Instructions For Form 5695

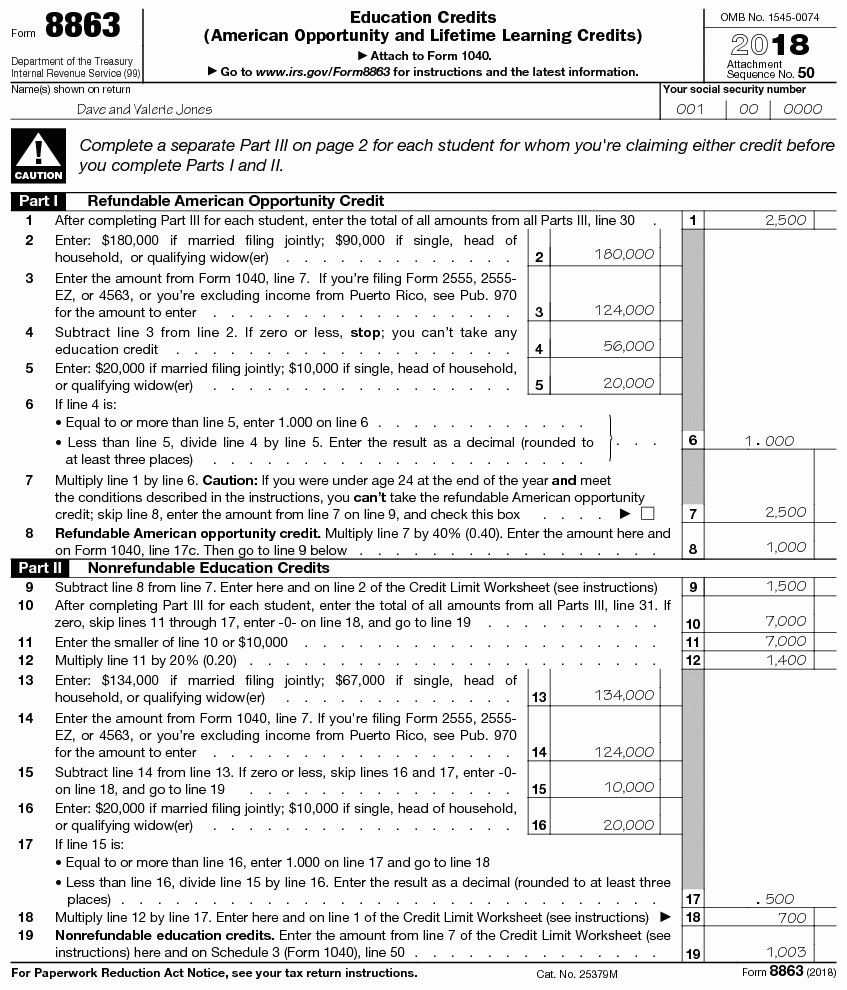

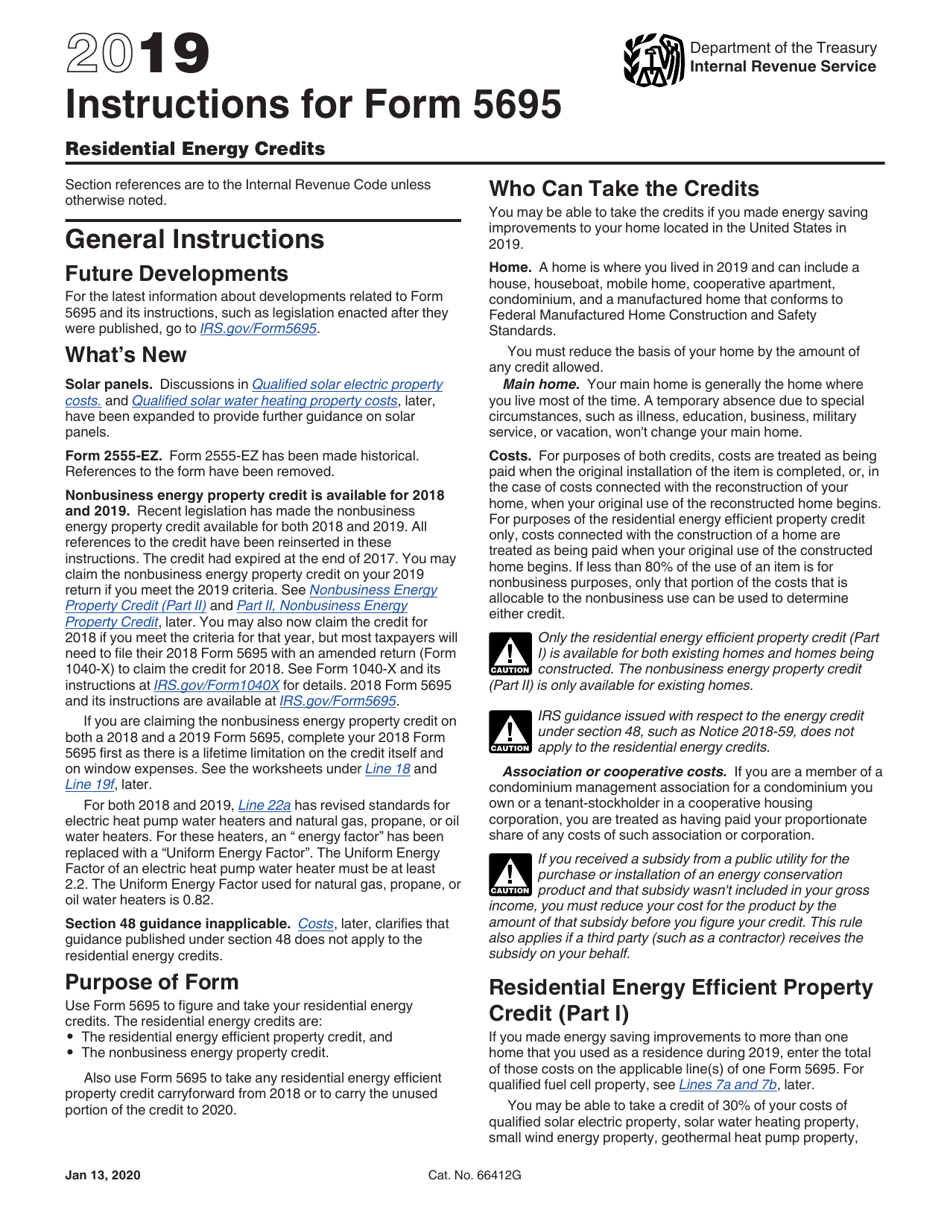

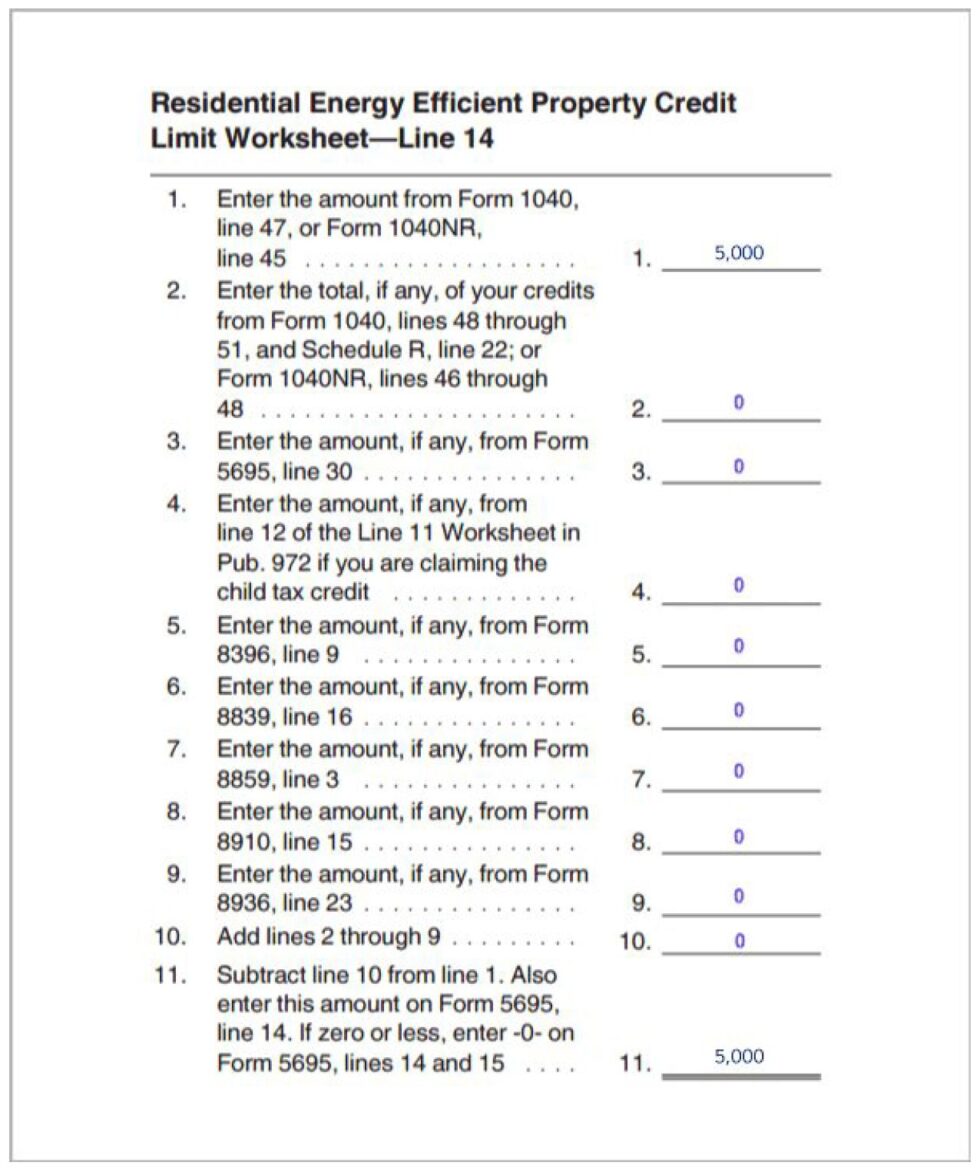

Instructions For Form 5695 - Use form 5695 to figure and take your residential energy credits. Figure the amount of any of the following credits you are claiming. Web use form 5695 to figure and take your residential energy credits. Web also use form 5695 to take any residential energy efficient property credit carryforward from 2020 or to carry the unused portion of the credit to 2022. Enter your energy efficiency property costs form 5695 calculates tax. The residential energy credits are: Web purpose of form use form 5695 to figure and take your residential energy credits. You just have to complete the section concerning to the types of credits you need to claim. Before you begin part i. Web on line 25 of the form with the combined amount on line 24, cross out the preprinted $500 and enter $1,000.

