Form 4506-F

Form 4506-F - Web send irs form 4506 f via email, link, or fax. The irs must receive form 4506 within 120 days of the date signed by the taxpayer or it will be. Request a copy of your tax return, or designate a third party to. Edit your 4506 f online. Are you seeking a quick and practical solution to complete form 4506 f at an affordable price? Web form 4506 must be signed and dated by the taxpayer listed on line 1a or 2a. Web department of the treasury internal revenue service request for copy of tax return do not sign this form unless all applicable lines have been completed. Include a copy of a government issued id (driver’s license or passport) to. Web form 4506, request for copy of tax return, takes longer and costs $50 per return form 4506 is useful if you need a copy of your tax return from more than three years ago. Ives request for transcript of tax return.

Web form 4506 is used by taxpayers to request copies of their tax returns for a fee. Type text, add images, blackout confidential details, add. Ives request for transcript of tax return. Request a copy of your tax return, or designate a third party to. Ad download or email irs 4506 & more fillable forms, register and subscribe now! A copy of an exempt or political organization’s return, report, notice, or exemption application. A copy of an exempt organization’s exemption application or letter. The irs must receive form 4506 within 120 days of the date signed by the taxpayer or it will be. Are you seeking a quick and practical solution to complete form 4506 f at an affordable price? Web follow the simple instructions below:

Type text, add images, blackout confidential details, add. Ad download or email irs 4506 & more fillable forms, register and subscribe now! The irs must receive form 4506 within 120 days of the date signed by the taxpayer or it will be. Get ready for tax season deadlines by completing any required tax forms today. Web department of the treasury internal revenue service request for copy of tax return do not sign this form unless all applicable lines have been completed. Web internal revenue code, section 6103(c), limits disclosure and use of return information received pursuant to the taxpayer’s consent and holds the recipient subject to penalties. Web form 4506 must be signed and dated by the taxpayer listed on line 1a or 2a. Web send irs form 4506 f via email, link, or fax. Ad download or email irs 4506 & more fillable forms, register and subscribe now! Edit your 4506 f online.

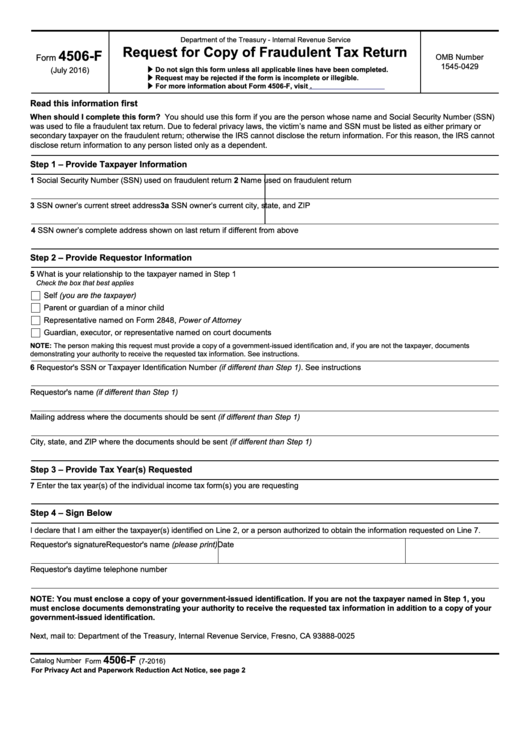

Form 4506F Identity Theft Victim’s Request for Copy of Fraudulent Tax

The irs must receive form 4506 within 120 days of the date signed by the taxpayer or it will be. Get ready for tax season deadlines by completing any required tax forms today. Include a copy of a government issued id (driver’s license or passport) to. You can also download it, export it or print it out. Edit your 4506.

