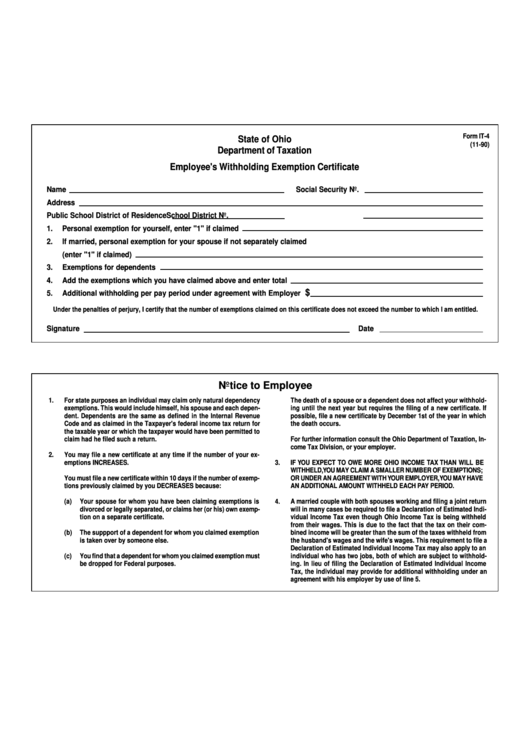

Ohio Withholding Tax Form

Ohio Withholding Tax Form - Web if your employer did not withhold the local tax at the rates shown, you are required to file a cincinnati tax return. Web download or print the 2022 ohio (employee's withholding exemption certificate) (2022) and other income tax forms from the ohio department of taxation. Web get access to the ohio tax withholding forms in order to determine how much income tax should be withheld from employee's salary. The ohio department of taxation provides a searchable repository of individual tax. Web we last updated the employee's withholding exemption certificate in february 2023, so this is the latest version of form it 4, fully updated for tax year 2022. Snohomish county tax preparer pleads guilty to assisting in the. Access the forms you need to file taxes or do business in ohio. If your income will be $200,000 or less ($400,000 or less if. Web you should make estimated payments if your estimated ohio tax liability (total tax minus total credits) less ohio withholding is more than $500. Welcome to the individual income tax forms archive.

Web you should make estimated payments if your estimated ohio tax liability (total tax minus total credits) less ohio withholding is more than $500. The forms below are sorted by form number. Enter a full or partial form. Omaha man sentenced for tax evasion and role in multimillion dollar embezzlement. Web we last updated the employee's withholding exemption certificate in february 2023, so this is the latest version of form it 4, fully updated for tax year 2022. Web all employers are required to file and pay electronically through ohio business gateway (obg) [o.a.c. Web individual income tax forms archive march 31, 2020 | agency. Other tax forms — a. The ohio department of taxation provides a searchable repository of individual tax. Welcome to the individual income tax forms archive.

Web individual income tax forms archive march 31, 2020 | agency. Web you should make estimated payments if your estimated ohio tax liability (total tax minus total credits) less ohio withholding is more than $500. Employers must register their business and may apply for an. The ohio department of taxation provides a searchable repository of individual tax. The forms below are sorted by form number. Web filing the individual estimated income tax form it 1040es, the individual may provide for additional withholding with the death of a spouse or a dependent does not affect your. Web ohio form it 4, employee’s withholding exemption certificate, is a tax form issued by the ohio department of taxation. Other tax forms — a. Welcome to the individual income tax forms archive. Snohomish county tax preparer pleads guilty to assisting in the.

Top Ohio Withholding Form Templates free to download in PDF format

Employers must register their business and may apply for an. Web filing the individual estimated income tax form it 1040es, the individual may provide for additional withholding with the death of a spouse or a dependent does not affect your. Access the forms you need to file taxes or do business in ohio. Web the ohio department of taxation only.

