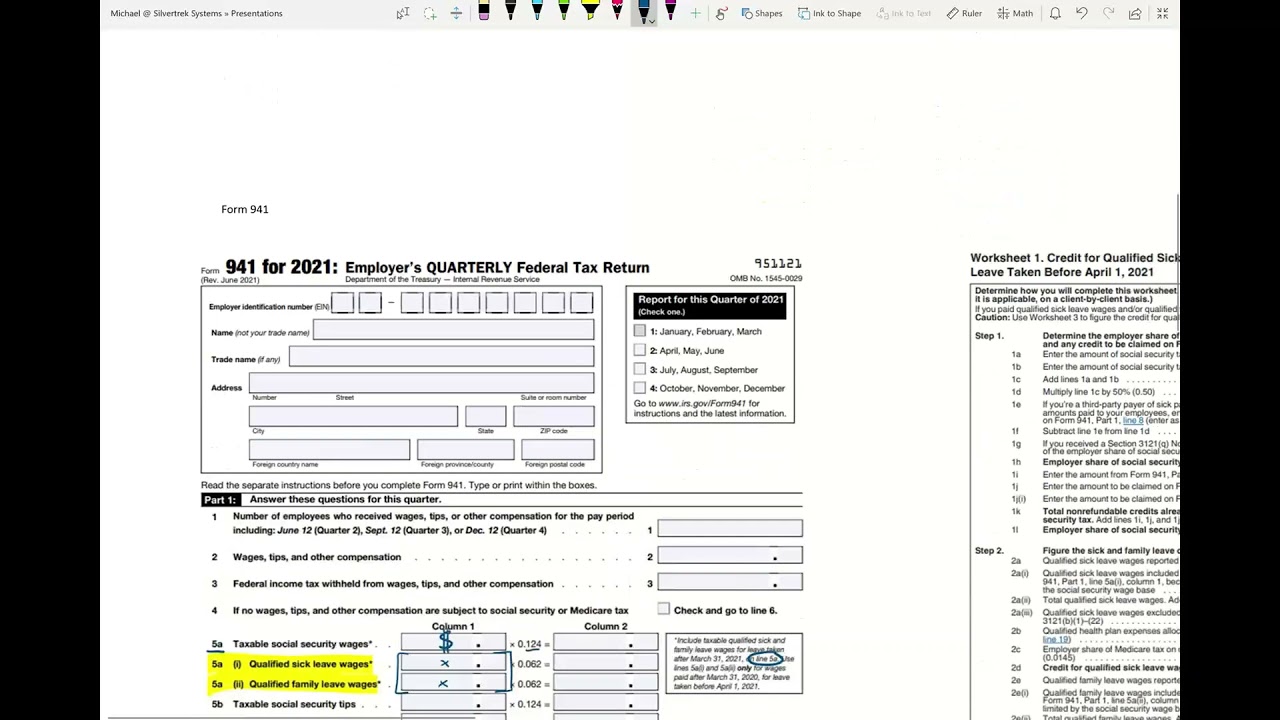

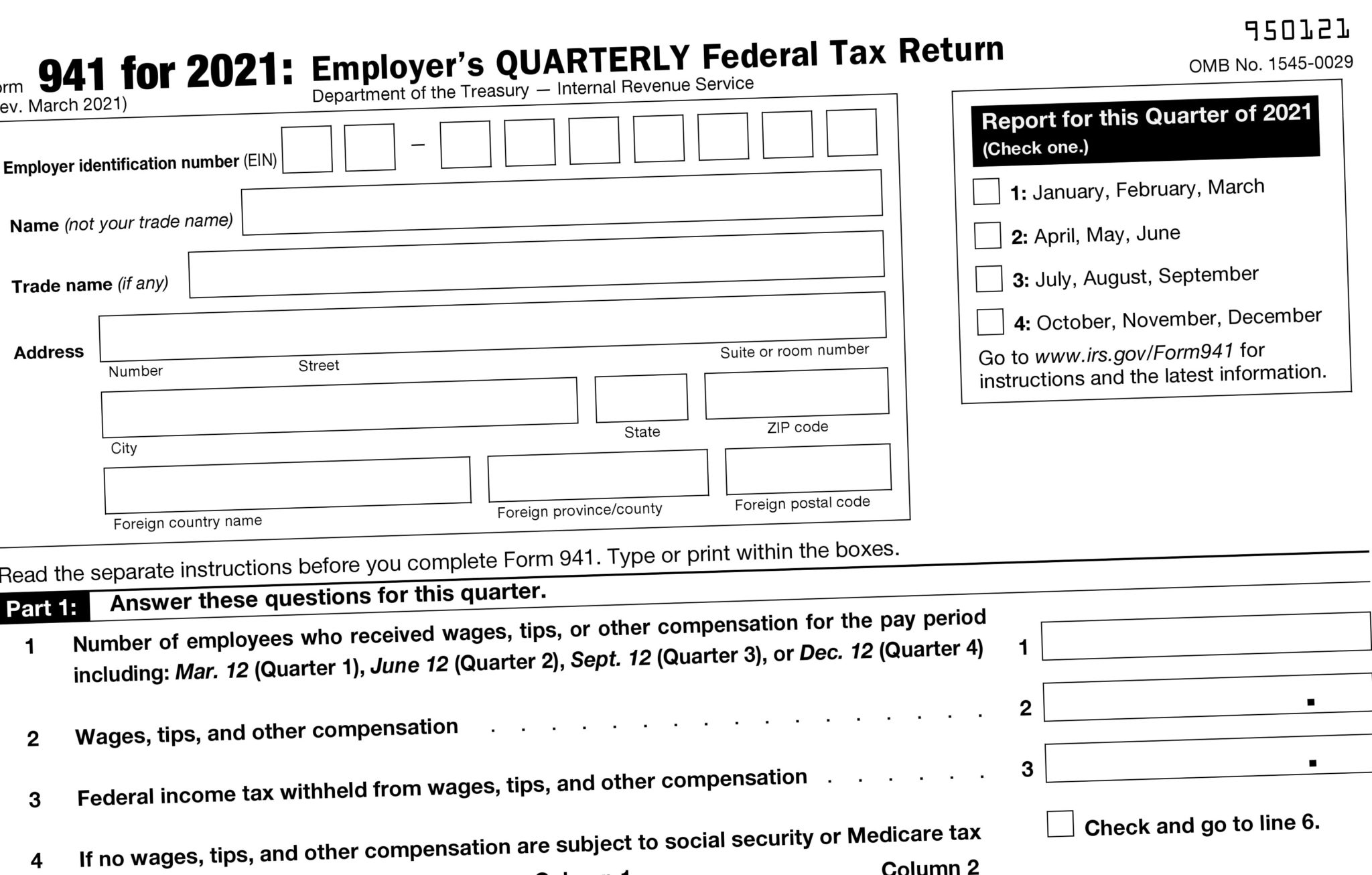

Form 941 Employee Retention Credit Worksheet

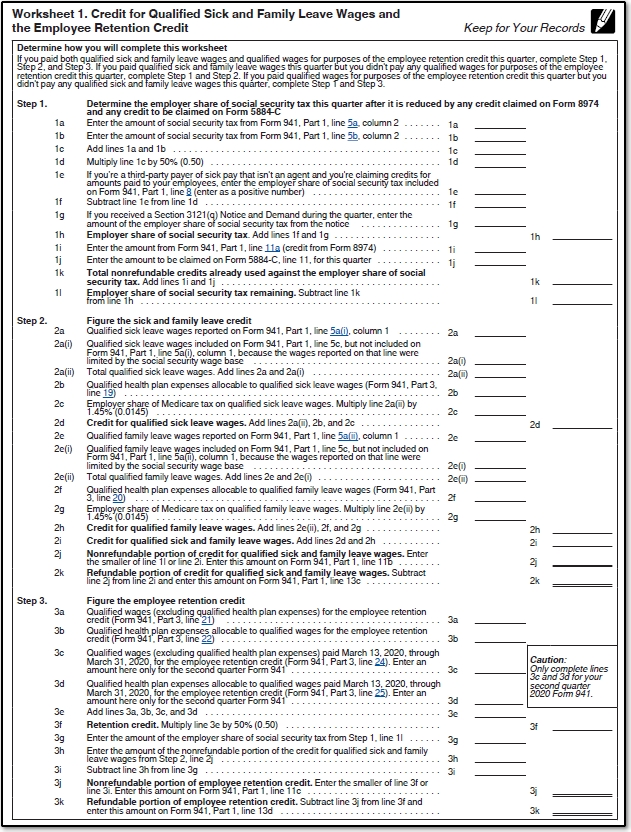

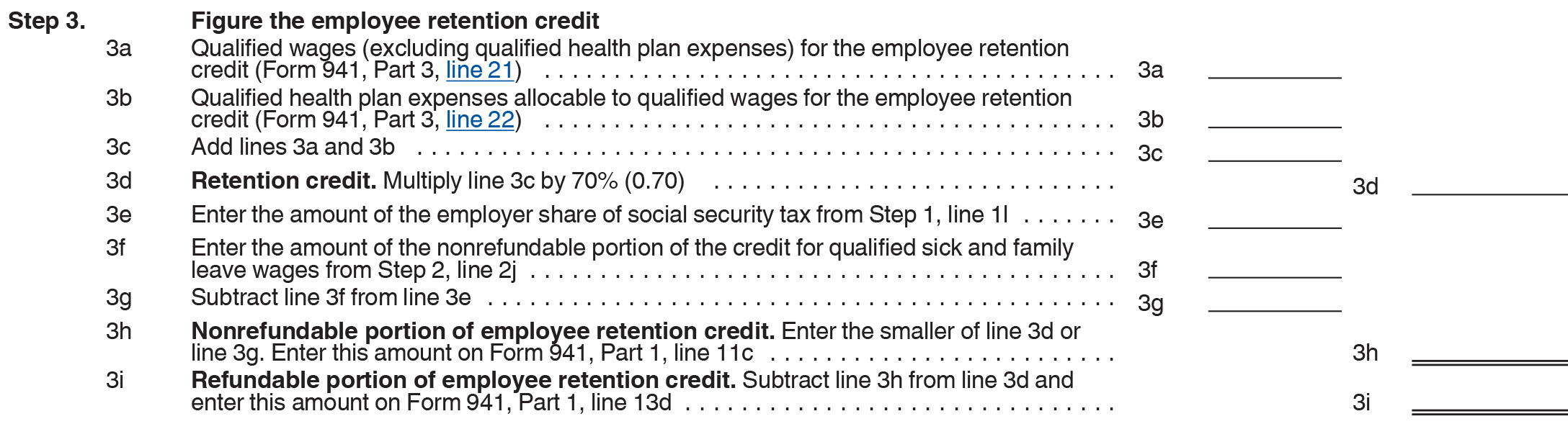

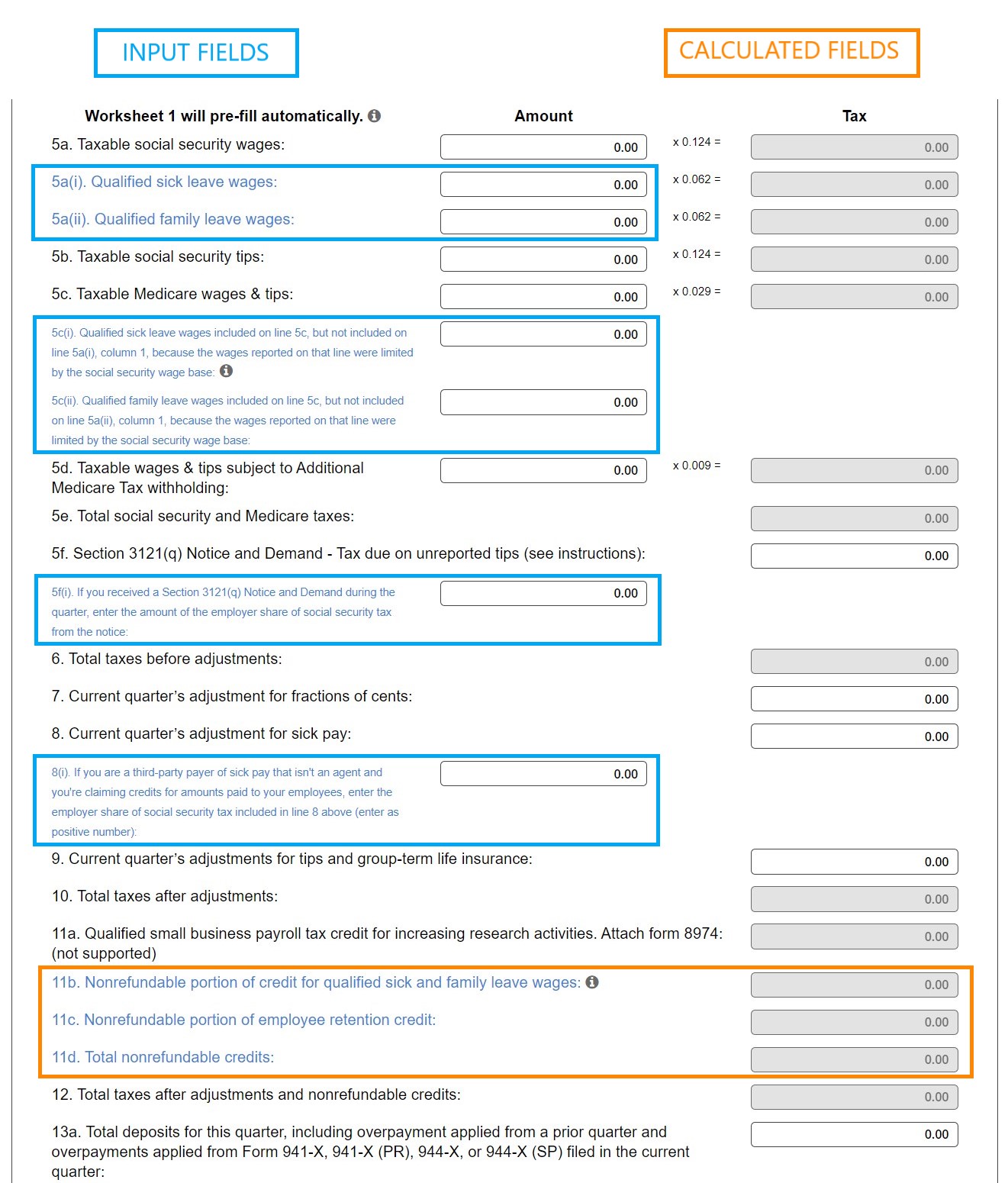

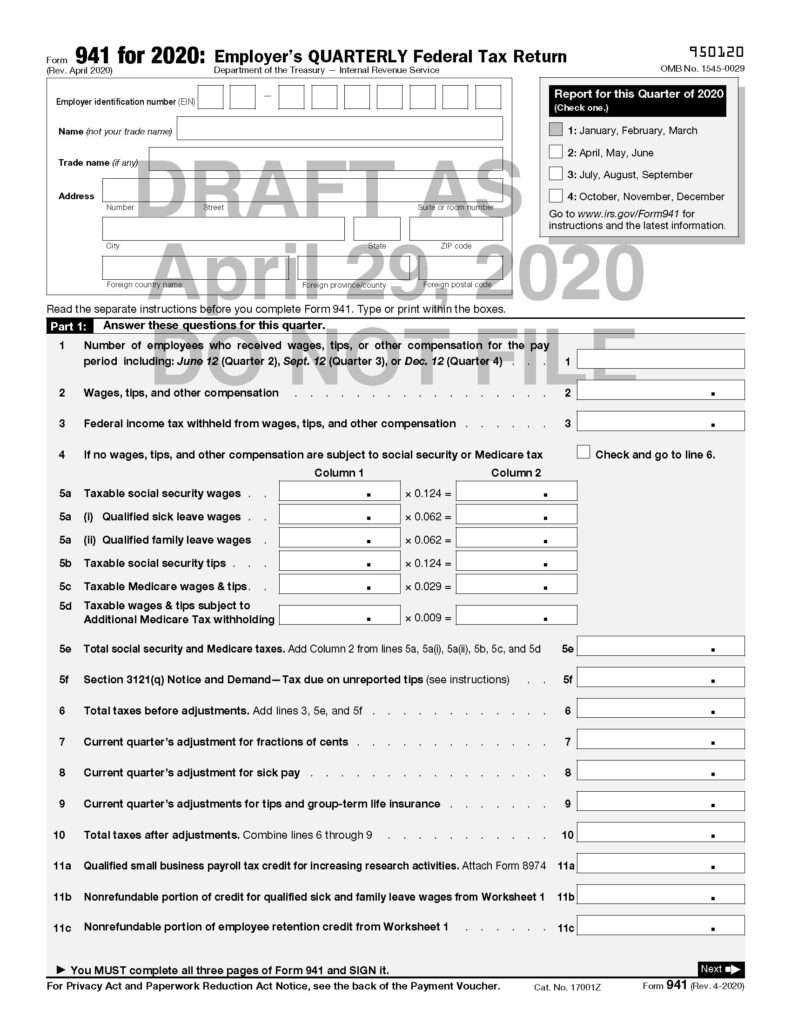

Form 941 Employee Retention Credit Worksheet - Use worksheet 1 for 941 3. Fees based on a percentage of the refund amount of erc claimed. Web the employee retention credit is a complex credit that requires careful review before applying. Employers engaged in a trade or business who pay compensation. Web worksheet 1 (included in the instructions to the form 941) is used to calculate the nonrefundable portion and refundable portion of the erc. This worksheet applies to qualified employees’ wages paid to employees after june 30, 2021. Understand which quarters qualify step 2: Qualified wages are limited to $10,000 per employee per calendar quarter in 2021. This is a quarterly federal tax return document that also allows employers to pay their own share of social security or medicare taxes. Credit for qualified sick and family leave wages paid this quarter of 2023 for leave taken after march 31, 2020, and before april 1, 2021.22 worksheet 2.

2021, are reported on form 941, worksheet 3. Employee retention credits for 2020 and 2022; Large upfront fees to claim the credit. Scam promoters are luring people to. Employers engaged in a trade or business who pay compensation. Last quarter there was a workaround to generate worksheet 1 for the ertc by putting a 1.00 in the additional. Worksheet 2 is used for qualified wages paid after march 12, 2020 and before july 1, 2021. Web employee retention credit on or before the due date of the deposit for wages paid on december 31, 2021 (regardless of whether wages are actually paid on that date); Fees based on a percentage of the refund amount of erc claimed. Web worksheet 1 (included in the instructions to the form 941) is used to calculate the nonrefundable portion and refundable portion of the erc.

Large upfront fees to claim the credit. Determine business status step 5: As of now, qb only generates worksheet 3. Form 941 instructions, december 2021 revision pdf for additional information related to the erc for quarters in 2021; Also, ensure if these payroll items are set up correctly, including their