Fidelity Hardship Withdrawal Form

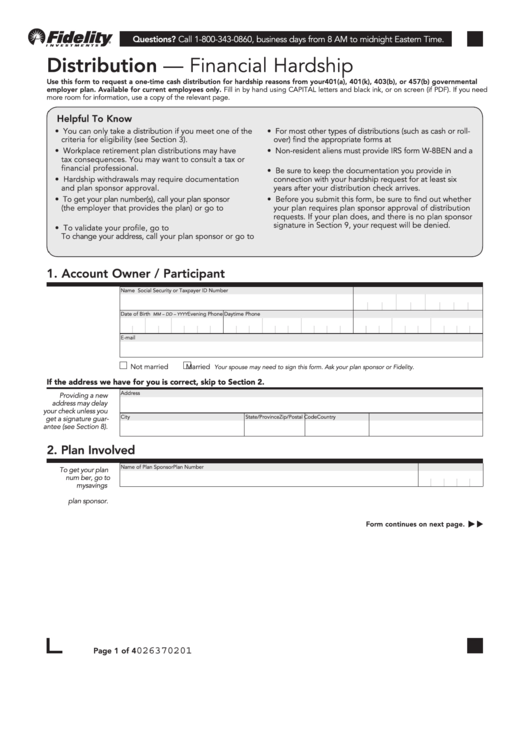

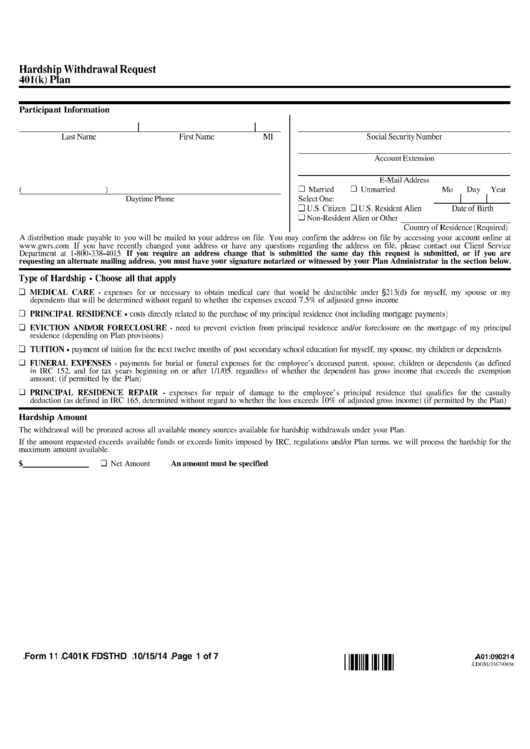

Fidelity Hardship Withdrawal Form - Web the maximum you can request to withdraw from your account online or by telephone is $100,000 per account. Unreimbursed medical expenses for you or your family; Uninsured medical expenses for yourself, your spouse, or your dependents. Payment of college tuition and related costs for family members; The purchase of a primary residence; Please use this form if you wish to request a distribution from your fidelity advisor 403(b) account. Payments necessary to prevent eviction or foreclosure; And certain expenses for the repair of. Purchase of your principal residence (excluding mortgage payments). A 401 (k) loan may be a better option than a traditional hardship withdrawal, if it's available.

