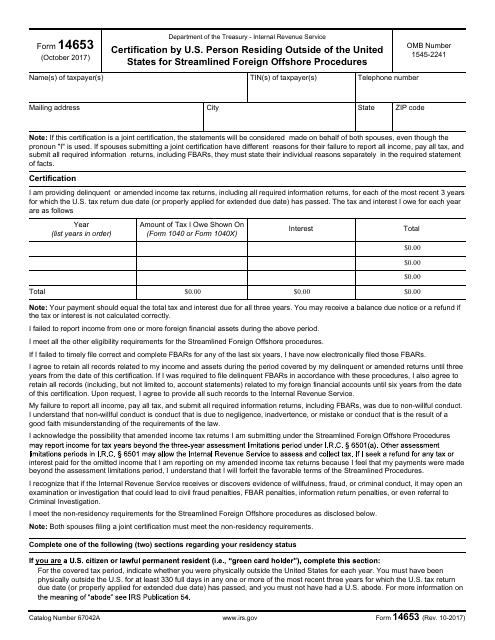

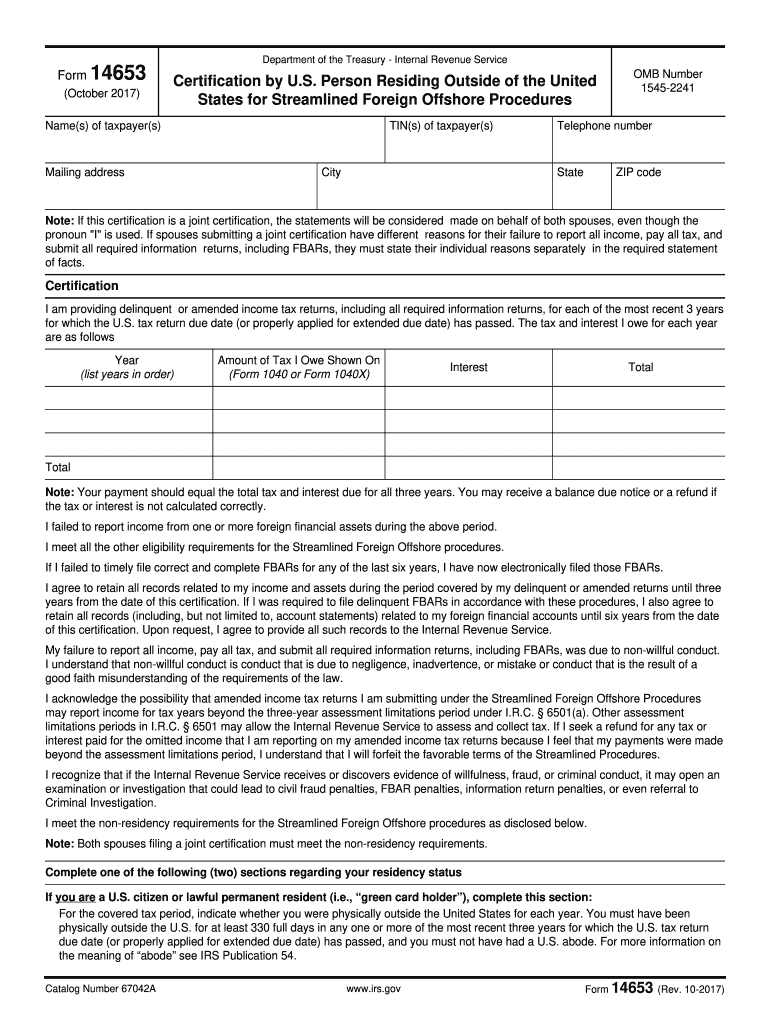

Irs Form 14653

Irs Form 14653 - § 6501 may allow the internal revenue service to assess and collect tax. Web form 14653 is an irs tax form expats must file when using the streamlined filing compliance procedures program. Web i am providing delinquent or amended income tax returns, including all required information returns, for each of the most recent 3 years for which the u.s. The tax and interest i owe for each year are as follows: Person residing outside of the u.s.(form 14653) pdf certifying (1) that you are eligible for the streamlined foreign offshore procedures; The amended form 14653 must include all facts and circumstances concerning the error in the original streamlined submission. On august 1, 2021, taxpayer makes a submission to the streamlined foreign offshore procedures (sfo). Other assessment limitations periods in i.r.c. Web she must provide amended income tax returns for tax years 2012, 2013, and 2014, an amended streamlined certification on form 14653, and payment for increases in tax and interest. The streamlined foreign offshore disclosure requires the applicant to complete form 14653.

Person residing outside of the u.s.(form 14653) pdf certifying (1) that you are eligible for the streamlined foreign offshore procedures; As of today, no separate filing guidelines for the form are provided by the irs. Form 14653 is intended to verify that your tax delinquency was not willful, which is required to utilize the streamlined program for getting caught up on taxes without penalties. Tax return due date (or properly applied for extended due date) has passed. Web i am providing delinquent or amended income tax returns, including all required information returns, for each of the most recent 3 years for which the u.s. And (3) that the failure to file tax returns, report all income, pay all. Person residing outside of the united states for streamlined foreign offshore procedures created date: The form 14653 certification by u.s. Web complete and sign a statement on the certification by u.s. Web what is irs form 14653?