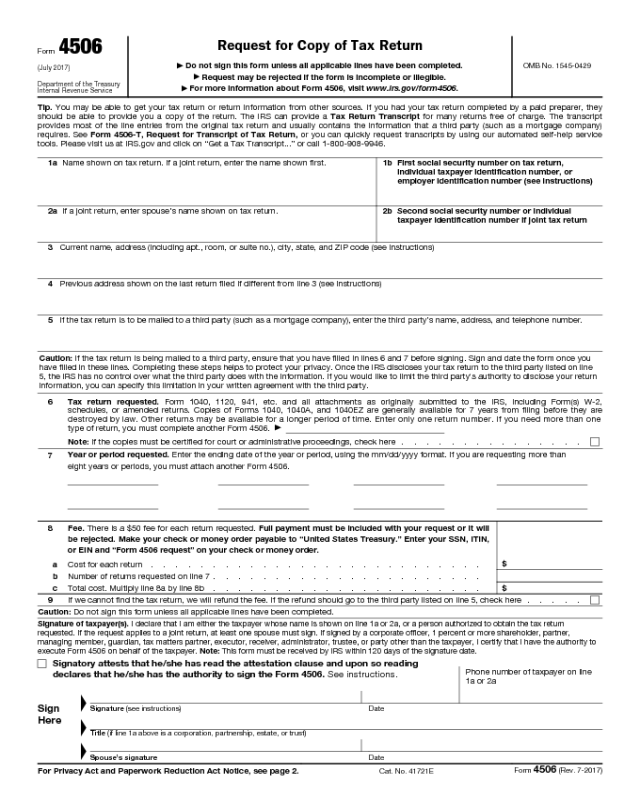

Form 4506 Edit, Fill, Sign Online Handypdf

Ad download or email irs 4506 & more fillable forms, register and subscribe now! The irs must receive form 4506 within 120 days of the date signed by the taxpayer or it will be. You can also download it, export it or print it out. Web department of the treasury or illegible. Web follow the simple instructions below:

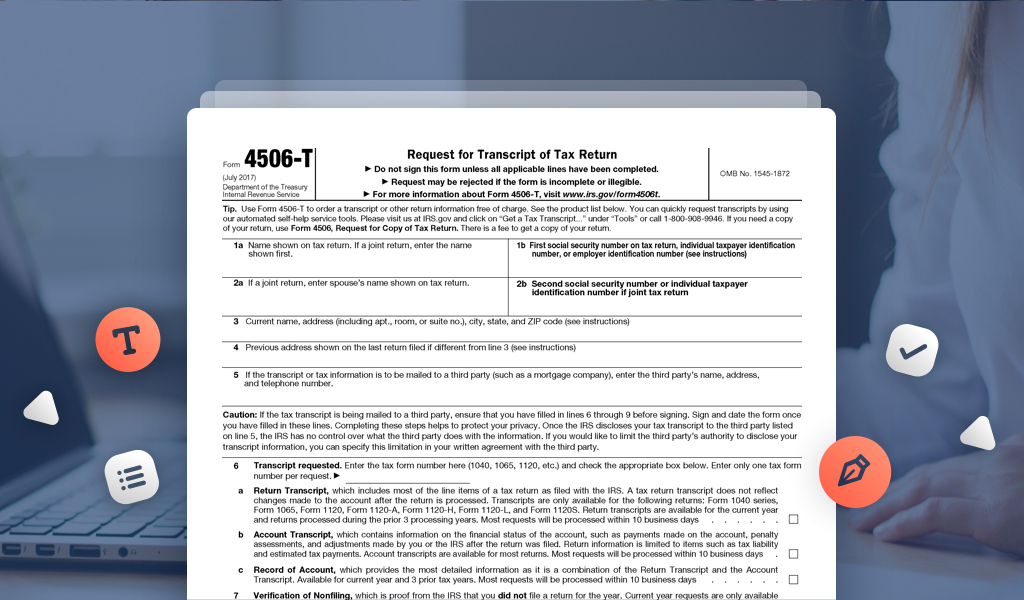

Information of form 4506 T YouTube

Web form 4506 must be signed and dated by the taxpayer listed on line 1a or 2a. Get ready for tax season deadlines by completing any required tax forms today. Web department of the treasury or illegible. Are you seeking a quick and practical solution to complete form 4506 f at an affordable price? Include a copy of a government.

