Form 199 California

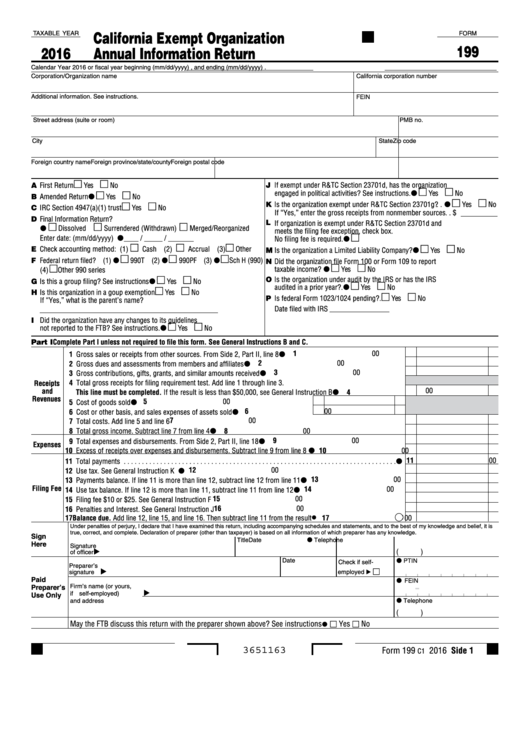

Form 199 California - This form allows your nonprofit to report receipts, revenue, expenses, and disbursements to the ftb. What is ca form 199? Most of the information requested on form 199 is virtually the same as the federal return, though much less information is requested. 2gross dues and assessments from members and affiliates.•200. Web we last updated the exempt organization annual information return in january 2023, so this is the latest version of form 199, fully updated for tax year 2022. 1gross sales or receipts from other sources. It can best be thought of as california’s version of irs form 990. Web 2020 california exempt organization annual information return. This form is for income earned in tax year 2022, with tax returns due in april 2023. Supports filing for 2022, 2021, & 2020 tax year.

Religious or apostolic organizations described in r&tc section 23701k must attach a. Nonexempt charitable trusts as described in irc section 4947 (a) (1). This form is for income earned in tax year 2022, with tax returns due in april 2023. 1gross sales or receipts from other sources. Web expresstaxexempt now supports form 199 and offers the best filing solution for california nonprofits. Web use the tables to determine your organization's filing requirement for the following forms: 2gross dues and assessments from members and affiliates.•200. What is ca form 199? Web form 199, california exempt organization annual information return, is used by the following organizations to report the receipts and revenues, expenses, and disbursements. This form allows your nonprofit to report receipts, revenue, expenses, and disbursements to the ftb.

Web 2020 california exempt organization annual information return. 3gross contributions, gifts, grants, and similar amounts received.•300. You can print other california tax forms here. It can best be thought of as california’s version of irs form 990. Web form 199 2020 side 1. Supports filing for 2022, 2021, & 2020 tax year. Web we last updated the exempt organization annual information return in january 2023, so this is the latest version of form 199, fully updated for tax year 2022. Web california form 199 is an annual information return filed by the following organizations to report the income & expenses. Web use the tables to determine your organization's filing requirement for the following forms: Nonexempt charitable trusts as described in irc section 4947 (a) (1).

