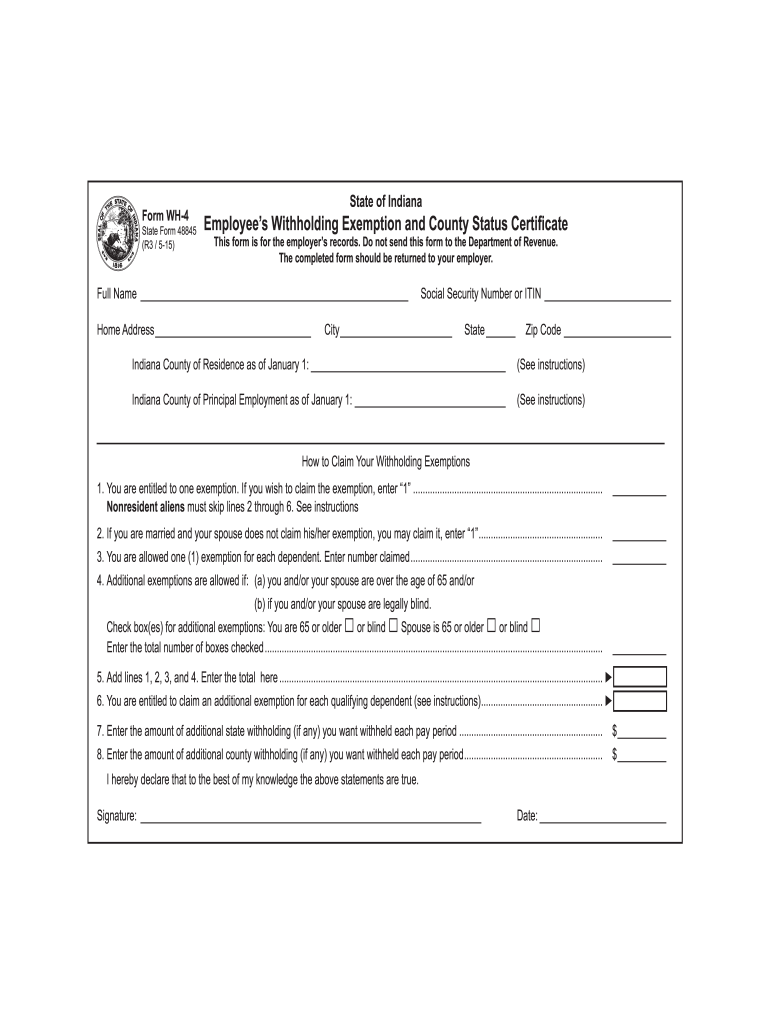

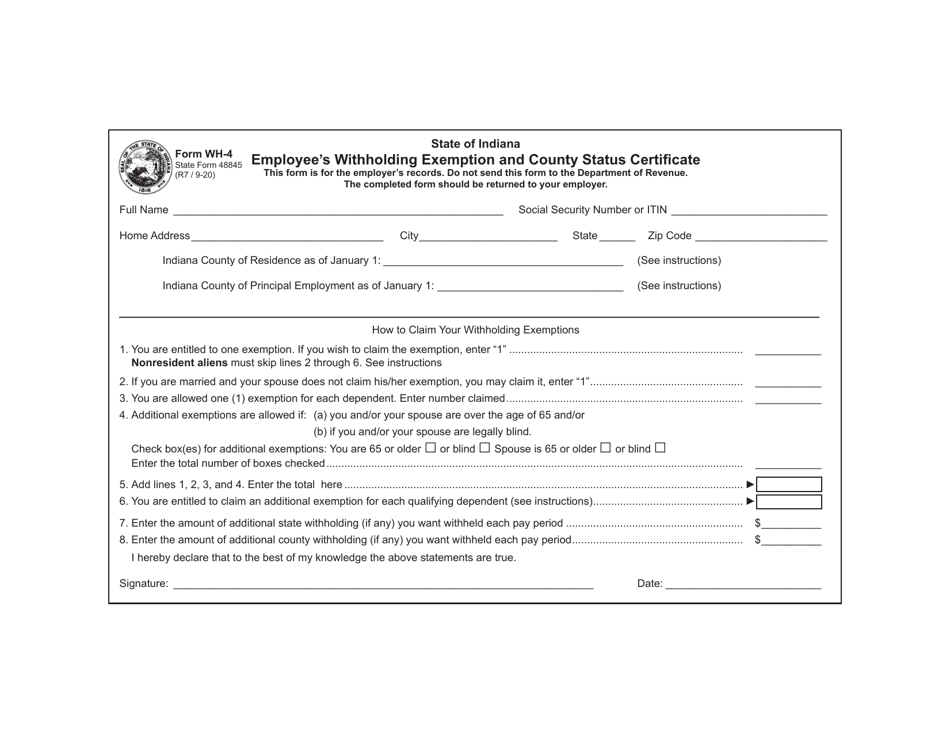

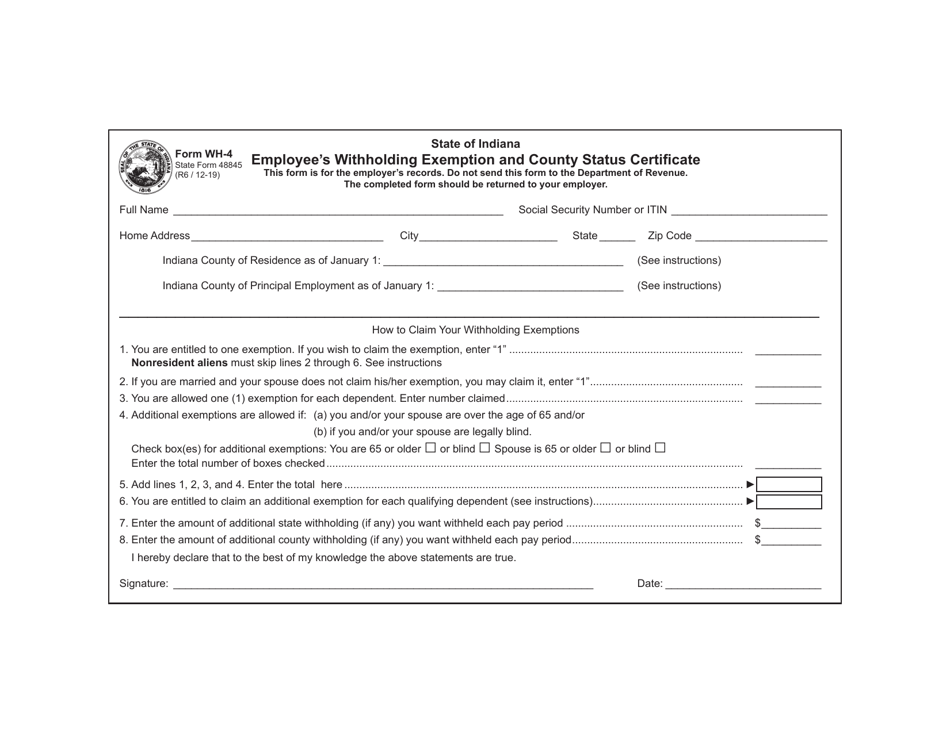

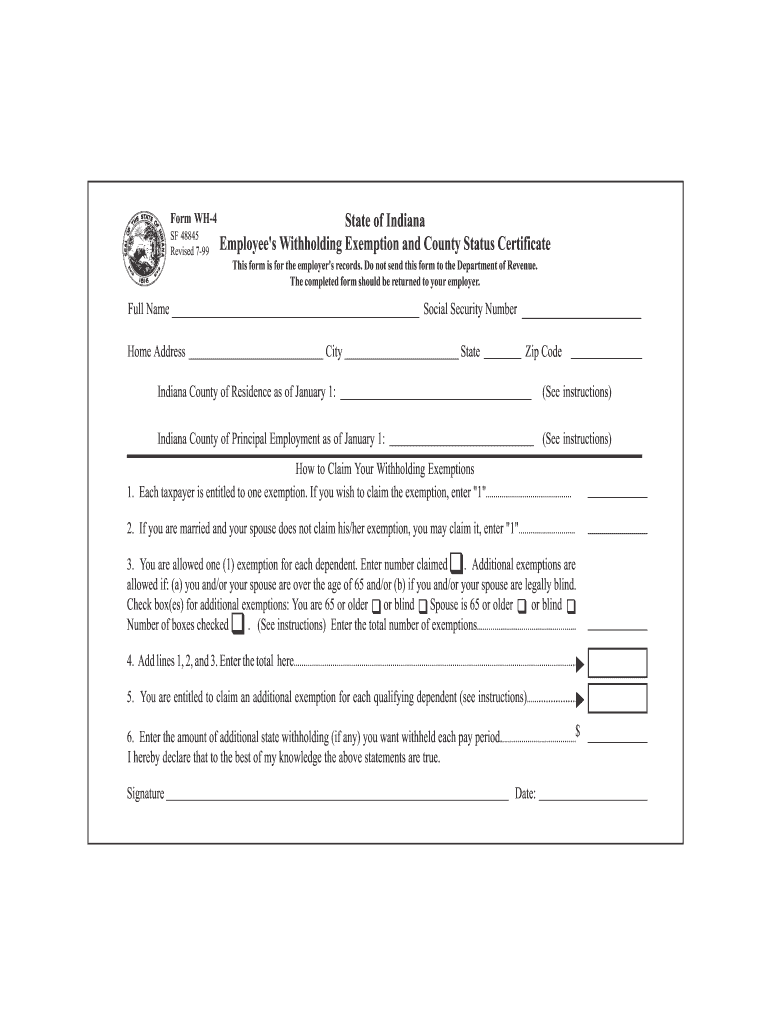

Indiana Form Wh 4

Indiana Form Wh 4 - Edit your 2019 indiana state withholding form online. In addition, the employer should look at. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. If too little is withheld, you will generally owe tax when. Web send wh 4 form 2019 via email, link, or fax. The new form no longer uses withholding allowances. You are entitled to one exemption. Web to register for withholding for indiana, the business must have an employer identification number (ein) from the federal government. If too little is withheld, you will generally owe tax when you file your tax return.

