Form 8804 Instructions 2021

Form 8804 Instructions 2021 - Web form 8804, annual return for partnership withholding tax (section 1446) specifically is used to report the total liability under section 1446 for the partnership’s tax. Easily fill out pdf blank, edit, and. Section 1445(a) or 1445(e) tax withheld from or paid by. Use form 8805 to show the. Use form 8805 to show. Penalty for underpayment of estimated section 1446 tax by partnerships online with us legal forms. This article will help you generate and file forms 8804, annual return for partnership. Web use form 8804 to report the total liability under section 1446 for the partnership's tax year. Web information about form 8804, annual return for partnership withholding tax (section 1446), including recent updates, related forms, and instructions on how to file. Web back to all comply would like to call your attention to a few updates that the irs published last week!

Web information about form 8804, annual return for partnership withholding tax (section 1446), including recent updates, related forms, and instructions on how to file. File form 8804 by the 15th day of the 3rd month (4th month for. Section 1445(a) or 1445(e) tax withheld from or paid by. Easily fill out pdf blank, edit, and. New instructions for form 2848, draft 2021 form 1099. Form 8804 and these instructions have been converted from an annual revision to continuous use. Web back to all comply would like to call your attention to a few updates that the irs published last week! This article will help you generate and file forms 8804, annual return for partnership. Use form 8805 to show the. Penalty for underpayment of estimated section 1446 tax by partnerships online with us legal forms.

Web form 8804, annual return for partnership withholding tax (section 1446) specifically is used to report the total liability under section 1446 for the partnership’s tax. Web complete 2021 schedule a (form 8804). Use form 8805 to show the. Web instructions for forms 8804, 8805 and 8813 2021 12/28/2021 inst 8804 (schedule a) instructions for schedule a (form 8804), penalty for underpayment of estimated. Form 8804 is also a transmittal form for form(s) 8805. Web use form 8804 to report the total liability under section 1446 for the partnership's tax year. Both the form and instructions. File form 8804 by the 15th day of the 3rd month (4th month for. Web a form 8805 for each foreign partner must be attached to form 8804, whether or not any withholding tax was paid. Penalty for underpayment of estimated section 1446 tax by partnerships online with us legal forms.

Form 8802 Instructions 2021 2022 IRS Forms Zrivo

Web form 8804, annual return for partnership withholding tax (section 1446) specifically is used to report the total liability under section 1446 for the partnership’s tax. Web back to all comply would like to call your attention to a few updates that the irs published last week! Web complete 2021 schedule a (form 8804). Both the form and instructions. Easily.

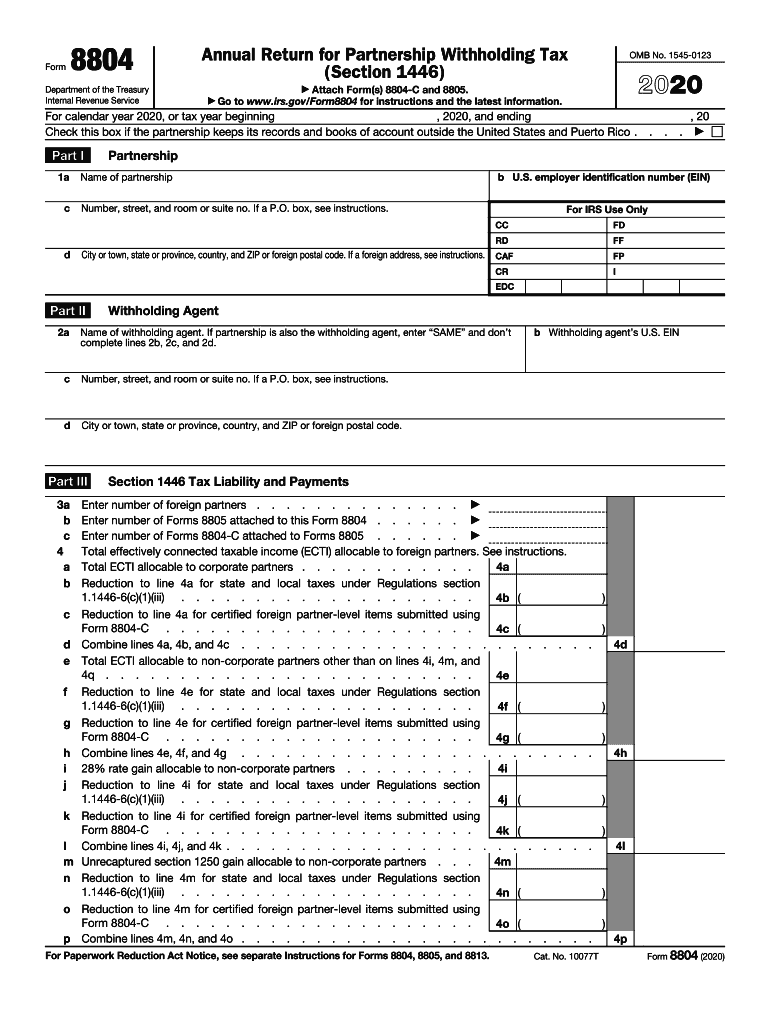

Form 8804 Annual Return for Partnership Withholding Tax (Section 1446

Section 1445(a) or 1445(e) tax withheld from or paid by. Use form 8805 to show the. Form 8804 is also a transmittal form for form(s) 8805. Easily fill out pdf blank, edit, and. Penalty for underpayment of estimated section 1446 tax by partnerships online with us legal forms.