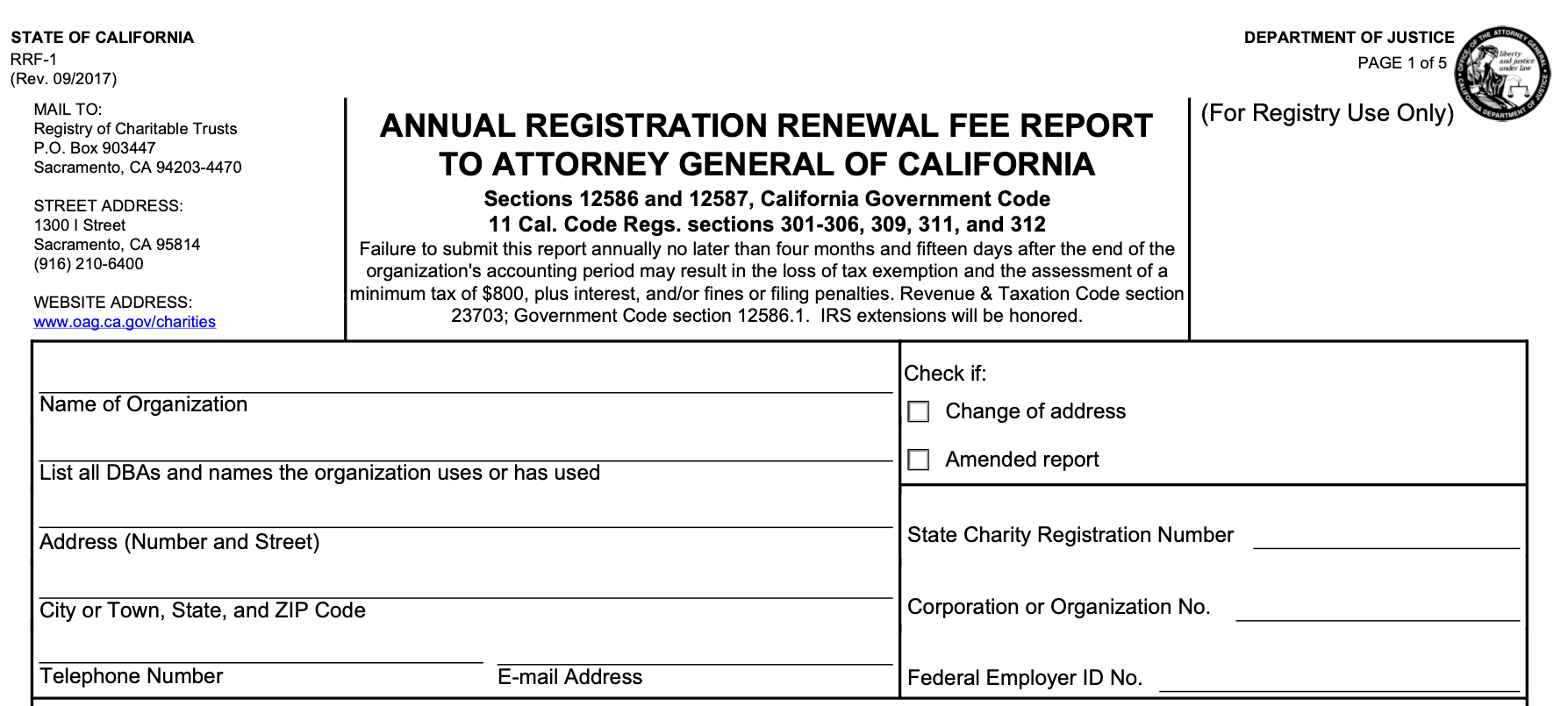

California Fundraising Registration

Form 199 is the california exempt organization annual information return. Web form 199 2020 side 1. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web expresstaxexempt now supports form 199 and offers the best filing solution for california nonprofits. From side 2, part ii, line 8.•100.