You are entitled to one exemption. Print or type your full name, social. Print or type your full name, social. Do not send this form to the. Web to register for withholding for indiana, the business must have an employer identification number (ein) from the federal government. Instead, there is a five. If too little is withheld, you will generally owe tax when you file your tax return. You can also download it, export it or print it out. Web send wh 4 form 2019 via email, link, or fax. The first question is 1.

Print or type your full name, social. The new form no longer uses withholding allowances. Web to register for withholding for indiana, the business must have an employer identification number (ein) from the federal government. Do not send this form to the. In addition, the employer should look at. If too little is withheld, you will generally owe tax when you file your tax return. Web send wh 4 form 2019 via email, link, or fax. The first question is 1. You can also download it, export it or print it out. You are entitled to one exemption.

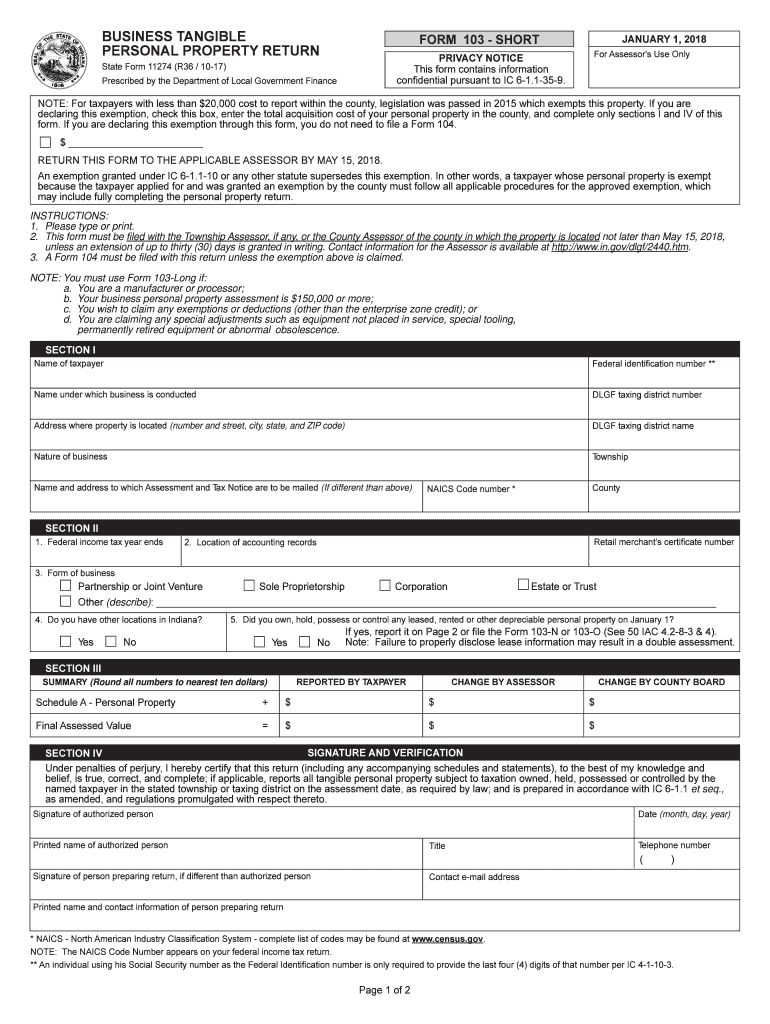

1996 IN Form 46800 Fill Online, Printable, Fillable, Blank pdfFiller

Web to register for withholding for indiana, the business must have an employer identification number (ein) from the federal government. In addition, the employer should look at. If too little is withheld, you will generally owe tax when you file your tax return. If too little is withheld, you will generally owe tax when. Table b is used to figure.

