Form Nyc 208

Form Nyc 208 - Web the tax commission is an independent agency authorized to correct the tax class, assessed value, or exemption of your property. Web nyc property and business tax forms documents on this page are provided in pdf format. Web what is form nyc 208? Web 2022 business corporation tax. Documents on this page are provided in pdf format. Go digital and save time with signnow, the. Sign it in a few clicks draw your. Get ready for tax season deadlines by completing any required tax forms today. Edit your nyc 208 form 2018 pdf online type text, add images, blackout confidential details, add comments, highlights and more. Property forms business & excise tax forms benefit application forms general.

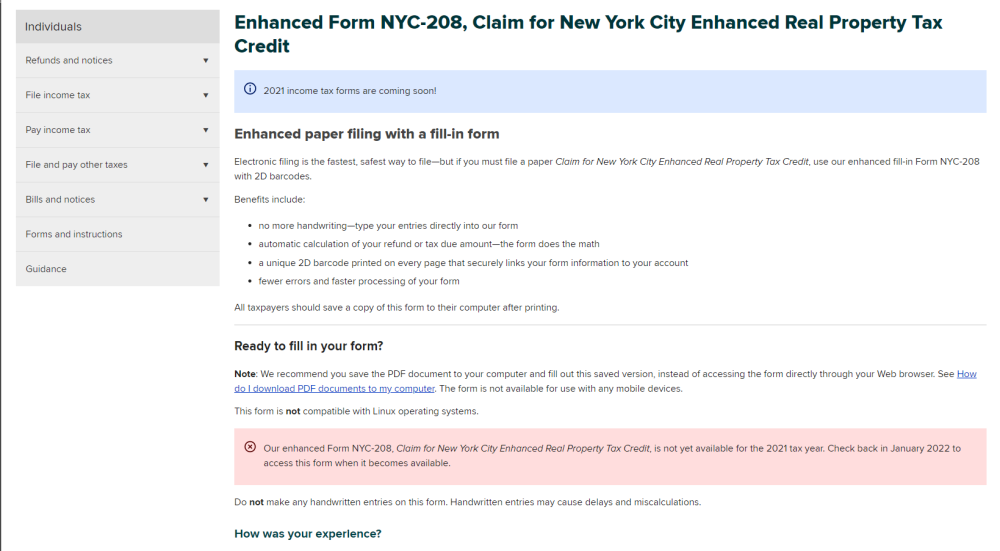

Use get form or simply click on the template preview to open it in the editor. Web nyc property and business tax forms documents on this page are provided in pdf format. Electronic filing is the fastest, safest way to file—but if you must file a paper claim for new york city enhanced real property. Web 2022 business corporation tax. Web what is form nyc 208? Web the tax commission is an independent agency authorized to correct the tax class, assessed value, or exemption of your property. Go digital and save time with signnow, the. Web find your requested refund amount by form and tax year; Read your department of finance. **say thanks by clicking the thumb icon in.

Edit your nyc 208 form 2018 pdf online type text, add images, blackout confidential details, add comments, highlights and more. Start completing the fillable fields and. Property forms business & excise tax forms benefit application forms general. **say thanks by clicking the thumb icon in. Web 2022 business corporation tax. Are you still seeking a quick and convenient tool to complete nyc 208 at a reasonable cost? Web the tax commission is an independent agency authorized to correct the tax class, assessed value, or exemption of your property. Our service will provide you with a rich variety. Web what is form nyc 208? Electronic filing is the fastest, safest way to file—but if you must file a paper claim for new york city enhanced real property.

Marchon NYC 208 Eyeglasses

Sign it in a few clicks draw your. Read your department of finance. Are you still seeking a quick and convenient tool to complete nyc 208 at a reasonable cost? **say thanks by clicking the thumb icon in. Web the tax commission is an independent agency authorized to correct the tax class, assessed value, or exemption of your property.