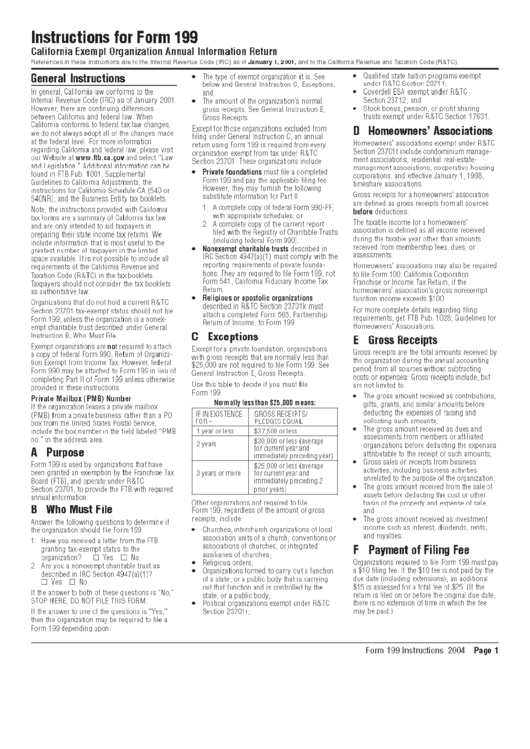

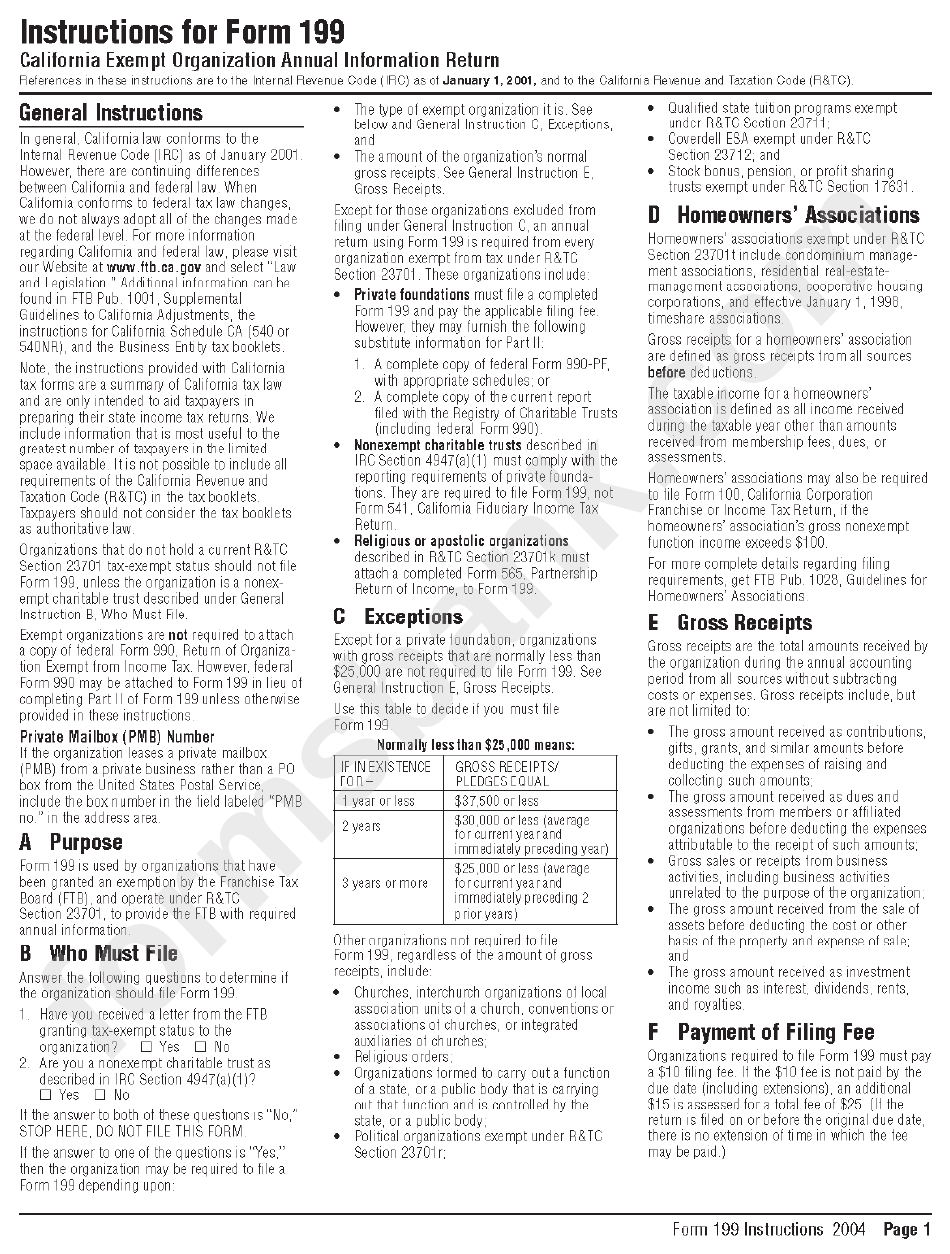

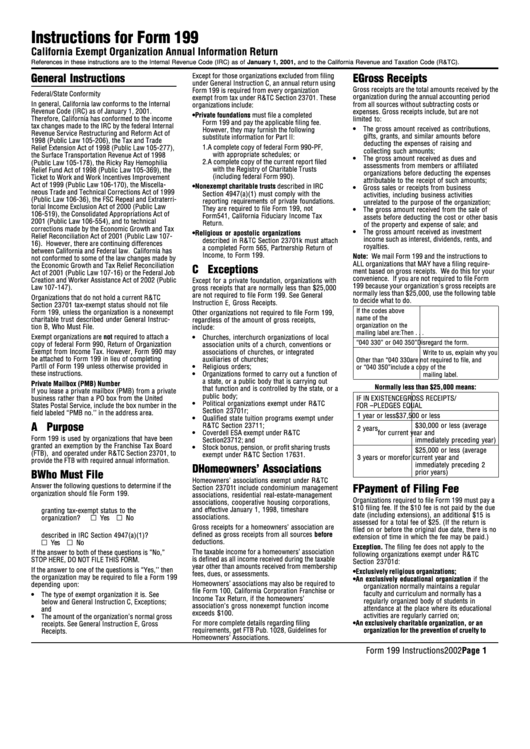

2015 Form CA FTB 199 Instructions Fill Online, Printable, Fillable

From side 2, part ii, line 8.•100. 3gross contributions, gifts, grants, and similar amounts received.•300. Web california form 199 is an annual information return filed by the following organizations to report the income & expenses. Web we last updated california form 199 in january 2023 from the california franchise tax board. The trust may be required to file form 199.

