Form 990 Ez Pdf

Form 990 Ez Pdf - Professional fundraising services, fundraising events, and; This form is for income earned in tax. Web publication 1828, tax guide for churches and religious organizations pdf; Instructions for these schedules are. Complete, edit or print tax forms instantly. Web form 990 overview course: On this page you may download the 990 series filings. Web (form 990) department of the treasury internal revenue service public charity status and public support complete if the organization is a section 501(c)(3) organization or a. If an organization isn’t required to file form 990 or form. Ad get ready for tax season deadlines by completing any required tax forms today.

Web form 990 overview course: Complete, edit or print tax forms instantly. On this page you may download the 990 series filings. Go to www.irs.gov/form990 for the latest information. Complete, edit or print tax forms instantly. Web in detail mandatory electronic filing. Ad get ready for tax season deadlines by completing any required tax forms today. Instructions for these schedules are. Web publication 1828, tax guide for churches and religious organizations pdf; Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w.

Ad get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Instructions for these schedules are. Complete, edit or print tax forms instantly. Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w. On this page you may download the 990 series filings. Web form 990 overview course: Go to www.irs.gov/form990 for the latest information. Web (form 990) department of the treasury internal revenue service public charity status and public support complete if the organization is a section 501(c)(3) organization or a. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions.

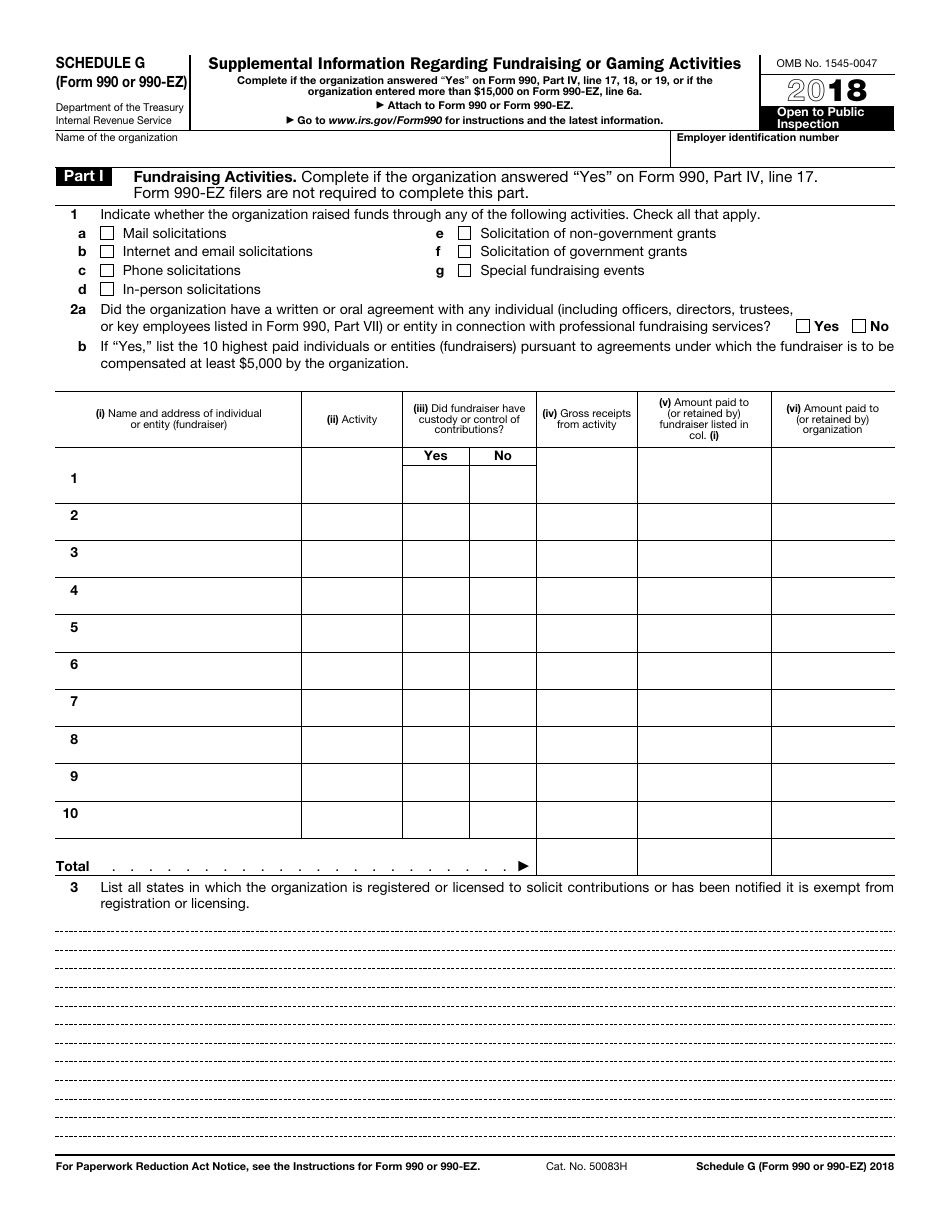

IRS Form 990 (990EZ) Schedule G Download Fillable PDF or Fill Online

Web publication 1828, tax guide for churches and religious organizations pdf; If an organization isn’t required to file form 990 or form. Web (form 990) department of the treasury internal revenue service public charity status and public support complete if the organization is a section 501(c)(3) organization or a. Ad get ready for tax season deadlines by completing any required.

990 ez Fill Online, Printable, Fillable Blank form990or990ez

Professional fundraising services, fundraising events, and; Instructions for these schedules are. Instructions for form 990 pdf; Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w. Ad get ready for tax season deadlines by completing any required tax forms today.

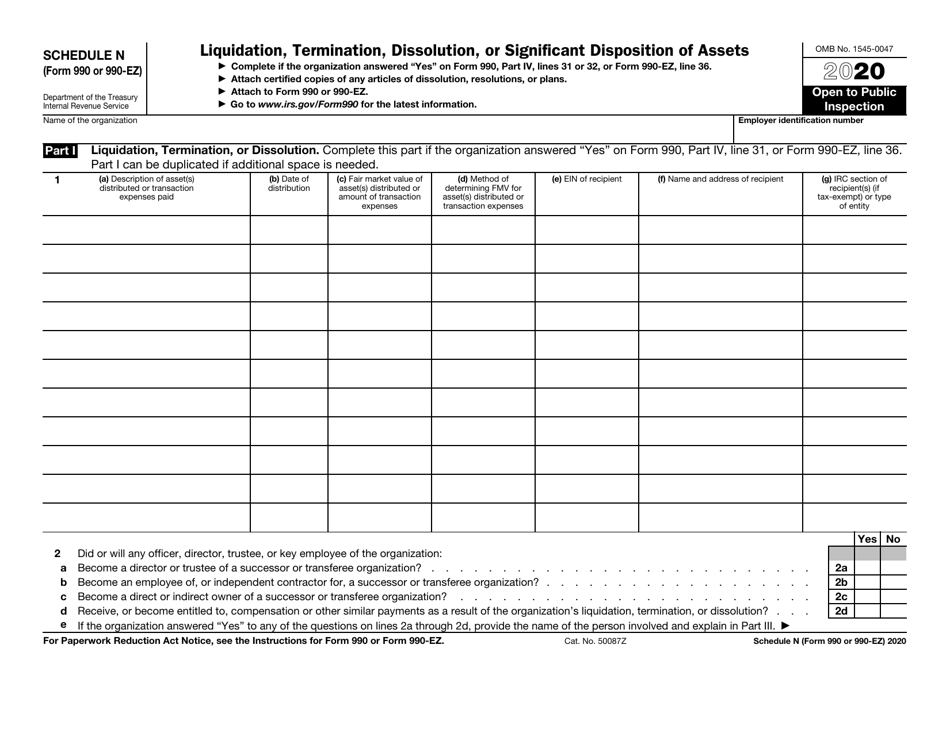

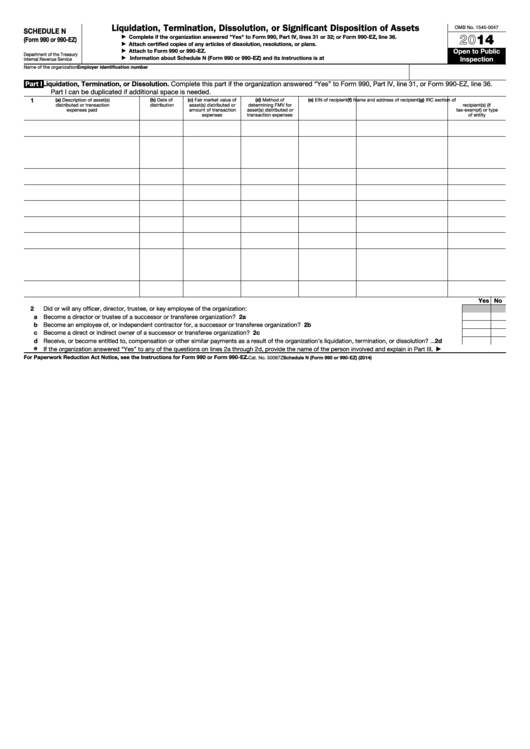

IRS Form 990 (990EZ) Schedule N Download Fillable PDF or Fill Online

Instructions for these schedules are. On this page you may download the 990 series filings. Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w. Go to www.irs.gov/form990 for the latest information. Professional fundraising services, fundraising events, and;

form 990 ez schedule g 2017 Fill Online, Printable, Fillable Blank

Professional fundraising services, fundraising events, and; Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w. Web publication 1828, tax guide for churches and religious organizations pdf; Web form 990 overview course: Web the following schedules to form 990, return of.

Fillable Schedule N (Form 990 Or 990Ez) Liquidation, Termination

On this page you may download the 990 series filings. Complete, edit or print tax forms instantly. Go to www.irs.gov/form990 for the latest information. Ad get ready for tax season deadlines by completing any required tax forms today. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions.

Printable Irs Form 990 Master of Documents

Professional fundraising services, fundraising events, and; Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web (form 990) department of the treasury internal revenue service public charity status and public support complete if the organization is a section 501(c)(3) organization or a. Web form 990 overview course: On this page.

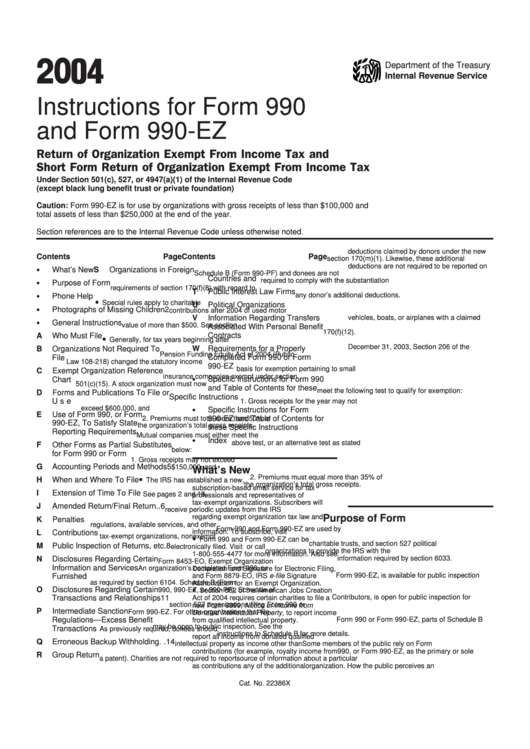

Instructions For Form 990 And Form 990Ez 2004 printable pdf download

On this page you may download the 990 series filings. Web (form 990) department of the treasury internal revenue service public charity status and public support complete if the organization is a section 501(c)(3) organization or a. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Ad get ready for.

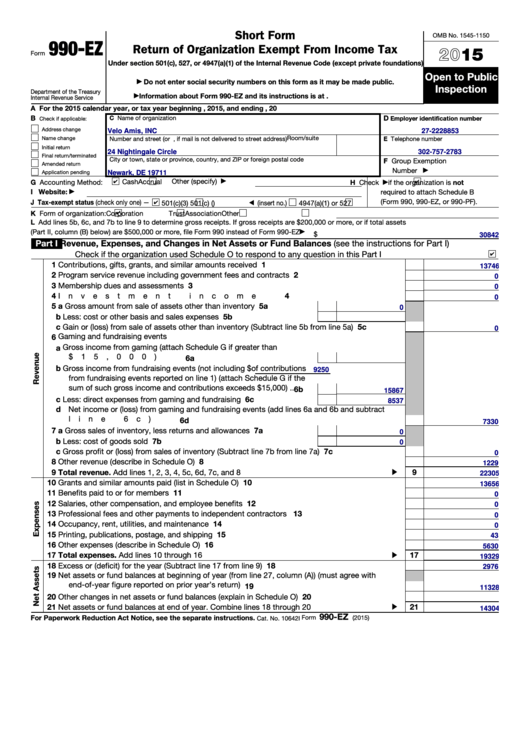

Fillable Form 990 Ez Short Form Return Of Organization Exempt From

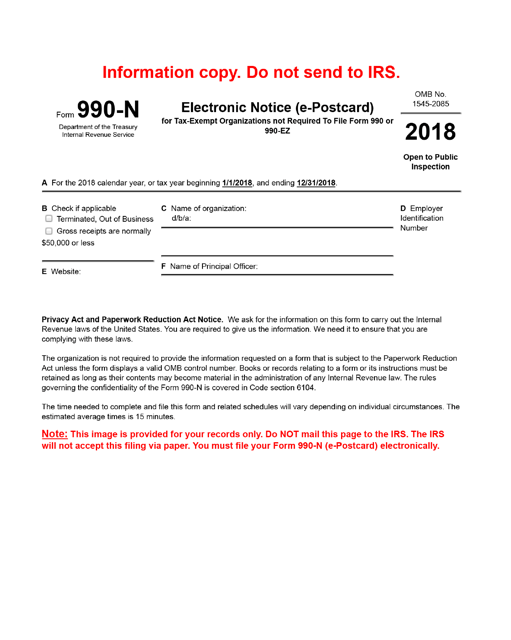

Professional fundraising services, fundraising events, and; If an organization isn’t required to file form 990 or form. Instructions for these schedules are. Web in detail mandatory electronic filing. Complete, edit or print tax forms instantly.

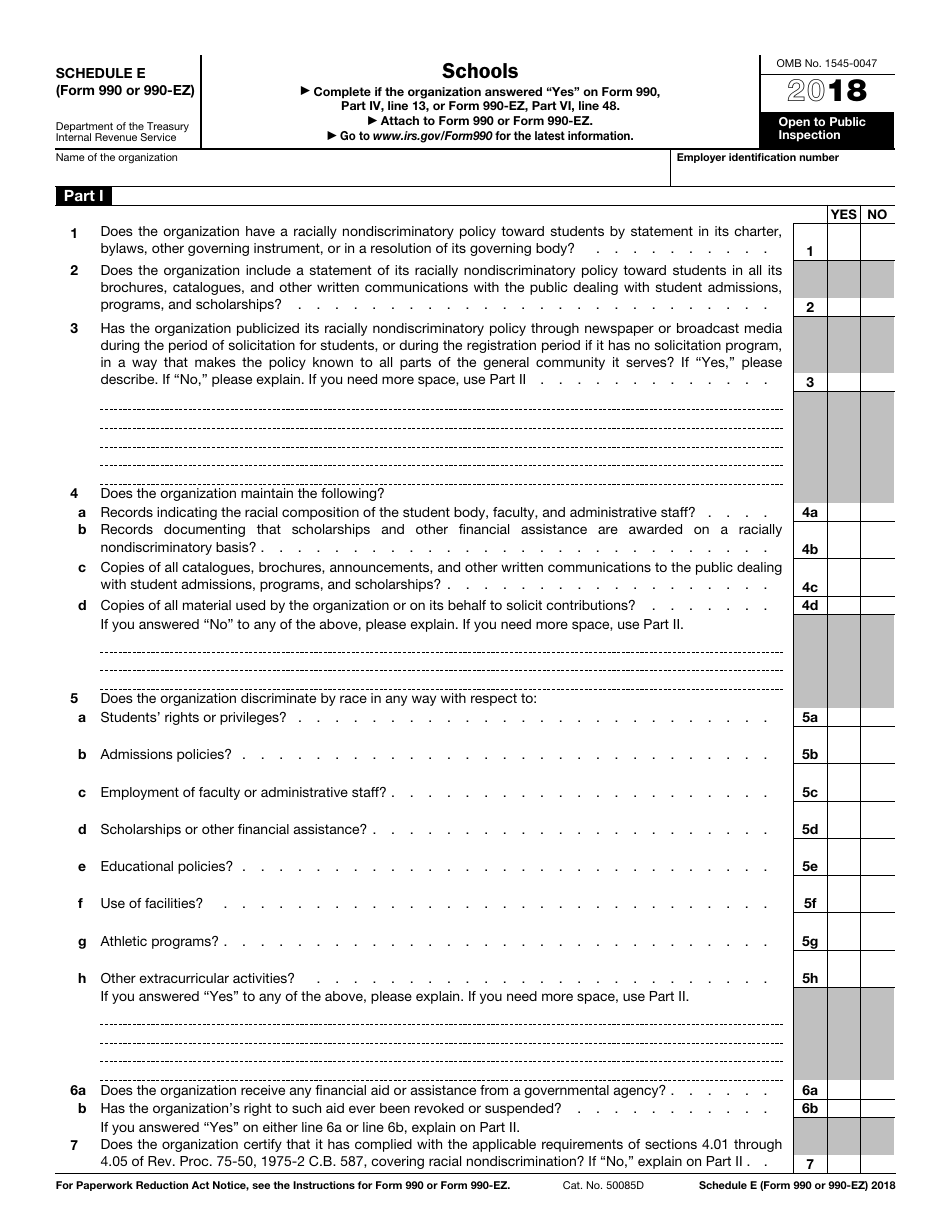

IRS Form 990 (990EZ) Schedule E Download Fillable PDF or Fill Online

Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w. Instructions for these schedules are. Name of the organization employer identification number internal revenue service department of the treasury. Web form 990 overview course: Web in detail mandatory electronic filing.

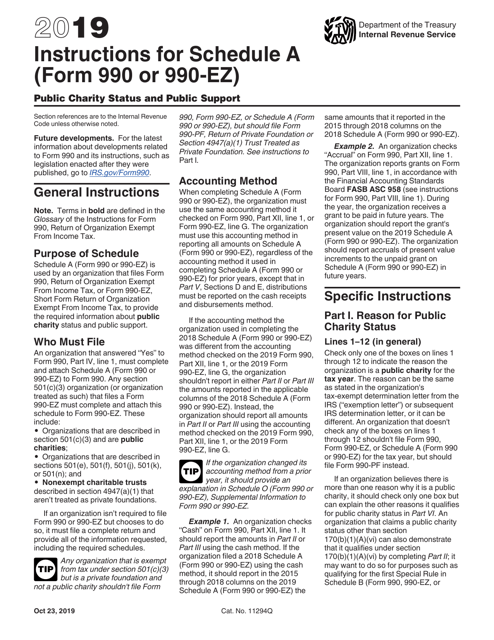

Download Instructions for IRS Form 990, 990EZ Schedule A Public

Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w. Complete, edit or print tax forms instantly. Name of the organization employer identification number internal revenue service department of the treasury. Web publication 1828, tax guide for churches and religious organizations.

Web Form 990 (2022) Page 5 Part V Statements Regarding Other Irs Filings And Tax Compliance (Continued) Yes No 2A Enter The Number Of Employees Reported On Form W.

Name of the organization employer identification number internal revenue service department of the treasury. Web form 990 overview course: Web in detail mandatory electronic filing. Web publication 1828, tax guide for churches and religious organizations pdf;

Web The Following Schedules To Form 990, Return Of Organization Exempt From Income Tax, Do Not Have Separate Instructions.

If an organization isn’t required to file form 990 or form. On this page you may download the 990 series filings. Professional fundraising services, fundraising events, and; Web (form 990) department of the treasury internal revenue service public charity status and public support complete if the organization is a section 501(c)(3) organization or a.

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Instructions for form 990 pdf; Complete, edit or print tax forms instantly. Go to www.irs.gov/form990 for the latest information. Instructions for these schedules are.

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Complete, edit or print tax forms instantly. This form is for income earned in tax.