20192023 Form NY NYC208 Fill Online, Printable, Fillable, Blank

Go digital and save time with signnow, the. Property forms business & excise tax forms benefit application forms general. Use get form or simply click on the template preview to open it in the editor. Our service will provide you with a rich variety. Web find your requested refund amount by form and tax year;

NYC 208 Stijn Nieuwendijk Flickr

Our service will provide you with a rich variety. Are you still seeking a quick and convenient tool to complete nyc 208 at a reasonable cost? Use get form or simply click on the template preview to open it in the editor. Web find your requested refund amount by form and tax year; **say thanks by clicking the thumb icon.

How To Qualify For Nyc Enhanced Real Property Tax Credit PRFRTY

Are you still seeking a quick and convenient tool to complete nyc 208 at a reasonable cost? Edit your nyc 208 form 2018 pdf online type text, add images, blackout confidential details, add comments, highlights and more. Web 2022 business corporation tax. Web find your requested refund amount by form and tax year; Documents on this page are provided in.

0905_NYC_2081 peinong Flickr

Go digital and save time with signnow, the. Electronic filing is the fastest, safest way to file—but if you must file a paper claim for new york city enhanced real property. If you filed for tax year your requested refund amount is; Read your department of finance. Get ready for tax season deadlines by completing any required tax forms today.

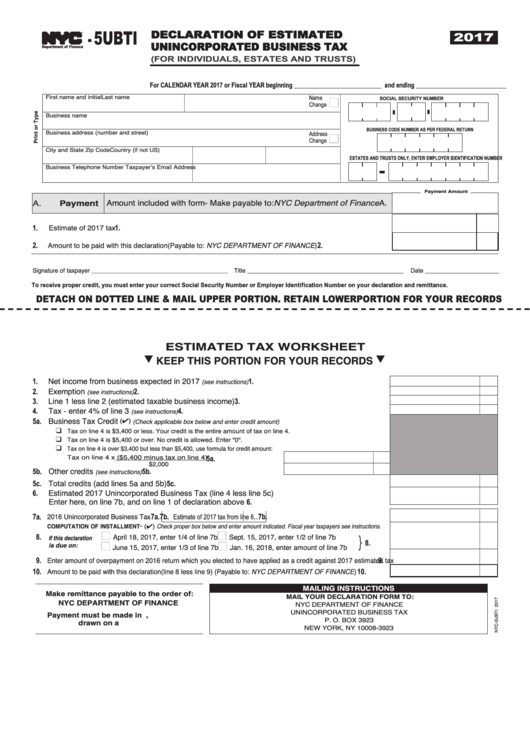

Form Nyc5ubti Declaration Of Estimated Unincorporated Business Tax

Are you still seeking a quick and convenient tool to complete nyc 208 at a reasonable cost? Edit your nyc 208 form 2018 pdf online type text, add images, blackout confidential details, add comments, highlights and more. Property forms business & excise tax forms benefit application forms general. Web nyc property and business tax forms documents on this page are.

Form NYC208 Enhanced Real Property Credit Renter Credit General

**say thanks by clicking the thumb icon in. Edit your nyc 208 form 2018 pdf online type text, add images, blackout confidential details, add comments, highlights and more. Electronic filing is the fastest, safest way to file—but if you must file a paper claim for new york city enhanced real property. Web nyc property and business tax forms documents on.