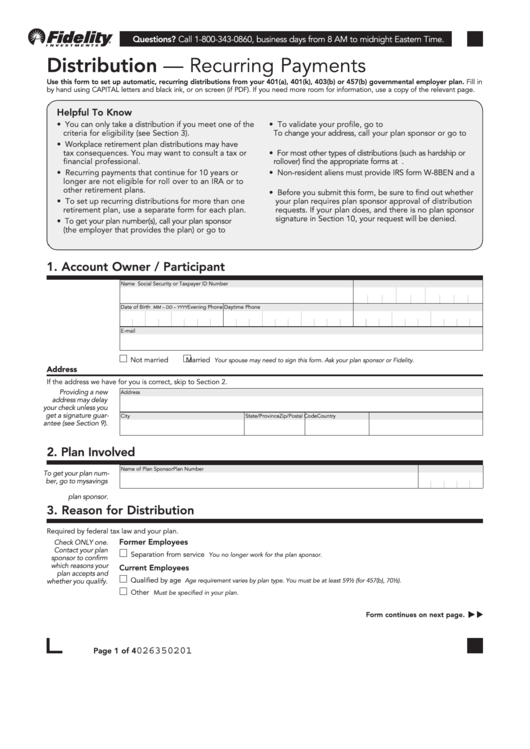

Please use this form if you wish to request a distribution from your fidelity advisor 403(b) account. Payments necessary to prevent eviction or foreclosure; Establish, change, or cancel an earnings automatic withdrawal plan for your nonretirement account. Web schedule automatic withdrawals from your fidelity accounts, including withdrawal plans for rmds and earnings. Here's how hardship withdrawals work and some ways to avoid penalties for using them. Web distribution request form fidelity advisor 403(b) distribution request form note: Web retirement accounts such as a 401(k) or an ira allow you to take hardship or early withdrawals from your account. Every employer's plan has different rules for 401 (k) withdrawals and loans, so find out what your plan allows. Web the maximum you can request to withdraw from your account online or by telephone is $100,000 per account. To get your plan number(s), log into your workplace retirement savings plan at www.netbenefits.com and under quick links, select summary 1.

Here's how hardship withdrawals work and some ways to avoid penalties for using them. Web the maximum you can request to withdraw from your account online or by telephone is $100,000 per account. Web schedule automatic withdrawals from your fidelity accounts, including withdrawal plans for rmds and earnings. Web the irs defines six areas of need that qualify for a hardship withdrawal: To request a withdrawal greater than $100,000, you must complete a paper form. Establish, change, or cancel an earnings automatic withdrawal plan for your nonretirement account. Web use the 401(k) plan application for hardship withdrawal—safe harbor if the requested withdrawal from your 401(k) shared savings plan account is for: Payment of college tuition and related costs for family members; Transfer assets to fidelity transfer investments or retirement plans currently held by another institution to fidelity. Purchase of your principal residence (excluding mortgage payments).

Top 6 Fidelity Forms And Templates free to download in PDF format

Automatic withdrawal nonretirement earnings plan. And certain expenses for the repair of. Web retirement accounts such as a 401(k) or an ira allow you to take hardship or early withdrawals from your account. Web the irs defines six areas of need that qualify for a hardship withdrawal: Your employer/plan sponsor or tpa must authorize this distribution request.

Top 6 Fidelity Forms And Templates free to download in PDF format

Web key takeaways explore all your options for getting cash before tapping your 401 (k) savings. Here's how hardship withdrawals work and some ways to avoid penalties for using them. Every employer's plan has different rules for 401 (k) withdrawals and loans, so find out what your plan allows. Payments necessary to prevent eviction or foreclosure; Web use the 401(k).

