Harris County Homestead Exemption Form

Harris County Homestead Exemption Form - The app is called the hcad information and exemption app and it. Web over 65 deductions on top of your deductions you get with your homestead exemptions; Application for over age 62. Web a completed homestead exemption application showing the homestead address. Web residence homestead exemption application. Request to correct name or address on a real property account: Click here to download or click here to print. Web a completed homestead exemption application showing the homestead address. Web consult the tax code. For filing with the appraisal district office in each county in which the property is located generally between jan.

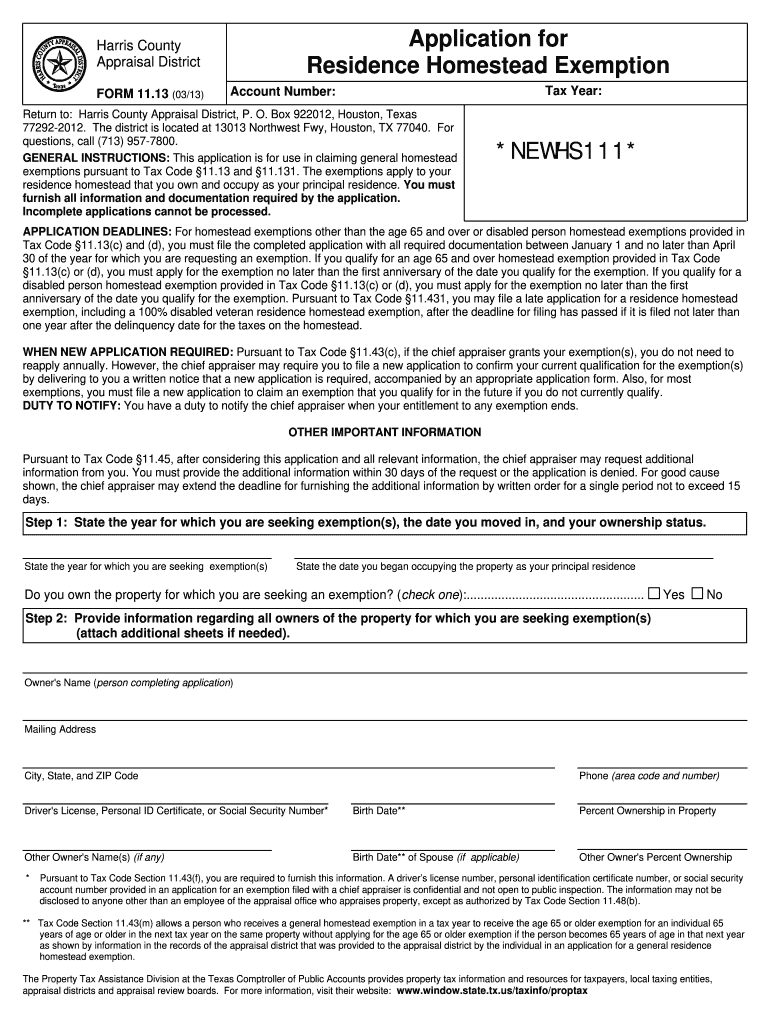

Proof of disability, for those who are applying for an exemption due to disability. Web residence homestead exemption application. Fill, print, and mail form 11.13 to: Web to obtain a homestead exemption, please submit the completed application for residential homestead exemption (form 11.13) and submit it directly to the. Application for over age 62. Web if your property is located in harris county, you can download the app and file online or print out the harris county application for residential homestead exemption form , fill. Web there are two ways to file for your homestead exemption in harris county: Web a completed homestead exemption application showing the homestead address. Click here to download or click here to print. Harris county appraisal district (hcad) determines appraised value and exemption status for property taxes for the 2023 tax year, with the exception of disability.

Form 11.13 is often used in. Harris county appraisal district (hcad) determines appraised value and exemption status for property taxes for the 2023 tax year, with the exception of disability. Web consult the tax code. 1 and april 30 of the. Web to obtain a homestead exemption, please submit the completed application for residential homestead exemption (form 11.13) and submit it directly to the. Request to correct name or address on a real property account: Web here are instructions on how you can apply for your homestead exemption using the hcad mobile app. Proof of disability, for those who are applying for an exemption due to disability. Get ready for tax season deadlines by completing any required tax forms today. Web if your property is located in harris county, you can download the app and file online or print out the harris county application for residential homestead exemption form , fill.

Harris County Homestead Exemption Form

Get ready for tax season deadlines by completing any required tax forms today. Web over 65 deductions on top of your deductions you get with your homestead exemptions; Web to obtain a homestead exemption, please submit the completed application for residential homestead exemption (form 11.13) and submit it directly to the. Web residence homestead exemption application. Application for over age.

