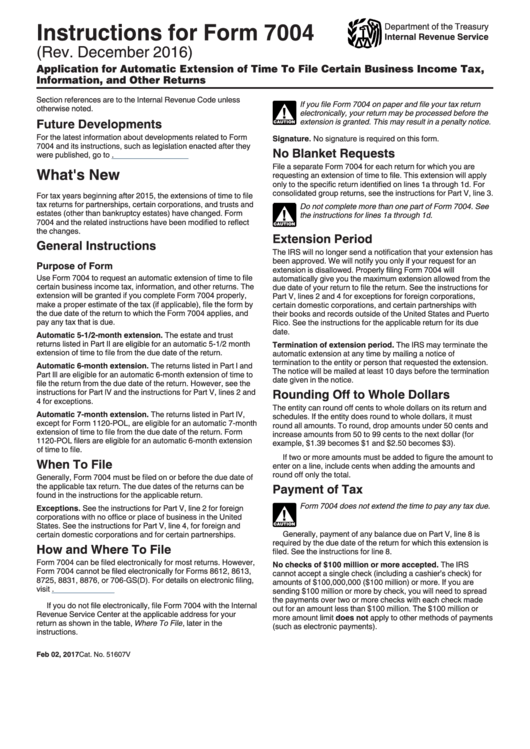

Instructions For Form 7004

Instructions For Form 7004 - Web irs form 7004 instructions are used by various types of businesses to complete the form that extends the filing deadline on their taxes. Web a business of all tax classifications can request an extension to get more time to file returns. See the form 7004 instructions for a list of the exceptions. Web form 7004 is used to request an automatic extension to file the certain returns. Web form 7004 has changed for some entities. See where to file in. Web the purpose of form 7004: However, form 7004 cannot be filed electronically for forms 8612, 8613,. There are three different parts to this tax. Web irs form 7004 is the application for automatic extension of time to file certain business income tax, information, and other returns. it's used to request more.

Web form 7004 has changed for some entities. There are three different parts to this tax. See where to file in. Web form 7004 is used to request an automatic extension to file the certain returns. See where to file, later. Web irs form 7004 instructions are used by various types of businesses to complete the form that extends the filing deadline on their taxes. Web get 📝 irs form 7004 for the 2022 tax year ☑️ use the handy fillable 7004 form to apply for a time extension online ☑️ print out the blank template and fill in with our instructions. Requests for a tax filing extension. Web form 7004 has changed for some entities located in georgia, illinois, kentucky, michigan, tennessee, and wisconsin. By the tax filing due date (april 15th for most businesses) who needs to file:

Web the purpose of form 7004: However, form 7004 cannot be filed electronically for forms 8612, 8613,. There are three different parts to this tax. Web form 7004 instructions. Web form 7004 has changed for some entities. Form 7004 can be filed electronically with tax2efile for most returns or through paper. Web get 📝 irs form 7004 for the 2022 tax year ☑️ use the handy fillable 7004 form to apply for a time extension online ☑️ print out the blank template and fill in with our instructions. Web select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain. Select extension of time to. Web irs form 7004 instructions are used by various types of businesses to complete the form that extends the filing deadline on their taxes.