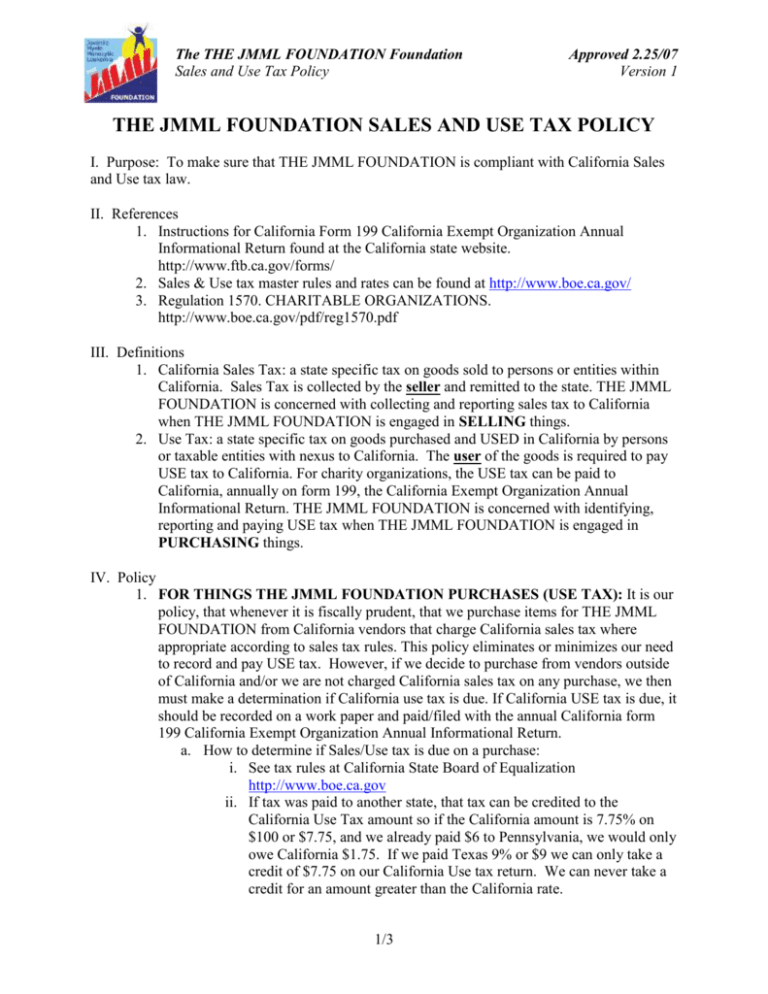

Sales and Use Tax Policy

Web california form 199 is an annual information return filed by the following organizations to report the income & expenses. Web expresstaxexempt now supports form 199 and offers the best filing solution for california nonprofits. 2gross dues and assessments from members and affiliates.•200. This form allows your nonprofit to report receipts, revenue, expenses, and disbursements to the ftb. Religious or.

Instructions For Form 199 California Exempt Organization Annual

Form 199 is the california exempt organization annual information return. Web california form 199 is an annual information return filed by the following organizations to report the income & expenses. Religious or apostolic organizations described in r&tc section 23701k must attach a. Supports filing for 2022, 2021, & 2020 tax year. The trust may be required to file form 199.

Instructions For Form 199 California Exempt Organization Annual

From side 2, part ii, line 8.•100. This form allows your nonprofit to report receipts, revenue, expenses, and disbursements to the ftb. Nonexempt charitable trusts as described in irc section 4947 (a) (1). Click here to learn more about form 199. What is ca form 199?

