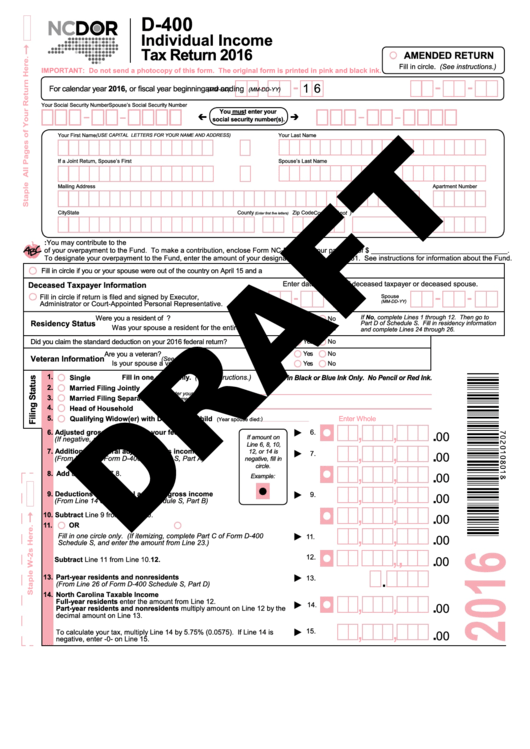

Tax Form D400

Tax Form D400 - Get answers to your tax questions. Web where to file your taxes for form 9465. Do not send a photocopy of this form. Multiply line 14 by 5.25% (0.0525). (fill in one circle only. If you are filing form 9465. Pay a balance due on your individual income tax return for the current tax year, and prior years through tax year 2003. Avalara calculates, collects, files & remits sales tax returns for your business. Web form tax year description electronic options; Most likely, the state department of revenue.

Pay a balance due on your individual income tax return for the current tax year, and prior years through tax year 2003. If you are filing form 9465. Apply for an employer id number. Sales and use electronic data. Ad hundreds of tax forms supported. Web form tax year description electronic options; File them for free today! Check your federal tax withholding. Do not send a photocopy of this form. Ad avalara avatax lowers risk by automating sales tax compliance.

This form is for income earned in tax year 2022, with tax. North carolina income tax 15. If you are filing form 9465 with your return, attach it to the front of your return when you file. Web form tax year description electronic options; If zero or less, enter a zero. Most likely, the state department of revenue. If you are filing form 9465. (fill in one circle only. Web where to file your taxes for form 9465. Individual income tax instructions schedule a:

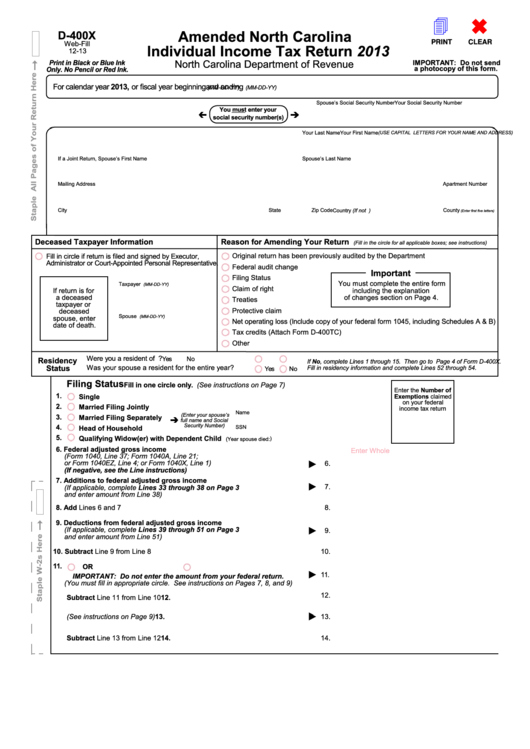

Fillable Form D400x Amended North Carolina Individual Tax

Sales and use electronic data. Avalara calculates, collects, files & remits sales tax returns for your business. Get answers to your tax questions. Individual income tax instructions schedule a: Ad avalara avatax lowers risk by automating sales tax compliance.

Instructions for Form D400 North Carolina Department of Revenue

Apply for an employer id number. Do not send a photocopy of this form. Ad avalara avatax lowers risk by automating sales tax compliance. Multiply line 14 by 5.25% (0.0525). Individual income tax instructions schedule a:

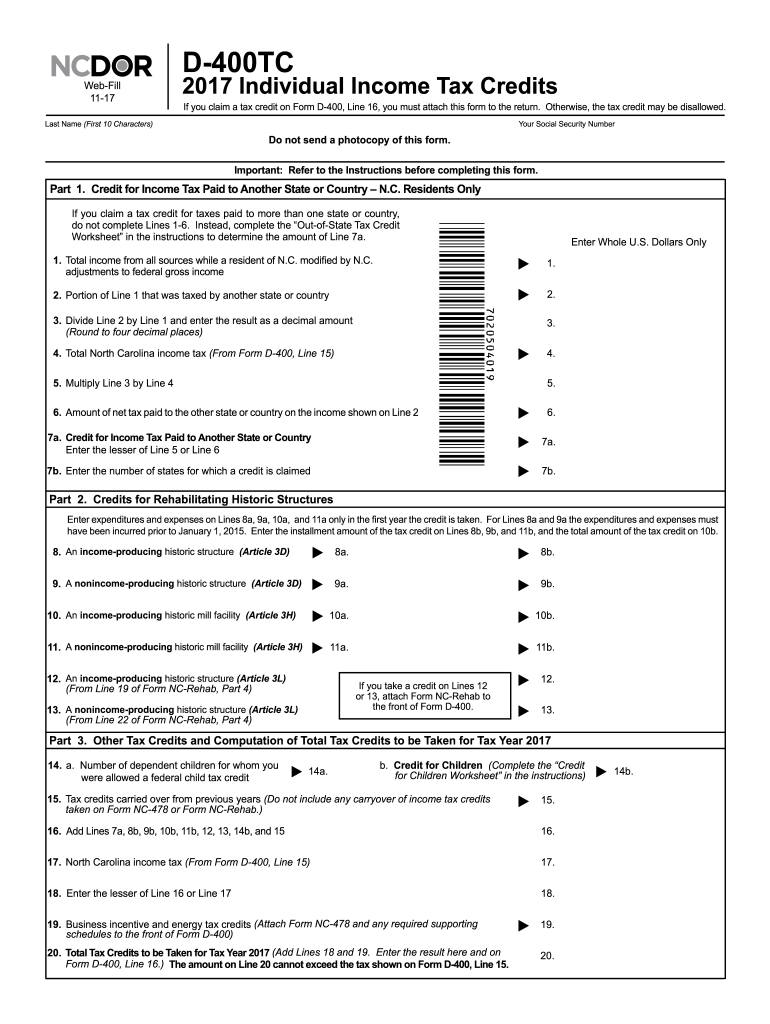

Form D 400TC Individual Tax Return YouTube

Web where to file your taxes for form 9465. If zero or less, enter a zero. This form is for income earned in tax year 2022, with tax. Pay a balance due on your individual income tax return for the current tax year, and prior years through tax year 2003. Get answers to your tax questions.

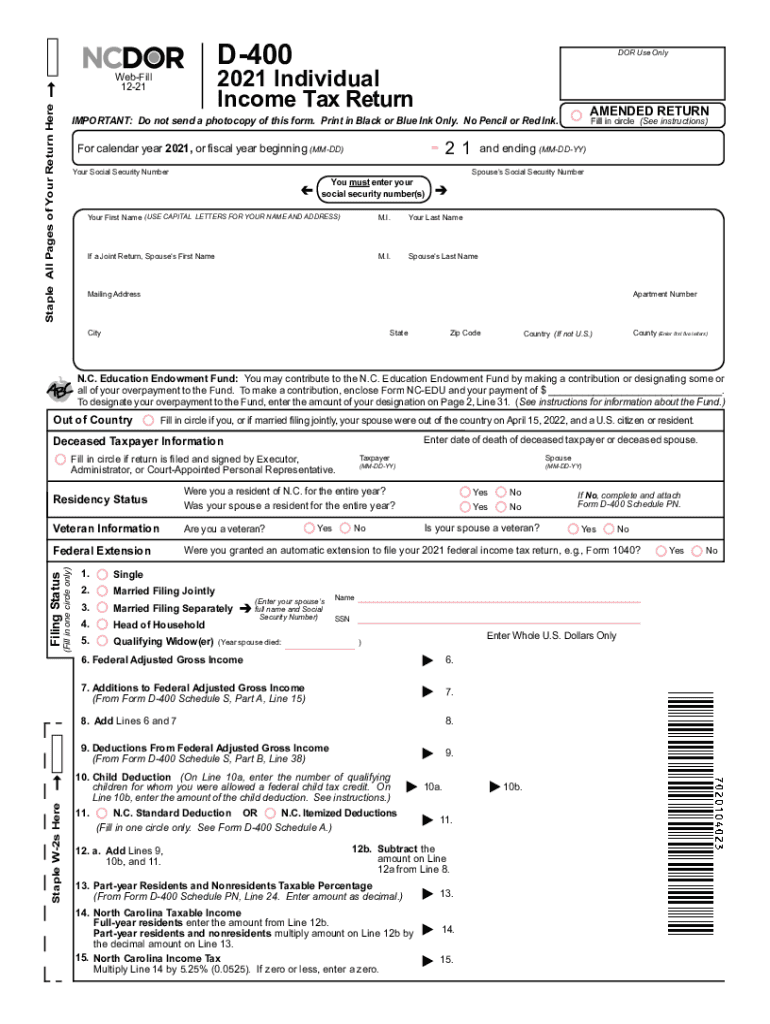

2021 Form NC DoR D400 Fill Online, Printable, Fillable, Blank pdfFiller

If you are filing form 9465. Web form tax year description electronic options; Sales and use electronic data. Multiply line 14 by 5.25% (0.0525). Pay a balance due on your individual income tax return for the current tax year, and prior years through tax year 2003.