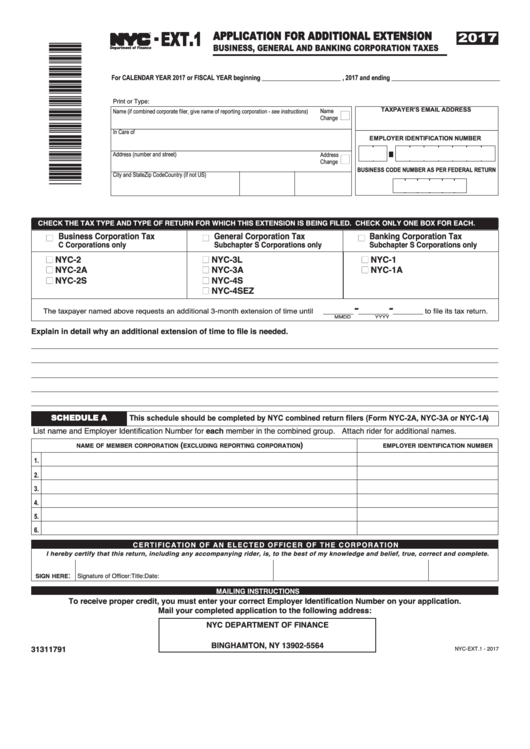

Fillable Form NycExt.1 Application For Additional Extension Business

Web nyc property and business tax forms documents on this page are provided in pdf format. Web 2022 business corporation tax. Electronic filing is the fastest, safest way to file—but if you must file a paper claim for new york city enhanced real property. Web satisfied 109 votes handy tips for filling out form nyc 208 online printing and scanning.

208 West 30th Street Meridian Capital Group

Start completing the fillable fields and. Use get form or simply click on the template preview to open it in the editor. Web the tax commission is an independent agency authorized to correct the tax class, assessed value, or exemption of your property. Web follow the simple instructions below: If you filed for tax year your requested refund amount is;

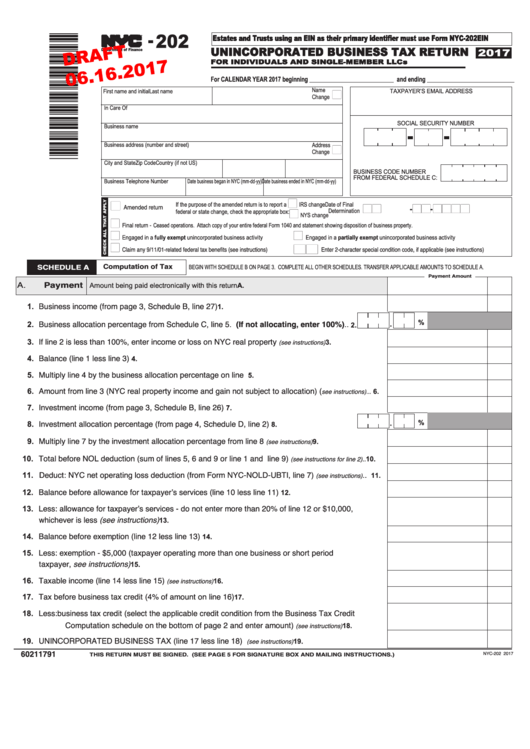

Form Nyc202 Draft Unincorporated Business Tax Return For Individuals

Web find your requested refund amount by form and tax year; Documents on this page are provided in pdf format. Web 2022 business corporation tax. Web what is form nyc 208? Web satisfied 109 votes handy tips for filling out form nyc 208 online printing and scanning is no longer the best way to manage documents.

Web The Tax Commission Is An Independent Agency Authorized To Correct The Tax Class, Assessed Value, Or Exemption Of Your Property.

**say thanks by clicking the thumb icon in. Start completing the fillable fields and. Web 2022 business corporation tax. Go digital and save time with signnow, the.

Edit Your Nyc 208 Form 2018 Pdf Online Type Text, Add Images, Blackout Confidential Details, Add Comments, Highlights And More.

Our service will provide you with a rich variety. Read your department of finance. Web follow the simple instructions below: Web what is form nyc 208?

If You Filed For Tax Year Your Requested Refund Amount Is;

Are you still seeking a quick and convenient tool to complete nyc 208 at a reasonable cost? Property forms business & excise tax forms benefit application forms general. Web satisfied 109 votes handy tips for filling out form nyc 208 online printing and scanning is no longer the best way to manage documents. Electronic filing is the fastest, safest way to file—but if you must file a paper claim for new york city enhanced real property.

Documents On This Page Are Provided In Pdf Format.

Use get form or simply click on the template preview to open it in the editor. Web nyc property and business tax forms documents on this page are provided in pdf format. Sign it in a few clicks draw your. Web find your requested refund amount by form and tax year;