Form 1120 Schedule M 3 Instructions

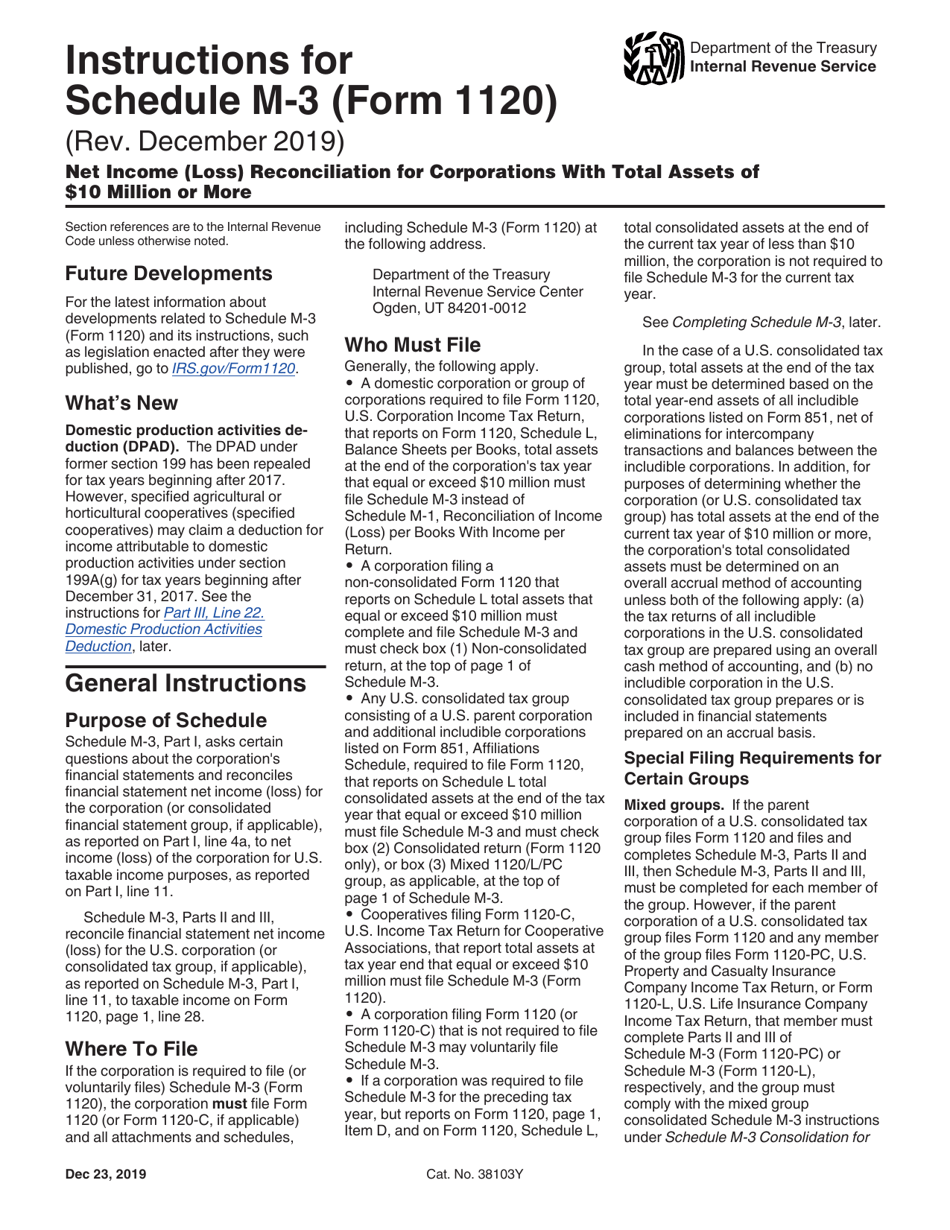

Form 1120 Schedule M 3 Instructions - Web general information what is the purpose of schedule m? Schedule m, other additions and subtractions, allows you to figure the total amount of “other additions and subtractions”. Where to file example 1. Web revenue code unless otherwise noted. On form 1120, page 1, line 28. Corporation (or consolidated tax group, if applicable), as reported. The partnership's total assets at the end of the tax year are $10 million or more,.

Web revenue code unless otherwise noted. Schedule m, other additions and subtractions, allows you to figure the total amount of “other additions and subtractions”. Web general information what is the purpose of schedule m? The partnership's total assets at the end of the tax year are $10 million or more,. Corporation (or consolidated tax group, if applicable), as reported. On form 1120, page 1, line 28. Where to file example 1.