tax tracking type in the system. Last quarter there was a workaround to generate worksheet 1 for the ertc by putting a 1.00 in the additional. Scam promoters are luring people to. This worksheet pertains to qualified wages paid after march 31 2021. Section 3121 (b) definition of employment Web irs form 941 is the form you regularly file quarterly with your payroll.

What Is The Nonrefundable Portion Of Employee Retention Credit 2021

Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Web the employee retention credit has its own separate worksheet, 941 worksheet 4 for quarter 3 and 4 2021. Employers engaged in a trade or business who pay compensation. Web employee retention credit worksheet calculation step 1: Web.

Don’t Worksheet 1 When You File Your Form 941 this Quarter

Web worksheet 1 (included in the instructions to the form 941) is used to calculate the nonrefundable portion and refundable portion of the erc. Use worksheet 1 for 941 3. Irs commissioner danny werfel is calling for a potential early end to the employee retention credit as the number of what he called “legitimate claims” declines. Form 941 instructions 2020.

IRS Form 941 Worksheet 1 for 2021 & 2020 (COVID19 Tax Credits)

2021, are reported on form 941, worksheet 3. This worksheet is used by employers for the third and fourth quarter of 2021. Form 941 instructions 2020 revisions pdf for additional information related to the erc for quarters in 2020; The nonrefundable portion of the erc (as calculated on worksheet 1) is the amount that applies against the employer’s 6.2% share.