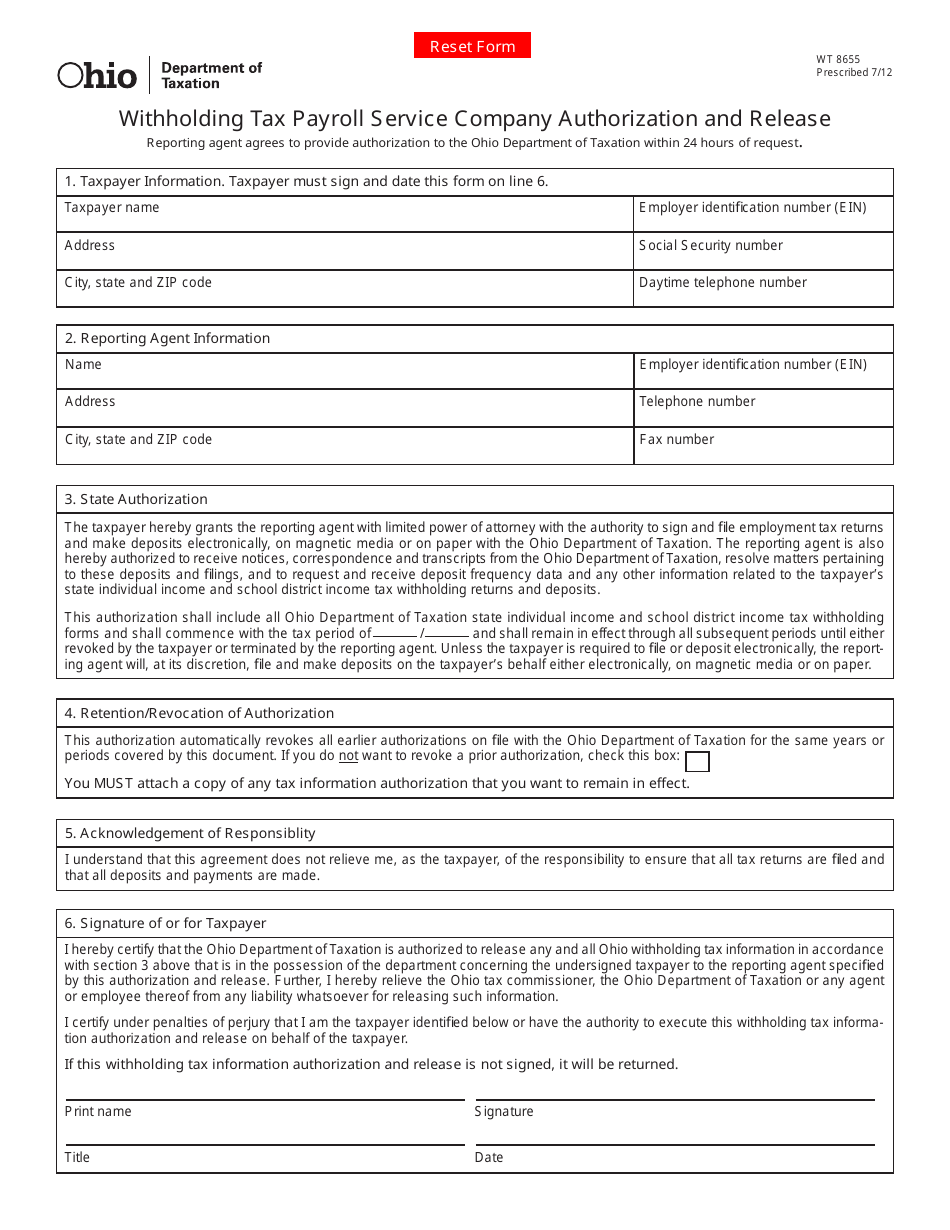

Form WT8655 Download Fillable PDF or Fill Online Withholding Tax

1st of the year in which the death occurs. Enter a full or partial form. Snohomish county tax preparer pleads guilty to assisting in the. Web july 20, 2023. Web individual income tax forms archive march 31, 2020 | agency.

