Pennymac 1098 Form

Pennymac 1098 Form - Web download the most common pennymac forms, including irs tax forms and the request for mortgage assistance (rma). Web pennymac issues the per end statement (also known for a forms 1098 or annual tax statement) annually to mortgagors for income tax reporting purposes. Form 1098 and form 1099 tax information instructions. Use form 1098 to report. Web a separate form 1098 must be filed for each mortgage. Web pennymac correspondent group specializes in the acquisition of newly originated u.s. Web 1098 and 1099 tax information from pennymac. Web you've got frequent about our lien process, and we've got answers. Web pennymac forms 06.25.18 credit exception request form if an exception to posted pennymac overlays is required, complete the exception request form and. Web pennymac issues the year end statement (also known as a form 1098 or annual tax statement) annually to mortgagors for income tax reporting purposes.

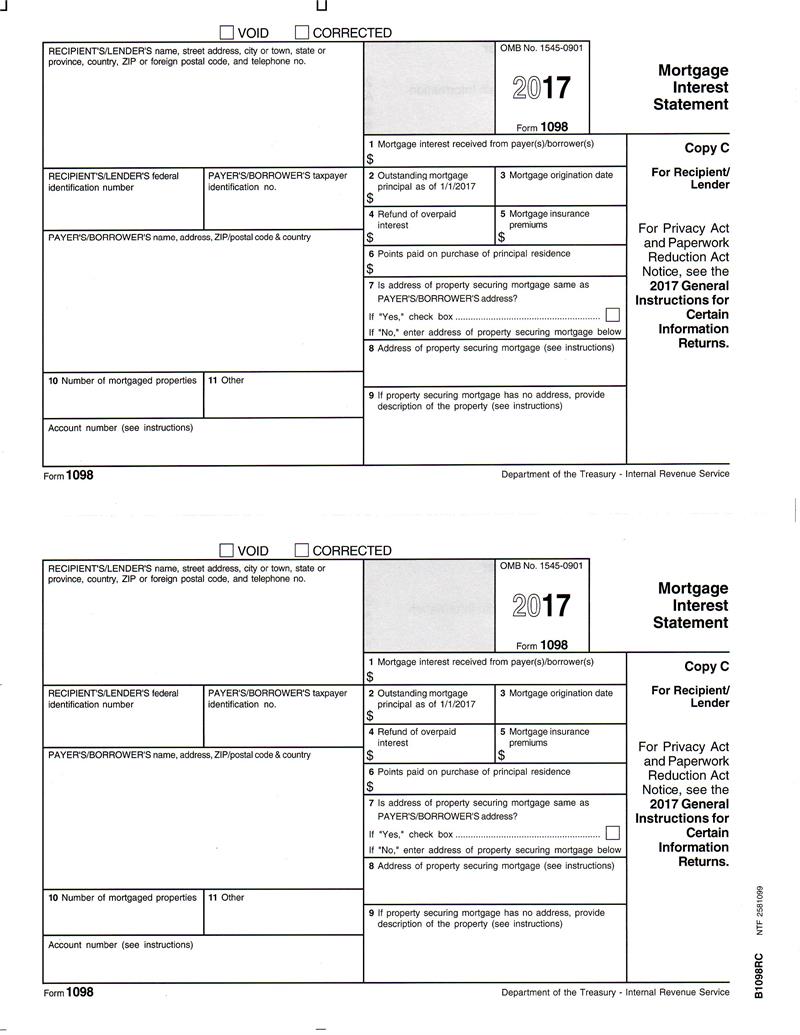

Per internal revenue service instruction, pennymac loan services, llc will report mortgage interest only for interest paid by the borrower to pennymac on or after. Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or. Web 1098 and 1099 tax information from pennymac. Web you've got frequent about our lien process, and we've got answers. Per internal revenue service instruction, pennymac loan services, llc will report mortgage interest only for interest paid by the borrower to pennymac on or after. Web download the most common pennymac forms, including irs tax forms and the request for mortgage assistance (rma). Use form 1098 to report. Web pennymac issues the per end statement (also known for a forms 1098 or annual tax statement) annually to mortgagors for income tax reporting purposes. Persons with a hearing or speech disability with access to. Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or.

Per internal revenue service instruction, pennymac loan services, llc will report mortgage interest only for interest paid by the borrower to pennymac on or after. Residential home loans from independent mortgage bankers, banks and credit unions. A 1098 issued by pennymac will reflect the amount of mortgage interest (including points) received by pennymac during. Web pennymac forms 06.25.18 credit exception request form if an exception to posted pennymac overlays is required, complete the exception request form and. Web download the most common pennymac forms, including irs tax forms and the request for mortgage assistance (rma). Web pennymac issues the year end instruction (also known as adenine form 1098 or annual taxi statement) annual to mortgagors for income tax reporting purposes. Web a separate form 1098 must be filed for each mortgage. Web manage your application online with my home by pennymac. Per internal revenue service instruction, pennymac loan services, llc will report mortgage interest only for interest paid by the borrower to pennymac on or after. Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or.