COVID19 Relief Legislation Expands Employee Retention Credit

2021, are reported on form 941, worksheet 3. The nonrefundable portion of the credit is reported on line 11d, and any refundable portion of the credit is reported on line 13e “the irs claims to have doubled the amount of employee retention tax credit claims that they process every week from processing 20,000 claims per week during the filing season.

941x Worksheet 1 Excel

As of now, qb only generates worksheet 3. Credit for qualified sick and family leave wages paid this quarter of 2023 for leave taken after march 31, 2020, and before april 1, 2021.22 worksheet 2. Understand which quarters qualify step 2: Large upfront fees to claim the credit. Web form 941 worksheet 1 is designed to accompany the newly revised.

How Do I Claim Employee Retention Credit On Form 941 Printable Form 2022

Web the form 941 worksheet 4 will be used by employers to calculate their refundable and nonrefundable portions of the employee retention credit during the third and fourth quarters of 2021. Web the form 941 for the quarter for which the credit is being claimed has been filed. Irs commissioner danny werfel is calling for a potential early end to.

Worksheet 2 Adjusted Employee Retention Credit

Fees based on a percentage of the refund amount of erc claimed. To claim the employee retention credit, utilize line 11c in form 941, and worksheet 1 that it references is on the last page of the form 941 instructions. Web file for multiple business and employees by importing all their data in bulk. Large upfront fees to claim the.

Updated 941 and Employee Retention Credit in Vista YouTube

This was calculated in worksheet 2 for the second quarter. Employers engaged in a trade or business who pay compensation. Credit for qualified sick and family leave wages paid this quarter of 2023 for leave taken after march 31, 2021, and before Web worksheet 1 (included in the instructions to the form 941) is used to calculate the nonrefundable portion.

How To Fill Out Form 941 X For Employee Retention Credit In 2020

Scam promoters are luring people to. Understand which quarters qualify step 2: Web 2 days agothe employee retention credit, or erc,. Web the form 941 for the quarter for which the credit is being claimed has been filed. As of now, qb only generates worksheet 3.

Guest column Employee Retention Tax Credit cheat sheet Repairer

“the irs claims to have doubled the amount of employee retention tax credit claims that they process every week from processing 20,000 claims per week during the filing season down to 40,000 claims per week. Unsolicited calls or advertisements mentioning an easy application process. statements that the promoter or company can determine erc eligibility within minutes or before any discussion.

Determine If You Had A Qualifying Closure Step 4:

And • reports the tax liability associated with the termination of the employer's employee retention credit on form 941, line 16, month 3, or, if a semiweekly schedule depositor, on Web the employee retention credit is a complex credit that requires careful review before applying. Last quarter there was a workaround to generate worksheet 1 for the ertc by putting a 1.00 in the additional. Web the form 941 worksheet 4 will be used by employers to calculate their refundable and nonrefundable portions of the employee retention credit during the third and fourth quarters of 2021.

The Nonrefundable Portion Of The Credit Is Reported On Line 11D, And Any Refundable Portion Of The Credit Is Reported On Line 13E

Form 941 instructions, december 2021 revision pdf for additional information related to the erc for quarters in 2021; Web the employee retention credit has its own separate worksheet, 941 worksheet 4 for quarter 3 and 4 2021. Employers engaged in a trade or business who pay compensation. Instead of worksheet 1, worksheet 2 needs to be generated and completed to flow the ertc credits to the 941.

The Irs Continues To Warn.

Understand which quarters qualify step 2: Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020 and beyond. Irs commissioner danny werfel is calling for a potential early end to the employee retention credit as the number of what he called “legitimate claims” declines. Web to have the worksheet 1 populate when opening form 941, you should claim a credit under the family first coronavirus response act (ffcra).

This Was Calculated In Worksheet 2 For The Second Quarter.

Employee retention credits for 2020 and 2022; The employee retention credit is a complex credit that requires careful. Qualified wages are limited to $10,000 per employee per calendar quarter in 2021. Web eligible employers can now claim a refundable tax credit against the employer share of social security tax equal to 70% of the qualified wages they pay to employees after december 31, 2020, through june 30, 2021.