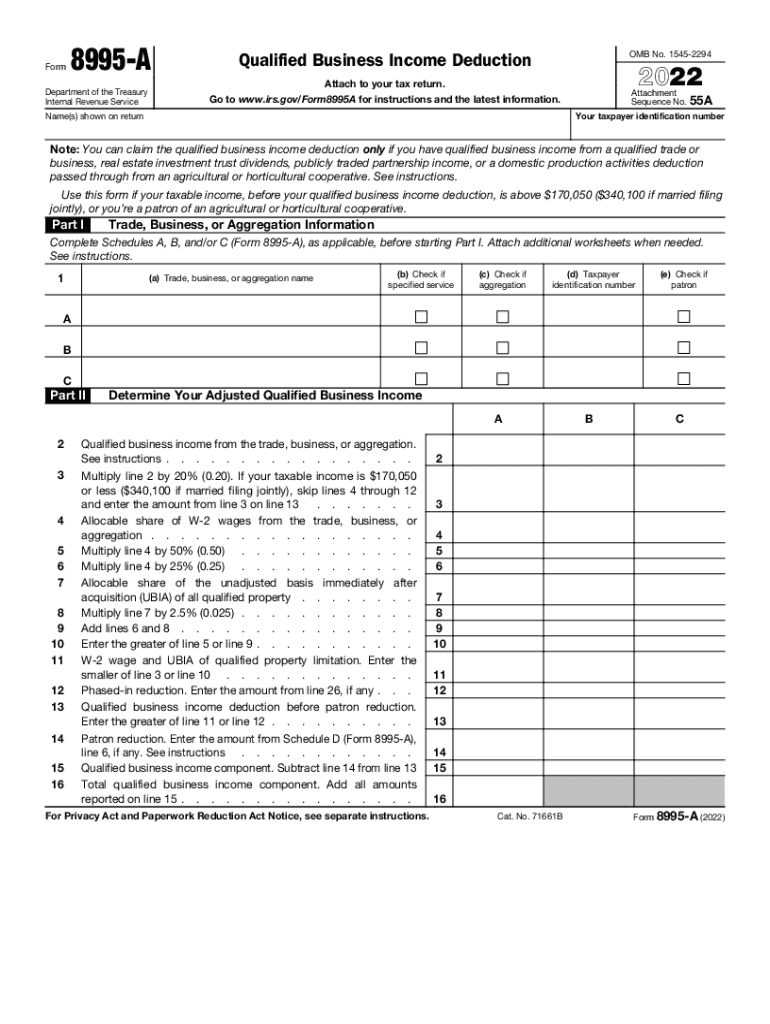

Qualified Business Income Deduction From Form 8995 Or Form 8995-A

Qualified Business Income Deduction From Form 8995 Or Form 8995-A - Web use form 8995 to calculate your qualified business income (qbi) deduction. Web qualified business income deduction attach to your tax return. You have qualified business income, qualified reit. You have qualified business income, qualified reit dividends, or. Individual taxpayers and some trusts and estates may be entitled to a deduction of up to 20% of. And • your 2022 taxable income before. Web qualified business income deduction simplified computation attach to your tax return. Go to www.irs.gov/form8995a for instructions and the latest information. • you have qbi, qualified reit dividends, or qualified ptp income or loss; And • your 2022 taxable income before your qbi.

Web use form 8995 to calculate your qualified business income (qbi) deduction. Web form 8995 to figure the qbi deduction if: Web if you have qualified business income from a qualified trade or business, real estate investment trust dividends, publicly traded partnership income, or a domestic production. You have qualified business income, qualified reit. And • your 2022 taxable income before your qbi. With this deduction, select types of domestic businesses can deduct roughly 20% of their qbi,. And • your 2022 taxable income before. Several online services assist with. Web qualified business income deduction simplified computation attach to your tax return. • you have qbi, qualified reit dividends, or qualified ptp income or loss (all defined later);

• you have qbi, qualified reit dividends, or qualified ptp income or loss (all defined later); With this deduction, select types of domestic businesses can deduct roughly 20% of their qbi,. If you are unfamiliar with the qualified business income deduction (qbid), click here for more information. Web use this form if your taxable income, before your qualified business income deduction, is above $170,050 ($340,100 if married filing jointly), or you’re a patron of an agricultural. Go to www.irs.gov/form8995a for instructions and the latest information. Web the qualified business income deduction (qbi) is a recently established tax deduction allowing businesses to deduct as much as 20% of their earnings. Web section 199a is a qualified business income (qbi) deduction. • you have qbi, qualified reit dividends, or qualified ptp income or loss; Web qualified business income deduction attach to your tax return. Several online services assist with.