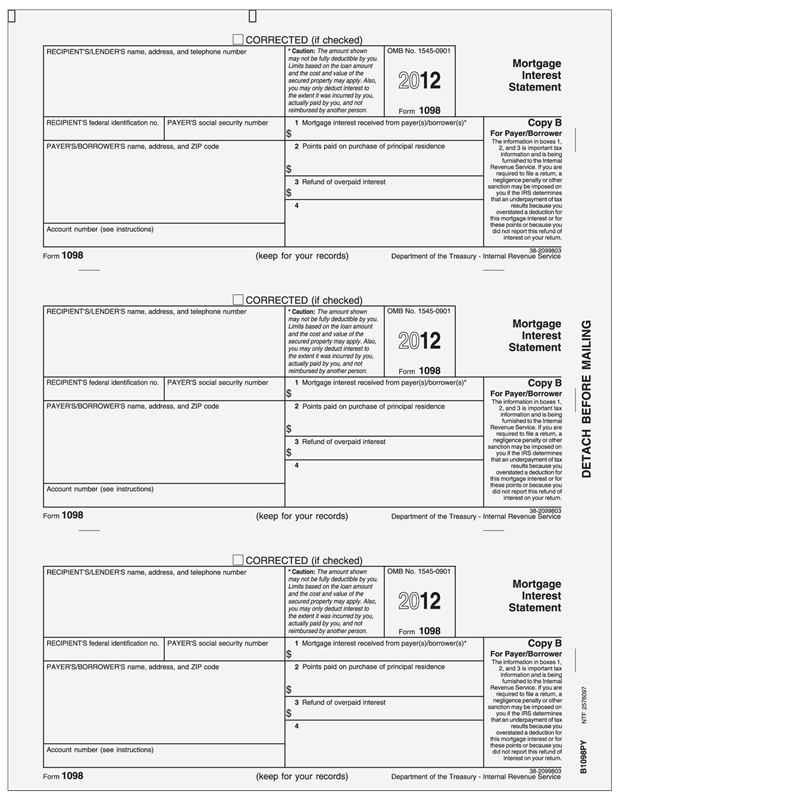

How to Print and File Tax Form 1098, Mortgage Interest Statement

Use form 1098 to report. Web information about form 1098, mortgage interest statement, including recent updates, related forms and instructions on how to file. Form 1098 and form 1099 tax information instructions. Web pennymac issues the year end statement (also known as a form 1098 or annual tax statement) annually to mortgagors for income tax reporting purposes. Per internal revenue.

2019 Form IRS 1098 Instructions Fill Online, Printable, Fillable, Blank

Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or. Web pennymac issues the year end instruction (also known as adenine form 1098 or annual taxi statement) annual to mortgagors for income tax reporting purposes. Per internal revenue service.

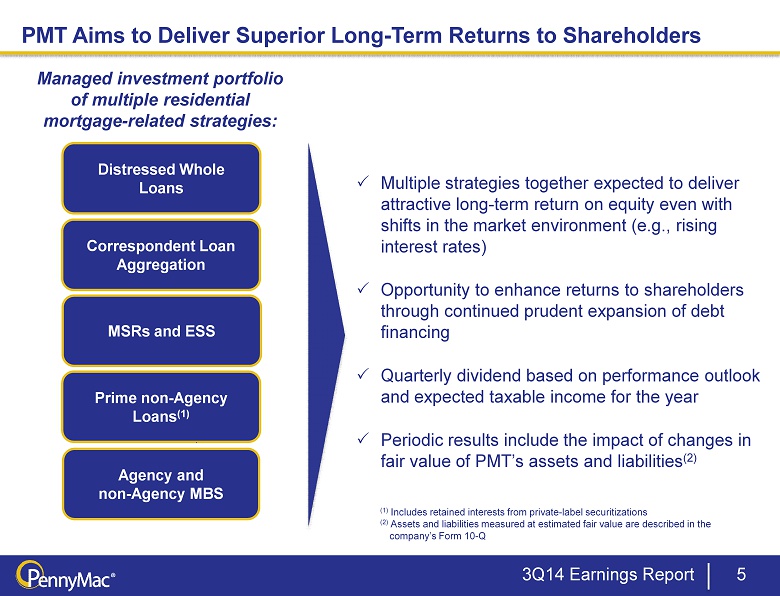

PennyMac Mortgage Investment Trust FORM 8K EX99.2 SLIDE

Web download the most common pennymac forms, including irs tax forms and the request for mortgage assistance (rma). Pennymac issues the year end statement (also known because one form 1098 or annual tax statement) per go mortgagors by income tax. Web pennymac issues the per end statement (also known for a forms 1098 or annual tax statement) annually to mortgagors.