The streamlined foreign offshore disclosure requires the applicant to complete form 14653. Web she must provide amended income tax returns for tax years 2012, 2013, and 2014, an amended streamlined certification on form 14653, and payment for increases in tax and interest. As of today, no separate filing guidelines for the form are provided by the irs. Web form 14653 is an irs tax form expats must file when using the streamlined filing compliance procedures program. And (3) that the failure to file tax returns, report all income, pay all. Person residing outside of the u.s.(form 14653) pdf certifying (1) that you are eligible for the streamlined foreign offshore procedures; Web i am providing delinquent or amended income tax returns, including all required information returns, for each of the most recent 3 years for which the u.s. Person residing outside of the united states for streamlined foreign offshore procedures, is a very important irs certification form used with the streamlined foreign offshore procedures (sfop). Taxpayer a's sfo submission includes a form 14653 and delinquent income tax returns for tax years, 2017, 2018, 2019, and 2020. The amended form 14653 must include all facts and circumstances concerning the error in the original streamlined submission.

Streamlined Procedure How to File Form 14653

The form 14653 certification by u.s. The amended form 14653 must include all facts and circumstances concerning the error in the original streamlined submission. Here are some quick tips. Taxpayer a's sfo submission includes a form 14653 and delinquent income tax returns for tax years, 2017, 2018, 2019, and 2020. Department of the treasury on october 1, 2017.

