Form 4972 Irs

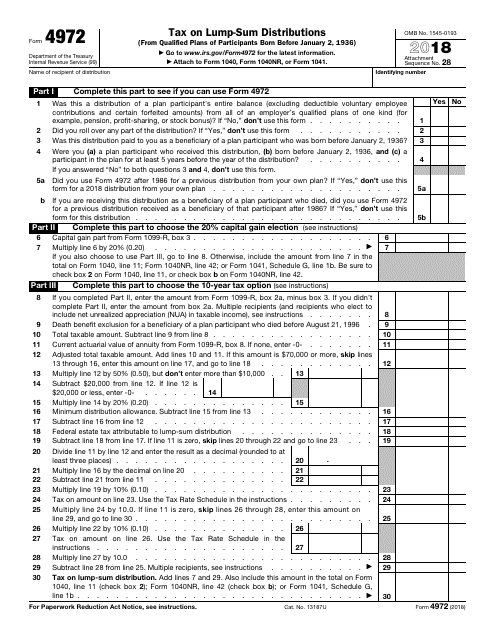

Form 4972 Irs - This form is usually required when:. In the case of any qualified employer plan, there is hereby imposed a tax equal to 10. Ad download or email irs 4972 & more fillable forms, register and subscribe now! The following choices are available. Use this form to figure the. Complete, edit or print tax forms instantly. You can download or print current. Use screen 1099r in the income folder to complete form 4972. Web you can use form 4972 if you received a qualifying distribution in 1992 and meet the age requirement. Ad download or email irs 4972 & more fillable forms, register and subscribe now!

Web form 4972 to figure the tax on that income. The following choices are available. To see if you qualify, you must first determine if your distribution is a qualified lump sum. It allows beneficiaries to receive their entire benefit in. Web you can use form 4972 if you received a qualifying distribution in 1992 and meet the age requirement. To claim these benefits, you must file irs. In the case of any qualified employer plan, there is hereby imposed a tax equal to 10. Web how to complete form 4972 in lacerte. Web form 4972 and its instructions, such as legislation enacted after they were published, go to. Complete, edit or print tax forms instantly.

General instructions purpose of form. Web what is irs form 4972: Web form 4972 and its instructions, such as legislation enacted after they were published, go to. Form 4972 is an irs form with stipulated terms and conditions that is filled out to reduce the taxes that may be incurred. It allows beneficiaries to receive their entire benefit in. Web how to complete form 4972 in lacerte. Ad download or email irs 4972 & more fillable forms, register and subscribe now! This form is usually required when:. Use distribution code a and answer all. In the case of any qualified employer plan, there is hereby imposed a tax equal to 10.