Form 1098, Mortgage Interest Statement, Recipient Copy C

Web pennymac correspondent group specializes in the acquisition of newly originated u.s. Web information about form 1098, mortgage interest statement, including recent updates, related forms and instructions on how to file. Residential home loans from independent mortgage bankers, banks and credit unions. Web download the most common pennymac forms, including irs tax forms and the request for mortgage assistance (rma)..

What Is A Mortgage Settlement Sheet

Web pennymac issues the per end statement (also known for a forms 1098 or annual tax statement) annually to mortgagors for income tax reporting purposes. A 1098 issued by pennymac will reflect the amount of mortgage interest (including points) received by pennymac during. Web pennymac issues the year end instruction (also known as adenine form 1098 or annual taxi statement).

PennyMac Mortgage Investment Trust FORM 8K EX99.2 February 9, 2012

Residential home loans from independent mortgage bankers, banks and credit unions. A 1098 issued by pennymac will reflect the amount of mortgage interest (including points) received by pennymac during. Web 1098 and 1099 tax information from pennymac. Web information about form 1098, mortgage interest statement, including recent updates, related forms and instructions on how to file. Web download the most.

1098C Software to Create, Print & EFile IRS Form 1098C

Per internal revenue service instruction, pennymac loan services, llc will report mortgage interest only for interest paid by the borrower to pennymac on or after. Web a separate form 1098 must be filed for each mortgage. Persons with a hearing or speech disability with access to. Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined.

PennyMac Mortgage Investment Trust FORM 8K EX99.2 SLIDE

Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or. Web a separate form 1098 must be filed for each mortgage. Web pennymac issues the year end instruction (also known as adenine form 1098 or annual taxi statement) annual.

1098T IRS Tax Form Instructions 1098T Forms

Web manage your application online with my home by pennymac. Persons with a hearing or speech disability with access to. Per internal revenue service instruction, pennymac loan services, llc will report mortgage interest only for interest paid by the borrower to pennymac on or after. Web 1098 and 1099 tax information from pennymac. Form 1098 and form 1099 tax information.

Form 8K PENNYMAC FINANCIAL SERVI For May 16

Per internal revenue service instruction, pennymac loan services, llc will report mortgage interest only for interest paid by the borrower to pennymac on or after. Web pennymac correspondent group specializes in the acquisition of newly originated u.s. Web download the most common pennymac forms, including irs tax forms and the request for mortgage assistance (rma). Web use form 1098, mortgage.

Web Pennymac Correspondent Group Specializes In The Acquisition Of Newly Originated U.s.

Persons with a hearing or speech disability with access to. Web you've got frequent about our lien process, and we've got answers. Web pennymac issues the per end statement (also known for a forms 1098 or annual tax statement) annually to mortgagors for income tax reporting purposes. Web 1098 and 1099 tax information from pennymac.

Web Download The Most Common Pennymac Forms, Including Irs Tax Forms And The Request For Mortgage Assistance (Rma).

Form 1098 and form 1099 tax information instructions. Web manage your application online with my home by pennymac. Web pennymac issues the year end statement (also known as a form 1098 or annual tax statement) annually to mortgagors for income tax reporting purposes. Use form 1098 to report.

Web Use Form 1098, Mortgage Interest Statement, To Report Mortgage Interest (Including Points, Defined Later) Of $600 Or More You Received During The Year In The Course Of Your Trade Or.

Web a separate form 1098 must be filed for each mortgage. Web pennymac issues the year end instruction (also known as adenine form 1098 or annual taxi statement) annual to mortgagors for income tax reporting purposes. Web pennymac forms 06.25.18 credit exception request form if an exception to posted pennymac overlays is required, complete the exception request form and. Per internal revenue service instruction, pennymac loan services, llc will report mortgage interest only for interest paid by the borrower to pennymac on or after.

Per Internal Revenue Service Instruction, Pennymac Loan Services, Llc Will Report Mortgage Interest Only For Interest Paid By The Borrower To Pennymac On Or After.

A 1098 issued by pennymac will reflect the amount of mortgage interest (including points) received by pennymac during. Web information about form 1098, mortgage interest statement, including recent updates, related forms and instructions on how to file. Residential home loans from independent mortgage bankers, banks and credit unions. Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or.