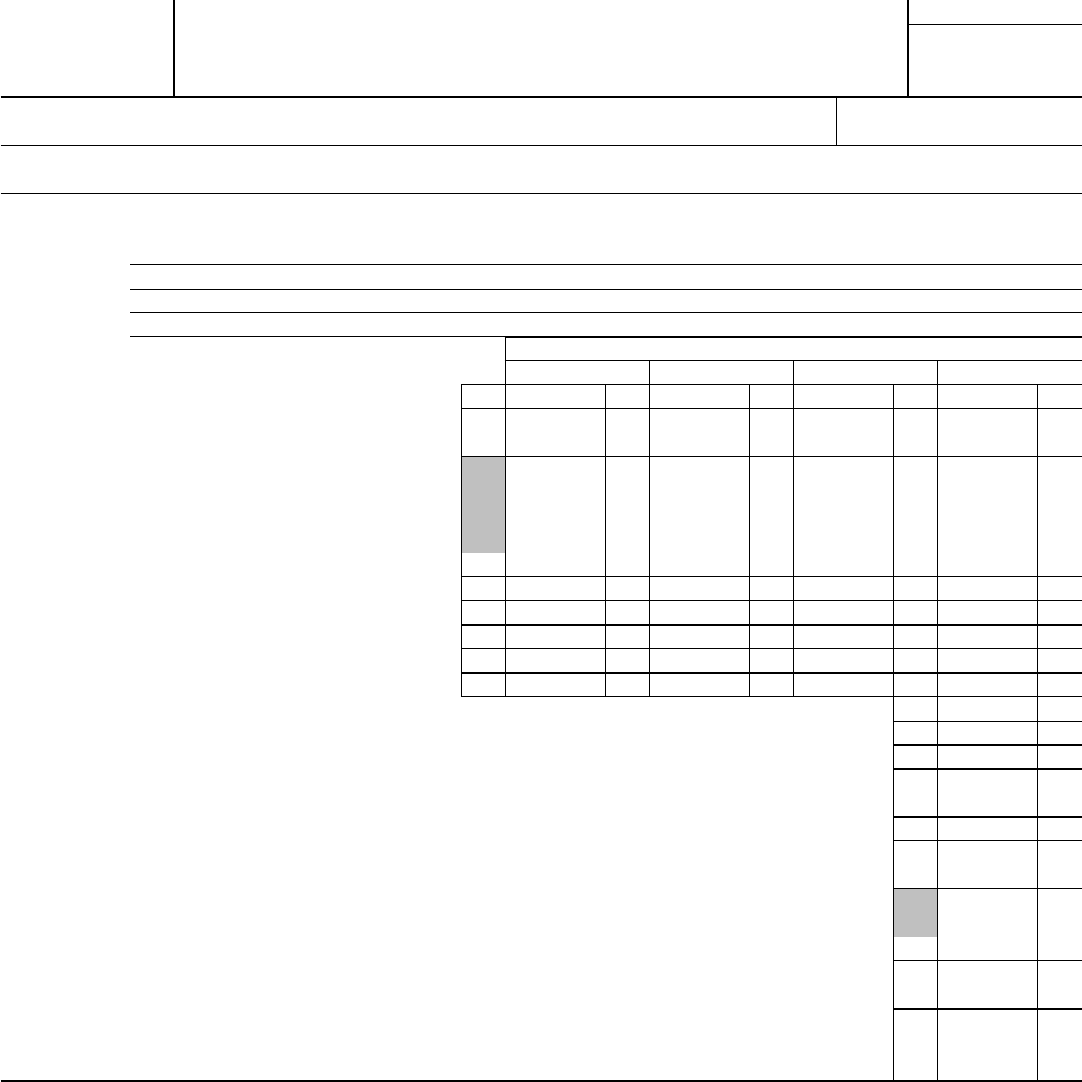

Form 6198 Irs

Form 6198 Irs - Web the internal revenue service (irs) lets taxpayers deduct cash spent on company expenses up to a specified amount. Web form 6198 is filed by individuals caution business of a qualified c! Web guide on how to write a form 6198. Real property (other than mineral (including filers of schedules c, e, and corporation. B increases since (check box that applies): Web if some of the money you invested isn’t at risk, use form 6198 to figure your allowable loss. Web form 6198 is only generated in the tax program when the taxpayer is reporting a loss and has indicated that not all of their investment in the business is at risk. 16 16 a effective date 17 b the end of your. We have no way of. Application for enrollment to practice before the internal revenue service.

