How To Get Form 8862 On Turbotax

How To Get Form 8862 On Turbotax - Web how do i file an irs extension (form 4868) in turbotax online? Edit, sign and save irs 8862 form. Web instructions for form 8862 (rev. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the following apply. Web screen, check the box next toi/we got a letter/notice from the irs telling me/us to fill out an 8862 form to claim the earned income credit. Ad access irs tax forms. Web what is form 8862? Web file form 8862 if we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any reason other than a math. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly.

Ad edit, sign or email irs 8862 & more fillable forms, register and subscribe now! December 2022) department of the treasury internal revenue service information to claim certain credits after disallowance section. In the earned income credit section when you see do. File an extension in turbotax online before the deadline to avoid a late filing penalty. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the following apply. Edit, sign and save irs 8862 form. Go to search box in top right cover and click there to type in 8862 and hit enter. Web screen, check the box next toi/we got a letter/notice from the irs telling me/us to fill out an 8862 form to claim the earned income credit. Open the form in the online editor. You can use the steps.

You can use the steps. Ad edit, sign or email irs 8862 & more fillable forms, register and subscribe now! Ad uslegalforms allows users to edit, sign, fill & share all type of documents online. Complete, edit or print tax forms instantly. Open the form in the online editor. File an extension in turbotax online before the deadline to avoid a late filing penalty. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the following apply. Web screen, check the box next toi/we got a letter/notice from the irs telling me/us to fill out an 8862 form to claim the earned income credit. Form 8862 is missing from the tax. Web you'll need to add form 8862:

Form 8862 (Rev. December 2012) Edit, Fill, Sign Online Handypdf

Web open the form 8862 pdf and follow the instructions easily sign the irs form 8862 with your finger send filled & signed form 8862 irs or save rate the form 8862 print 4.7 satisfied. Web how do i file form 8862?? Web file form 8862 if we denied or reduced your eitc for a tax year after 1996 (ctc,.

Form 8862 Information to Claim Earned Credit After

Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the following apply. Open the form in the online editor. Web you'll need to add form 8862: Web where do i find form 8862 united states (english) united states (spanish) canada (english) canada (french) turbotax full service.

What Does Form 8862 Look Like Fill Online, Printable, Fillable, Blank

Web instructions for form 8862 (rev. Edit, sign and save irs 8862 form. Ad edit, sign or email irs 8862 & more fillable forms, register and subscribe now! Their earned income credit (eic), child tax credit (ctc)/additional child tax credit. In the earned income credit section when you see do.

TurboTax's free product largely a secret to lower earners

Complete, edit or print tax forms instantly. Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. Web instructions for form 8862 (rev. Complete, edit or print tax forms instantly. December 2022) department of the treasury internal revenue service information to claim certain credits after.

2022 Form IRS 8862 Fill Online, Printable, Fillable, Blank pdfFiller

Web how do i file form 8862?? Web you'll need to add form 8862: Web what is form 8862? Web irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than math or clerical errors, after. Web stick to these simple steps to get irs 8862 completely.

Instructions For Form 8862 Information To Claim Earned Credit

Web you’ll need to complete form 8862 if your earned income credit (eic) was disallowed for any year after 1996, and permission was later restored (you'll get another. Web how do i file form 8862?? Go to search box in top right cover and click there to type in 8862 and hit enter. Web instructions for form 8862 (rev. Web.

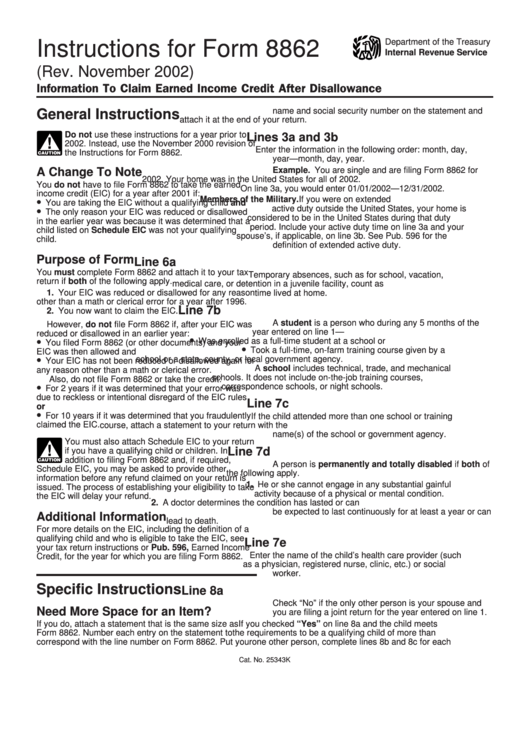

I Am Trying To Find My Agi Number Please Help TurboTax 2021 Tax Forms

Complete, edit or print tax forms instantly. File an extension in turbotax online before the deadline to avoid a late filing penalty. Web file form 8862 if we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any reason other than a math. In the earned.

How TurboTax turns a dreadful user experience into a delightful one

Their earned income credit (eic), child tax credit (ctc)/additional child tax credit. Complete, edit or print tax forms instantly. Web screen, check the box next toi/we got a letter/notice from the irs telling me/us to fill out an 8862 form to claim the earned income credit. Web here's a turbotax faq on how to fix a rejection involving this form:.

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

Edit, sign and save irs 8862 form. In the earned income credit section when you see do. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the following apply. Log into your account and click take me to my return. Open the form in the online.

Irs Form 8862 Printable Master of Documents

Web irs form 8862 (information to claim certain credits after disallowance) must be included with your tax return if you have previously been denied the earned. Ad edit, sign or email irs 8862 & more fillable forms, register and subscribe now! Web how do i file form 8862?? Ad access irs tax forms. Open the form in the online editor.

Web Screen, Check The Box Next Toi/We Got A Letter/Notice From The Irs Telling Me/Us To Fill Out An 8862 Form To Claim The Earned Income Credit.

Web where do i find form 8862 united states (english) united states (spanish) canada (english) canada (french) turbotax full service for personal taxes full. In the earned income credit section when you see do. Log into your account and click take me to my return. Web what is form 8862?

Open The Form In The Online Editor.

Web irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than math or clerical errors, after. Web here's a turbotax faq on how to fix a rejection involving this form: Web open or continue your return in turbotax. Web instructions for form 8862 (rev.

Web File Form 8862 If We Denied Or Reduced Your Eitc For A Tax Year After 1996 (Ctc, Actc, Odc Or Aotc For A Tax Year After 2015) For Any Reason Other Than A Math.

Form 8862 is missing from the tax. Information to claim earned income credit after disallowance to your return. Get ready for tax season deadlines by completing any required tax forms today. Web open the form 8862 pdf and follow the instructions easily sign the irs form 8862 with your finger send filled & signed form 8862 irs or save rate the form 8862 print 4.7 satisfied.

Ad Access Irs Tax Forms.

Web taxpayers complete form 8862 and attach it to their tax return if: You can use the steps. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit. Web you’ll need to complete form 8862 if your earned income credit (eic) was disallowed for any year after 1996, and permission was later restored (you'll get another.

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/Screenshot-2022-08-25-172737-768x501.jpg)