Web general information what is the purpose of schedule m? Where to file example 1. The partnership's total assets at the end of the tax year are $10 million or more,. Web revenue code unless otherwise noted. Corporation (or consolidated tax group, if applicable), as reported. Schedule m, other additions and subtractions, allows you to figure the total amount of “other additions and subtractions”. On form 1120, page 1, line 28.

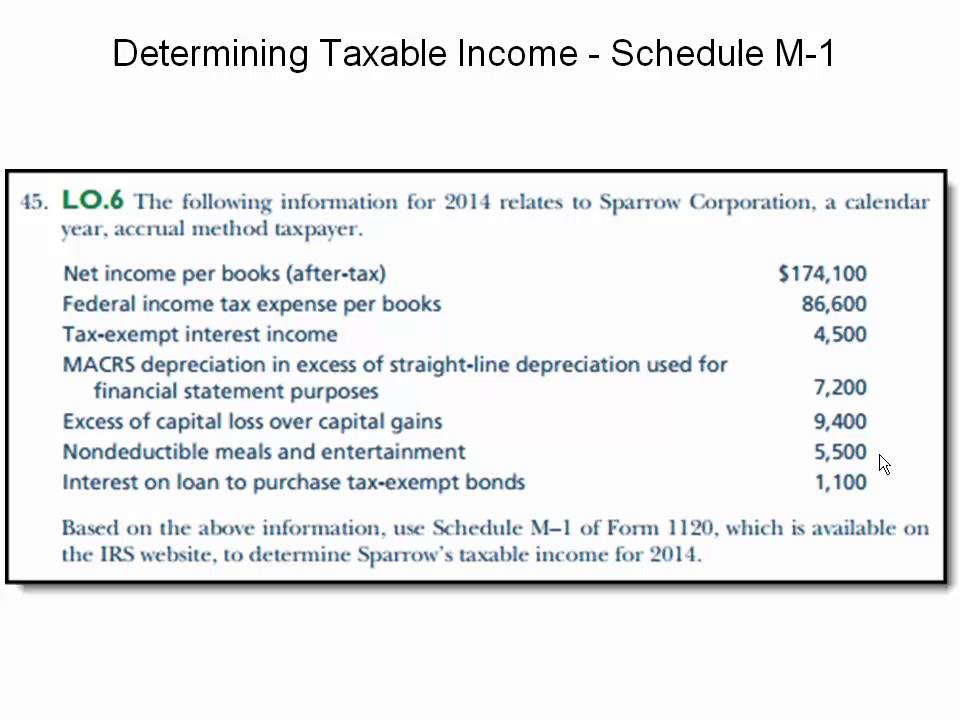

Taxable Schedule M1 Form 1120 YouTube

Schedule m, other additions and subtractions, allows you to figure the total amount of “other additions and subtractions”. Where to file example 1. Web revenue code unless otherwise noted. Web general information what is the purpose of schedule m? The partnership's total assets at the end of the tax year are $10 million or more,.

Inst 1120PC (Schedule M3)Instructions for Schedule M3 (Form 1120…

Where to file example 1. Schedule m, other additions and subtractions, allows you to figure the total amount of “other additions and subtractions”. Web general information what is the purpose of schedule m? The partnership's total assets at the end of the tax year are $10 million or more,. Web revenue code unless otherwise noted.