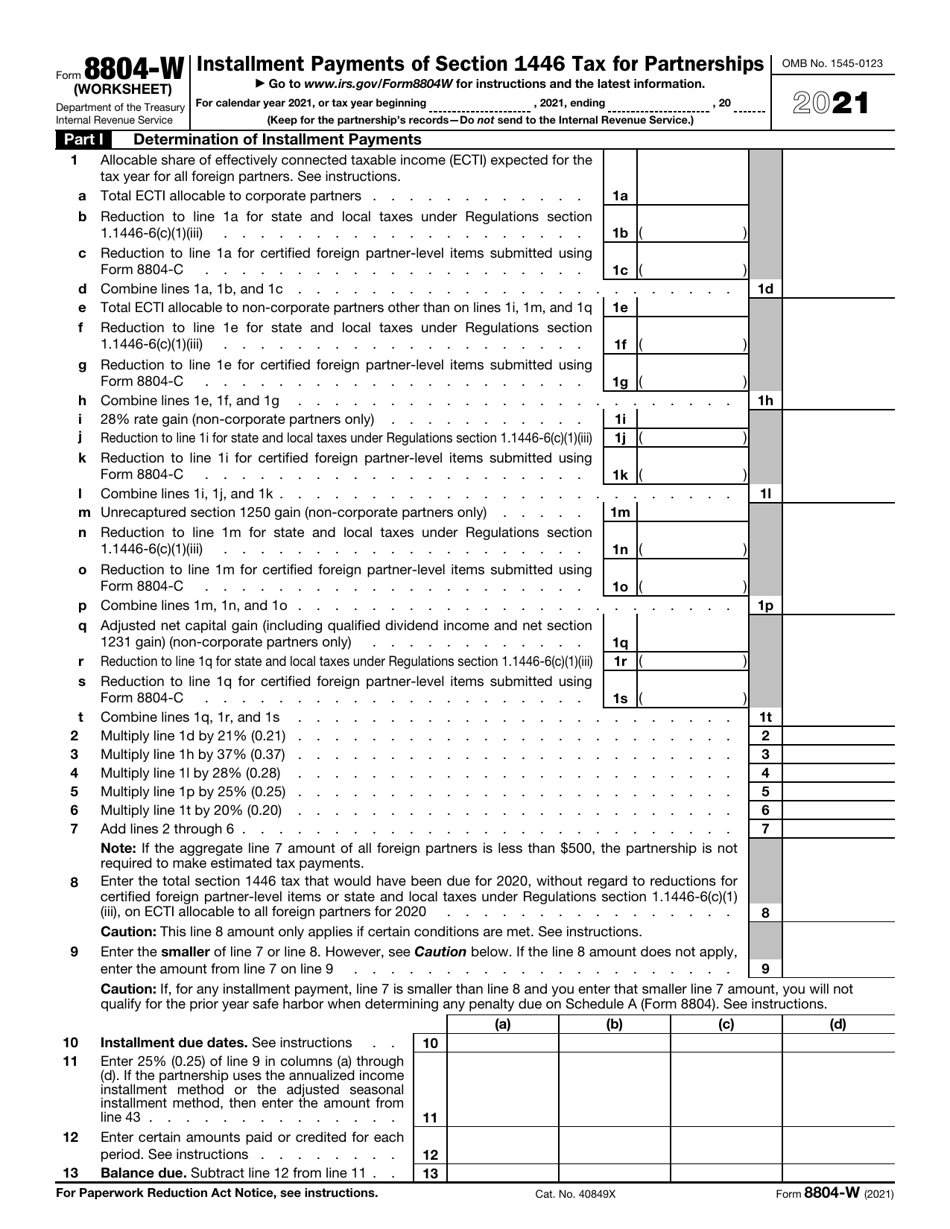

Fill Free fillable Installment Payments of Section 1446 Tax for

Form 8804 and these instructions have been converted from an annual revision to continuous use. Form 8804 is also a transmittal form for form(s) 8805. Web generating forms 8804 and 8805 for a partnership return in lacerte. Use form 8805 to show. New instructions for form 2848, draft 2021 form 1099.

Form 8804 PDF Internal Revenue Service Fill Out and Sign Printable

Use form 8805 to show. Section 1445(a) or 1445(e) tax withheld from or paid by. File form 8804 by the 15th day of the 3rd month (4th month for. Form 8804 and these instructions have been converted from an annual revision to continuous use. Web complete 2021 schedule a (form 8804).

