Form 4868 Line 5

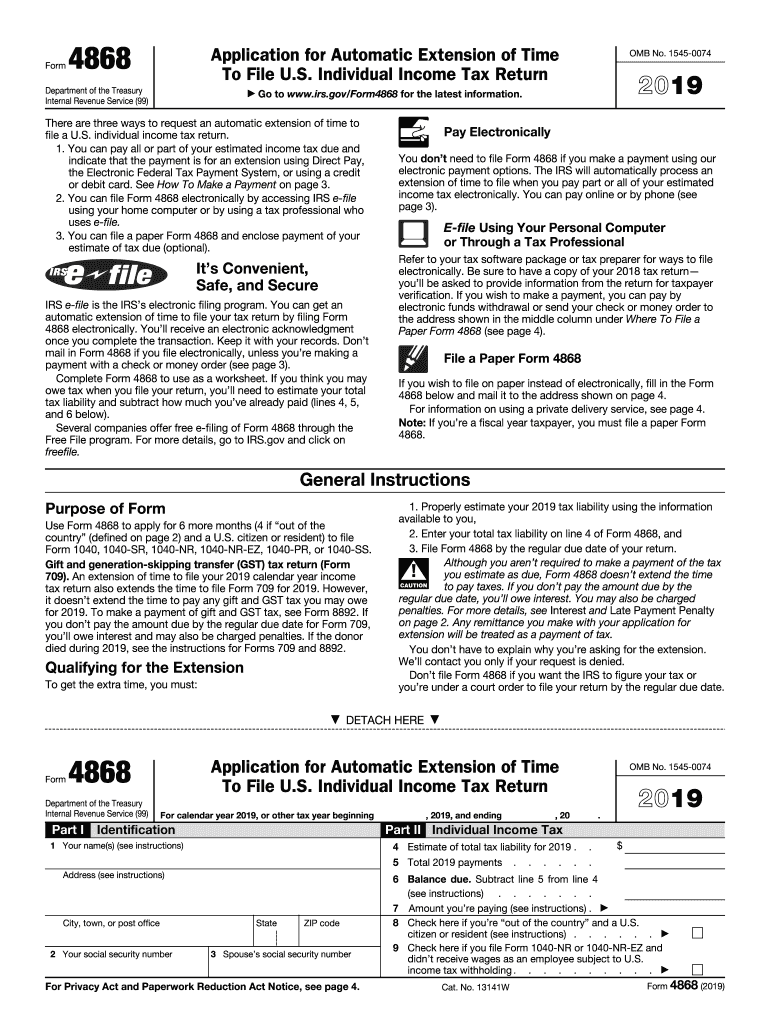

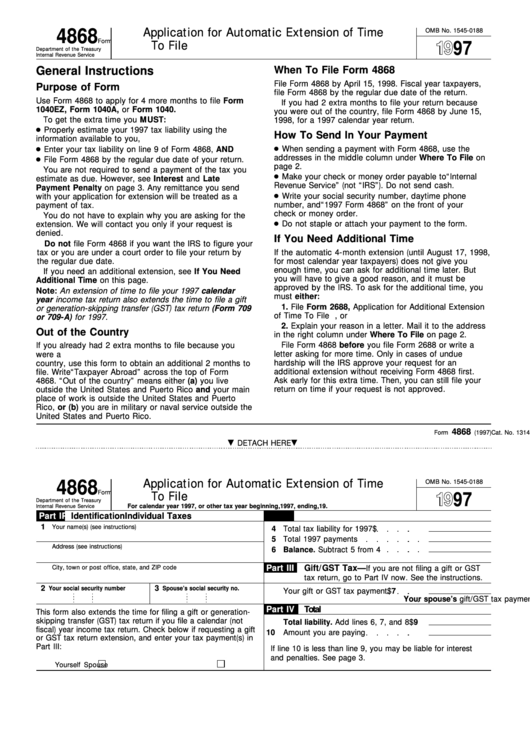

Form 4868 Line 5 - Enter your total tax liability on line 4 of form. Web when filing an federal extension 4868, do i include the fica and social security in the total 20xx line 5 payments or only fed withheld from the w2?. If line 5 is more than line 4 then you do not owe anything. Web line 5—estimate of total payments for the year enter the total payments that you expect to report on your income tax return. Web we last updated the application for automatic extension of time to file u.s. Web general instructions purpose of form use form 4868 to apply for 6 more months (4 if “out of the country” (defined later under taxpayers who are out of the country) and a u.s. Options to pay taxes due. Web irs form 4868, application for automatic extension of time to file. Individual income tax return in december 2022, so this is the latest version of form 4868, fully. If you don’t have any tax liability, enter “0” in line 4 on your 4868 extension form.

Current revision form 4868 pdf recent. Web for some of you, it may be your first time filing for an extension and you are barely getting the 4868 tax extension form filled out properly. The tp files form 4868 on february 1, 2021 to extend the due date for filing his 2020 federal income tax. Individual income tax return in december 2022, so this is the latest version of form 4868, fully. Web subtract line 5 from line 4 (see instructions) 5 6 detach here application for automatic extension of time omb no. This amount will appear on your tax form 1040,. If you don’t have any tax liability, enter “0” in line 4 on your 4868 extension form. Mail in the paper irs form 4868. Individual income tax return,” is a form that taxpayers can file with the irs if. Enter your total tax liability on line 4 of form.

You have two options to submit your irs form 4868. This amount will appear on your tax form 1040,. Web paper file form 4868 my extension was rejected for the wrong agi for state tax extensions, see how do i file an extension for my personal state taxes? Web line 5—estimate of total payments for the year enter the total payments that you expect to report on your income tax return. Citizen or resident files this form to request an automatic extension of time to file a u.s. Get your extension approved or money back*. Web when filing an federal extension 4868, do i include the fica and social security in the total 20xx line 5 payments or only fed withheld from the w2?. Web form 4868, also known as an “application for automatic extension of time to file u.s. Individual income tax return in december 2022, so this is the latest version of form 4868, fully. Web two forms 4868 on the correct line of your joint return.

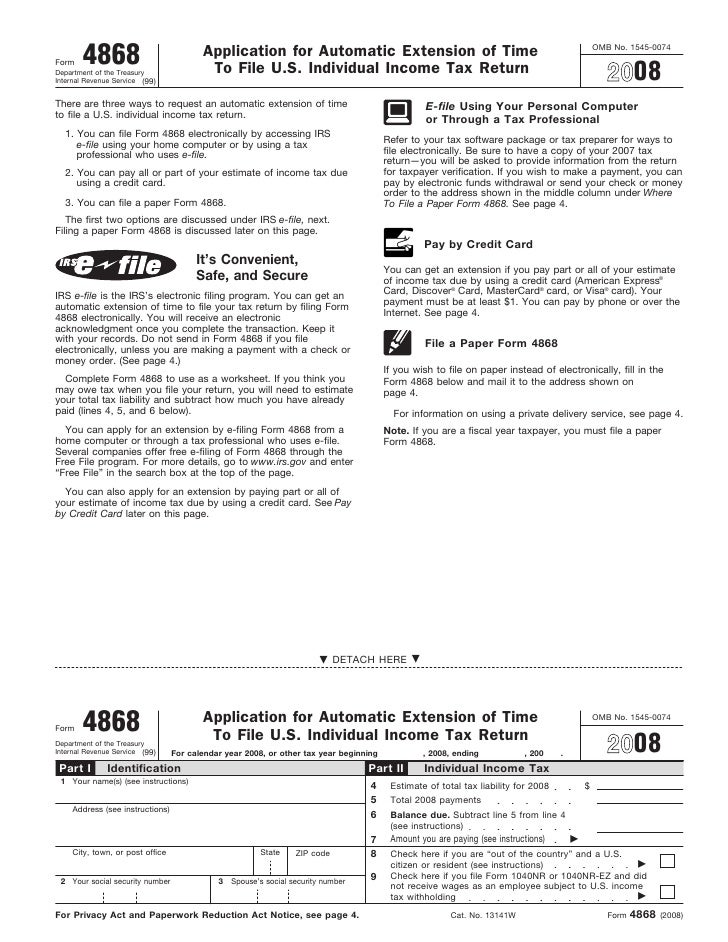

Form 4868 Application for Automatic Extension of Time to File U.S

Web when filing an federal extension 4868, do i include the fica and social security in the total 20xx line 5 payments or only fed withheld from the w2?. Mail in the paper irs form 4868. Web two forms 4868 on the correct line of your joint return. Get your extension approved or money back*. Web for some of you,.

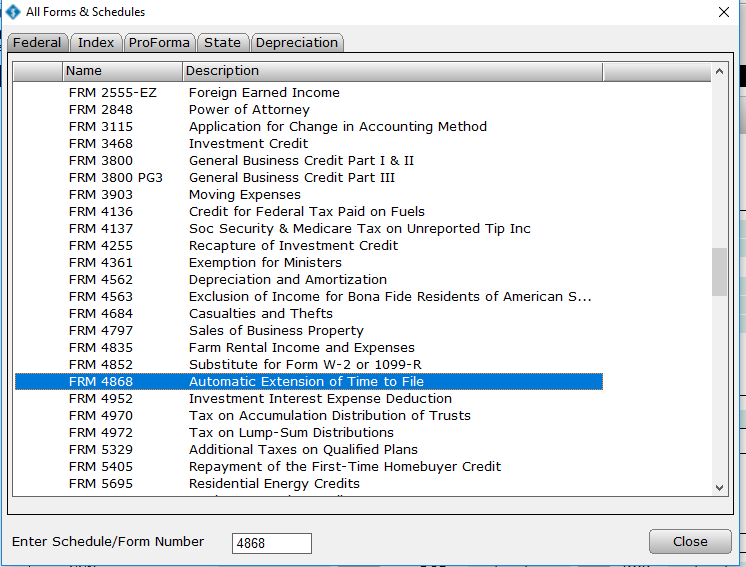

How to create and electronically file Form 4868 SimpleTAX Support

Current revision form 4868 pdf recent. Web paper file form 4868 my extension was rejected for the wrong agi for state tax extensions, see how do i file an extension for my personal state taxes? Web when filing an federal extension 4868, do i include the fica and social security in the total 20xx line 5 payments or only fed.

Form 4868Application for Automatic Extension of Time

Individual income tax return,” is a form that taxpayers can file with the irs if. Web irs form 4868, application for automatic extension of time to file. Mail in the paper irs form 4868. Web for some of you, it may be your first time filing for an extension and you are barely getting the 4868 tax extension form filled.

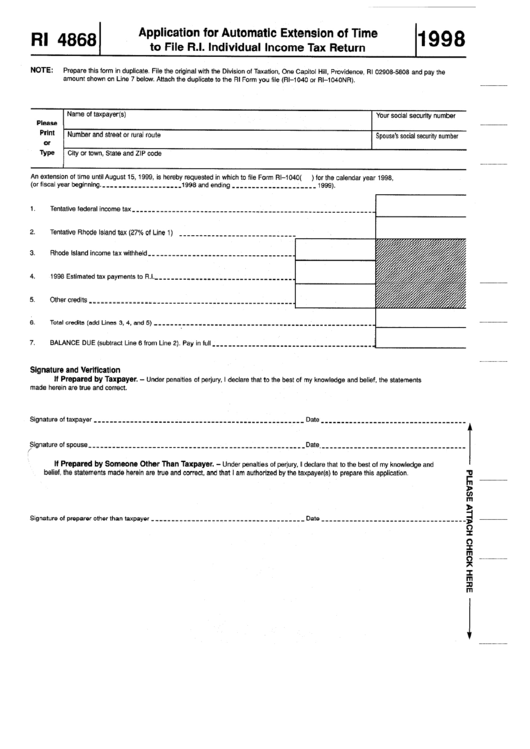

Fillable Form Ri 4868 Application For Automatic Extension Of Time To

Options to pay taxes due. Web for some of you, it may be your first time filing for an extension and you are barely getting the 4868 tax extension form filled out properly. Web two forms 4868 on the correct line of your joint return. Web when filing an federal extension 4868, do i include the fica and social security.

E File Tax Form 4868 Online Universal Network

You have two options to submit your irs form 4868. The tp files form 4868 on february 1, 2021 to extend the due date for filing his 2020 federal income tax. Individual income tax return,” is a form that taxpayers can file with the irs if. Web paper file form 4868 my extension was rejected for the wrong agi for.

File IRS Form 4868 Online EFile IRS 4868 for 2021 Tax Year

Enter your total tax liability on line 4 of form. The tp files form 4868 on february 1, 2021 to extend the due date for filing his 2020 federal income tax. Web when filing an federal extension 4868, do i include the fica and social security in the total 20xx line 5 payments or only fed withheld from the w2?..

How to file form 4868 IRS Extension YouTube

Web general instructions purpose of form use form 4868 to apply for 6 more months (4 if “out of the country” (defined later under taxpayers who are out of the country) and a u.s. Web business accounting accounting questions and answers 7. Web when filing an federal extension 4868, do i include the fica and social security in the total.

Form 4868 Application for Automatic Extension of Time to File U.S

If you don’t have any tax liability, enter “0” in line 4 on your 4868 extension form. You do not have to explain why you are. Web form 4868, also known as an “application for automatic extension of time to file u.s. Web we last updated the application for automatic extension of time to file u.s. Web subtract line 5.

2019 Form IRS 4868 Fill Online, Printable, Fillable, Blank pdfFiller

Current revision form 4868 pdf recent. Enter your total tax liability on line 4 of form. Mail in the paper irs form 4868. Web general instructions purpose of form use form 4868 to apply for 6 more months (4 if “out of the country” (defined later under taxpayers who are out of the country) and a u.s. Citizen or resident.

Fillable Form 4868 Application For Automatic Extension Of Time To

Web line 5—estimate of total payments for the year enter the total payments that you expect to report on your income tax return. Web irs form 4868, application for automatic extension of time to file. Web when filing an federal extension 4868, do i include the fica and social security in the total 20xx line 5 payments or only fed.

*File From Any Device And Get Up To 6 Months Extension.

If you don’t have any tax liability, enter “0” in line 4 on your 4868 extension form. Enter your total tax liability on line 4 of form. Purpose use form 4868 to ask for 4 more months to file form 1040a or form 1040. Web we last updated the application for automatic extension of time to file u.s.

Individual Income Tax Return,” Is A Form That Taxpayers Can File With The Irs If.

Get your extension approved or money back*. Web general instructions purpose of form use form 4868 to apply for 6 more months (4 if “out of the country” (defined later under taxpayers who are out of the country) and a u.s. Web general instructions purpose of form use form 4868 to apply for 6 more months (4 if “out of the country” (defined on page 2) and a u.s. Web irs form 4868, application for automatic extension of time to file.

Web Business Accounting Accounting Questions And Answers 7.

This amount will appear on your tax form 1040,. Citizen or resident) to file form 1040,. Citizen or resident files this form to request an automatic extension of time to file a u.s. The tp files form 4868 on february 1, 2021 to extend the due date for filing his 2020 federal income tax.

Mail In The Paper Irs Form 4868.

Individual income tax return in december 2022, so this is the latest version of form 4868, fully. Web when filing an federal extension 4868, do i include the fica and social security in the total 20xx line 5 payments or only fed withheld from the w2?. Web for some of you, it may be your first time filing for an extension and you are barely getting the 4868 tax extension form filled out properly. If line 5 is more than line 4 then you do not owe anything.