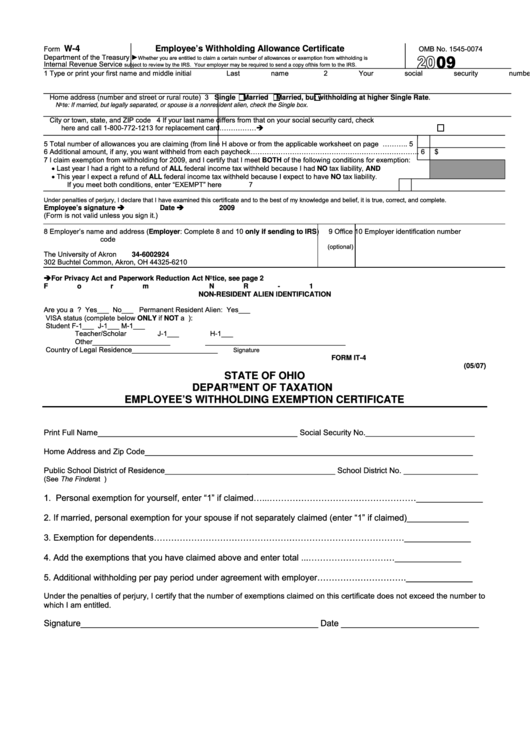

Ohio Withholding Form W 4 2022 W4 Form

Web withholding until the next year but requires the filing of a new certificate. Access the forms you need to file taxes or do business in ohio. Omaha man sentenced for tax evasion and role in multimillion dollar embezzlement. Web download or print the 2022 ohio (employee's withholding exemption certificate) (2022) and other income tax forms from the ohio department.