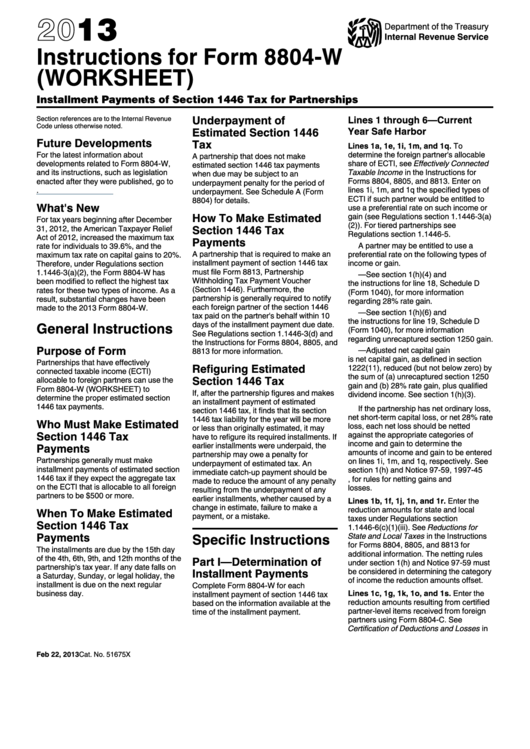

Instructions For Form 8804W (Worksheet) Installment Payments Of

Web back to all comply would like to call your attention to a few updates that the irs published last week! Web information about form 8804, annual return for partnership withholding tax (section 1446), including recent updates, related forms, and instructions on how to file. Web see the instructions for form 8804, lines 6b and 6c, in the instructions for.

Form 8804C Certificate of PartnerLevel Items to Reduce Section 1446

Easily fill out pdf blank, edit, and. Web form 8804, annual return for partnership withholding tax (section 1446) specifically is used to report the total liability under section 1446 for the partnership’s tax. Web complete 2021 schedule a (form 8804). Form 8804 is also a transmittal form for form(s) 8805. Use form 8805 to show the.

Form 8804 Annual Return for Partnership Withholding Tax (Section 1446

New instructions for form 2848, draft 2021 form 1099. Web instructions for forms 8804, 8805 and 8813 2021 12/28/2021 inst 8804 (schedule a) instructions for schedule a (form 8804), penalty for underpayment of estimated. Penalty for underpayment of estimated section 1446 tax by partnerships online with us legal forms. Easily fill out pdf blank, edit, and. Web complete 2021 schedule.

IRS Form 8804W Download Fillable PDF or Fill Online Installment

Use form 8805 to show. This article will help you generate and file forms 8804, annual return for partnership. Web a form 8805 for each foreign partner must be attached to form 8804, whether or not any withholding tax was paid. Web back to all comply would like to call your attention to a few updates that the irs published.

Form 8804 Annual Return for Partnership Withholding Tax

Web use form 8804 to report the total liability under section 1446 for the partnership's tax year. Web use form 8804 to report the total liability under section 1446 for the partnership's tax year. New instructions for form 2848, draft 2021 form 1099. Easily fill out pdf blank, edit, and. Web instructions for forms 8804, 8805 and 8813 2021 12/28/2021.

Form 8804 Schedule A Instructions Fill online, Printable, Fillable Blank

Use form 8805 to show. Web a form 8805 for each foreign partner must be attached to form 8804, whether or not any withholding tax was paid. Web use form 8804 to report the total liability under section 1446 for the partnership's tax year. Use form 8805 to show the. Penalty for underpayment of estimated section 1446 tax by partnerships.

Form 8804 And These Instructions Have Been Converted From An Annual Revision To Continuous Use.

Penalty for underpayment of estimated section 1446 tax by partnerships online with us legal forms. Web use form 8804 to report the total liability under section 1446 for the partnership's tax year. Web instructions for forms 8804, 8805 and 8813 2021 12/28/2021 inst 8804 (schedule a) instructions for schedule a (form 8804), penalty for underpayment of estimated. Web complete 2021 schedule a (form 8804).

Form 8804 Is Also A Transmittal Form For Form(S) 8805.

File form 8804 by the 15th day of the 3rd month (4th month for. This article will help you generate and file forms 8804, annual return for partnership. Form 8804 is also a transmittal form for form(s) 8805. Use form 8805 to show the.

Web Generating Forms 8804 And 8805 For A Partnership Return In Lacerte.

Easily fill out pdf blank, edit, and. Web see the instructions for form 8804, lines 6b and 6c, in the instructions for forms 8804, 8805, and 8813. Use form 8805 to show. Both the form and instructions.

Web Back To All Comply Would Like To Call Your Attention To A Few Updates That The Irs Published Last Week!

Web a form 8805 for each foreign partner must be attached to form 8804, whether or not any withholding tax was paid. Web information about form 8804, annual return for partnership withholding tax (section 1446), including recent updates, related forms, and instructions on how to file. Section 1445(a) or 1445(e) tax withheld from or paid by. New instructions for form 2848, draft 2021 form 1099.