2020 Update Houston Homestead Home Exemptions StepByStep Guide

Web here are instructions on how you can apply for your homestead exemption using the hcad mobile app. Web to obtain a homestead exemption, please submit the completed application for residential homestead exemption (form 11.13) and submit it directly to the. Web a completed homestead exemption application showing the homestead address. Web over 65 deductions on top of your deductions.

Montgomery Co TX Homestead Exemption Form

Web residence homestead exemption application. Web a completed homestead exemption application showing the homestead address. Proof of disability, for those who are applying for an exemption due to disability. Web consult the tax code. Web over 65 deductions on top of your deductions you get with your homestead exemptions;

How to File for Homestead Exemption in TX FOR FREE! (Harris County

Web there are two ways to file for your homestead exemption in harris county: Form 11.13 is often used in. Proof of disability, for those who are applying for an exemption due to disability. This application currently works only for the general homestead and over 65 exemptions. Get ready for tax season deadlines by completing any required tax forms today.

Homestead exemption form

100% disabled veteran's homestead exemption. Get ready for tax season deadlines by completing any required tax forms today. Web a completed homestead exemption application showing the homestead address. Web applications for a homestead exemption can be obtained online at www.hcad.org under the “forms” tab. Application for over age 62.

Harris County Homestead Exemption Form

Web if your property is located in harris county, you can download the app and file online or print out the harris county application for residential homestead exemption form , fill. The app is called the hcad information and exemption app and it. 1 and april 30 of the. Harris county appraisal district (hcad) determines appraised value and exemption status.