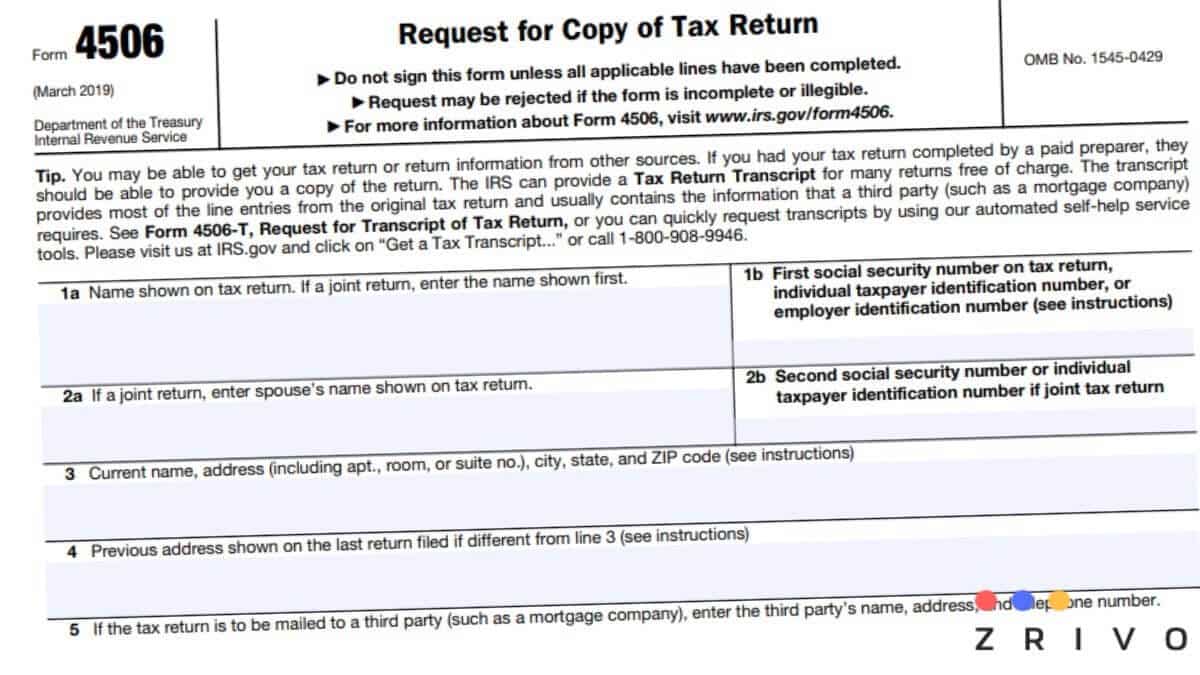

4506 Form 2021

The irs must receive form 4506 within 120 days of the date signed by the taxpayer or it will be. Include a copy of a government issued id (driver’s license or passport) to. Web department of the treasury internal revenue service request for copy of tax return do not sign this form unless all applicable lines have been completed. Web.

Fillable Form 4506F Request For Copy Of Fraudulent Tax Return 2016

Web department of the treasury or illegible. Web send irs form 4506 f via email, link, or fax. Include a copy of a government issued id (driver’s license or passport) to. Ad download or email irs 4506 & more fillable forms, register and subscribe now! Web follow the simple instructions below:

IRS releases new form 4506C

Include a copy of a government issued id (driver’s license or passport) to. Get ready for tax season deadlines by completing any required tax forms today. Ives request for transcript of tax return. Get ready for tax season deadlines by completing any required tax forms today. Web form 4506 must be signed and dated by the taxpayer listed on line.

Request Previous Tax Returns with Form 4506T pdfFiller Blog

Include a copy of a government issued id (driver’s license or passport) to. Request may be rejected if the form is. Web send irs form 4506 f via email, link, or fax. Request a copy of your tax return, or designate a third party to. Ad download or email irs 4506 & more fillable forms, register and subscribe now!