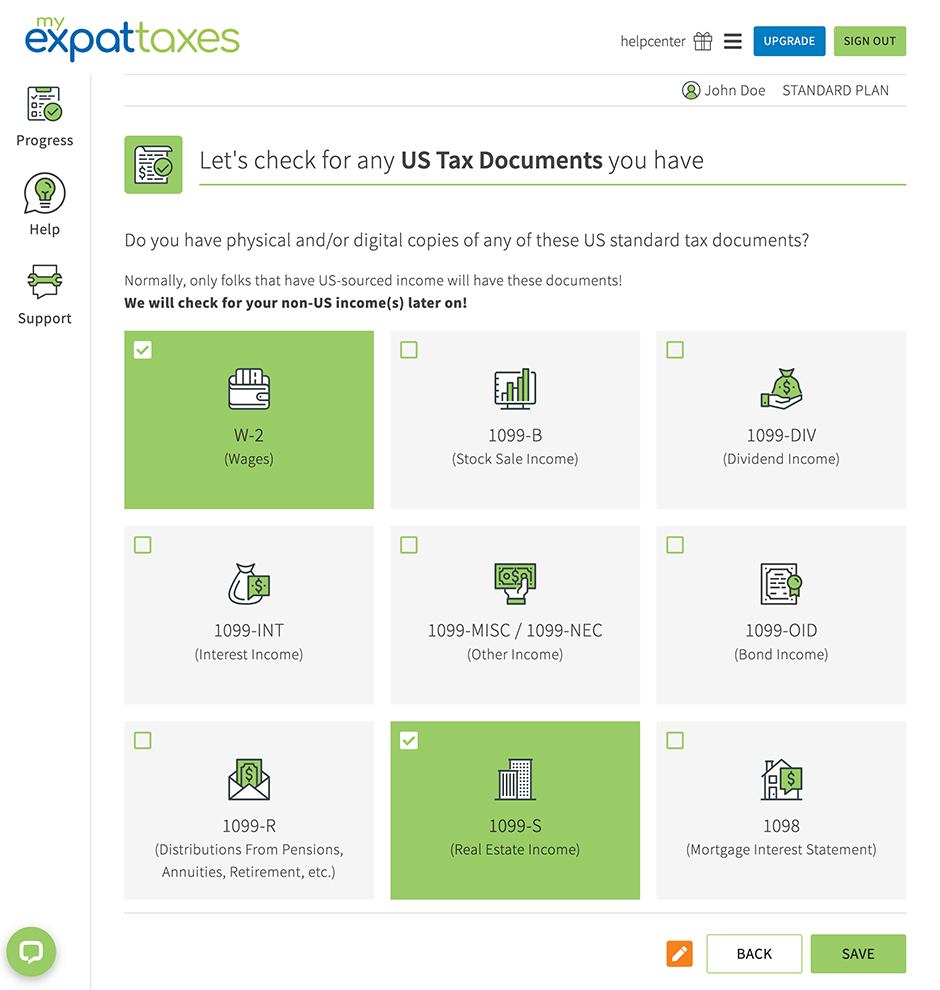

Most Affordable IRS Streamlining Option for US Expats MyExpatTaxes

(2) that all required fbars have now been filed (see instruction 8 below); Taxpayer a's sfo submission includes a form 14653 and delinquent income tax returns for tax years, 2017, 2018, 2019, and 2020. Web complete and sign a statement on the certification by u.s. The streamlined foreign offshore disclosure requires the applicant to complete form 14653. Department of the.

A Form 14653 Tax Certification Guide What You Must Know

Here are some quick tips. On august 1, 2021, taxpayer makes a submission to the streamlined foreign offshore procedures (sfo). Web what is irs form 14653? And (3) that the failure to file tax returns, report all income, pay all. Person residing outside of the u.s.(form 14653) pdf certifying (1) that you are eligible for the streamlined foreign offshore procedures;

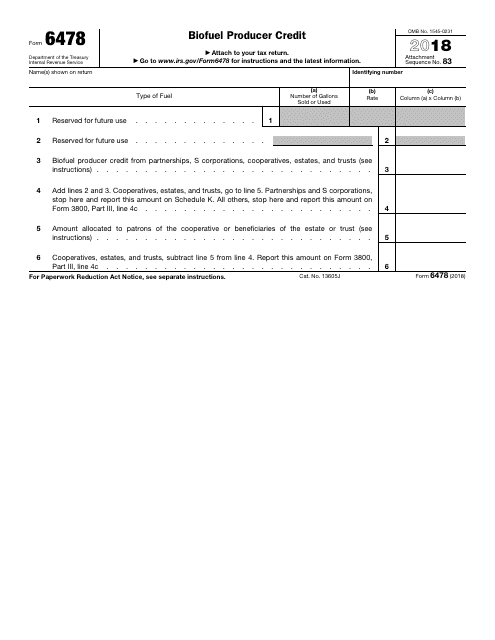

IRS Form 6478 Download Fillable PDF or Fill Online Biofuel Producer

§ 6501 may allow the internal revenue service to assess and collect tax. Web what is irs form 14653? As of today, no separate filing guidelines for the form are provided by the irs. On august 1, 2021, taxpayer makes a submission to the streamlined foreign offshore procedures (sfo). And (3) that the failure to file tax returns, report all.