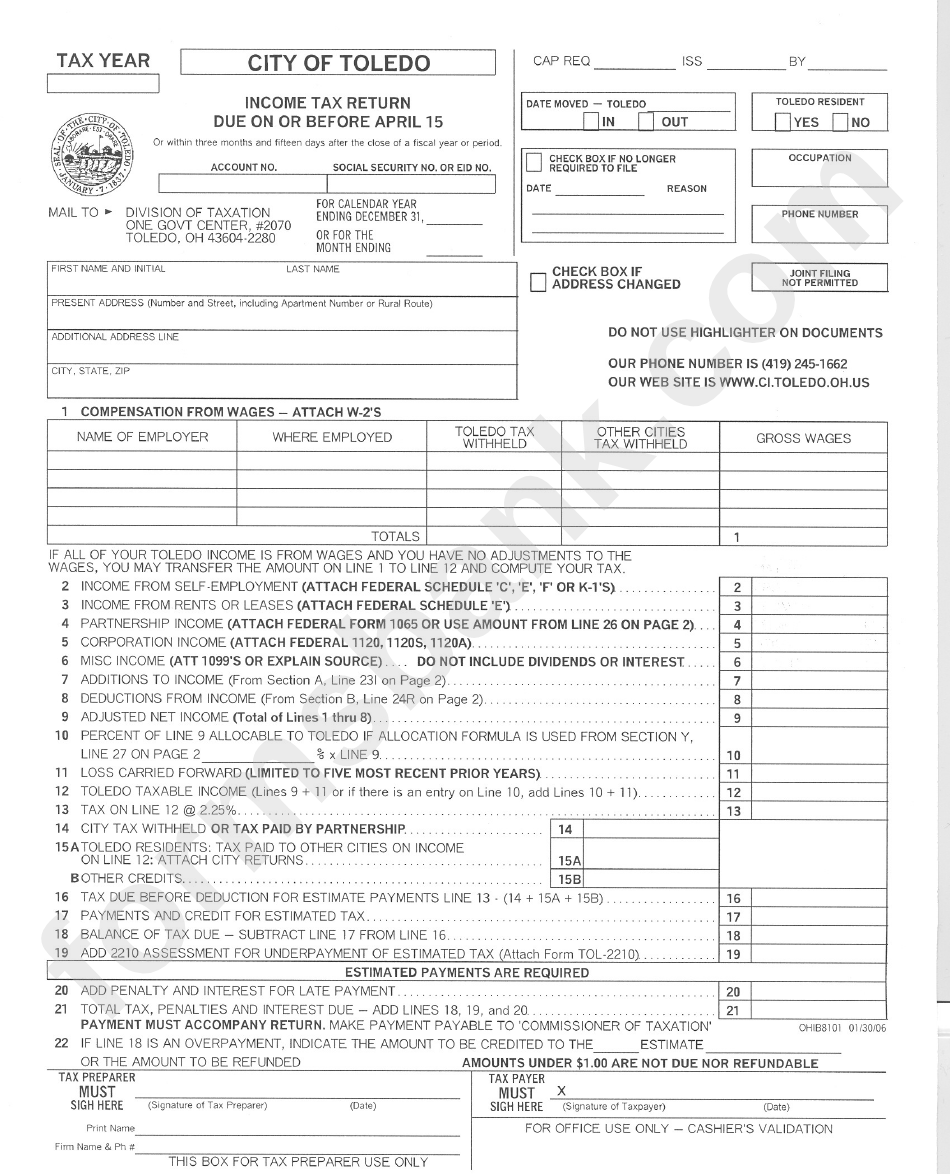

Tax Return Form Toledo Ohio printable pdf download

The forms below are sorted by form number. If possible, file a new certificate by dec. Web we last updated the employee's withholding exemption certificate in february 2023, so this is the latest version of form it 4, fully updated for tax year 2022. Web individual income tax forms archive march 31, 2020 | agency. Web download or print the.