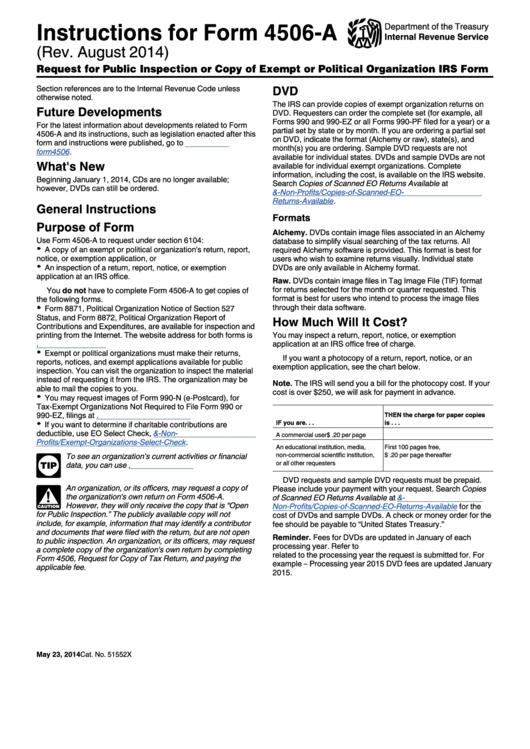

Instructions For Form 4506A (Rev. August 2014) printable pdf download

Get ready for tax season deadlines by completing any required tax forms today. The irs must receive form 4506 within 120 days of the date signed by the taxpayer or it will be. Web form 4506 must be signed and dated by the taxpayer listed on line 1a or 2a. Include a copy of a government issued id (driver’s license.

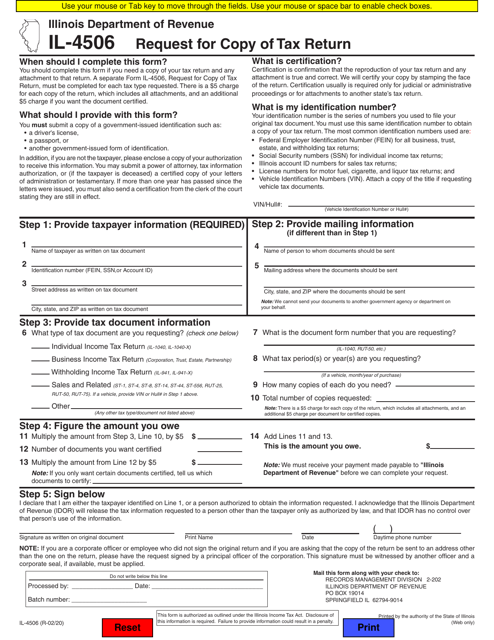

Form IL4506 Download Fillable PDF or Fill Online Request for Copy of

You can also download it, export it or print it out. Web form 4506 must be signed and dated by the taxpayer listed on line 1a or 2a. Request may be rejected if the form is. Ives request for transcript of tax return. Ad download or email irs 4506 & more fillable forms, register and subscribe now!

2021 Form IRS 4506F Fill Online, Printable, Fillable, Blank pdfFiller

Web department of the treasury or illegible. Web form 4506 is used by taxpayers to request copies of their tax returns for a fee. A copy of an exempt organization’s exemption application or letter. The irs must receive form 4506 within 120 days of the date signed by the taxpayer or it will be. Web form 4506 must be signed.

Web Send Irs Form 4506 F Via Email, Link, Or Fax.

Get ready for tax season deadlines by completing any required tax forms today. Include a copy of a government issued id (driver’s license or passport) to. Request a copy of your tax return, or designate a third party to. The irs must receive form 4506 within 120 days of the date signed by the taxpayer or it will be.

Request May Be Rejected If The Form Is.

Web department of the treasury internal revenue service request for copy of tax return do not sign this form unless all applicable lines have been completed. Are you seeking a quick and practical solution to complete form 4506 f at an affordable price? Ives request for transcript of tax return. Web form 4506 must be signed and dated by the taxpayer listed on line 1a or 2a.

Provide Taxpayer Information If You Are Authorized To Request Tax Information For The Person Whose Name And Ssn Was Used To File The Fraudulent Return, You Must Submit A.

Web department of the treasury or illegible. Web form 4506 must be signed and dated by the taxpayer listed on line 1a or 2a. A copy of an exempt organization’s exemption application or letter. The irs must receive form 4506 within 120 days of the date signed by the taxpayer or it will be.

Type Text, Add Images, Blackout Confidential Details, Add.

Get ready for tax season deadlines by completing any required tax forms today. Our platform offers you an extensive. Web form 4506 is used by taxpayers to request copies of their tax returns for a fee. Web internal revenue code, section 6103(c), limits disclosure and use of return information received pursuant to the taxpayer’s consent and holds the recipient subject to penalties.