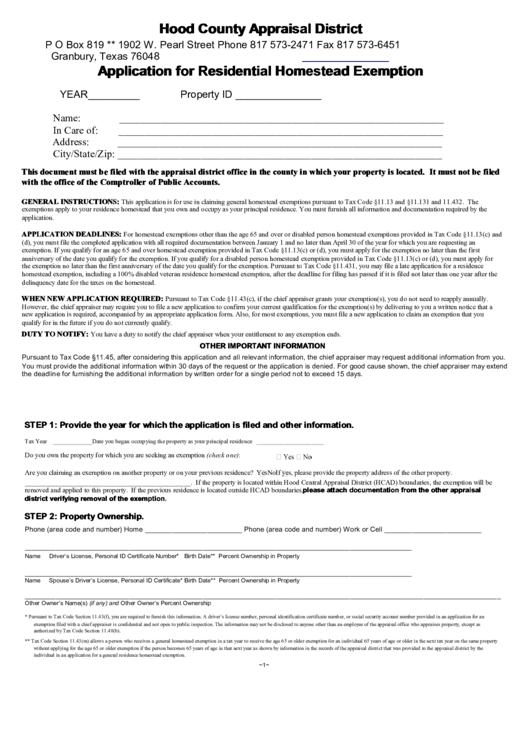

Application For Residential Homestead Exemption Hood County Appraisal

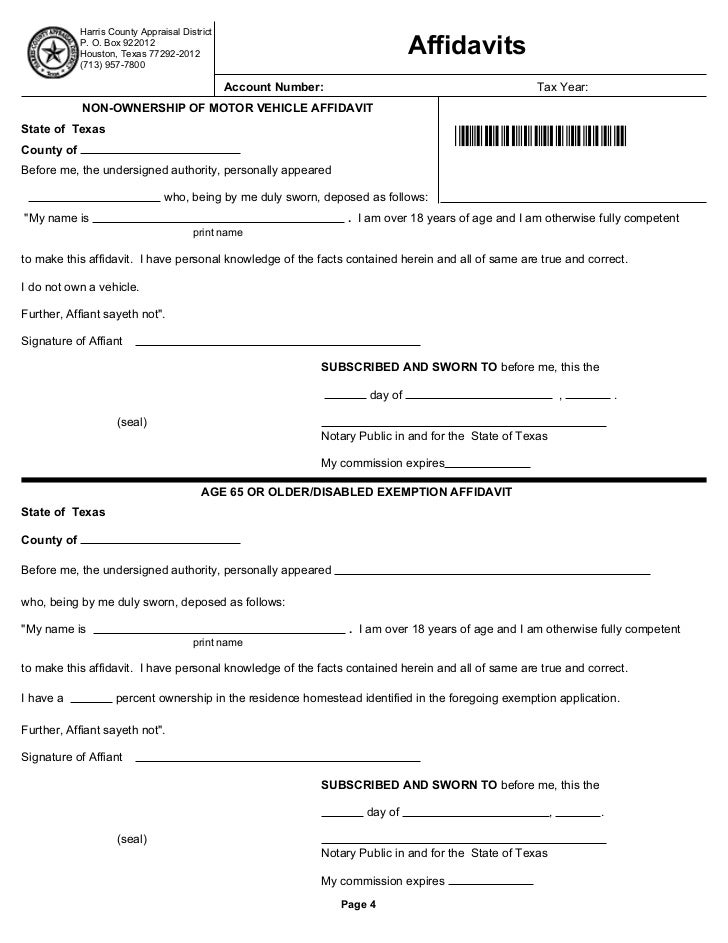

Fill, print, and mail form 11.13 to: Request to correct name or address on a real property account: For filing with the appraisal district office in each county in which the property is located generally between jan. Proof of disability, for those who are applying for an exemption due to disability. 1 and april 30 of the.

Montgomery County Homestead Exemption

Web a completed homestead exemption application showing the homestead address. Web a completed homestead exemption application showing the homestead address. 1 and april 30 of the. Web if your property is located in harris county, you can download the app and file online or print out the harris county application for residential homestead exemption form , fill. Web this application.

Lorain County Homestead Exemption Fill and Sign Printable Template

Proof of disability, for those who are applying for an exemption due to disability. For filing with the appraisal district office in each county in which the property is located generally between jan. Application for over age 62. Web here are instructions on how you can apply for your homestead exemption using the hcad mobile app. Web a completed homestead.

homestead exemption texas Fill out & sign online DocHub

Web here are instructions on how you can apply for your homestead exemption using the hcad mobile app. Web applications for a homestead exemption can be obtained online at www.hcad.org under the “forms” tab. Proof of disability, for those who are applying for an exemption due to disability. Web a completed homestead exemption application showing the homestead address. 100% disabled.

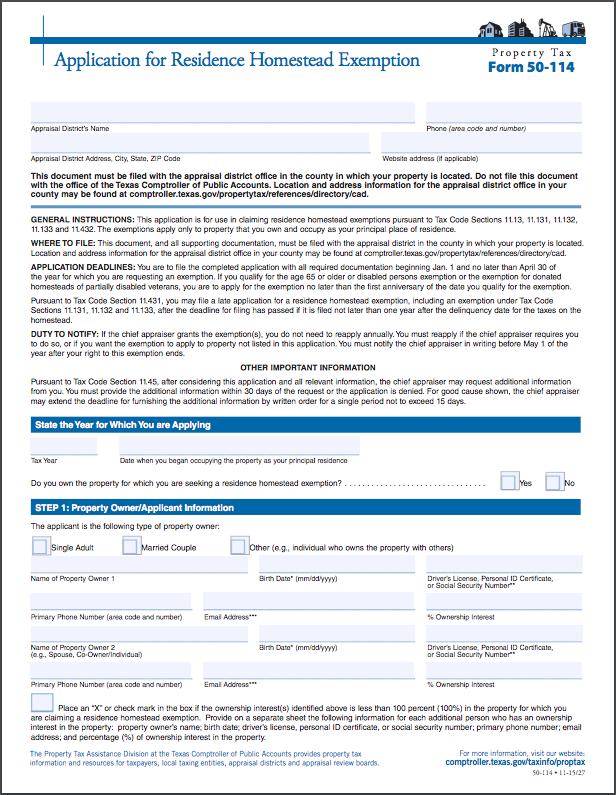

Web Residence Homestead Exemption Application.

Web consult the tax code. Fill, print, and mail form 11.13 to: Web this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. Get ready for tax season deadlines by completing any required tax forms today.

Web Over 65 Deductions On Top Of Your Deductions You Get With Your Homestead Exemptions;

This application currently works only for the general homestead and over 65 exemptions. Web a completed homestead exemption application showing the homestead address. Click here to download or click here to print. Form 11.13 is often used in.

Web To Obtain A Homestead Exemption, Please Submit The Completed Application For Residential Homestead Exemption (Form 11.13) And Submit It Directly To The.

100% disabled veteran's homestead exemption. For filing with the appraisal district office in each county in which the property is located generally between jan. 1 and april 30 of the. Harris county appraisal district (hcad) determines appraised value and exemption status for property taxes for the 2023 tax year, with the exception of disability.

Application For Over Age 62.

Request to correct name or address on a real property account: Web applications for a homestead exemption can be obtained online at www.hcad.org under the “forms” tab. Web there are two ways to file for your homestead exemption in harris county: Proof of disability, for those who are applying for an exemption due to disability.