Indiana State Form 1940 Fill Online, Printable, Fillable, Blank

Do not send this form to the. If too little is withheld, you will generally owe tax when you file your tax return. Web send wh 4 form 2019 via email, link, or fax. Print or type your full name, social. If too little is withheld, you will generally owe tax when.

Form wh 4 2019 indiana Fill Out and Sign Printable PDF Template SignNow

Edit your 2019 indiana state withholding form online. In addition, the employer should look at. Table b is used to figure additional dependent exemptions. You are entitled to one exemption. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax.

Download Form WH4 State of Indiana for Free TidyTemplates

Print or type your full name, social. You are entitled to one exemption. Edit your 2019 indiana state withholding form online. If too little is withheld, you will generally owe tax when. Do not send this form to the.

Form WH4 (State Form 48845) Download Fillable PDF or Fill Online

In addition, the employer should look at. Print or type your full name, social. You can also download it, export it or print it out. Web send wh 4 form 2019 via email, link, or fax. Most employees are entitled to deduct $1,500 per year per qualifying dependent exemption.

Indiana Form 11274 Fill Out and Sign Printable PDF Template signNow

You are entitled to one exemption. Print or type your full name, social. Do not send this form to the. Table b is used to figure additional dependent exemptions. If too little is withheld, you will generally owe tax when you file your tax return.

Form WH4 (State Form 48845) Download Fillable PDF or Fill Online

If too little is withheld, you will generally owe tax when you file your tax return. Instead, there is a five. Print or type your full name, social. You can also download it, export it or print it out. The new form no longer uses withholding allowances.

IN Form WH4 1999 Fill and Sign Printable Template Online US Legal

The first question is 1. If too little is withheld, you will generally owe tax when. You can also download it, export it or print it out. In addition, the employer should look at. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax.

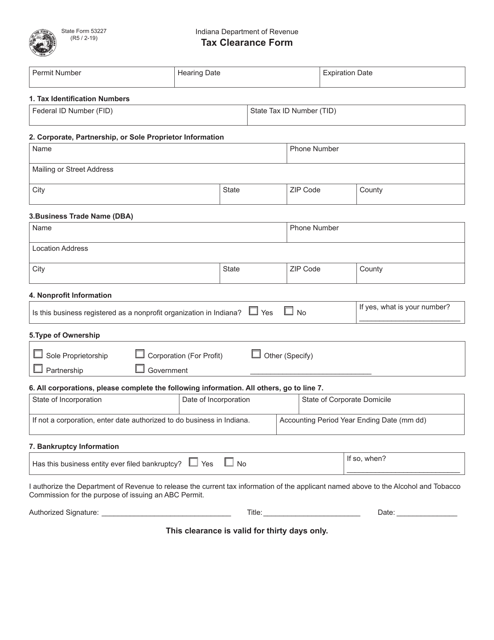

State Form 53227 Download Fillable PDF or Fill Online Tax Clearance

If too little is withheld, you will generally owe tax when. Web send wh 4 form 2019 via email, link, or fax. You can also download it, export it or print it out. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Print or type your full.

Certificate Of Residence {WH47} Indiana

Print or type your full name, social. Do not send this form to the. You are entitled to one exemption. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Web to register for withholding for indiana, the business must have an employer identification number (ein) from the.

The First Question Is 1.

Do not send this form to the. Print or type your full name, social. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. If too little is withheld, you will generally owe tax when you file your tax return.

Most Employees Are Entitled To Deduct $1,500 Per Year Per Qualifying Dependent Exemption.

Print or type your full name, social. Web send wh 4 form 2019 via email, link, or fax. You are entitled to one exemption. Web to register for withholding for indiana, the business must have an employer identification number (ein) from the federal government.

If Too Little Is Withheld, You Will Generally Owe Tax When.

In addition, the employer should look at. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Instead, there is a five. Edit your 2019 indiana state withholding form online.

Table B Is Used To Figure Additional Dependent Exemptions.

You can also download it, export it or print it out. The new form no longer uses withholding allowances.