Generally, any loss from an activity (such as a rental). You can download or print current or past. Web form 6198 is filed by individuals caution business of a qualified c! Do not enter the amount from line 10b of the 2007 form. Real property (other than mineral (including filers of schedules c, e, and corporation. Web the internal revenue service (irs) lets taxpayers deduct cash spent on company expenses up to a specified amount. Drafting irs form 6198 is a good skill to have so you can determine the maximum deductible amount after a loss in your invested business. 16 16 a effective date 17 b the end of your. Application for enrollment to practice before the internal revenue service. Web from 2007 form 6198, line 19b.

B increases since (check box that applies): Web form 6198 is filed by individuals caution business of a qualified c! If you completed part iii of form 6198. You can download or print current or past. Do not enter the amount from line 10b of the 2007 form. Drafting irs form 6198 is a good skill to have so you can determine the maximum deductible amount after a loss in your invested business. 16 16 a effective date 17 b the end of your. Application for enrollment to practice before the internal revenue service. Web guide on how to write a form 6198. Web if some of the money you invested isn’t at risk, use form 6198 to figure your allowable loss.

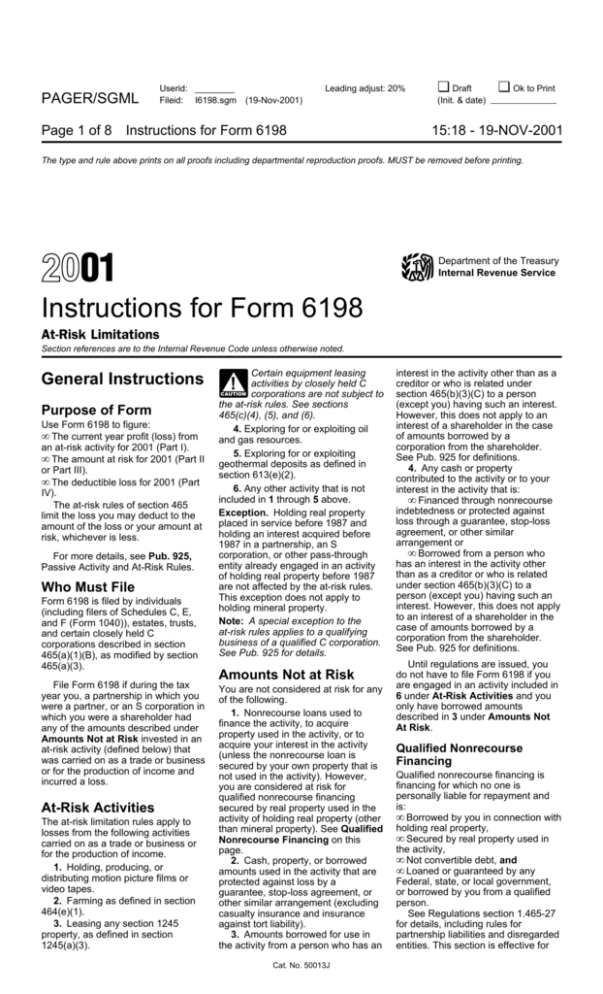

Instructions for Form 6198

16 16 a effective date 17 b the end of your. If you completed part iii of form 6198. We have no way of. Generally, any loss from an activity (such as a rental). Web the internal revenue service (irs) lets taxpayers deduct cash spent on company expenses up to a specified amount.