Type 5695to highlight the form 5695 and click okto open the form. Web use form 5695 to figure and take your residential energy credits. Part i residential energy efficient property credit. You just have to complete the section concerning to the types of credits you need to claim. Web generating the 5695 in proseries: Web purpose of form use form 5695 to figure and take your residential energy credits. The instructions give taxpayers additional information regarding eligibility for the credit. The residential energy credits are: To add or remove this. The residential energy credits are:

The instructions give taxpayers additional information regarding eligibility for the credit. Type 5695to highlight the form 5695 and click okto open the form. All you need to do is complete irs form 5695, “residential energy credits,” and include the final result. Web purpose of form use form 5695 to figure and take your residential energy credits. Enter your energy efficiency property costs form 5695 calculates tax. • the residential energy efficient property credit, and. The residential energy credits are: • the residential clean energy credit, and • the. The residential energy credits are: You just have to complete the section concerning to the types of credits you need to claim.

Tax Form 5695 by AscendWorks Issuu

Meaning of 5695 form as a finance term. Web per irs instructions for form 5695, page 1: Web purpose of form use form 5695 to figure and take your residential energy credits. The residential energy credits are: • the residential clean energy credit, and • the.

Form Instructions Is Available For How To File 5695 2018 —

On the dotted line to the left of line 25, enter more. Web what is form 5695? The instructions give taxpayers additional information regarding eligibility for the credit. The residential energy credits are: The residential energy credits are:

How to Claim the Federal Solar Investment Tax Credit Solar Sam

The residential energy efficient property credit, and the nonbusiness energy. All you need to do is complete irs form 5695, “residential energy credits,” and include the final result. Use form 5695 to figure and take your residential energy credits. Type 5695to highlight the form 5695 and click okto open the form. Web purpose of form use form 5695 to figure.