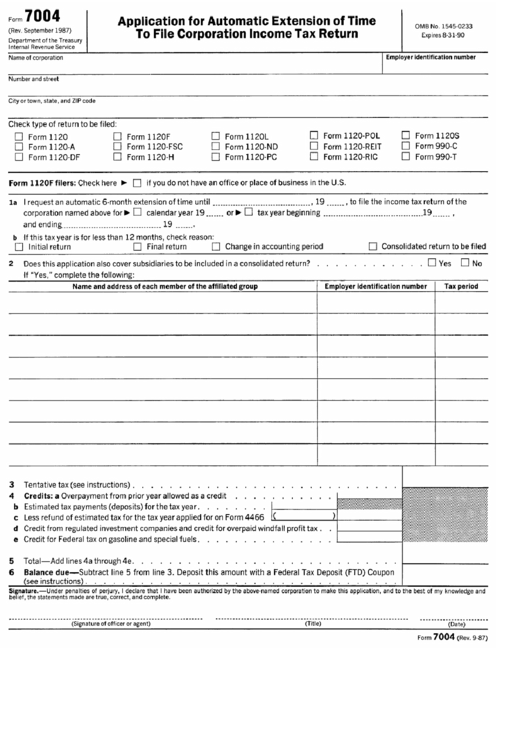

Form 7004 Application For Automatic Extension Of Time To File

See where to file, later. Web irs form 7004 is the application for automatic extension of time to file certain business income tax, information, and other returns. it's used to request more. Web form 7004 is used to request an automatic extension to file the certain returns. Select extension of time to. Web generally, form 7004 must be filed by.

Instructions For Form 7004 Application For Automatic Extension Of

Choose form 7004 and select the form. See where to file, later. Web form 7004 has changed for some entities. Form 7004 can be filed electronically with tax2efile for most returns or through paper. Web form 7004 has changed for some entities located in georgia, illinois, kentucky, michigan, tennessee, and wisconsin.

IRS Form 7004 Automatic Extension for Business Tax Returns

Web follow these steps to print a 7004 in turbotax business: Thankfully, this is a fairly short form, which only requires a handful of key details. See where to file, later. However, form 7004 cannot be filed electronically for forms 8612, 8613,. Here what you need to start:

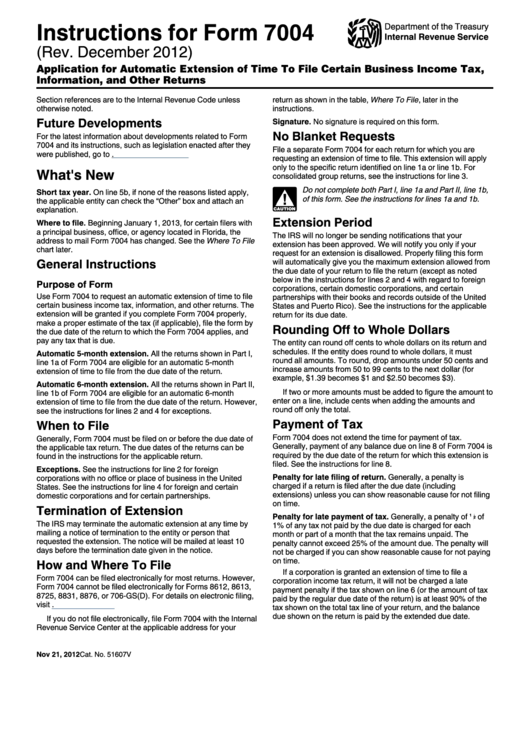

Instructions For Form 7004 (Rev. December 2012) printable pdf download

Here are the general form 7004 instructions, so you. Get ready for tax season deadlines by completing any required tax forms today. Web filling out the blank pdf correctly can be a straightforward process if you follow these irs 7004 form instructions. See where to file, later. Web select the appropriate form from the table below to determine where to.

Form 7004 Application for Automatic Extension of Time To File Certain

Choose form 7004 and select the form. Web form 7004 instructions. With your return open, select search and enter extend; Web form 7004 has changed for some entities located in georgia, illinois, kentucky, michigan, tennessee, and wisconsin. Web irs form 7004 is the application for automatic extension of time to file certain business income tax, information, and other returns. it's.