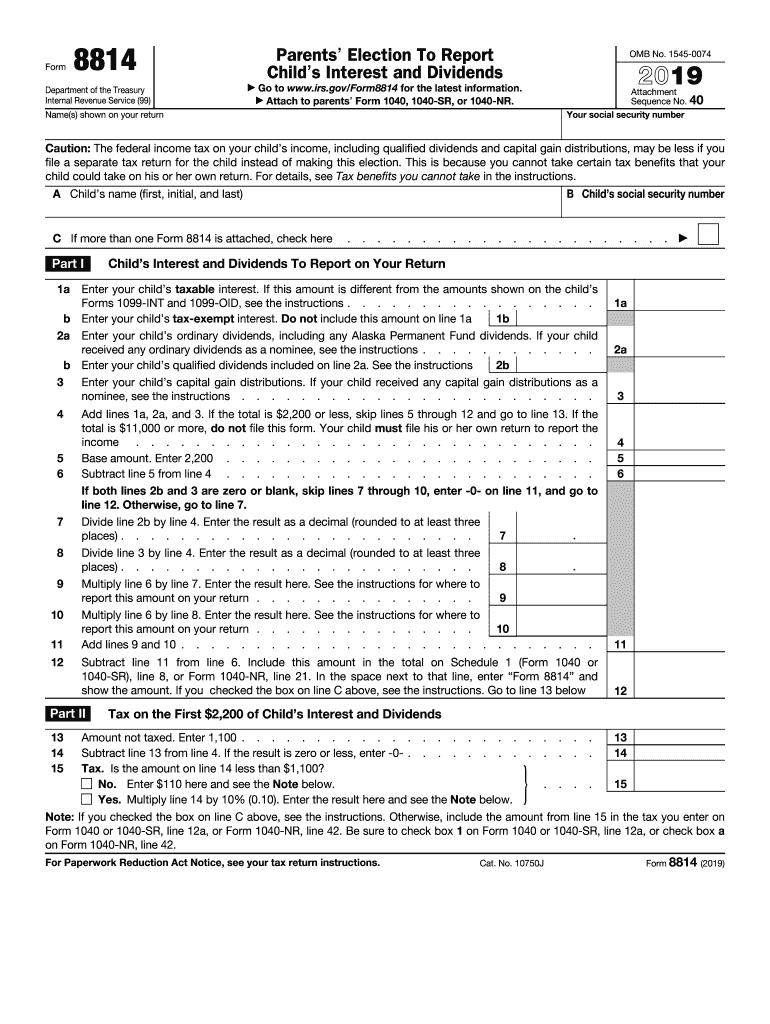

8814 Fill Out and Sign Printable PDF Template signNow

Ad download or email irs 4972 & more fillable forms, register and subscribe now! Use screen 1099r in the income folder to complete form 4972. Ad download or email irs 4972 & more fillable forms, register and subscribe now! To claim these benefits, you must file irs. Form 4972 is an irs form with stipulated terms and conditions that is.

