1099 Consolidated Form

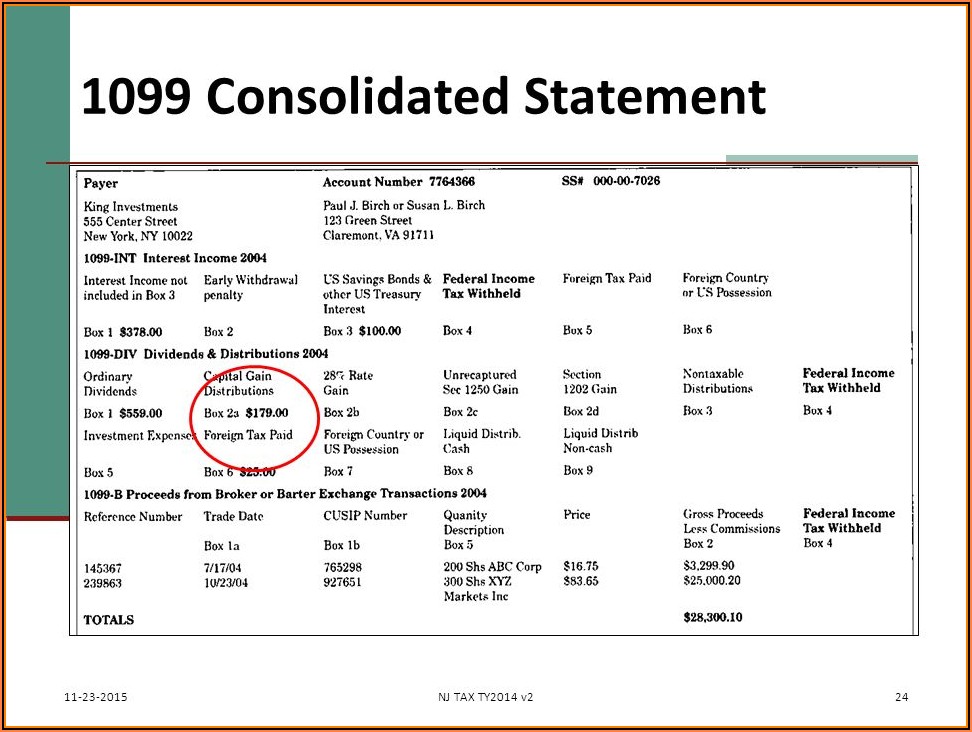

1099 Consolidated Form - If the real estate was not your main home, report the transaction on form 4797, form 6252, and/or the schedule d for the appropriate income tax form. Web if i received a consolidated 1099, do i still need to fill out form 8949? For whom, they sold stocks, commodities, regulated futures contracts, foreign currency contracts, forward contracts, debt instruments, options, securities futures contracts, etc., for cash, who received cash. It could include some or all of the following five forms: Web the consolidated form 1099 combines five separate 1099 forms into one. A corrected consolidated form 1099 may be required under these circumstances: Sections reportable by janney directly to the irs are indicated where applicable on your 1099 form. Sign in to access your forms. It covers reportable income and transactions for the tax year, from interest income to investment expenses, and royalties to real estate mortgage investment conduits (remic). Web some tax documents are available on the tax documents page.

1042, annual withholding tax return for u.s. Web the consolidated form 1099 is the collection of all applicable forms 1099 merged into one document. It reflects information that is reported to the irs and is designed to assist you with filing your federal income tax return. Sign in to access your forms. Web go to income/deductions > consolidated 1099. Which tax forms will i get? It reflects information that is reported to the irs and is designed to assist you with filing your federal income tax return. The following guides take you through the different tax forms furnished by edward jones and provide some basic answers to common questions that may assist you and your tax professional with preparing your return. Web some tax documents are available on the tax documents page. This also applies to statements furnished as part of a consolidated reporting statement.

The form reports the interest income you received, any federal income taxes. To order these instructions and additional forms, go to www.irs.gov/employerforms. Fractional shares may be subject to a deminimis reporting if under $20.00. It could include some or all of the following five forms: Here are 8 key things to look for on yours. For whom, they sold stocks, commodities, regulated futures contracts, foreign currency contracts, forward contracts, debt instruments, options, securities futures contracts, etc., for cash, who received cash. Web the consolidated form 1099 is the collection of all applicable forms 1099 merged into one document. See the guide to information returns for due dates for all returns. It covers reportable income and transactions for the tax year, from interest income to investment expenses, and royalties to real estate mortgage investment conduits (remic). Specifically, it includes the following forms:

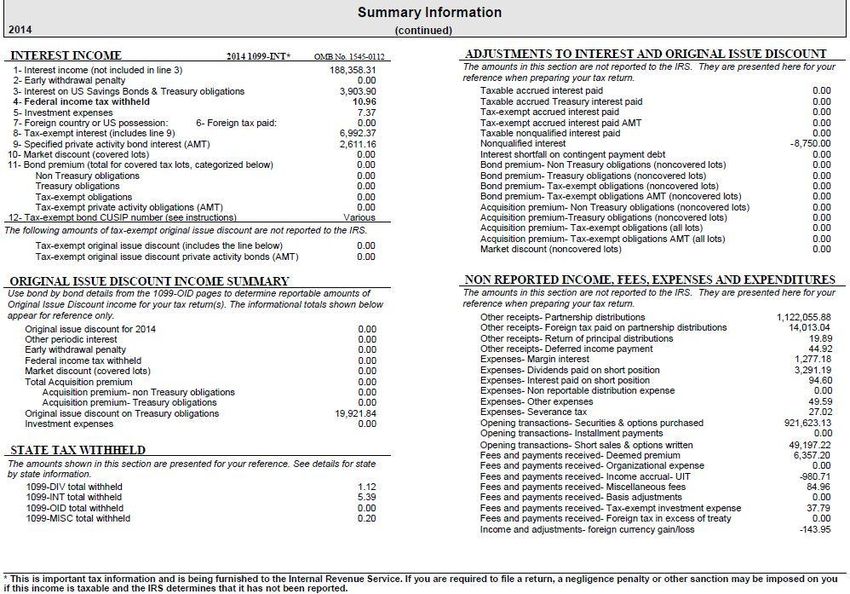

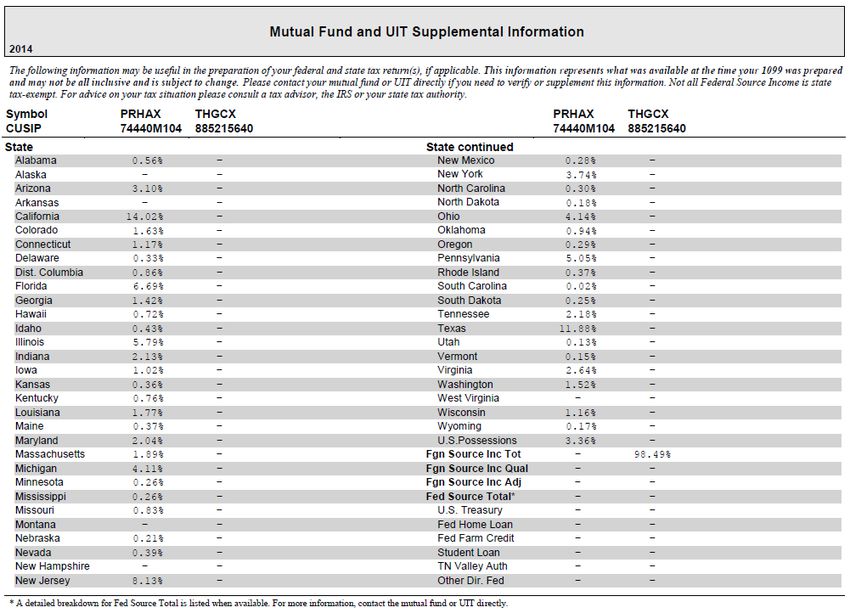

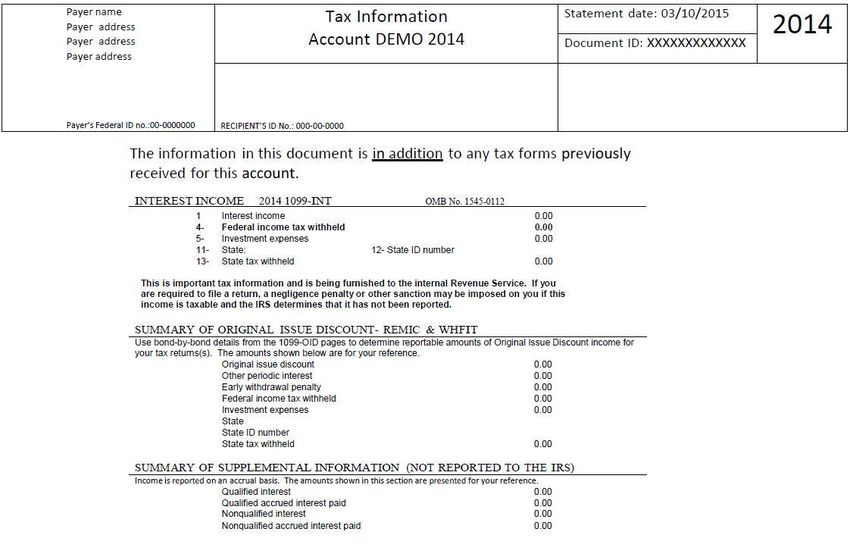

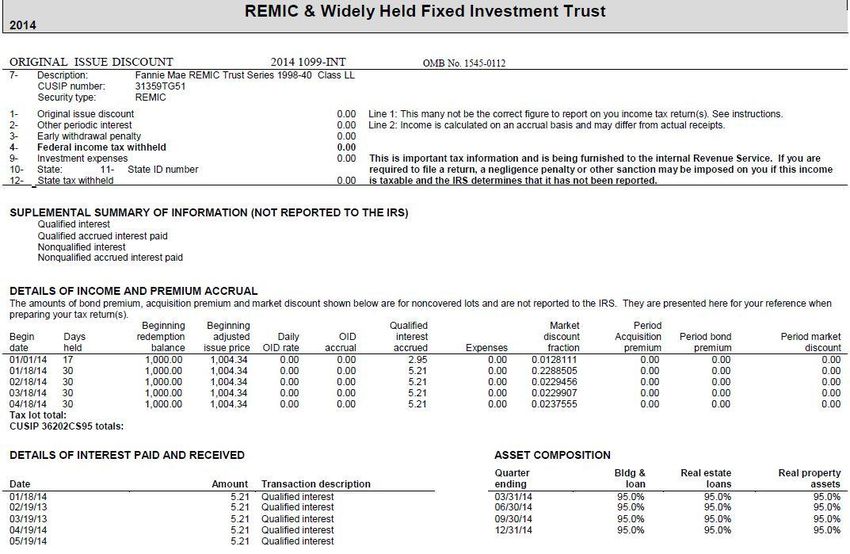

A guide to your 2014 Consolidated IRS Form 1099

Medical and health care payments. If the real estate was not your main home, report the transaction on form 4797, form 6252, and/or the schedule d for the appropriate income tax form. It reflects information that is reported to the irs and is designed to assist you with filing your federal income tax return. Sections reportable by janney directly to.

Forms 1099 The Basics You Should Know Kelly CPA

Lines 9 through 13 will automatically populate based on the tsj code entered in line 1. Fractional shares may be subject to a deminimis reporting if under $20.00. Web the consolidated form 1099 is the collection of all applicable forms 1099 merged into one document. A broker or barter exchange must file this form for each person: Some consolidated statements.

A guide to your 2014 Consolidated IRS Form 1099

To order these instructions and additional forms, go to www.irs.gov/employerforms. Specifically, it includes the following forms: It could include some or all of the following five forms: Payments made to someone not your employee for services in the course of your trade or business. Lines 9 through 13 will automatically populate based on the tsj code entered in line 1.

What Is A Consolidated 1099 Tax Form Form Resume Examples Wk9yMaO93D

It reflects information that is reported to the irs and is designed to assist you with filing your federal income tax return. Here are 8 key things to look for on yours. Payments made to someone not your employee for services in the course of your trade or business. See the guide to information returns for due dates for all.

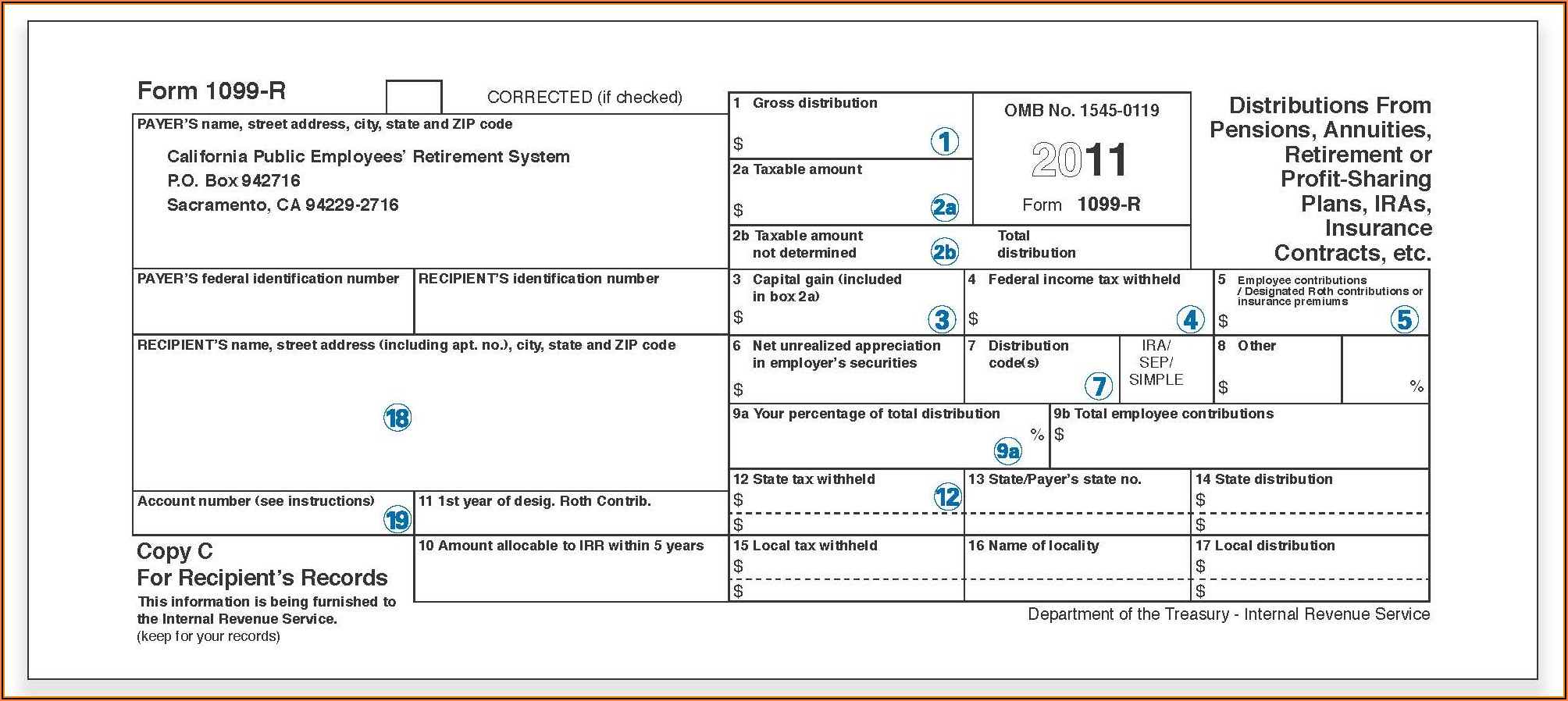

1099 Form Tax Id Form Resume Examples kLYrPX726a

Here are 8 key things to look for on yours. Web the consolidated form 1099 is the collection of all applicable forms 1099 merged into one document. Web your consolidated 1099 tax form will show all your reportable income and transactions for the tax year. In general, 1099 forms report income other than wages. Lines 9 through 13 will automatically.

A guide to your 2014 Consolidated IRS Form 1099

Web the consolidated form 1099 is the collection of all applicable forms 1099 merged into one document. Source income subject to withholding pdf A corrected consolidated form 1099 may be required under these circumstances: Reports all interest income earned on bonds, cds, and cash in your brokerage account A broker or barter exchange must file this form for each person:

A guide to your 2014 Consolidated IRS Form 1099

Sign in to access your forms. It reflects information that is reported to the irs and is designed to assist you with filing your federal income tax return. This also applies to statements furnished as part of a consolidated reporting statement. See the guide to information returns for due dates for all returns. A corrected consolidated form 1099 may be.

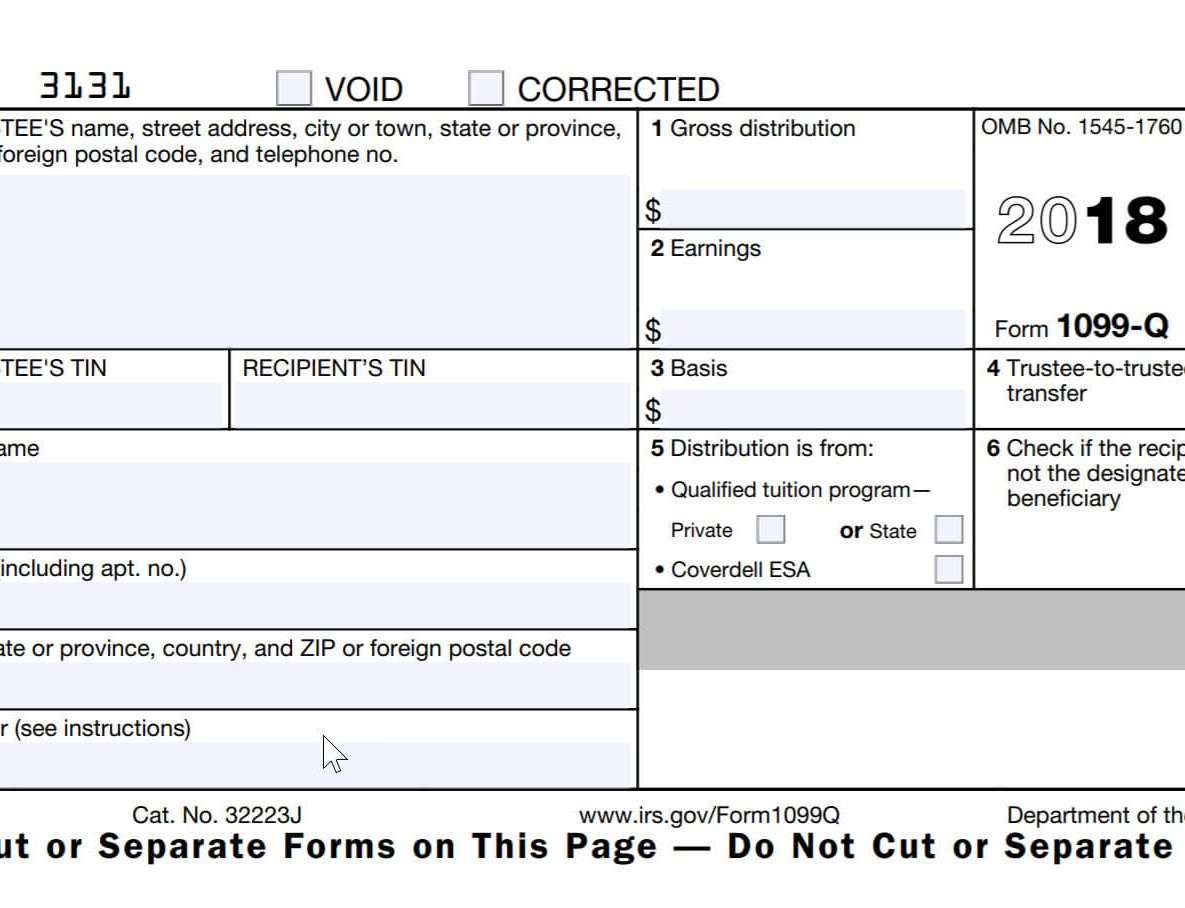

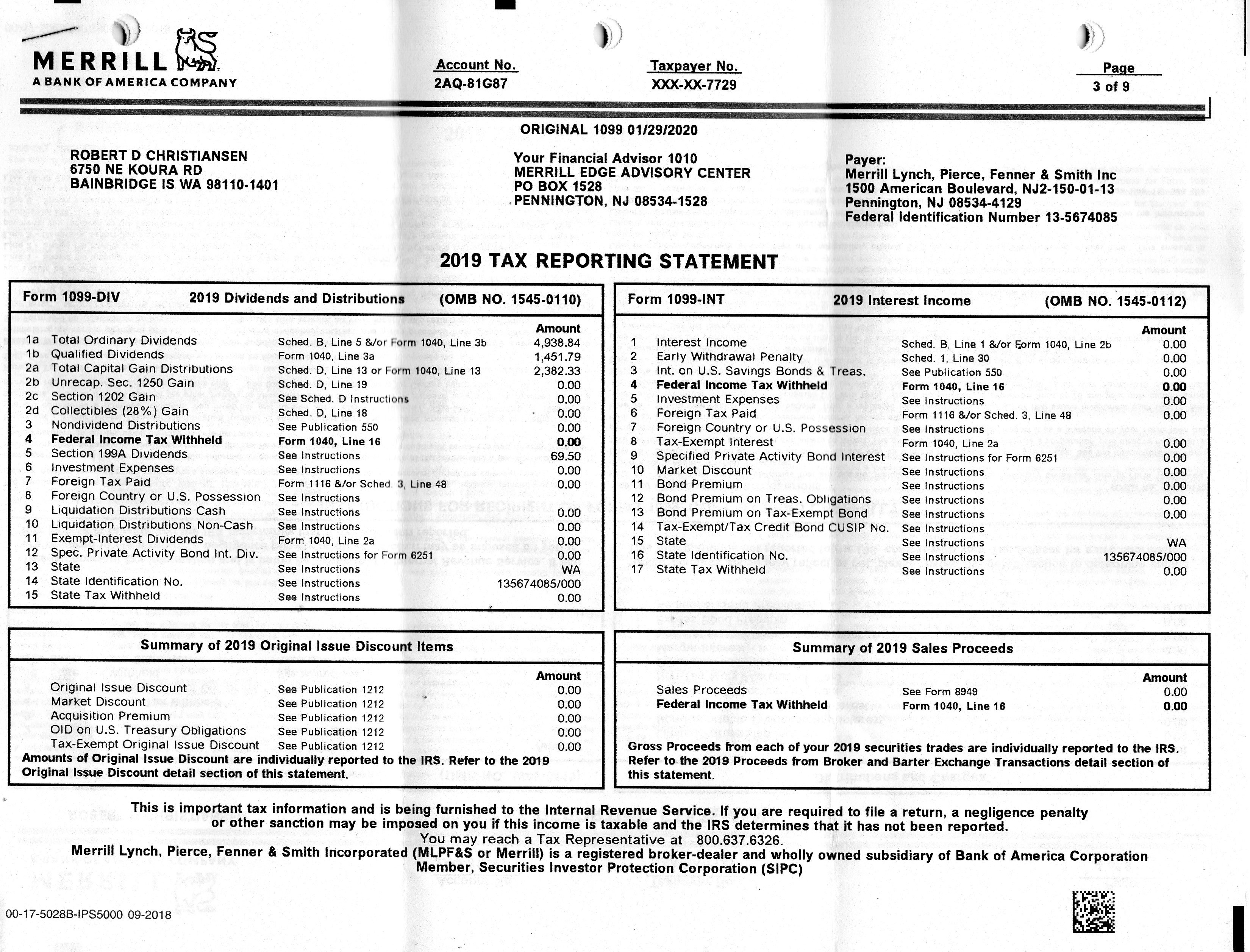

tax 2019

Web your consolidated 1099 tax form will show all your reportable income and transactions for the tax year. You may have to recapture (pay back) all or part of The form reports the interest income you received, any federal income taxes. Some consolidated statements include all 5 forms, while others only include the 1099s the irs requires for that client..

A guide to your 2014 Consolidated IRS Form 1099

1042, annual withholding tax return for u.s. It covers reportable income and transactions for the tax year, from interest income to investment expenses, and royalties to real estate mortgage investment conduits (remic). It reflects information that is reported to the irs and is designed to assist you with filing your federal income tax return. A corrected consolidated form 1099 may.

A guide to your 2014 Consolidated IRS Form 1099

It reflects information that is reported to the irs and is designed to assist you with filing your federal income tax return. Source income subject to withholding pdf Web some tax documents are available on the tax documents page. A corrected consolidated form 1099 may be required under these circumstances: To order these instructions and additional forms, go to www.irs.gov/employerforms.

Specifically, It Includes The Following Forms:

In general, 1099 forms report income other than wages. Web the consolidated form 1099 combines five separate 1099 forms into one. Web the consolidated form 1099 is the collection of all applicable forms 1099 merged into one document. Medical and health care payments.

Sections Reportable By Janney Directly To The Irs Are Indicated Where Applicable On Your 1099 Form.

Web your consolidated 1099 tax form will show all your reportable income and transactions for the tax year. Some consolidated statements include all 5 forms, while others only include the 1099s the irs requires for that client. Payments made to someone not your employee for services in the course of your trade or business. You may have to recapture (pay back) all or part of

Schedule An Appointment Learn More More To Explore Tips On Taxes Ideas To Help Reduce Taxes On Income, Investments, And Savings.

It could include some or all of the following five forms: Fractional shares may be subject to a deminimis reporting if under $20.00. Sign in to access your forms. Web some tax documents are available on the tax documents page.

A Corrected Consolidated Form 1099 May Be Required Under These Circumstances:

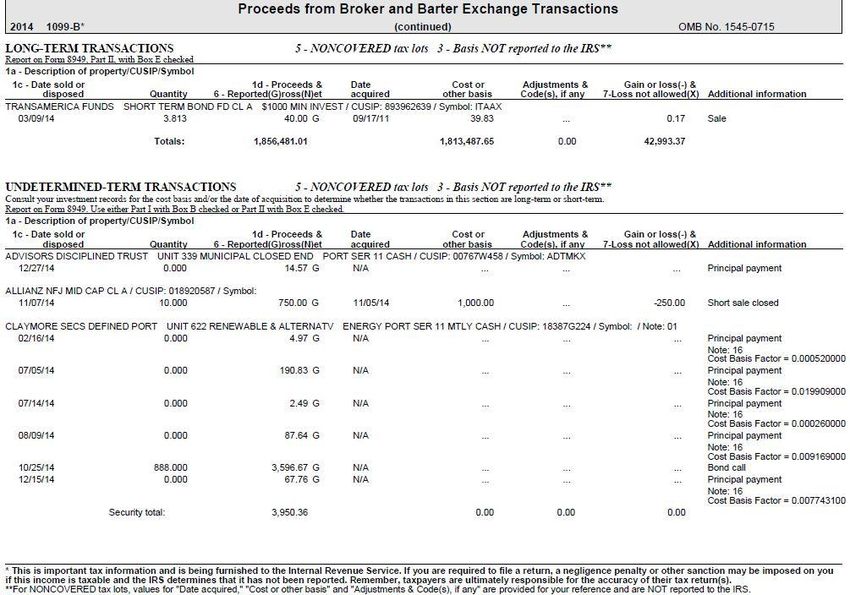

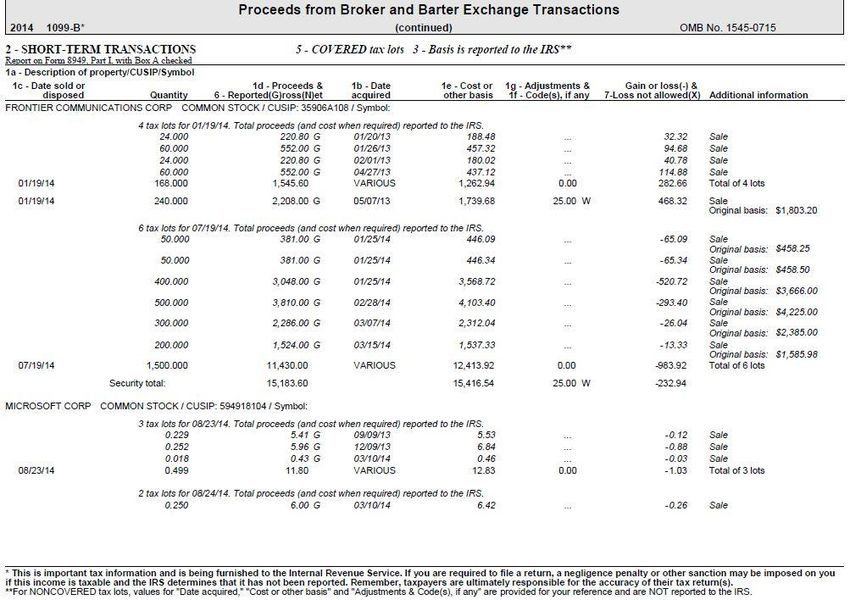

For whom, they sold stocks, commodities, regulated futures contracts, foreign currency contracts, forward contracts, debt instruments, options, securities futures contracts, etc., for cash, who received cash. Web if i received a consolidated 1099, do i still need to fill out form 8949? A broker or barter exchange must file this form for each person: Web the consolidated form 1099 is the collection of all applicable forms 1099 merged into one document.