What to Know About Form 14653? Example and Useful Tips Munchkin Press

Web complete and sign a statement on the certification by u.s. Web form 14653 is an irs tax form expats must file when using the streamlined filing compliance procedures program. As of today, no separate filing guidelines for the form are provided by the irs. Person residing outside of the united states for streamlined foreign offshore procedures, is a very.

IRS Form 14653 Download Fillable PDF or Fill Online Certification by U

§ 6501 may allow the internal revenue service to assess and collect tax. Person residing outside of the united states for streamlined foreign offshore procedures created date: Year list years in order (form 1040, line 76 Person residing outside of the united states for streamlined foreign offshore procedures, is a very important irs certification form used with the streamlined foreign.

Form 14653 Fill out & sign online DocHub

(2) that all required fbars have now been filed (see instruction 8 below); Taxpayer a's sfo submission includes a form 14653 and delinquent income tax returns for tax years, 2017, 2018, 2019, and 2020. The streamlined foreign offshore disclosure requires the applicant to complete form 14653. The tax and interest i owe for each year are as follows: Person residing.

IRS Form 14653 Download Fillable PDF or Fill Online Certification by U

Web complete and sign a statement on the certification by u.s. Tax return due date (or properly applied for extended due date) has passed. Web form 14653 is an irs tax form expats must file when using the streamlined filing compliance procedures program. Person residing outside of the united states for streamlined foreign offshore procedures created date: The form 14653.

Streamlined Foreign Offshore Procedure and Form 14653 SDG Accountant

Year list years in order (form 1040, line 76 Web she must provide amended income tax returns for tax years 2012, 2013, and 2014, an amended streamlined certification on form 14653, and payment for increases in tax and interest. Web complete and sign a statement on the certification by u.s. Tax return due date (or properly applied for extended due.