Fill Free fillable Form 2020 8995A Qualified Business

Several online services assist with. Web use this form if your taxable income, before your qualified business income deduction, is above $170,050 ($340,100 if married filing jointly), or you’re a patron of an agricultural. Web section 199a is a qualified business income (qbi) deduction. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified.

8995 A Qualified Business Deduction Form Fill Out and Sign Printable

Web the qualified business income deduction (qbi) is a recently established tax deduction allowing businesses to deduct as much as 20% of their earnings. Web download or print the 2022 federal 8995 (qualified business income deduction simplified computation) for free from the federal internal revenue service. Web the qualified business income deduction (qbi) is intended to reduce the tax rate.

Fill Free fillable Form 2019 8995A Qualified Business

You have qualified business income, qualified reit. Go to www.irs.gov/form8995a for instructions and the latest information. You have qualified business income, qualified reit dividends, or. And • your 2022 taxable income before. Web use this form if your taxable income, before your qualified business income deduction, is above $170,050 ($340,100 if married filing jointly), or you’re a patron of an.

Additional Guidance Needed Regarding the Qualified Business

Web form 8995 to figure the qbi deduction if: Web if you have qualified business income from a qualified trade or business, real estate investment trust dividends, publicly traded partnership income, or a domestic production. And • your 2022 taxable income before your qbi. And • your 2022 taxable income before. Web qualified business income deduction simplified computation attach to.

What You Need to Know about Qualified Business Deduction for

• you have qbi, qualified reit dividends, or qualified ptp income or loss; Individual taxpayers and some trusts and estates may be entitled to a deduction of up to 20% of. Several online services assist with. Web qualified business income deduction simplified computation attach to your tax return. Web qualified business income deduction attach to your tax return.

Qualified Business Deduction Summary Form Charles Leal's Template

And • your 2022 taxable income before. And • your 2022 taxable income before your qbi. If you are unfamiliar with the qualified business income deduction (qbid), click here for more information. You have qualified business income, qualified reit. Web if you have qualified business income from a qualified trade or business, real estate investment trust dividends, publicly traded partnership.

Using Form 8995 To Determine Your Qualified Business Deduction

Web section 199a is a qualified business income (qbi) deduction. • you have qbi, qualified reit dividends, or qualified ptp income or loss; Go to www.irs.gov/form8995 for instructions and the latest information. And • your 2022 taxable income before. You have qualified business income, qualified reit dividends, or.

IRS Form 8995 Download Fillable PDF or Fill Online Qualified Business

If you are unfamiliar with the qualified business income deduction (qbid), click here for more information. You have qualified business income, qualified reit. And • your 2022 taxable income before. Web use form 8995 to calculate your qualified business income (qbi) deduction. Go to www.irs.gov/form8995 for instructions and the latest information.

Form 8995a Qualified Business Deduction Phrase on the Sheet

Web qualified business income deduction attach to your tax return. Web download or print the 2022 federal 8995 (qualified business income deduction simplified computation) for free from the federal internal revenue service. Go to www.irs.gov/form8995a for instructions and the latest information. Web the qualified business income deduction (qbi) is a recently established tax deduction allowing businesses to deduct as much.

IRS Form 8995 Instructions Your Simplified QBI Deduction

Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax. If you are unfamiliar with the qualified business income deduction (qbid), click here for more information. • you have qbi, qualified reit dividends, or qualified ptp income or loss (all defined.

Web The Qualified Business Income Deduction (Qbi) Is A Recently Established Tax Deduction Allowing Businesses To Deduct As Much As 20% Of Their Earnings.

Several online services assist with. • you have qbi, qualified reit dividends, or qualified ptp income or loss (all defined later); Web form 8995 to figure the qbi deduction if: Go to www.irs.gov/form8995a for instructions and the latest information.

You Have Qualified Business Income, Qualified Reit.

And • your 2022 taxable income before your qbi. Web section 199a is a qualified business income (qbi) deduction. With this deduction, select types of domestic businesses can deduct roughly 20% of their qbi,. Web if you have qualified business income from a qualified trade or business, real estate investment trust dividends, publicly traded partnership income, or a domestic production.

Go To Www.irs.gov/Form8995 For Instructions And The Latest Information.

And • your 2022 taxable income before. If you are unfamiliar with the qualified business income deduction (qbid), click here for more information. Web use this form if your taxable income, before your qualified business income deduction, is above $170,050 ($340,100 if married filing jointly), or you’re a patron of an agricultural. Web download or print the 2022 federal 8995 (qualified business income deduction simplified computation) for free from the federal internal revenue service.

• You Have Qbi, Qualified Reit Dividends, Or Qualified Ptp Income Or Loss;

You have qualified business income, qualified reit dividends, or. Individual taxpayers and some trusts and estates may be entitled to a deduction of up to 20% of. Web use form 8995 to calculate your qualified business income (qbi) deduction. Web qualified business income deduction simplified computation attach to your tax return.