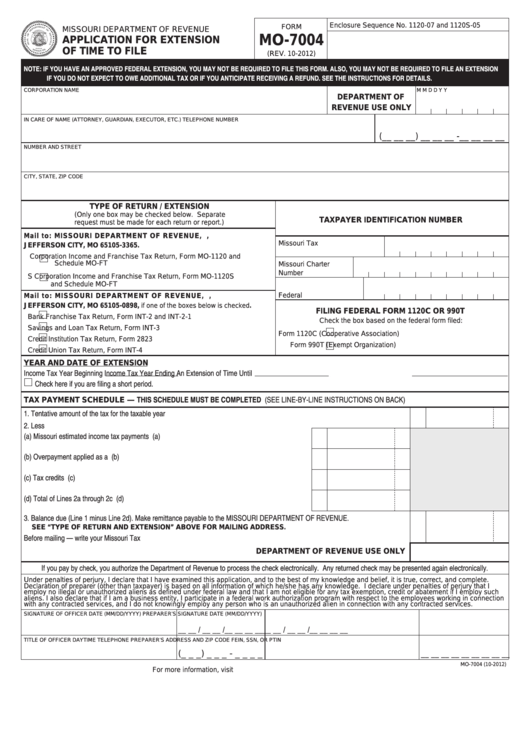

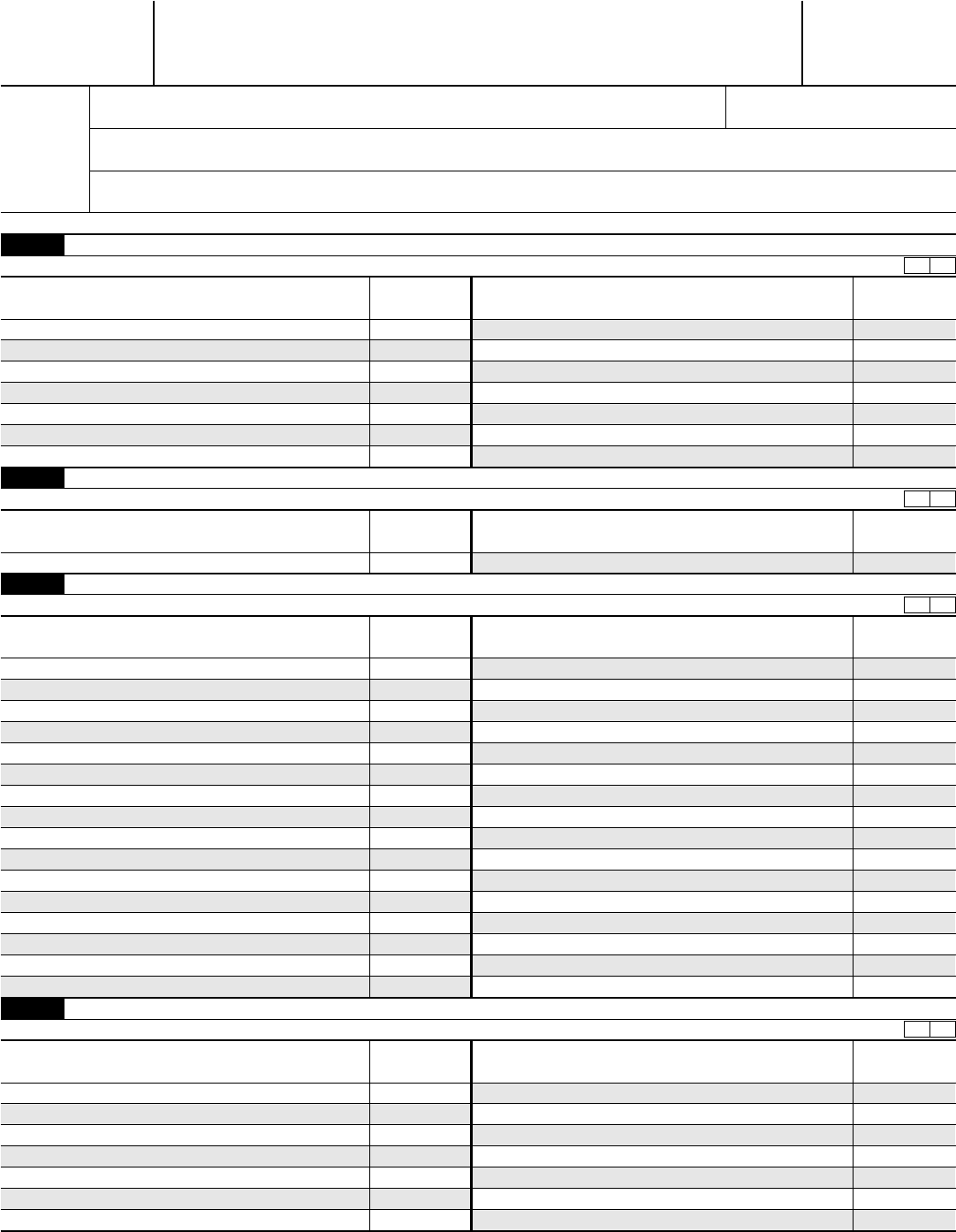

Fillable Form Mo7004 Application For Extension Of Time To File

See the form 7004 instructions for a list of the exceptions. See where to file, later. Web follow these steps to complete your business tax extension form 7004 using expressextension: By the tax filing due date (april 15th for most businesses) who needs to file: Web form 7004 has changed for some entities.

Form 7004 Edit, Fill, Sign Online Handypdf

Web generally, form 7004 must be filed by the due date of the return with the internal revenue service center where the corporation will file its income tax return. There are three different parts to this tax. Web get 📝 irs form 7004 for the 2022 tax year ☑️ use the handy fillable 7004 form to apply for a time.

Form 7004 Printable PDF Sample

Web select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain. Web follow these steps to print a 7004 in turbotax business: Web we last updated the irs automatic business extension instructions in february 2023, so this is the latest version of form 7004 instructions,.

Form Mo7004 Draft Application For Extension Of Time To File 2010

Web filling out the blank pdf correctly can be a straightforward process if you follow these irs 7004 form instructions. With your return open, select search and enter extend; Web follow these steps to print a 7004 in turbotax business: Thankfully, this is a fairly short form, which only requires a handful of key details. Web form 7004 has changed.

Instructions For Form 7004 Application For Automatic Extension Of

Here what you need to start: Web you can file an irs form 7004 electronically for most returns. Form 7004 can be filed electronically with tax2efile for most returns or through paper. Web form 7004 is used to request an automatic extension to file the certain returns. Web get 📝 irs form 7004 for the 2022 tax year ☑️ use.