20172019 Form NC DoR D400TC Fill Online, Printable, Fillable, Blank

Apply for an employer id number. Do not send a photocopy of this form. Sales and use electronic data. Maximum refund guaranteed for all. If zero or less, enter a zero.

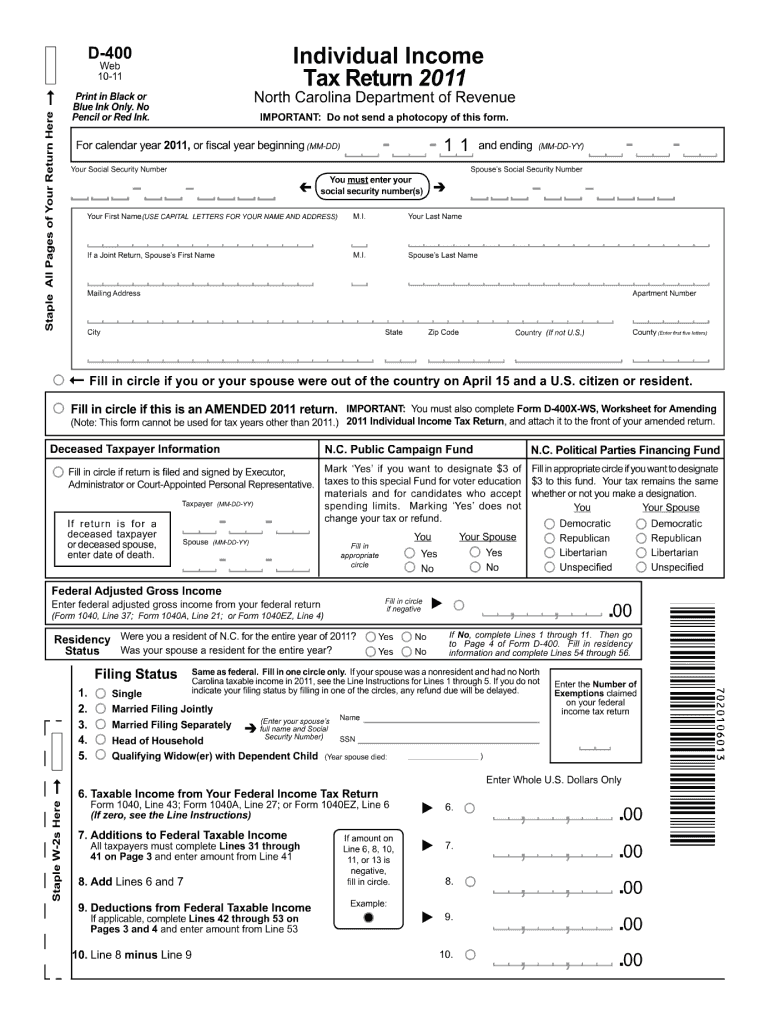

D400 Form Fill Out and Sign Printable PDF Template signNow

If you are filing form 9465. Looking for 2020 federal tax forms? Individual income tax instructions schedule a: Multiply line 14 by 5.25% (0.0525). Reach out to learn how we can help you!

NC DoR D400XWS 2010 Fill out Tax Template Online US Legal Forms

Get answers to your tax questions. Apply for an employer id number. Web form tax year description electronic options; Ad sovos combines tax automation with a human touch. Individual income tax instructions schedule a:

NC DoR D400 2015 Fill out Tax Template Online US Legal Forms

Sales and use electronic data. Looking for 2020 federal tax forms? Maximum refund guaranteed for all. North carolina income tax 15. Avalara calculates, collects, files & remits sales tax returns for your business.

Form D400 Individual Tax Return 2016 printable pdf download

Ad sovos combines tax automation with a human touch. Web where to file your taxes for form 9465. This form is for income earned in tax year 2022, with tax. File them for free today! If you are filing form 9465.

2014 Form NC DoR D400TC Fill Online, Printable, Fillable, Blank

Avalara calculates, collects, files & remits sales tax returns for your business. Pay a balance due on your individual income tax return for the current tax year, and prior years through tax year 2003. Reach out to learn how we can help you! File them for free today! Most likely, the state department of revenue.

Web Where To File Your Taxes For Form 9465.

Do not send a photocopy of this form. Sales and use electronic data. Multiply line 14 by 5.25% (0.0525). Apply for an employer id number.

If You Are Filing Form 9465.

Web form tax year description electronic options; Ad avalara avatax lowers risk by automating sales tax compliance. Ad sovos combines tax automation with a human touch. Check your federal tax withholding.

Maximum Refund Guaranteed For All.

Looking for 2020 federal tax forms? Sales and use electronic data. If zero or less, enter a zero. Pay a balance due on your individual income tax return for the current tax year, and prior years through tax year 2003.

North Carolina Income Tax 15.

Ad hundreds of tax forms supported. Avalara calculates, collects, files & remits sales tax returns for your business. If you are filing form 9465 with your return, attach it to the front of your return when you file. Reach out to learn how we can help you!