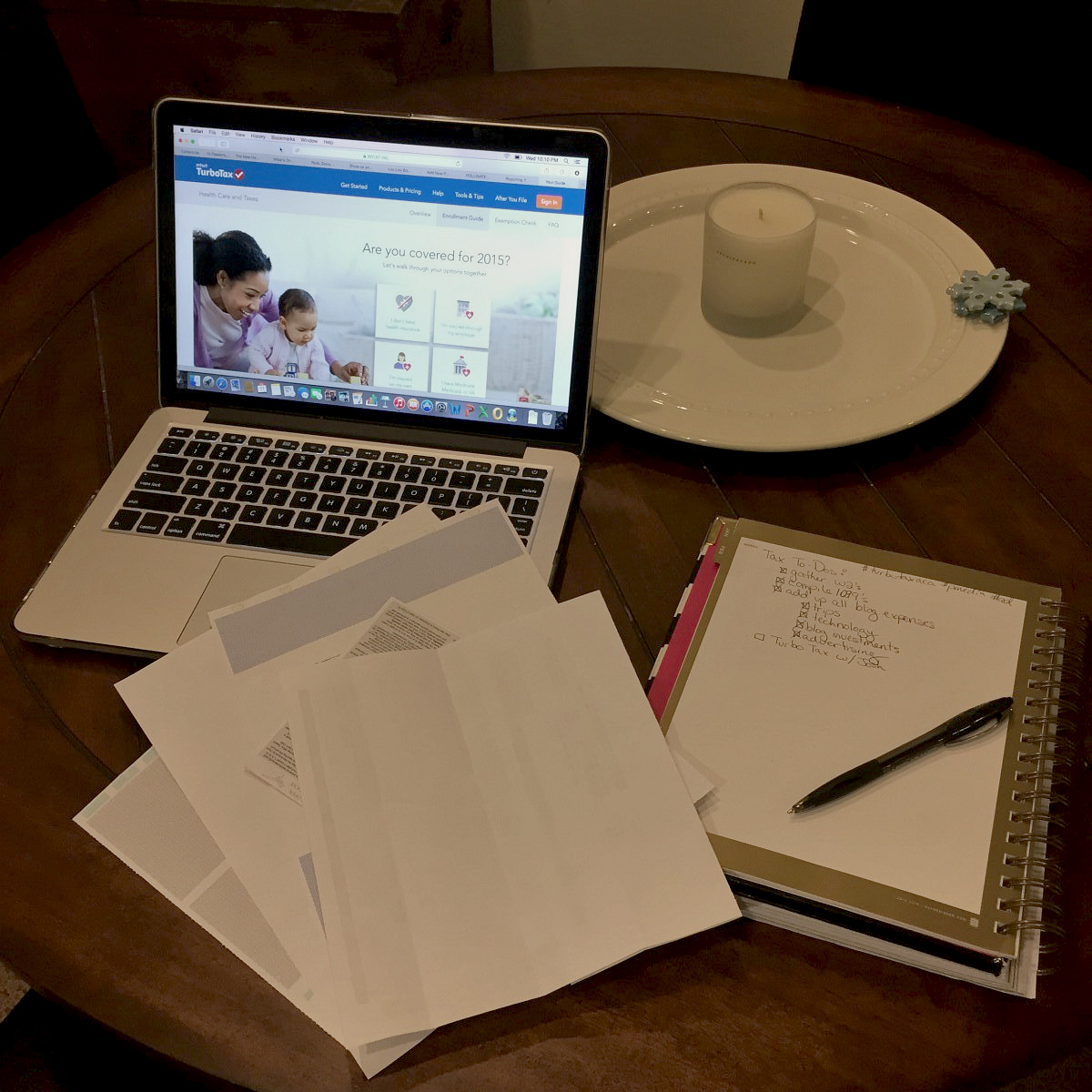

Tackling My Taxes with TurboTax Her Heartland Soul

Form 990, return of organization exempt from income tax; The following links can offer additional. Complete, edit or print tax forms instantly. Release dates vary by state. May the irs discuss this return with the preparer shown below.

File 990EZ Online Efile 990 Short Form 990EZ Filing Deadline

Ad get ready for tax season deadlines by completing any required tax forms today. Only available for returns not prepared by h&r block. Download or email irs 990ez & more fillable forms, register and subscribe now! Ad download or email irs 990ez & more fillable forms, register and subscribe now! Ad download or email irs 990ez & more fillable forms,.

File 990EZ Online Efile 990 Short Form 990EZ Filing Deadline

Ad get ready for tax season deadlines by completing any required tax forms today. Web enter amount of tax imposed on organization managers or disqualified persons during the year under sections 4912, 4955, and 4958 section 501(c)(3), 501(c)(4), and 501(c)(29). (nearly all the remaining organizations were required to report only minimal information. Request for taxpayer identification number (tin) and certification..

Ad Download Or Email Irs 990Ez & More Fillable Forms, Try For Free Now!

How do i file it electronically through intuit?. Ad download or email irs 990ez & more fillable forms, register and subscribe now! (nearly all the remaining organizations were required to report only minimal information. Web no, unfortunately, turbotax does not support form 990 and its variants.

Complete, Edit Or Print Tax Forms Instantly.

May the irs discuss this return with the preparer shown below. Form 990, return of organization exempt from income tax; After all, your form 990 is the face of your. Web enter amount of tax imposed on organization managers or disqualified persons during the year under sections 4912, 4955, and 4958 section 501(c)(3), 501(c)(4), and 501(c)(29).

Request For Taxpayer Identification Number (Tin) And Certification.

The following links can offer additional. Was the organization controlled directly or indirectly at any time during the tax year by one or more disqualified. Download or email irs 990ez & more fillable forms, register and subscribe now! Release dates vary by state.

Request For Transcript Of Tax Return.

Ad get ready for tax season deadlines by completing any required tax forms today. Verification routines ensure your return is accurate and complete. Only available for returns not prepared by h&r block. I would recommend contacting a local professional.