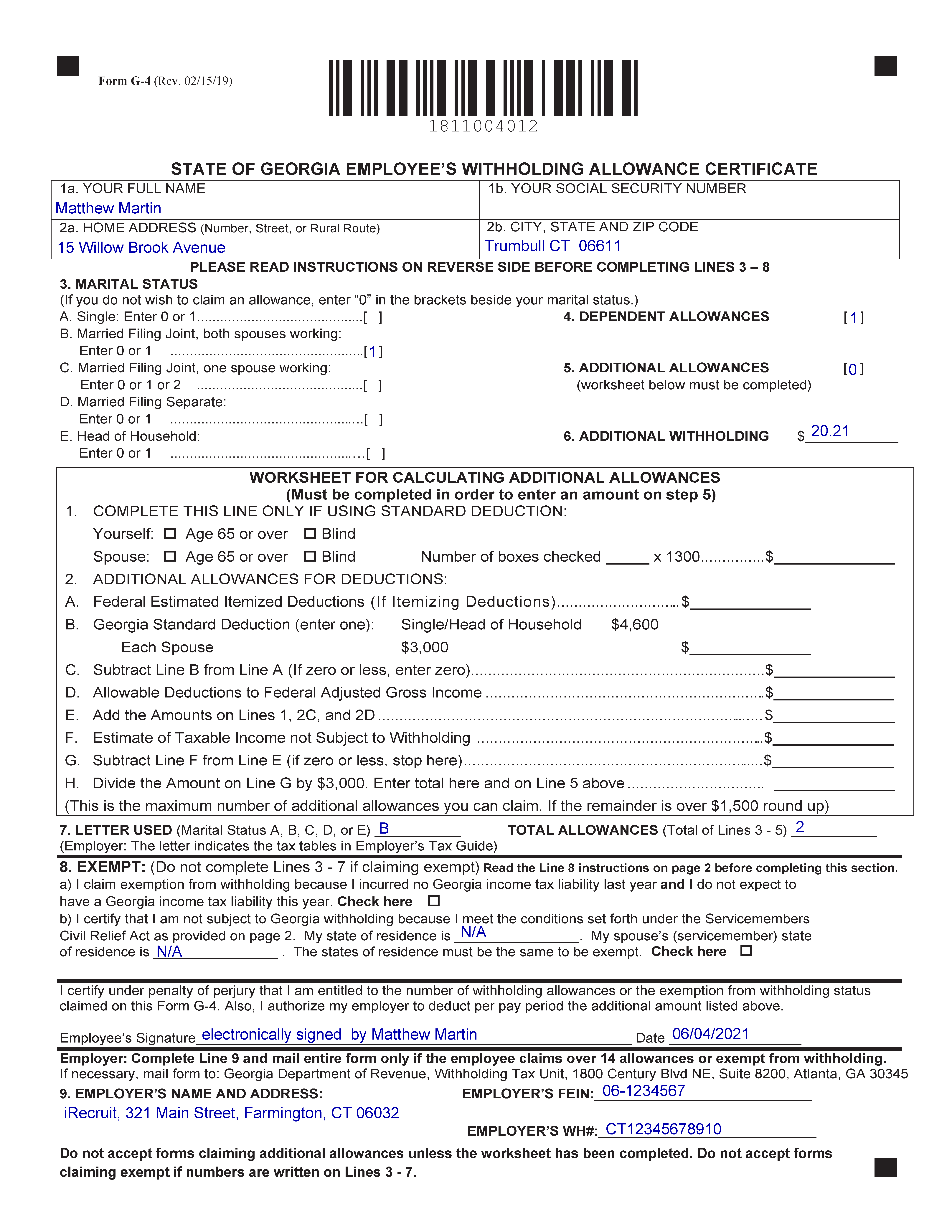

G4 Form Example

G4 Form Example - Staff to submit a request for g4/g1 visa depending on the appointment type. Web you can apply for the g4 visa only if you’re appointed at a designated international organization. Enjoy smart fillable fields and interactivity. It confirms that the applicant will be employed by an international organization located in the u.s., and thus will receive a salary from this organization. Filling it in correctly and updating it when necessary ensures accurate payroll Save or instantly send your ready documents. These nonimmigrants’ immediate family members are generally eligible for a corresponding dependent nonimmigrant status. File your georgia and federal tax returns online with turbotax in minutes. Your employer withheld $500 of georgia income tax from your wages. The amount on line 4 of form 500ez (or line 16 of form 500) was $100.