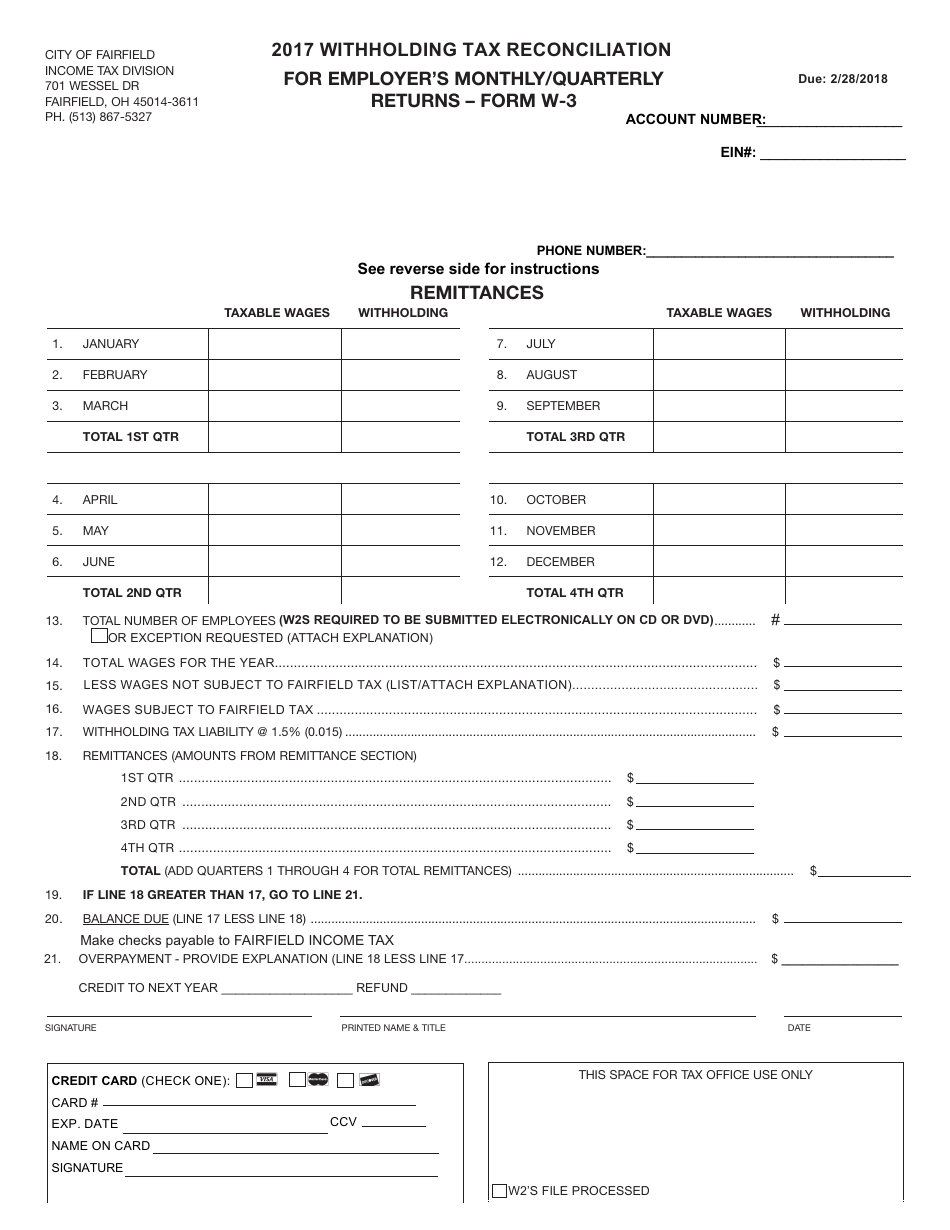

Form W3 Download Printable PDF or Fill Online Withholding Tax

Web ohio has a state income tax that ranges between 2.85% and 4.797%. Web get access to the ohio tax withholding forms in order to determine how much income tax should be withheld from employee's salary. Web if your employer did not withhold the local tax at the rates shown, you are required to file a cincinnati tax return. Web.

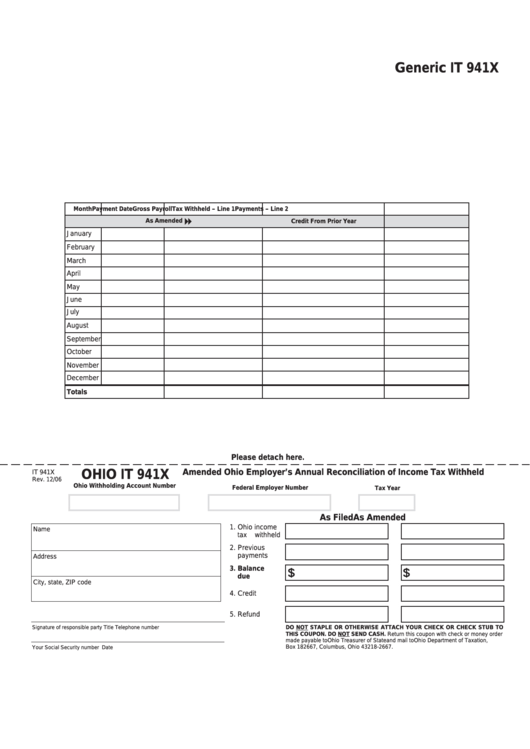

Fillable Ohio Form It 941x Amended Ohio Employer'S Annual

Web withholding until the next year but requires the filing of a new certificate. Web we last updated the employee's withholding exemption certificate in february 2023, so this is the latest version of form it 4, fully updated for tax year 2022. Omaha man sentenced for tax evasion and role in multimillion dollar embezzlement. Web get access to the ohio.

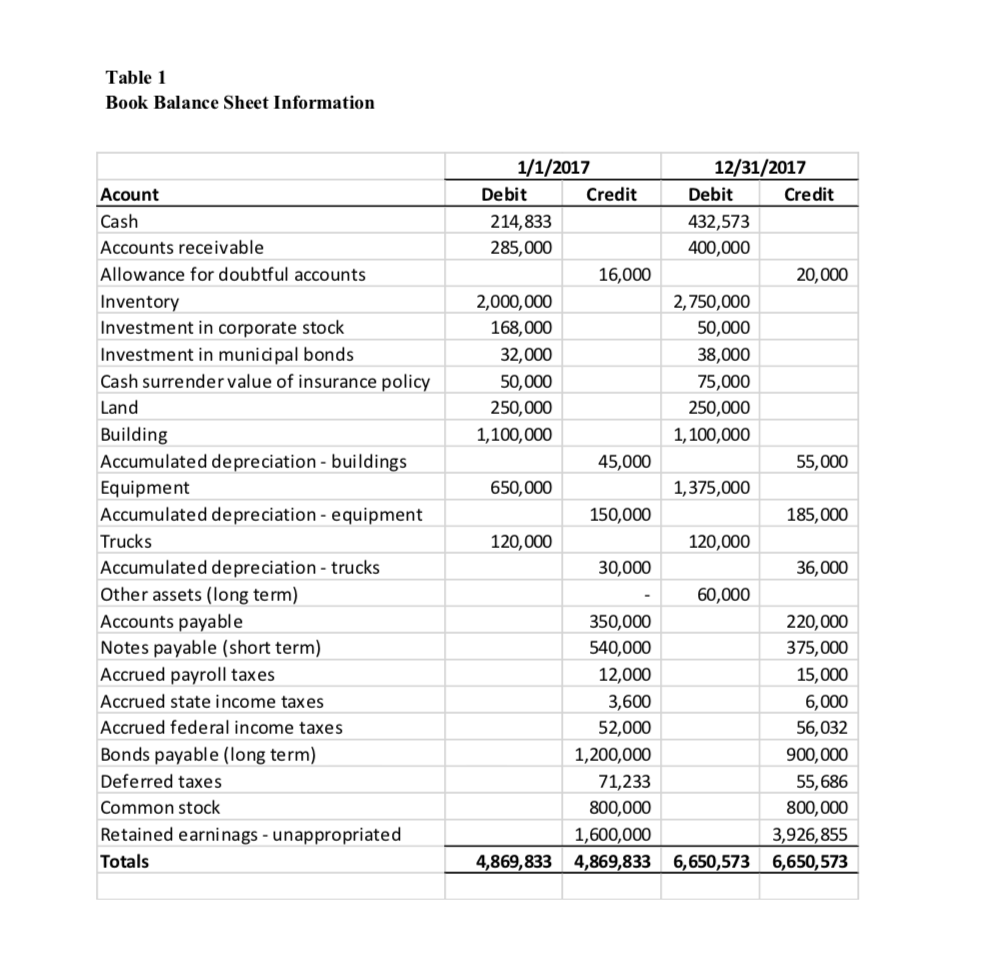

State Of Ohio Tax Withholding Tables 2017

The form gives a person or agency access to provide info about unemployment taxes. Web all employers are required to file and pay electronically through ohio business gateway (obg) [o.a.c. Web download or print the 2022 ohio (employee's withholding exemption certificate) (2022) and other income tax forms from the ohio department of taxation. If possible, file a new certificate by.

Fillable Heap Form Printable Forms Free Online

This form allows ohio employees to claim income tax. Web you should make estimated payments if your estimated ohio tax liability (total tax minus total credits) less ohio withholding is more than $500. Welcome to the individual income tax forms archive. Web ohio has a state income tax that ranges between 2.85% and 4.797%. If your income will be $200,000.