Form 5695 Download Fillable PDF or Fill Online Qualified Health

• the residential energy efficient property credit, and. Web also use form 5695 to take any residential energy efficient property credit carryforward from 2020 or to carry the unused portion of the credit to 2022. Meaning of 5695 form as a finance term. The residential energy credits are: Web per irs instructions for form 5695, on page 1:

Business Line Of Credit Stated 2022 Cuanmologi

Web what is form 5695? Web generating the 5695 in proseries: Use form 5695 to figure and take your residential energy credits. • the residential energy efficient property credit, and. All you need to do is complete irs form 5695, “residential energy credits,” and include the final result.

Form 5695 Instructions Information On Form 5695 —

The section 25c credit is claimed on form 5695. • the residential energy efficient property credit, and. The residential energy credits are: You just have to complete the section concerning to the types of credits you need to claim. Web on line 25 of the form with the combined amount on line 24, cross out the preprinted $500 and enter.

Download Instructions for IRS Form 5695 Residential Energy Credits PDF

Web also use form 5695 to take any residential energy efficient property credit carryforward from 2020 or to carry the unused portion of the credit to 2022. Irs form 5695 has a total of two parts in two pages. Press f6to bring up open forms. Web use form 5695 to figure and take your residential energy credits. Web on line.

How to file for the solar tax credit IRS Form 5695 instructions (2023)

Figure the amount of any of the following credits you are claiming. The residential energy credits are: Web use form 5695 to figure and take your residential energy credits. Before you begin part i. The instructions give taxpayers additional information regarding eligibility for the credit.

Instructions for filling out IRS Form 5695 Everlight Solar

Web purpose of form use form 5695 to figure and take your residential energy credits. Web also use form 5695 to take any residential energy efficient property credit carryforward from 2020 or to carry the unused portion of the credit to 2022. The residential energy credits are: The residential energy credits are: Figure the amount of any of the following.

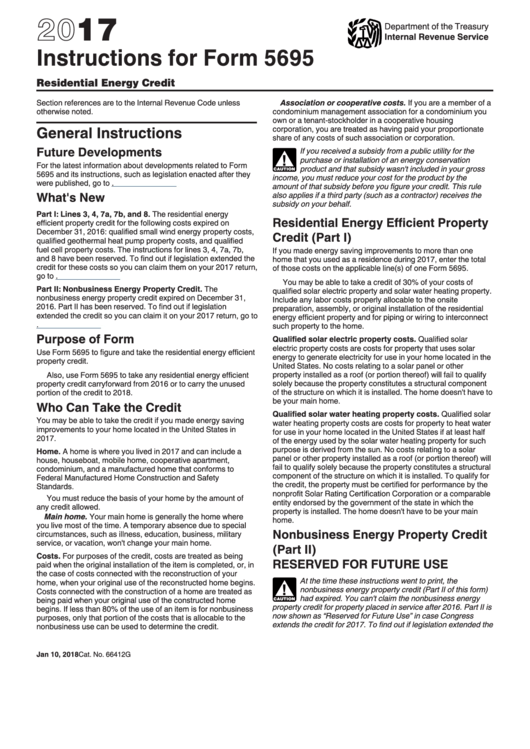

Instructions For Form 5695 Residential Energy Credit 2017 printable

Web form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment. Press f6to bring up open forms. The instructions give taxpayers additional information regarding eligibility for the credit. You just have to complete the section concerning to the types of credits you need to claim. Web generating the 5695 in proseries:

The Residential Energy Credits Are:

To add or remove this. The residential energy efficient property credit, and the nonbusiness energy. The residential energy credits are: Web what is form 5695?

Web Per Irs Instructions For Form 5695, Page 1:

Web instructions for filling out irs form 5695 for 2020 claiming the itc is easy. Web purpose of form use form 5695 to figure and take your residential energy credits. Part i residential energy efficient property credit. Web purpose of form use form 5695 to figure and take your residential energy credits.

Irs Form 5695 Has A Total Of Two Parts In Two Pages.

The instructions give taxpayers additional information regarding eligibility for the credit. Web generating the 5695 in proseries: Web per irs instructions for form 5695, on page 1: Web on line 25 of the form with the combined amount on line 24, cross out the preprinted $500 and enter $1,000.

The Residential Energy Credits Are:

Figure the amount of any of the following credits you are claiming. Use form 5695 to figure and take your residential energy credits. Web also use form 5695 to take any residential energy efficient property credit carryforward from 2020 or to carry the unused portion of the credit to 2022. All you need to do is complete irs form 5695, “residential energy credits,” and include the final result.