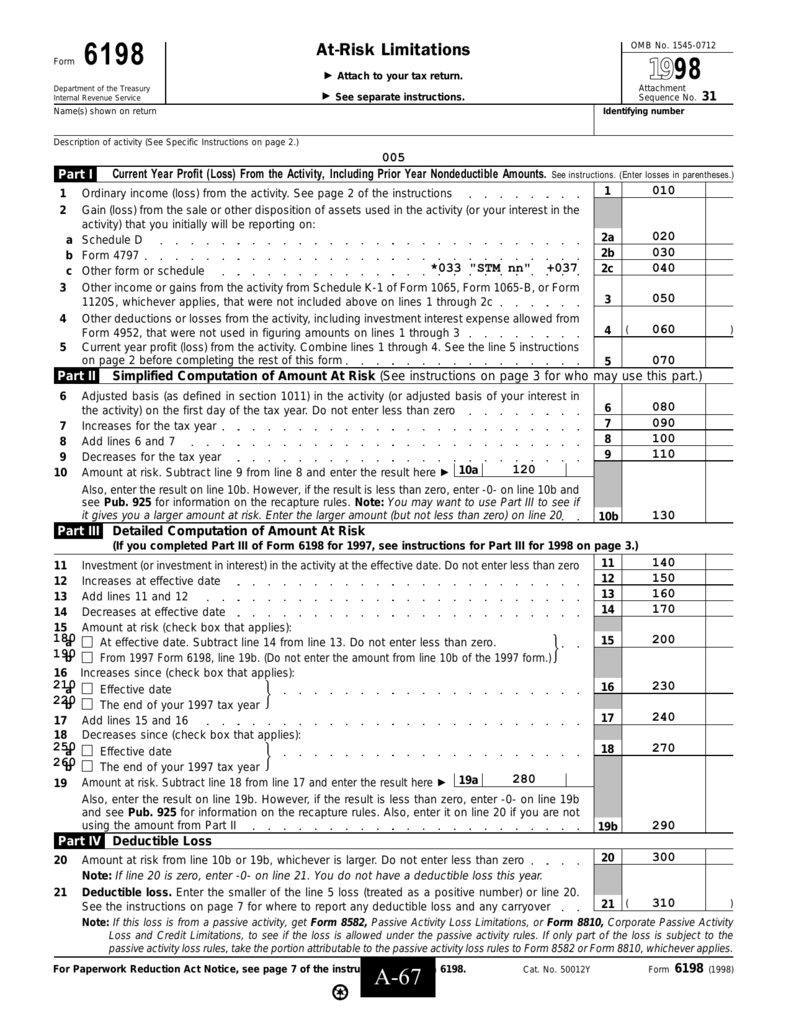

2007 Tax Form 6198 At

Web form 6198 is only generated in the tax program when the taxpayer is reporting a loss and has indicated that not all of their investment in the business is at risk. Form 6198 is used to determine the profit (or loss). Web from 2007 form 6198, line 19b. You can download or print current or past. Occupational tax and.