File now with turbotax related georgia individual income tax forms: Address to send form 4720. Your tax liability is the amount on line 4 (or line 16);therefore, you do not qualify to claim exempt. The amount on line 4 of form 500ez (or line 16 of form 500) was $100. Form 4868, application for automatic extension of time to file u.s. Therefore, you do not qualify to claim exempt. Your employer withheld $500 of georgia income tax from your wages. Your employer withheld $500 of georgia income tax from your wages. The amount on line 4 of form 500ez (or line 16 of form 500) was $100. Enter the number of dependent allowances you are entitled to claim.

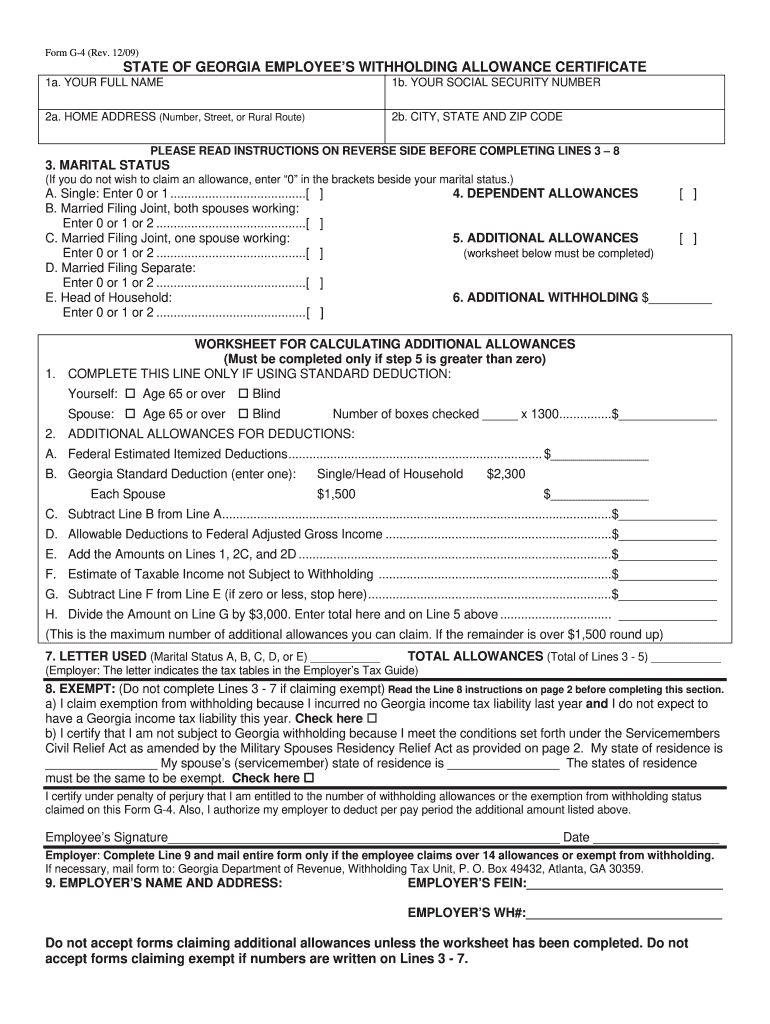

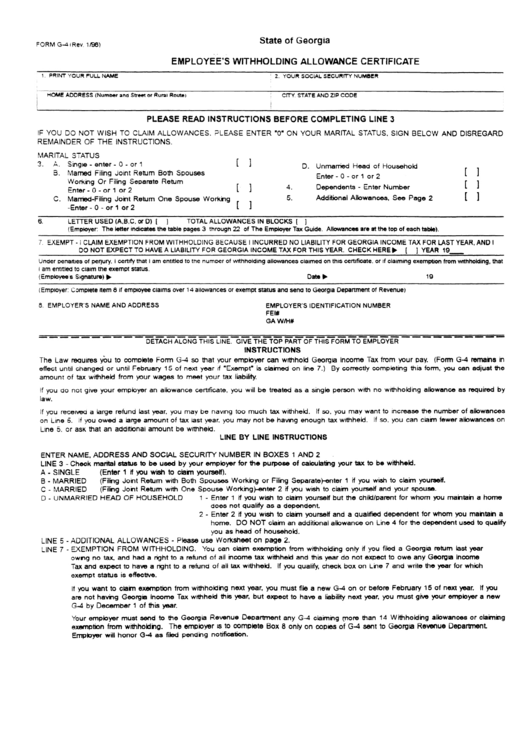

Get your online template and fill it in using progressive features. Therefore, you do not qualify to claim exempt. You must enter 1 on 3e to use this allowance. The amount on line 4 of form 500ez (or line 16 of form 500) was $100. Government document used to support an application for an a, e or g nonimmigrant visa. Form 4868, application for automatic extension of time to file u.s. Web employers in georgia will need to know georgia employee withholding to set up their payroll. Complete this section only if your household includes additional residents who are qualifying dependents. Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. It confirms that the applicant will be employed by an international organization located in the u.s., and thus will receive a salary from this organization.