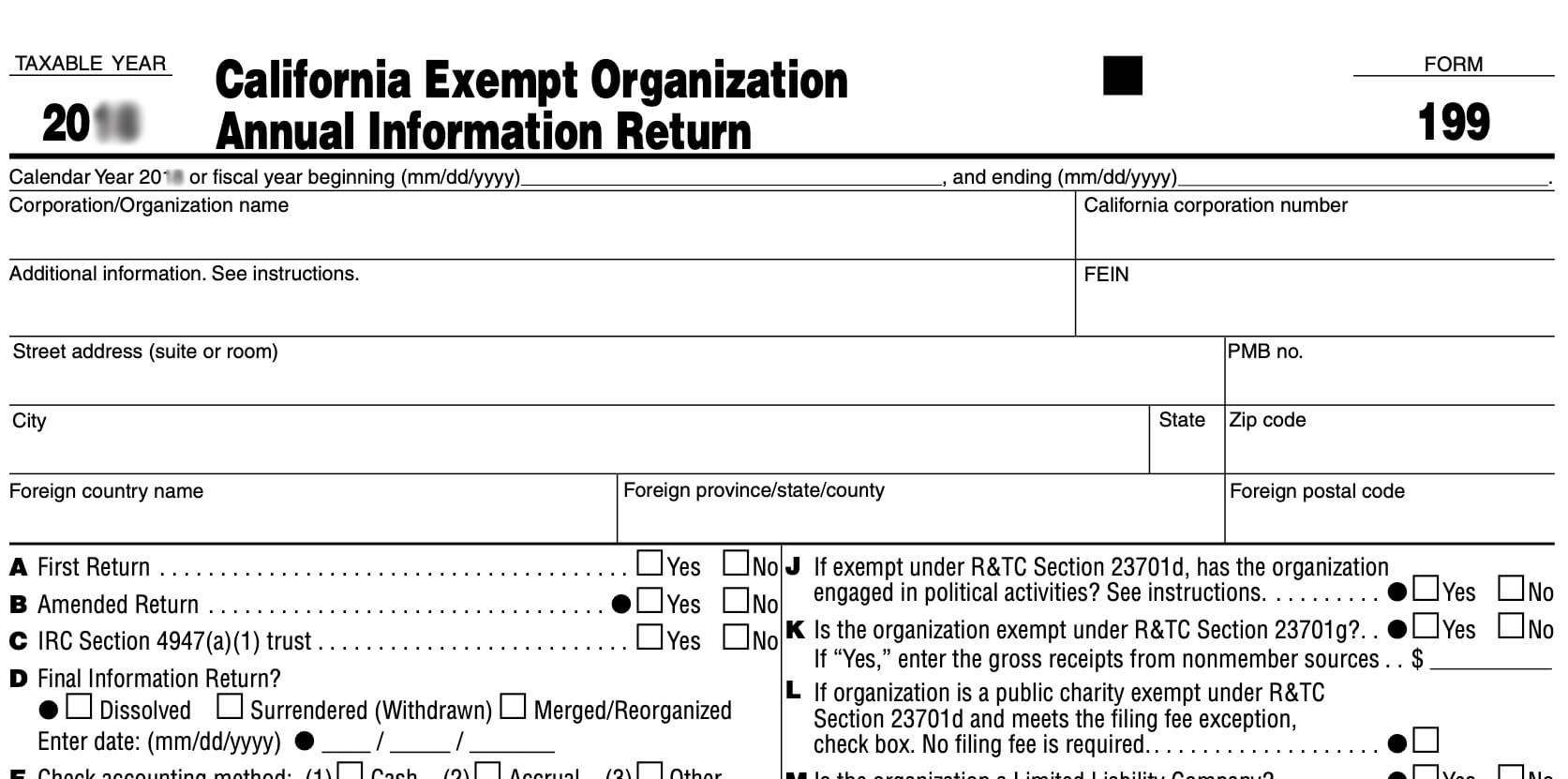

Fillable Form 199 California Exempt Organization Annual Information

3gross contributions, gifts, grants, and similar amounts received.•300. Web form 199 is called the california exempt organization annual information return. 1gross sales or receipts from other sources. Most of the information requested on form 199 is virtually the same as the federal return, though much less information is requested. We will update this page with a new version of the.

Instructions For Form 199 printable pdf download

Web we last updated the exempt organization annual information return in january 2023, so this is the latest version of form 199, fully updated for tax year 2022. What is ca form 199? Supports filing for 2022, 2021, & 2020 tax year. We will update this page with a new version of the form for 2024 as soon as it.

