Notice To Cosigner Form

Notice To Cosigner Form - If the buyer doesn’t pay the debt, you will have to. Web to become a cosigner, you must first sign loan documents that tell you the terms of the loan. If the borrower doesn’t pay the debt, you will have to. The term shall include any person whose signature is requested as a condition to granting credit to another person, or as a condition for forbearance on collection of another person's obligation that is in default. Be sure you can afford to pay if you have to, and that you want to accept this responsibility. If the borrower doesn’t pay the debt, you will have to. Web notice to cosigner youare being asked to guarantee this debt. Be sure you can afford to pay if you have to, and that you want to accept this responsibility. The lender also must give you a document called the notice to cosigner. You may have to pay up to the full amount of the debt if the borrower does not pay.

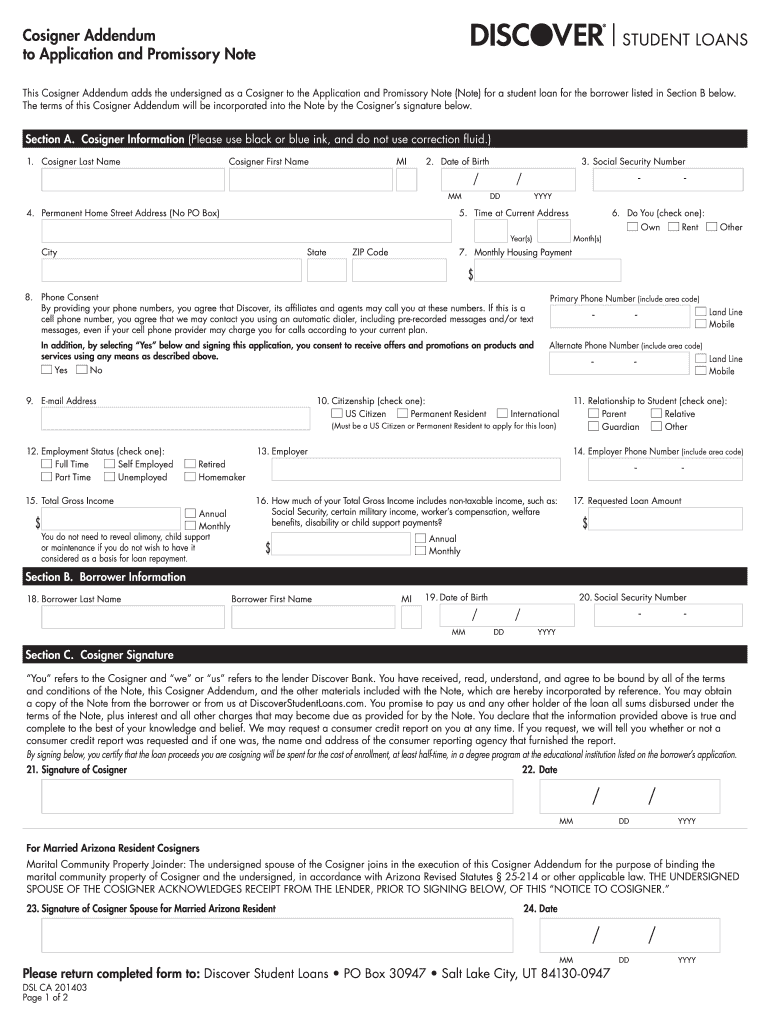

Think carefully before you do. If the borrower does not pay the debt, you will have to. Web the best way to modify and esign notice to cosigner without breaking a sweat get notice to co signer form and click on get form to get started. If the borrower doesn’t pay the debt, you will have to. Highlight relevant segments of your documents or blackout sensitive information with. Be sure you can afford to pay if you have to, and that you want to accept this responsibility. Web you may print the cosigner notice on your letterhead and include identifying information, such as the credit account number, the name of the cosigner, the amount of the debt, and the date. Web think carefully before you do. Be sure you can afford to pay if you have to, and that you want to accept this responsibility. You are being asked to guarantee this debt.

The term shall include any person whose signature is requested as a condition to granting credit to another person, or as a condition for forbearance on collection of another person's obligation that is in default. Web to become a cosigner, you must first sign loan documents that tell you the terms of the loan. Be sure you can afford to pay if you have to,. Web notice to cosigner youare being asked to guarantee this debt. Think carefully before you do. Think carefully before you do. You may have to pay up to the full amount of the debt if the buyer does not pay. Be sure you can afford to pay if you have to, and that you want to accept this responsibility. You may have to pay up to the full amount of the debt if the buyer does not pay. If the buyer doesn’t pay the debt, you will have to.