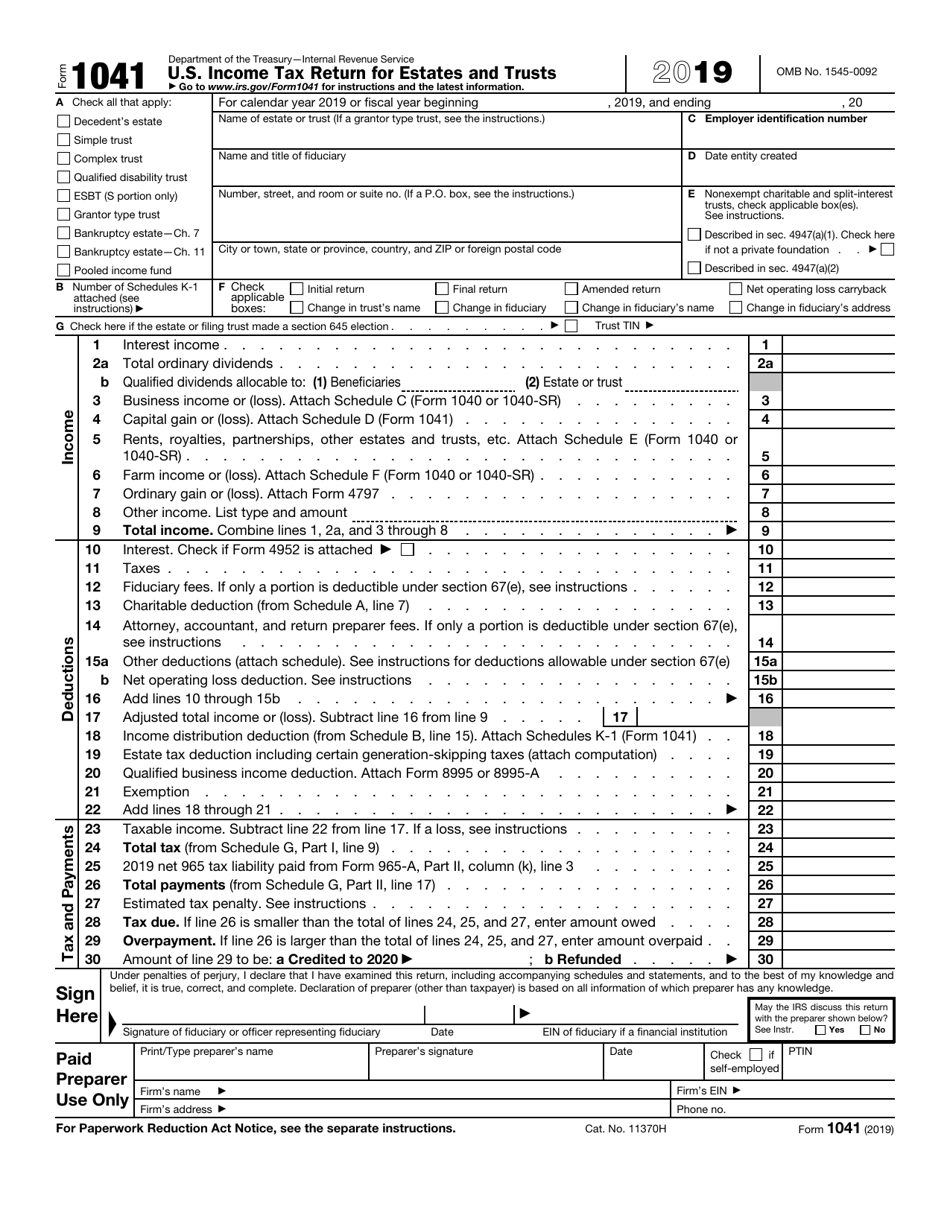

IRS Form 1041 Download Fillable PDF or Fill Online U.S. Tax

You can download or print current. It allows beneficiaries to receive their entire benefit in. Also, you must meet the conditions explained on page 2 under how often. To claim these benefits, you must file irs. Complete, edit or print tax forms instantly.

Form 4972 Tax on LumpSum Distributions (2015) Free Download

Ad download or email irs 4972 & more fillable forms, register and subscribe now! General instructions purpose of form. Form 4972 is an irs form with stipulated terms and conditions that is filled out to reduce the taxes that may be incurred. Web how to complete form 4972 in lacerte. To see if you qualify, you must first determine if.

Form 4972 Tax on LumpSum Distributions (2015) Free Download

Web how to complete form 4972 in lacerte. Complete, edit or print tax forms instantly. In the case of any qualified employer plan, there is hereby imposed a tax equal to 10. This form is usually required when:. Web form 4972 to figure the tax on that income.

revenue.ne.gov tax current f_1040n

Web you can use form 4972 if you received a qualifying distribution in 1992 and meet the age requirement. To claim these benefits, you must file irs. Web what is irs form 4972: The following choices are available. Web form 4972 and its instructions, such as legislation enacted after they were published, go to.

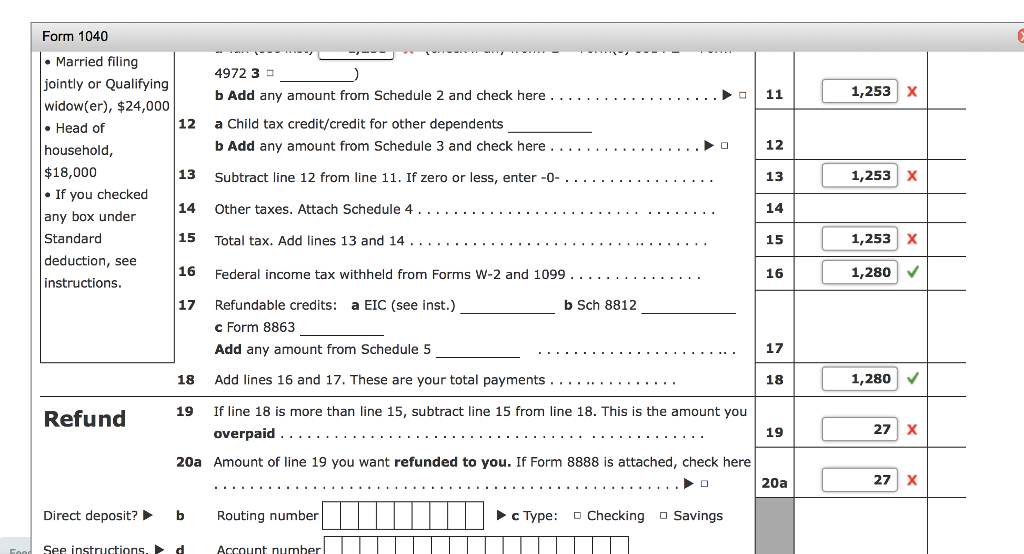

Solved Form 1040 Complete Patty's Form 1040 Form Department

In the case of any qualified employer plan, there is hereby imposed a tax equal to 10. Use distribution code a and answer all. To claim these benefits, you must file irs. Ad download or email irs 4972 & more fillable forms, register and subscribe now! Use screen 1099r in the income folder to complete form 4972.