How to fill out the G4 form in 2021 YouTube

Enter the number of dependent allowances you are entitled to claim. Free for simple returns, with discounts available for taxformfinder users! Form 4720, return of certain excise taxes on charities and other persons under chapters 41 and 42 of the internal revenue code. Enjoy smart fillable fields and interactivity. The forms will be effective with the first paycheck.

G4 App

Government document used to support an application for an a, e or g nonimmigrant visa. What is the g4 form? Therefore, you do not qualify to claim exempt. Web employers in georgia will need to know georgia employee withholding to set up their payroll. These nonimmigrants’ immediate family members are generally eligible for a corresponding dependent nonimmigrant status.

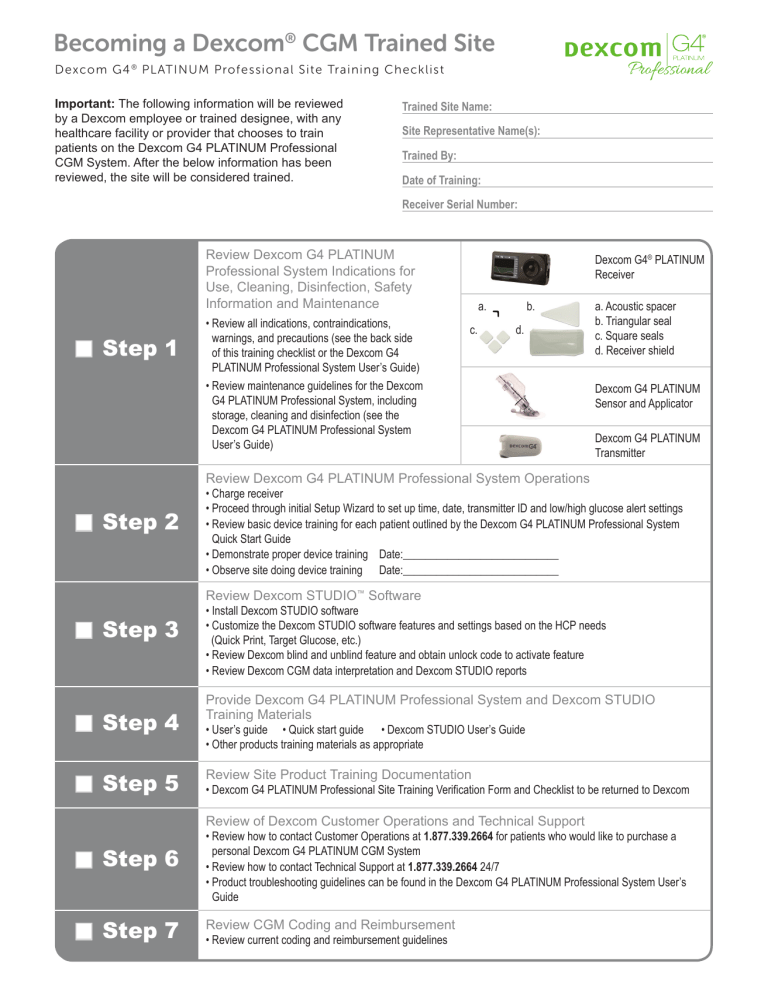

G4 Professional User manual Manualzz

These nonimmigrants’ immediate family members are generally eligible for a corresponding dependent nonimmigrant status. Complete this section only if your household includes additional residents who are qualifying dependents. Therefore, you do not qualify to claim exempt. Marital status (if you do not wish to claim an. You will need to check the designated international organizations in the foreign affairs manual,.