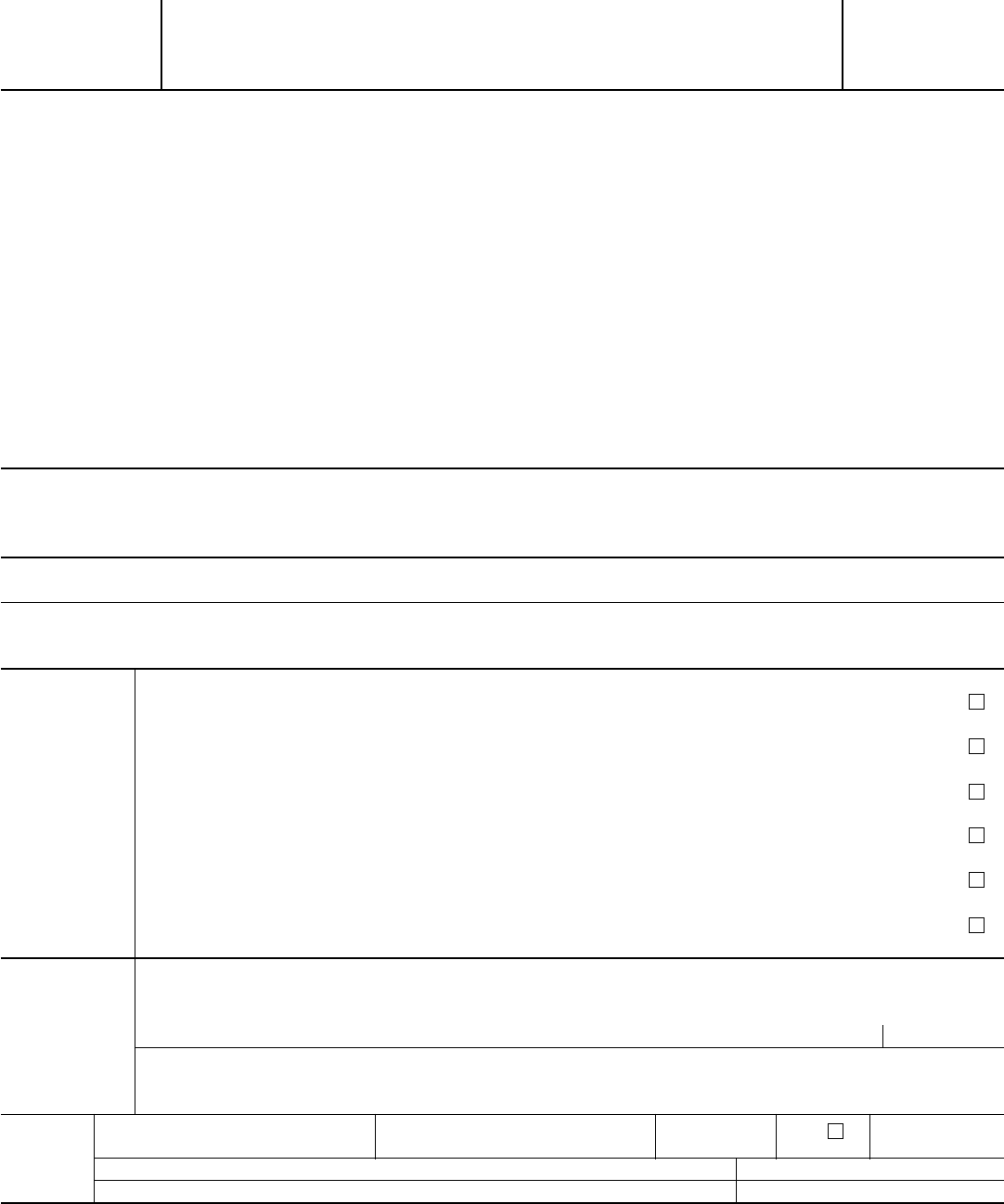

irs tax form 6198 on Tumblr

Web from 2007 form 6198, line 19b. Application for enrollment to practice before the internal revenue service. 16 16 a effective date 17 b the end of your. We have no way of. B increases since (check box that applies):

Form 6198 AtRisk Limitations (2009) Free Download

Occupational tax and registration return for wagering. Drafting irs form 6198 is a good skill to have so you can determine the maximum deductible amount after a loss in your invested business. Web form 6198 is only generated in the tax program when the taxpayer is reporting a loss and has indicated that not all of their investment in the.

Form 6198

Web form 6198 is filed by individuals caution business of a qualified c! Generally, any loss from an activity (such as a rental). Do not enter the amount from line 10b of the 2007 form. Application for enrollment to practice before the internal revenue service. Occupational tax and registration return for wagering.