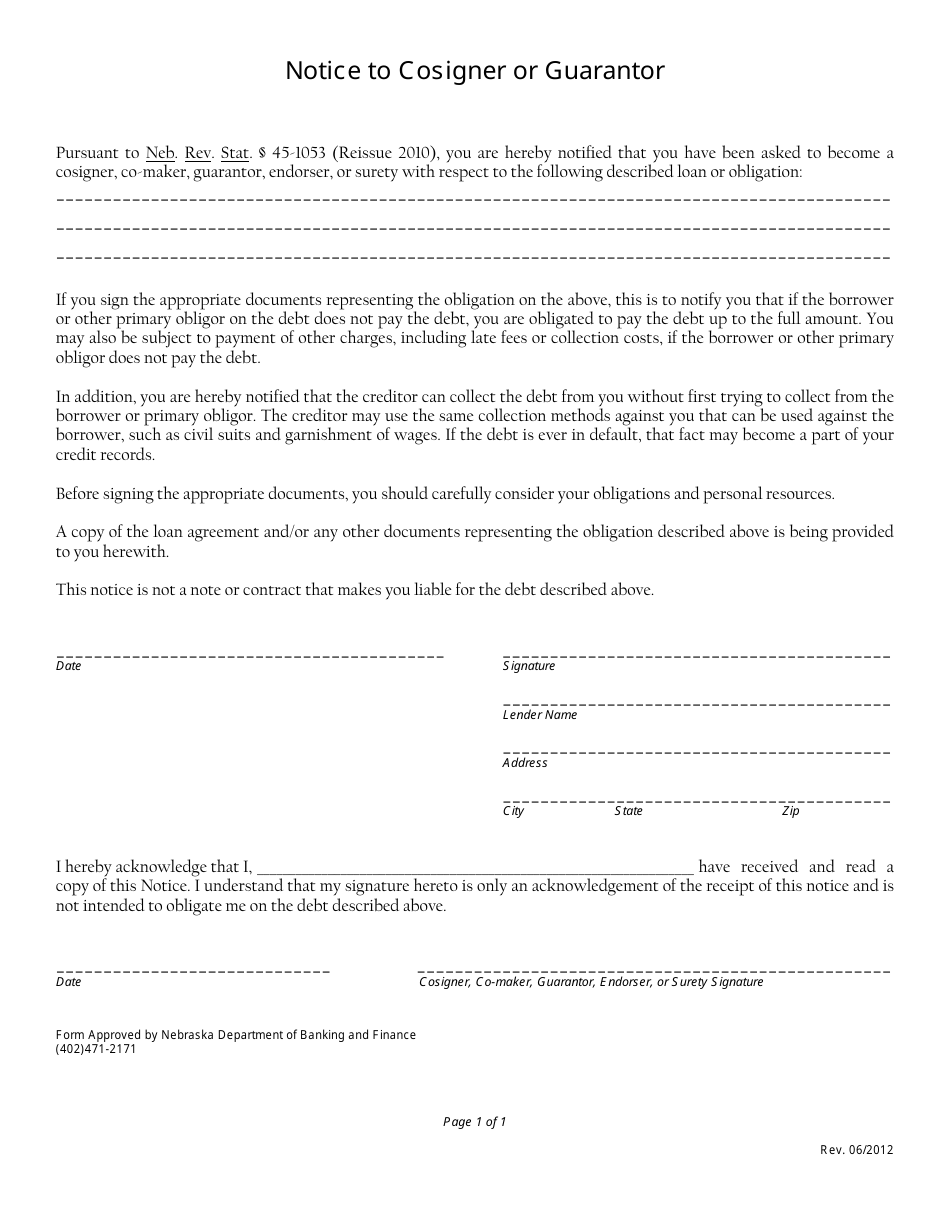

Nebraska Notice to Cosigner or Guarantor Download Printable PDF

The notice tells you what will happen if the main borrower doesn’t pay on time or defaults on the debt. You may have to pay up to the full amount of the debt if the borrower does not pay. If the buyer doesn t pay the debt, you will have to. Think carefully before you do. If the borrower does.

Application Form Rental Application Form With Cosigner

If the buyer doesn’t pay the debt, you will have to. Web you may print the cosigner notice on your letterhead and include identifying information, such as the credit account number, the name of the cosigner, the amount of the debt, and the date. Be sure you can afford to pay if you have to,. You may also have to.

Sample EForms

The lender also must give you a document called the notice to cosigner. The notice tells you what will happen if the main borrower doesn’t pay on time or defaults on the debt. You also may provide a signature line for the cosigner to acknowledge receipt of the notice. Web to become a cosigner, you must first sign loan documents.

Notice to Cosigner

Web think carefully before you do. The lender also must give you a document called the notice to cosigner. Think carefully before you do. You may have to pay up to the full amount of the debt if the borrower (buyer) does not pay. Web you may print the cosigner notice on your letterhead and include identifying information, such as.