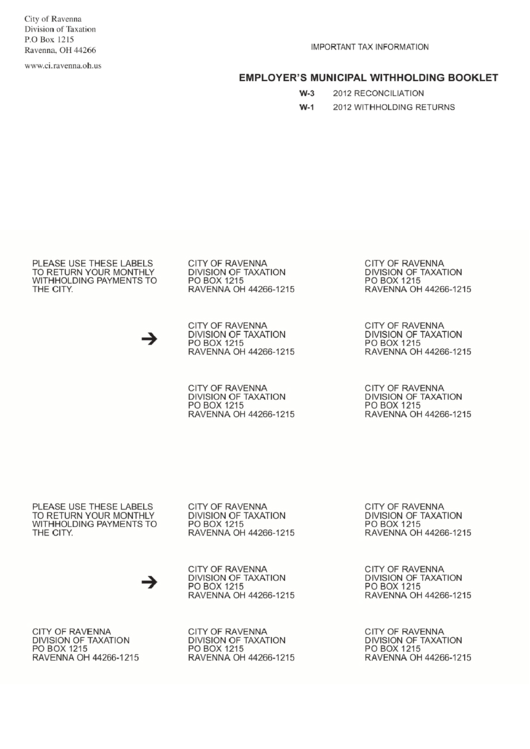

Huber Heights Ohio Withholding Tax Forms

Enter a full or partial form. Credit up to 1.8% effective 10/02/20 and 2.1% prior to 10/02/20 will. Welcome to the individual income tax forms archive. Other tax forms — a. Web you should make estimated payments if your estimated ohio tax liability (total tax minus total credits) less ohio withholding is more than $500.

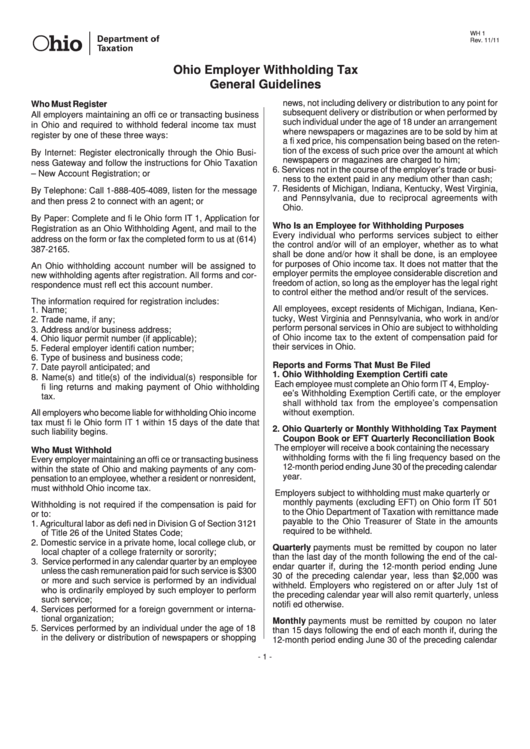

Instructions For Form It 1 Ohio Employer Withholding Tax printable

Welcome to the individual income tax forms archive. The form gives a person or agency access to provide info about unemployment taxes. Web ohio has a state income tax that ranges between 2.85% and 4.797%. Credit up to 1.8% effective 10/02/20 and 2.1% prior to 10/02/20 will. Web we last updated the employee's withholding exemption certificate in february 2023, so.

Web We Last Updated The Employee's Withholding Exemption Certificate In February 2023, So This Is The Latest Version Of Form It 4, Fully Updated For Tax Year 2022.

Omaha man sentenced for tax evasion and role in multimillion dollar embezzlement. Web all employers are required to file and pay electronically through ohio business gateway (obg) [o.a.c. Web download or print the 2022 ohio (employee's withholding exemption certificate) (2022) and other income tax forms from the ohio department of taxation. Web you should make estimated payments if your estimated ohio tax liability (total tax minus total credits) less ohio withholding is more than $500.

Other Tax Forms — A.

Enter a full or partial form. Web ohio form it 4, employee’s withholding exemption certificate, is a tax form issued by the ohio department of taxation. Web get access to the ohio tax withholding forms in order to determine how much income tax should be withheld from employee's salary. Web july 20, 2023.

Employers Must Register Their Business And May Apply For An.

If possible, file a new certificate by dec. Access the forms you need to file taxes or do business in ohio. This form allows ohio employees to claim income tax. Web the ohio department of taxation only requires 1099 forms that reflect ohio income tax withholding, such as forms 1099r, to be sent to us.

Web If Your Employer Did Not Withhold The Local Tax At The Rates Shown, You Are Required To File A Cincinnati Tax Return.

Snohomish county tax preparer pleads guilty to assisting in the. Credit up to 1.8% effective 10/02/20 and 2.1% prior to 10/02/20 will. Web filing the individual estimated income tax form it 1040es, the individual may provide for additional withholding with the death of a spouse or a dependent does not affect your. The forms below are sorted by form number.