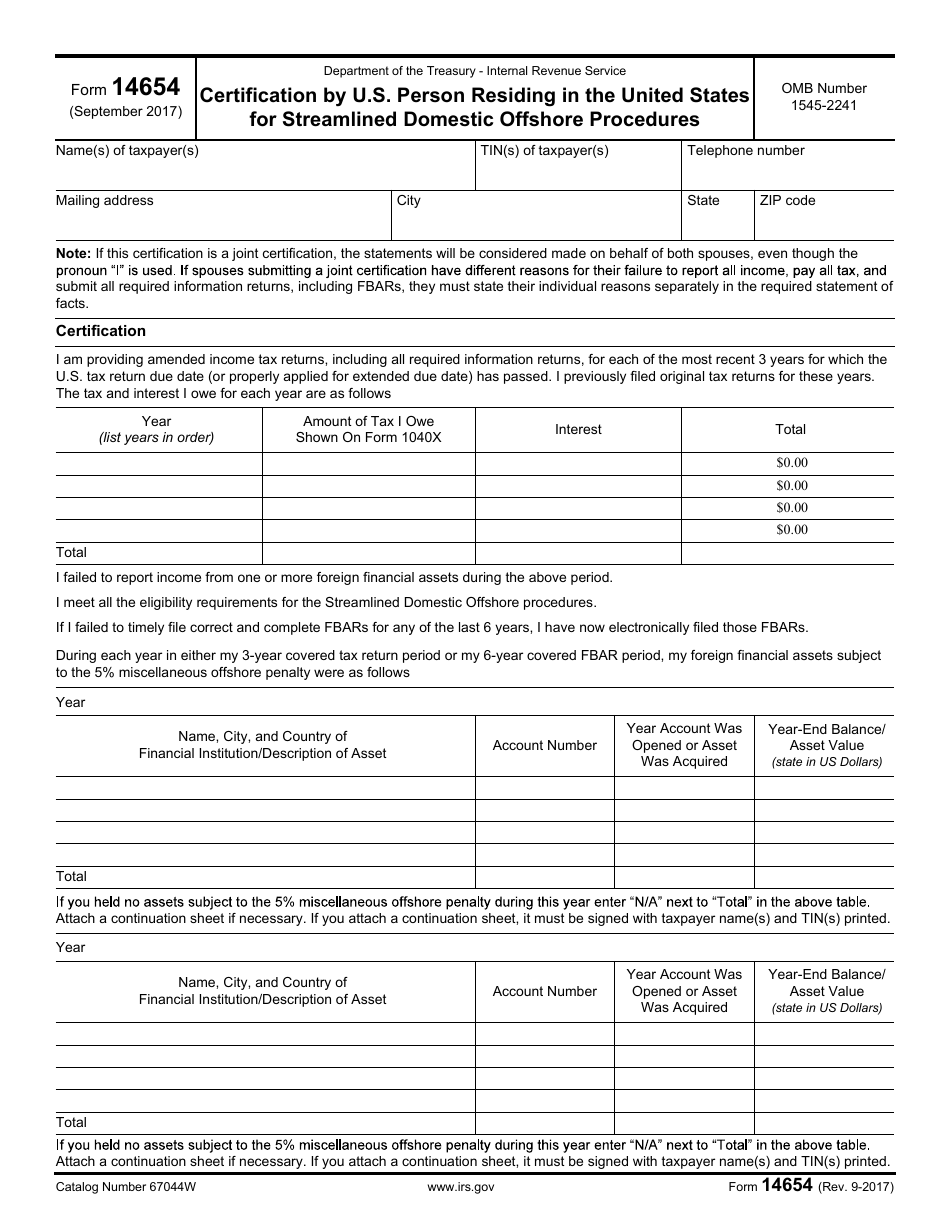

IRS Form 14654 Fill Out, Sign Online and Download Fillable PDF

The tax and interest i owe for each year are as follows: Web what is irs form 14653? The amended form 14653 must include all facts and circumstances concerning the error in the original streamlined submission. Web i am providing delinquent or amended income tax returns, including all required information returns, for each of the most recent 3 years for.

On August 1, 2021, Taxpayer Makes A Submission To The Streamlined Foreign Offshore Procedures (Sfo).

And (3) that the failure to file tax returns, report all income, pay all. The form 14653 certification by u.s. Web she must provide amended income tax returns for tax years 2012, 2013, and 2014, an amended streamlined certification on form 14653, and payment for increases in tax and interest. Person residing outside of the united states for streamlined foreign offshore procedures created date:

Web Complete And Sign A Statement On The Certification By U.s.

§ 6501 may allow the internal revenue service to assess and collect tax. Here are some quick tips. Taxpayer a's sfo submission includes a form 14653 and delinquent income tax returns for tax years, 2017, 2018, 2019, and 2020. Form 14653 is intended to verify that your tax delinquency was not willful, which is required to utilize the streamlined program for getting caught up on taxes without penalties.

Department Of The Treasury On October 1, 2017.

Person residing outside of the u.s.(form 14653) pdf certifying (1) that you are eligible for the streamlined foreign offshore procedures; The streamlined foreign offshore disclosure requires the applicant to complete form 14653. Other assessment limitations periods in i.r.c. The tax and interest i owe for each year are as follows:

Year List Years In Order (Form 1040, Line 76

Tax return due date (or properly applied for extended due date) has passed. As of today, no separate filing guidelines for the form are provided by the irs. Person residing outside of the united states for streamlined foreign offshore procedures, is a very important irs certification form used with the streamlined foreign offshore procedures (sfop). Web what is irs form 14653?