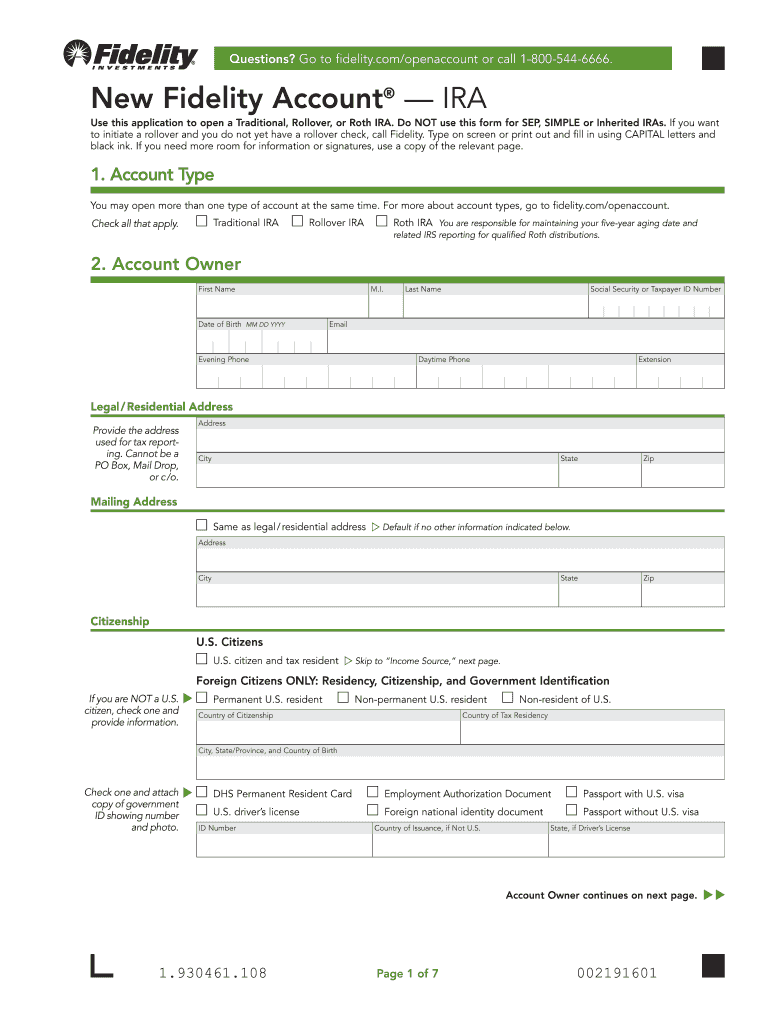

Fidelity Application Form Fill Online, Printable, Fillable, Blank

Web schedule automatic withdrawals from your fidelity accounts, including withdrawal plans for rmds and earnings. To request a withdrawal greater than $100,000, you must complete a paper form. Here's how hardship withdrawals work and some ways to avoid penalties for using them. Purchase of your principal residence (excluding mortgage payments). Every employer's plan has different rules for 401 (k) withdrawals.

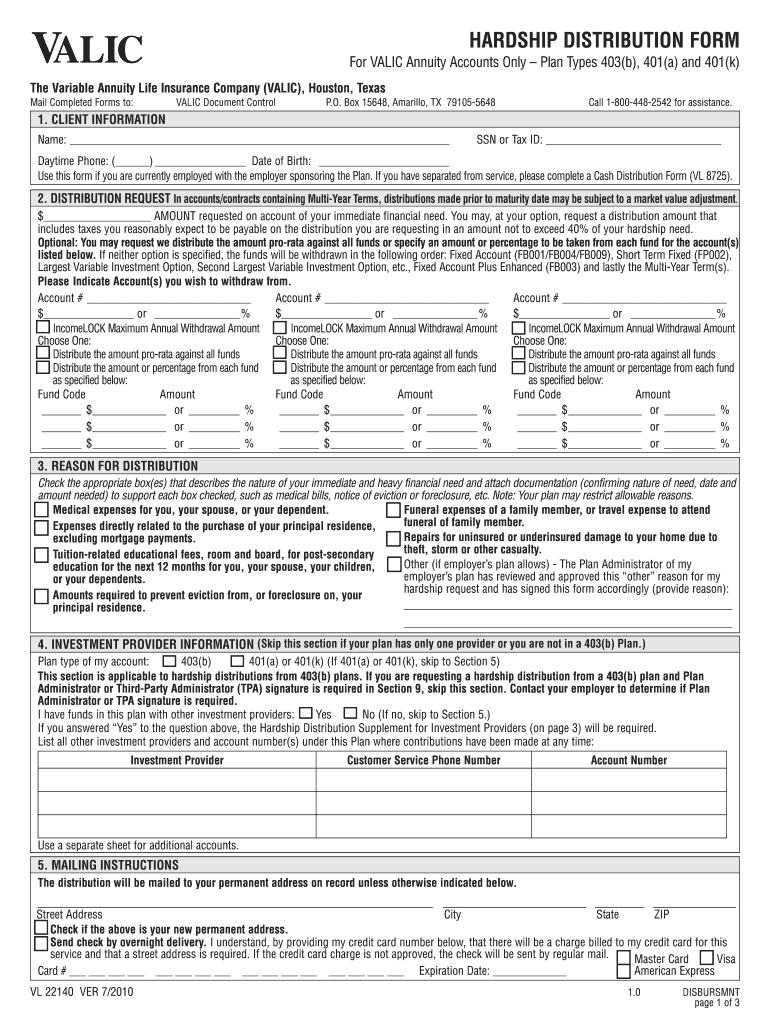

Valic Hardship Withdrawal Fill and Sign Printable Template Online

Payment of college tuition and related costs for family members; Here's how hardship withdrawals work and some ways to avoid penalties for using them. To request a withdrawal greater than $100,000, you must complete a paper form. Unreimbursed medical expenses for you or your family; Establish, change, or cancel an earnings automatic withdrawal plan for your nonretirement account.