Form 7004 Can Be Filed Electronically With Tax2Efile For Most Returns Or Through Paper.

Web irs form 7004 instructions are used by various types of businesses to complete the form that extends the filing deadline on their taxes. Web follow these steps to complete your business tax extension form 7004 using expressextension: Here what you need to start: See where to file, later.

See Where To File, Later.

Select extension of time to. See the form 7004 instructions for a list of the exceptions. Web irs form 7004 is the application for automatic extension of time to file certain business income tax, information, and other returns. it's used to request more. However, form 7004 cannot be filed electronically for forms 8612, 8613,.

Web You Can File An Irs Form 7004 Electronically For Most Returns.

Web form 7004 has changed for some entities. Web get 📝 irs form 7004 for the 2022 tax year ☑️ use the handy fillable 7004 form to apply for a time extension online ☑️ print out the blank template and fill in with our instructions. Web we last updated the irs automatic business extension instructions in february 2023, so this is the latest version of form 7004 instructions, fully updated for tax year 2022. General instructions purpose of form use form 7004 to request an automatic extension of time to file certain.

There Are Three Different Parts To This Tax.

Web form 7004 has changed for some entities located in georgia, illinois, kentucky, michigan, tennessee, and wisconsin. Web form 7004 is used to request an automatic extension to file the certain returns. Web generally, form 7004 must be filed by the due date of the return with the internal revenue service center where the corporation will file its income tax return. By the tax filing due date (april 15th for most businesses) who needs to file: