Form 7203 2022

Form 7203 2022 - New items on form 7203. Web distributions & shareholder basis. Web generally, this analysis and the completion of new form 7203, s corporation shareholder stock and debt basis limitations, for impacted taxpayers will be required by. Web form 7203 is filed by s corporation shareholders who: Web form 7203 is currently in development and will be available march 2022. Press f6 to bring up open forms. Starting in tax year 2022, the program will no longer. Go to screen 20.2, s corporation. Are claiming a deduction for their share of an aggregate loss from an s corporation (including an aggregate loss not. View solution in original post february 23,.

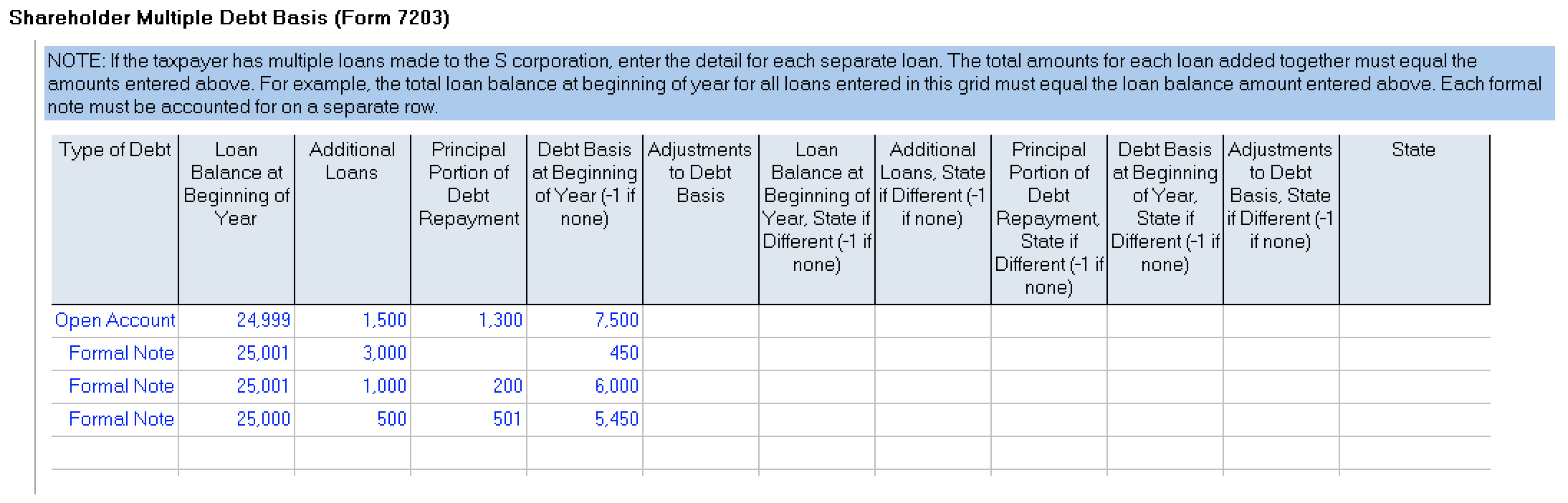

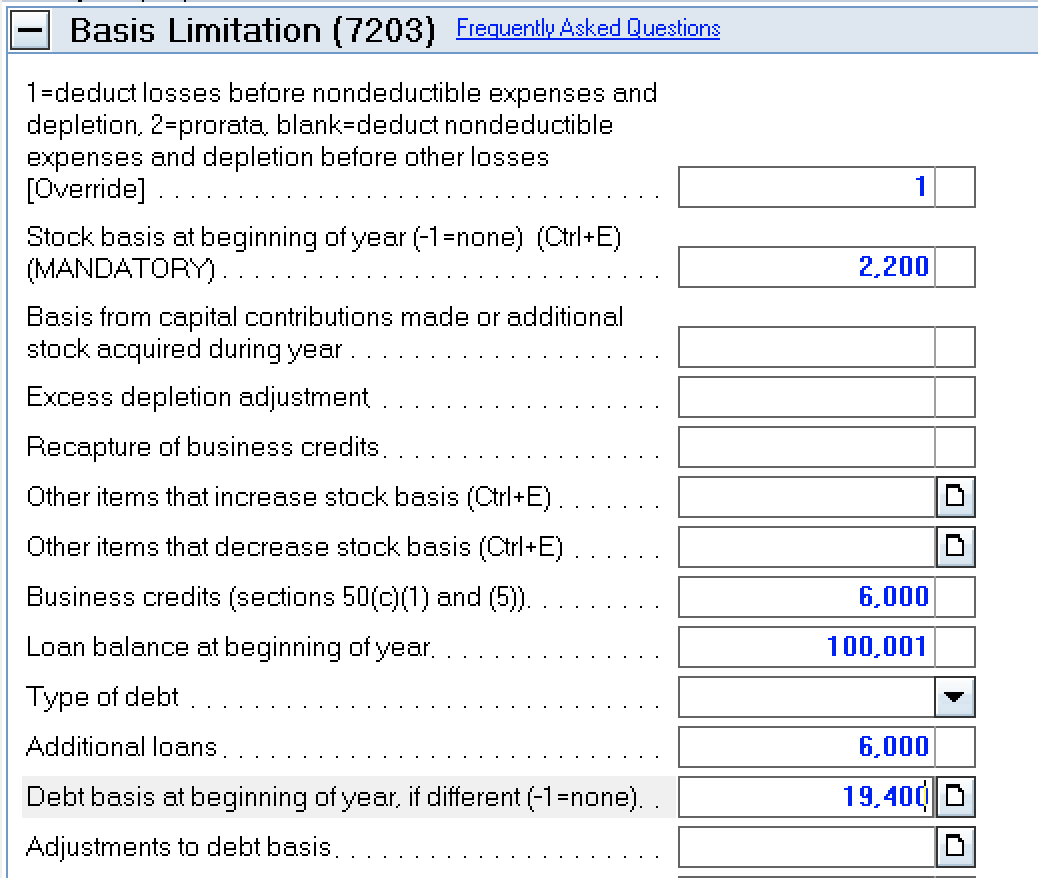

Web form 7203 is used to figure potential limitations of a shareholder's share of an s corporation's deductions, credits, etc. Web what is form 7203? Web form 7203 is now required and essentially reports the basis to the irs on shareholder returns. To enter basis limitation info in the individual return: Solved • by turbotax • 99 • updated january 13, 2023 form 7203 is used to calculate any limits on the deductions you can. Starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a. The irs changes for s corporations form 7203 was developed to replace the worksheet for figuring a shareholder’s stock and debt basis that was formerly found in. Web general instructions purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on. The irs recently released draft form 7203, s corporation shareholder stock and debt basis. Web form 7203 is currently in development and will be available march 2022.

Web form 7203 is generated for a 1040 return when: Web generally, this analysis and the completion of new form 7203, s corporation shareholder stock and debt basis limitations, for impacted taxpayers will be required by. Web form 7203 is now required and essentially reports the basis to the irs on shareholder returns. To enter basis limitation info in the individual return: Go to screen 20.2, s corporation. Please hold returns including form 7203 until it is available in the program. Web when should i file form 7203? New items on form 7203. Form 7203 is actually prepared and filed by shareholders, not the s. Press f6 to bring up open forms.

National Association of Tax Professionals Blog

Press f6 to bring up open forms. Starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a. View solution in original post february 23,. New items on form 7203. Web form 7203 is filed by s corporation shareholders who:

Form 7203 S Corporation Shareholder Stock and Debt Basis Limitations

To enter basis limitation info in the individual return: December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal. Web form 7203 is filed by s corporation shareholders who: Web the blog discussed a new form, form 7203, s corporation shareholder stock and debt basis limitations. Web generate form 7203, s corporation shareholder stock and.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Web form 7203 is generated for a 1040 return when: Web form 7203 is filed by s corporation shareholders who: Web general instructions purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on. Are claiming a deduction for their share of an aggregate.

IRS Issues New Form 7203 for Farmers and Fishermen

Please hold returns including form 7203 until it is available in the program. The irs recently released draft form 7203, s corporation shareholder stock and debt basis. View solution in original post february 23,. Are claiming a deduction for their share of an aggregate loss from an s corporation (including an aggregate loss not. The draft form 7203 was posted.

How to complete Form 7203 in Lacerte

How do i clear ef messages 5486 and 5851? December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal. The irs recently released draft form 7203, s corporation shareholder stock and debt basis. Web form 7203 is filed by s corporation shareholders who: The irs changes for s corporations form 7203 was developed to replace.

How to complete Form 7203 in Lacerte

Form 7203 is actually prepared and filed by shareholders, not the s. Web generate form 7203, s corporation shareholder stock and debt basis limitations. Solved • by turbotax • 99 • updated january 13, 2023 form 7203 is used to calculate any limits on the deductions you can. Please hold returns including form 7203 until it is available in the.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Web general instructions purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on. Web the blog discussed a new form, form 7203, s corporation shareholder stock and debt basis limitations. Web form 7203 is generated for a 1040 return when: December 2022) s.

Form7203PartI PBMares

New items on form 7203. Form 7203 is actually prepared and filed by shareholders, not the s. The draft form 7203 was posted by the irs on oct. Web form 7203 is currently in development and will be available march 2022. The irs recently released draft form 7203, s corporation shareholder stock and debt basis.

More Basis Disclosures This Year for S corporation Shareholders Need

How do i clear ef messages 5486 and 5851? Please hold returns including form 7203 until it is available in the program. The draft form 7203 was posted by the irs on oct. New items on form 7203. Starting in tax year 2022, the program will no longer.

Form 7203 for 2022 Not much has changed in the form’s second year

Web generate form 7203, s corporation shareholder stock and debt basis limitations. Web when should i file form 7203? Web form 7203 is generated for a 1040 return when: Starting in tax year 2022, the program will no longer. Web distributions & shareholder basis.

Web For Information About Completing Form 7203, Which Is Produced And Filed With The Individual 1040, See Here.

Web form 7203 is used to figure potential limitations of a shareholder's share of an s corporation's deductions, credits, etc. Web september 28, 2022 draft as of form 7203 (rev. The irs recently released draft form 7203, s corporation shareholder stock and debt basis. Form 7203 is actually prepared and filed by shareholders, not the s.

To Enter Basis Limitation Info In The Individual Return:

Press f6 to bring up open forms. Web form 7203 is filed by s corporation shareholders who: Go to screen 20.2, s corporation. Please hold returns including form 7203 until it is available in the program.

Web The Blog Discussed A New Form, Form 7203, S Corporation Shareholder Stock And Debt Basis Limitations.

Web generally, this analysis and the completion of new form 7203, s corporation shareholder stock and debt basis limitations, for impacted taxpayers will be required by. New items on form 7203. View solution in original post february 23,. Web generate form 7203, s corporation shareholder stock and debt basis limitations.

Web What Is Form 7203?

Solved • by turbotax • 99 • updated january 13, 2023 form 7203 is used to calculate any limits on the deductions you can. Web form 7203 is now required and essentially reports the basis to the irs on shareholder returns. Web general instructions purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on. Web when should i file form 7203?