Fidelity 401k Hardship Withdrawal Form Universal Network Free Nude

To get your plan number(s), log into your workplace retirement savings plan at www.netbenefits.com and under quick links, select summary 1. Payment of college tuition and related costs for family members; The purchase of a primary residence; Web key takeaways explore all your options for getting cash before tapping your 401 (k) savings. Unreimbursed medical expenses for you or your.

Hardship Withdrawals

Your employer/plan sponsor or tpa must authorize this distribution request. Web retirement accounts such as a 401(k) or an ira allow you to take hardship or early withdrawals from your account. Web the maximum you can request to withdraw from your account online or by telephone is $100,000 per account. Please use this form if you wish to request a.

Pentegra 401k Withdrawal Form Universal Network

Web distribution request form fidelity advisor 403(b) distribution request form note: Payments necessary to prevent eviction or foreclosure; Web schedule automatic withdrawals from your fidelity accounts, including withdrawal plans for rmds and earnings. To request a withdrawal greater than $100,000, you must complete a paper form. To get your plan number(s), log into your workplace retirement savings plan at www.netbenefits.com.

Metlife Hardship Withdrawal Form Fill Online, Printable, Fillable

Your employer/plan sponsor or tpa must authorize this distribution request. Transfer assets to fidelity transfer investments or retirement plans currently held by another institution to fidelity. Every employer's plan has different rules for 401 (k) withdrawals and loans, so find out what your plan allows. Payments necessary to prevent eviction or foreclosure; Web hardship withdrawals may require documentation and plan.

Form 11 Hardship Withdrawal Request 401(K) Plan printable pdf download

Transfer assets to fidelity transfer investments or retirement plans currently held by another institution to fidelity. Your employer/plan sponsor or tpa must authorize this distribution request. Web establish, change, or cancel an automatic rebalancing program for your fidelity personal retirement annuity ® and fidelity retirement reserves® annuity. Establish, change, or cancel an earnings automatic withdrawal plan for your nonretirement account..

Fidelity 401k Hardship Withdrawal Form Universal Network

Transfer assets to fidelity transfer investments or retirement plans currently held by another institution to fidelity. Payments necessary to prevent eviction or foreclosure; Purchase of your principal residence (excluding mortgage payments). Please use this form if you wish to request a distribution from your fidelity advisor 403(b) account. Web key takeaways explore all your options for getting cash before tapping.

Web Distribution Request Form Fidelity Advisor 403(B) Distribution Request Form Note:

Establish, change, or cancel an earnings automatic withdrawal plan for your nonretirement account. Payments necessary to prevent eviction or foreclosure; The purchase of a primary residence; Purchase of your principal residence (excluding mortgage payments).

Web Key Takeaways Explore All Your Options For Getting Cash Before Tapping Your 401 (K) Savings.

Transfer assets to fidelity transfer investments or retirement plans currently held by another institution to fidelity. Every employer's plan has different rules for 401 (k) withdrawals and loans, so find out what your plan allows. To request a withdrawal greater than $100,000, you must complete a paper form. Uninsured medical expenses for yourself, your spouse, or your dependents.

Web Hardship Withdrawals May Require Documentation And Plan Sponsor Approval.

Your employer/plan sponsor or tpa must authorize this distribution request. And certain expenses for the repair of. Web use the 401(k) plan application for hardship withdrawal—safe harbor if the requested withdrawal from your 401(k) shared savings plan account is for: Payment of college tuition and related costs for family members;

Web Retirement Accounts Such As A 401(K) Or An Ira Allow You To Take Hardship Or Early Withdrawals From Your Account.

To get your plan number(s), log into your workplace retirement savings plan at www.netbenefits.com and under quick links, select summary 1. Please use this form if you wish to request a distribution from your fidelity advisor 403(b) account. Web the maximum you can request to withdraw from your account online or by telephone is $100,000 per account. Here's how hardship withdrawals work and some ways to avoid penalties for using them.