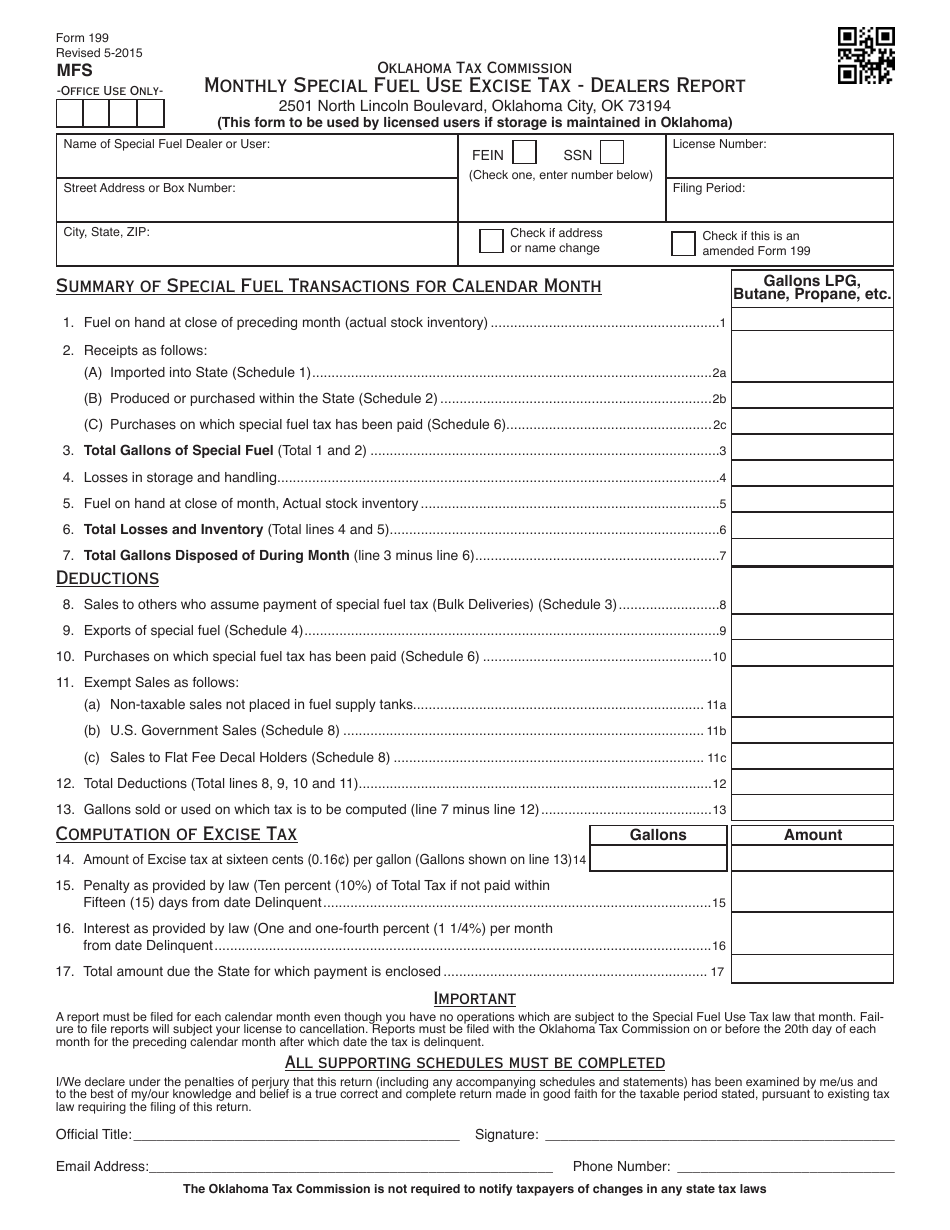

OTC Form 199 Download Fillable PDF or Fill Online Monthly Special Fuel

Web we last updated california form 199 in january 2023 from the california franchise tax board. Web form 199 2020 side 1. This form allows your nonprofit to report receipts, revenue, expenses, and disbursements to the ftb. You can print other california tax forms here. Religious or apostolic organizations described in r&tc section 23701k must attach a.

California Fundraising Registration

What is ca form 199? It can best be thought of as california’s version of irs form 990. This form is for income earned in tax year 2022, with tax returns due in april 2023. From side 2, part ii, line 8.•100. This form allows your nonprofit to report receipts, revenue, expenses, and disbursements to the ftb.