Ga Employee Withholding Form 2022 2023

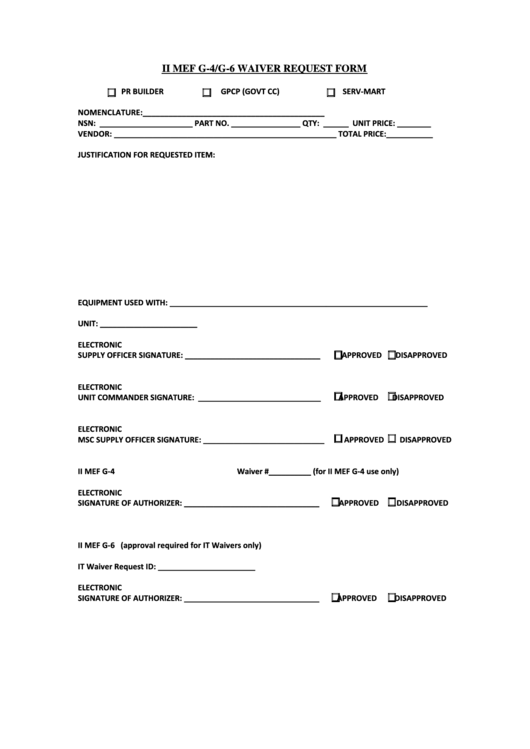

You cannot take the single allowance and the head of household allowance in. Staff to submit a request for g4/g1 visa depending on the appointment type. Government document used to support an application for an a, e or g nonimmigrant visa. It confirms that the applicant will be employed by an international organization located in the u.s., and thus will.

2000 Form GA DoR G4 Fill Online, Printable, Fillable, Blank PDFfiller

File your georgia and federal tax returns online with turbotax in minutes. The amount on line 4 of form 500ez (or line 16 of form 500) was $100. Address to send form 4720. Your tax liability is the amount on line 4 (or line 16); Marital status (if you do not wish to claim an.

G4 Form

Web ★ 4.8 satisfied 40 votes how to fill out and sign form g 4 2023 online? Web examples:your employer withheld $500 of georgia income tax from your wages. File your georgia and federal tax returns online with turbotax in minutes. It confirms that the applicant will be employed by an international organization located in the u.s., and thus will.

iMac G4 Form, meet function iMore

What is the g4 form? File now with turbotax related georgia individual income tax forms: Your employer withheld $500 of georgia income tax from your wages. Staff to submit a request for g4/g1 visa depending on the appointment type. Web employers in georgia will need to know georgia employee withholding to set up their payroll.

iConnect Including Different State W4s, Tied to Work Location

Get your online template and fill it in using progressive features. Form 4720, return of certain excise taxes on charities and other persons under chapters 41 and 42 of the internal revenue code. Complete this section only if your household includes additional residents who are qualifying dependents. Write the number of allowances you are claiming in the brackets beside your.

Fillable Form G4 Employee'S Withholding Allowance Certificate

Get your online template and fill it in using progressive features. Save or instantly send your ready documents. File your georgia and federal tax returns online with turbotax in minutes. Web efile your georgia tax return now efiling is easier, faster, and safer than filling out paper tax forms. Form (g4) is to be completed and submitted to your employer.

HP Z2 G4 Series Small Form Factor B&H Custom Workstation

Web examples:your employer withheld $500 of georgia income tax from your wages. Filling it in correctly and updating it when necessary ensures accurate payroll File your georgia and federal tax returns online with turbotax in minutes. The amount on line 4 of form 500ez (or line 16 of form 500) was $100. Select personal employees to learn more.

What Is The G4 Form?

Your employer withheld $500 of georgia income tax from your wages. Enter the number of dependent allowances you are entitled to claim. You must enter 1 on 3e to use this allowance. Enter the number of dependent allowances you are entitled to claim.

File Now With Turbotax Related Georgia Individual Income Tax Forms:

Get your online template and fill it in using progressive features. Staff to submit a request for g4/g1 visa depending on the appointment type. Your tax liability is the amount on line 4 (or line 16); Government document used to support an application for an a, e or g nonimmigrant visa.

Filling It In Correctly And Updating It When Necessary Ensures Accurate Payroll

Your tax liability is the amount on line 4 (or line 16);therefore, you do not qualify to claim exempt. Marital status (if you do not wish to claim an. Your employer withheld $500 of georgia income tax from your wages. Form 4868, application for automatic extension of time to file u.s.

Write The Number Of Allowances You Are Claiming In The Brackets Beside Your Marital Status.

Web efile your georgia tax return now efiling is easier, faster, and safer than filling out paper tax forms. Form 4720, return of certain excise taxes on charities and other persons under chapters 41 and 42 of the internal revenue code. Complete this section only if your household includes additional residents who are qualifying dependents. Address to send form 4720.