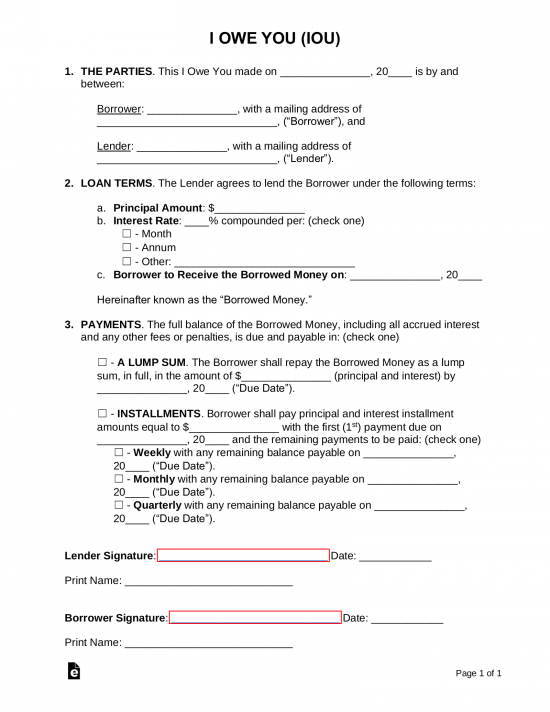

Free Promissory Note Templates Word PDF eForms

Think carefully before you do. Be sure you can afford to pay if you have to,. Think carefully before you do. If the borrower does not pay the debt, you will have to. Under the ftc’s credit practices rule, this is what the notice says:

COSIGNER AGREEMENT PDF Being a landlord, Wholesale real estate

Be sure you can afford to pay if you have to, and that you want to accept this responsibility. Think carefully before you do. If the borrower doesn’t pay the debt, you will have to. Think carefully before you do. Under the ftc’s credit practices rule, this is what the notice says:

Notice To Cosigner Form US Auto Supplies US AUTO SUPPLIES

Be sure you can afford to pay if you have to,. Be sure you can afford to pay if you have to, and that you want to accept this responsibility. You may have to pay up to the full amount of the debt if the borrower does not pay. If the buyer doesn t pay the debt, you will have.

Cosigner Addendum Form Fill Out and Sign Printable PDF Template signNow

Web think carefully before you do. Be sure you can afford to pay if you have to,. You may have to pay up to the full amount of the debt if the borrower (buyer) does not pay. Web you may print the cosigner notice on your letterhead and include identifying information, such as the credit account number, the name of.

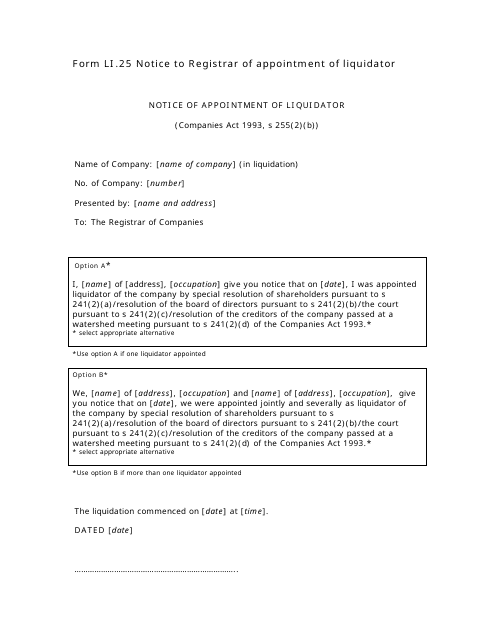

Notice to Registrar of Appointment of Liquidator Download Printable PDF

If the buyer doesn t pay the debt, you will have to. Take advantage of the instruments we offer to complete your document. You are being asked to guarantee this debt. Be sure you can afford to pay if you have to, and that you want to accept this responsibility. Highlight relevant segments of your documents or blackout sensitive information.

Cosigner Agreement Property Management Training

You may have to pay up to the full amount of the debt if the borrower (buyer) does not pay. You may have to pay up to the full amount of the debt if the buyer does not pay. Take advantage of the instruments we offer to complete your document. Think carefully before you do. Be sure you can afford.

If The Buyer Doesn T Pay The Debt, You Will Have To.

Web you may print the cosigner notice on your letterhead and include identifying information, such as the credit account number, the name of the cosigner, the amount of the debt, and the date. You are being asked to guarantee this debt. Under the ftc’s credit practices rule, this is what the notice says: Think carefully before you do.

If The Borrower Does Not Pay The Debt, You Will Have To.

Be sure you can afford to pay if you have to, and that you want to accept this responsibility. You may have to pay up to the full amount of the debt if the borrower does not pay. Take advantage of the instruments we offer to complete your document. If the borrower doesn’t pay the debt, you will have to.

If The Buyer Doesn’t Pay The Debt, You Will Have To.

You may also have to pay late fees or collection costs, which increase this amount. Think carefully before you do. Think carefully before you do. Web think carefully before you do.

The Notice Tells You What Will Happen If The Main Borrower Doesn’t Pay On Time Or Defaults On The Debt.

If the borrower (buyer) doesn’t pay the debt, you will have to. Be sure you can afford to pay if you have to, and that you want to accept this responsibility. Be sure you can afford to pay if you have to, and that you want to accept this responsibility. The lender also must give you a document called the notice to cosigner.