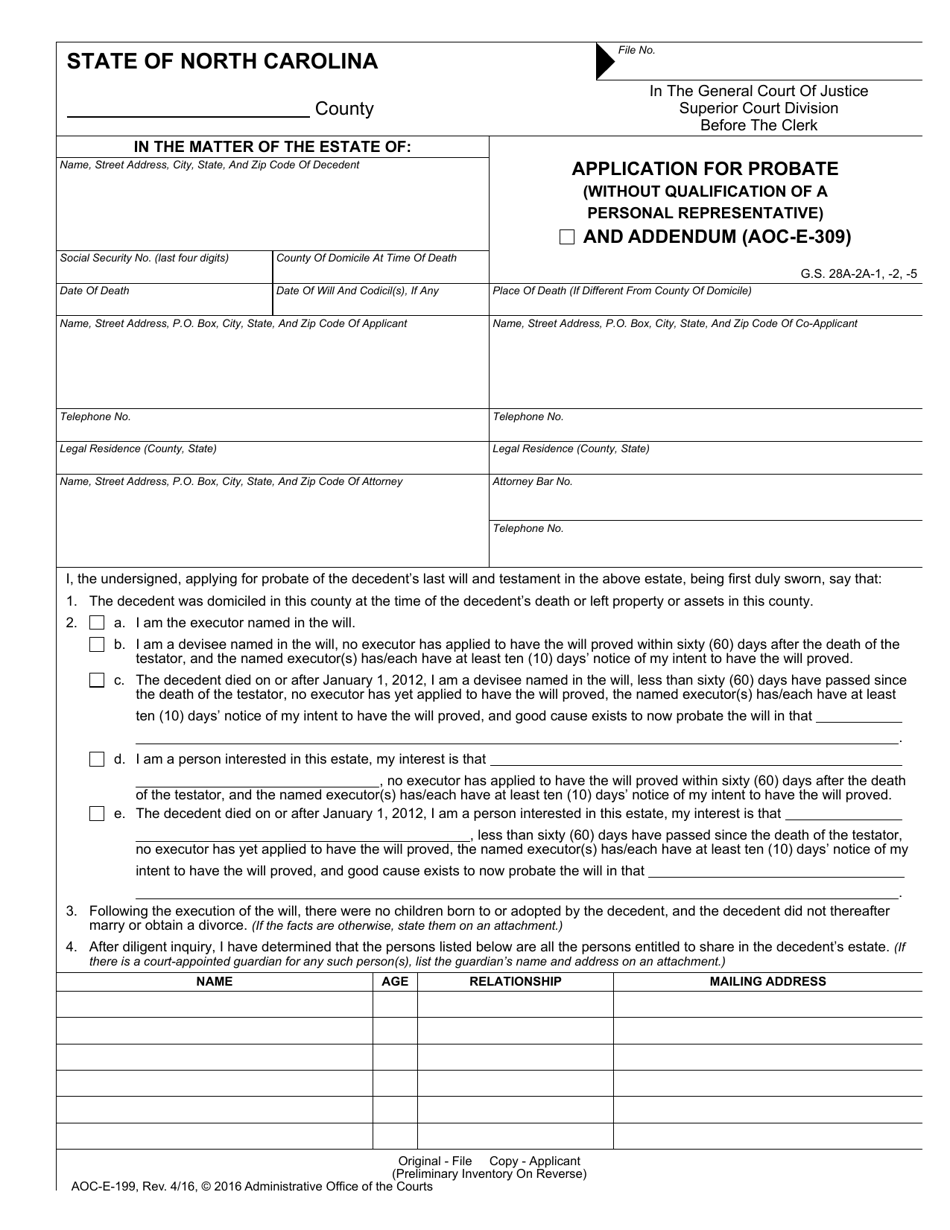

Form AOCE199 Download Fillable PDF or Fill Online Application for

What is ca form 199? Web we last updated the exempt organization annual information return in january 2023, so this is the latest version of form 199, fully updated for tax year 2022. Web 2020 california exempt organization annual information return. 3gross contributions, gifts, grants, and similar amounts received.•300. Web form 199, california exempt organization annual information return, is used.

Nonexempt Charitable Trusts As Described In Irc Section 4947 (A) (1).

Web use the tables to determine your organization's filing requirement for the following forms: Web form 199, california exempt organization annual information return, is used by the following organizations to report the receipts and revenues, expenses, and disbursements. Web 2020 california exempt organization annual information return. Web california form 199 is an annual information return filed by the following organizations to report the income & expenses.

Web Form 199 Is Called The California Exempt Organization Annual Information Return.

The trust may be required to file form 199. We will update this page with a new version of the form for 2024 as soon as it is made available by the california government. Form 199 is the california exempt organization annual information return. Religious or apostolic organizations described in r&tc section 23701k must attach a.

Most Of The Information Requested On Form 199 Is Virtually The Same As The Federal Return, Though Much Less Information Is Requested.

Click here to learn more about form 199. This form is for income earned in tax year 2022, with tax returns due in april 2023. What is ca form 199? Web expresstaxexempt now supports form 199 and offers the best filing solution for california nonprofits.

1Gross Sales Or Receipts From Other Sources.

Web we last updated the exempt organization annual information return in january 2023, so this is the latest version of form 199, fully updated for tax year 2022. It can best be thought of as california’s version of irs form 990. You can print other california tax forms here. 2gross dues and assessments from members and affiliates.•200.