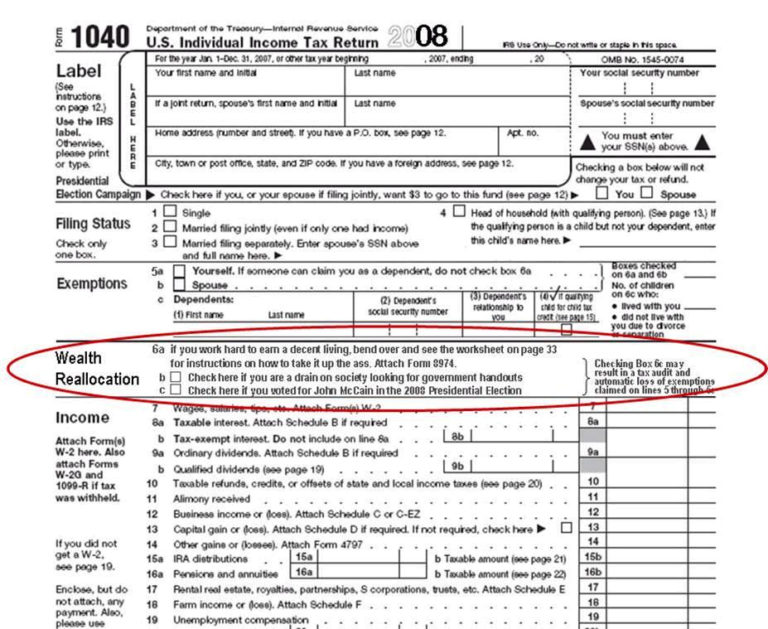

Obama S IRS Unveils New 1040 Tax Form International Liberty 2021 Tax

You can download or print current. Web you can use form 4972 if you received a qualifying distribution in 1992 and meet the age requirement. The following choices are available. Web what is irs form 4972: This form is usually required when:.

IRS Form 4972A Guide to Tax on LumpSum Distributions

Web how to complete form 4972 in lacerte. The following choices are available. General instructions purpose of form. In the case of any qualified employer plan, there is hereby imposed a tax equal to 10. Use screen 1099r in the income folder to complete form 4972.

Irs form 8814 instructions

Ad download or email irs 4972 & more fillable forms, register and subscribe now! Ad download or email irs 4972 & more fillable forms, register and subscribe now! Also, you must meet the conditions explained on page 2 under how often. Web form 4972 to figure the tax on that income. Complete, edit or print tax forms instantly.

IRS Form 4972 Download Fillable PDF or Fill Online Tax on LumpSum

This form is usually required when:. To see if you qualify, you must first determine if your distribution is a qualified lump sum. Use screen 1099r in the income folder to complete form 4972. Form 4972 is an irs form with stipulated terms and conditions that is filled out to reduce the taxes that may be incurred. The following choices.

Complete, Edit Or Print Tax Forms Instantly.

Web you can use form 4972 if you received a qualifying distribution in 1992 and meet the age requirement. Complete, edit or print tax forms instantly. Use screen 1099r in the income folder to complete form 4972. General instructions purpose of form.

Web The Purpose Of Form 4972 And Instructions To Fill It.

The following choices are available. Web form 4972 to figure the tax on that income. Ad download or email irs 4972 & more fillable forms, register and subscribe now! Also, you must meet the conditions explained on page 2 under how often.

To Claim These Benefits, You Must File Irs.

Use distribution code a and answer all. To see if you qualify, you must first determine if your distribution is a qualified lump sum. Web how to complete form 4972 in lacerte. Form 4972 is an irs form with stipulated terms and conditions that is filled out to reduce the taxes that may be incurred.

In The Case Of Any Qualified Employer Plan, There Is Hereby Imposed A Tax Equal To 10.

Web form 4972 and its instructions, such as legislation enacted after they were published, go to. Ad download or email irs 4972 & more fillable forms, register and subscribe now! This form is usually required when:. Use this form to figure the.