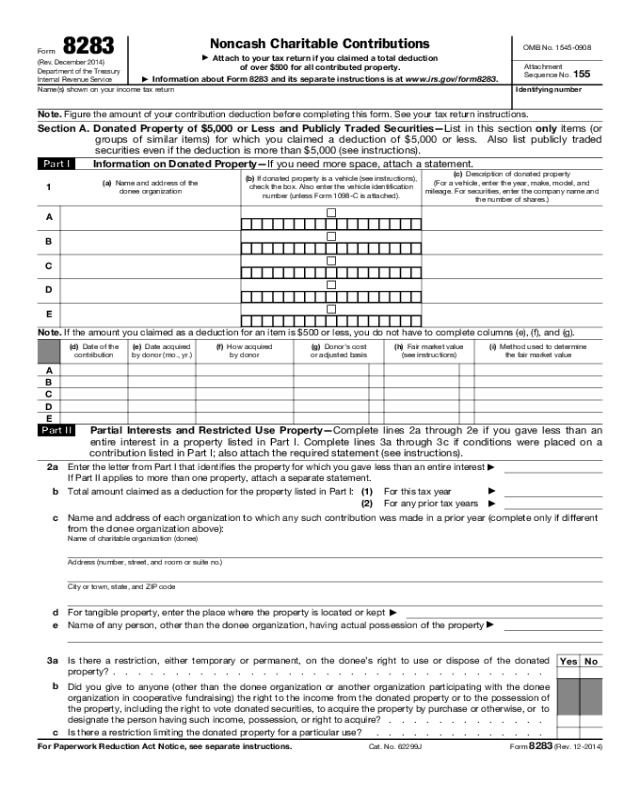

Form 13614C Edit, Fill, Sign Online Handypdf

Web if some of the money you invested isn’t at risk, use form 6198 to figure your allowable loss. Web the internal revenue service (irs) lets taxpayers deduct cash spent on company expenses up to a specified amount. Do not enter the amount from line 10b of the 2007 form. Drafting irs form 6198 is a good skill to have.

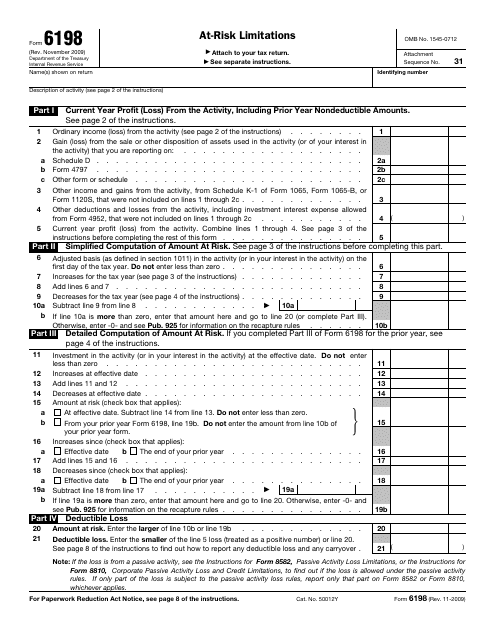

Form 8849 Edit, Fill, Sign Online Handypdf

Web form 6198 is filed by individuals caution business of a qualified c! 16 16 a effective date 17 b the end of your. Drafting irs form 6198 is a good skill to have so you can determine the maximum deductible amount after a loss in your invested business. Application for enrollment to practice before the internal revenue service. Web.

Form 4684 Edit, Fill, Sign Online Handypdf

To learn more, see publication 925: If you completed part iii of form 6198. Form 6198 is used to determine the profit (or loss). Application for enrollment to practice before the internal revenue service. Web from 2007 form 6198, line 19b.

2019 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

You can download or print current or past. Application for enrollment to practice before the internal revenue service. 16 16 a effective date 17 b the end of your. Drafting irs form 6198 is a good skill to have so you can determine the maximum deductible amount after a loss in your invested business. Real property (other than mineral (including.

IRS Form 6198 Download Fillable PDF or Fill Online AtRisk Limitations

B increases since (check box that applies): Web guide on how to write a form 6198. Web from 2007 form 6198, line 19b. Occupational tax and registration return for wagering. Web form 6198 is only generated in the tax program when the taxpayer is reporting a loss and has indicated that not all of their investment in the business is.

Do Not Enter The Amount From Line 10B Of The 2007 Form.

You can download or print current or past. 16 16 a effective date 17 b the end of your. Occupational tax and registration return for wagering. Web if some of the money you invested isn’t at risk, use form 6198 to figure your allowable loss.

If You Completed Part Iii Of Form 6198.

Web from 2007 form 6198, line 19b. Drafting irs form 6198 is a good skill to have so you can determine the maximum deductible amount after a loss in your invested business. Generally, any loss from an activity (such as a rental). Web form 6198 is only generated in the tax program when the taxpayer is reporting a loss and has indicated that not all of their investment in the business is at risk.

Web Form 6198 Is Filed By Individuals Caution Business Of A Qualified C!

Real property (other than mineral (including filers of schedules c, e, and corporation. Web guide on how to write a form 6198. We have no way of. B increases since (check box that applies):

To Learn More, See Publication 925:

Web the internal revenue service (irs) lets taxpayers deduct cash spent on company expenses up to a specified amount. Form 6198 is used to determine the profit (or loss). Application for enrollment to practice before the internal revenue service.