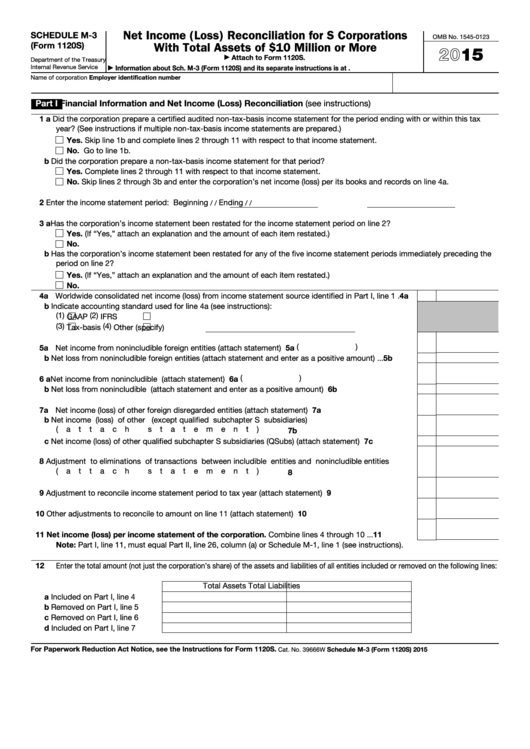

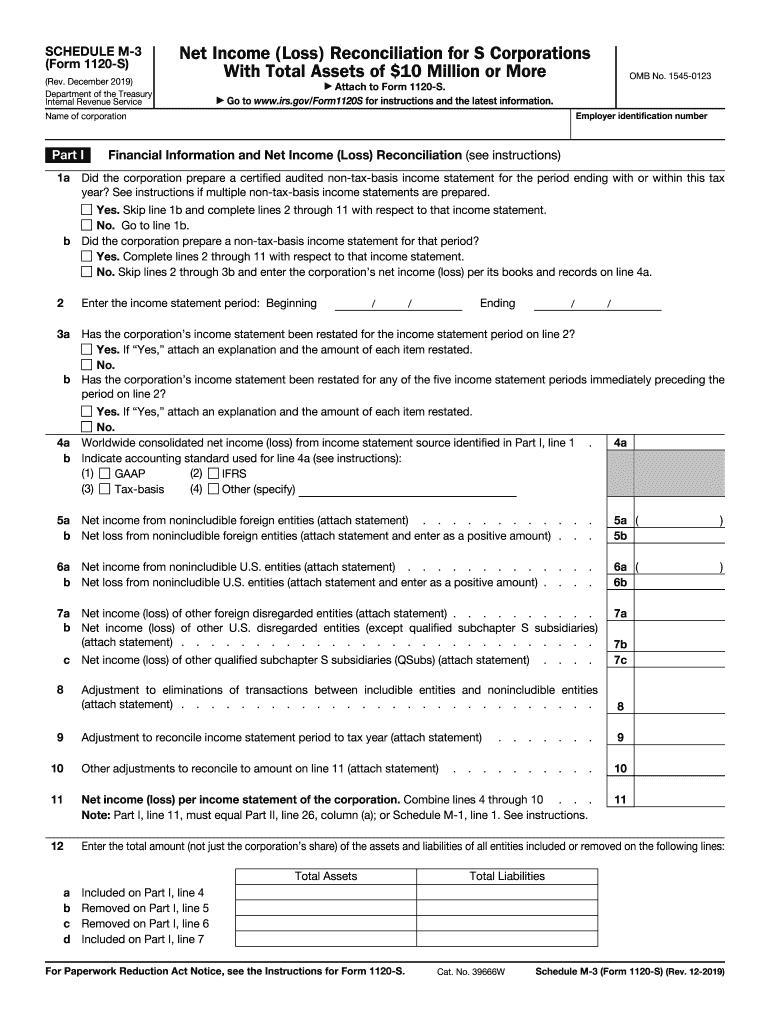

Fillable Schedule M3 (Form 1120s) Net (Loss) Reconciliation

Web revenue code unless otherwise noted. On form 1120, page 1, line 28. Where to file example 1. Schedule m, other additions and subtractions, allows you to figure the total amount of “other additions and subtractions”. Web general information what is the purpose of schedule m?

Download Instructions for IRS Form 1120 Schedule M3 Net (Loss

On form 1120, page 1, line 28. Schedule m, other additions and subtractions, allows you to figure the total amount of “other additions and subtractions”. The partnership's total assets at the end of the tax year are $10 million or more,. Web general information what is the purpose of schedule m? Web revenue code unless otherwise noted.

Schedule M 3 Instructions 1065 Blank Sample to Fill out Online in PDF

Schedule m, other additions and subtractions, allows you to figure the total amount of “other additions and subtractions”. On form 1120, page 1, line 28. Corporation (or consolidated tax group, if applicable), as reported. Web general information what is the purpose of schedule m? Web revenue code unless otherwise noted.

Form 1120 (Schedule M3) Net Reconciliation for Corporations

On form 1120, page 1, line 28. Web revenue code unless otherwise noted. Web general information what is the purpose of schedule m? Corporation (or consolidated tax group, if applicable), as reported. Schedule m, other additions and subtractions, allows you to figure the total amount of “other additions and subtractions”.

Inst 1120PC (Schedule M3)Instructions for Schedule M3 (Form 1120…

Schedule m, other additions and subtractions, allows you to figure the total amount of “other additions and subtractions”. On form 1120, page 1, line 28. Web revenue code unless otherwise noted. Corporation (or consolidated tax group, if applicable), as reported. Web general information what is the purpose of schedule m?

How to Complete Form 1120S Tax Return for an S Corp

The partnership's total assets at the end of the tax year are $10 million or more,. On form 1120, page 1, line 28. Web general information what is the purpose of schedule m? Where to file example 1. Corporation (or consolidated tax group, if applicable), as reported.

Form 1120 (Schedule M3) Net Reconciliation for Corporations

The partnership's total assets at the end of the tax year are $10 million or more,. Corporation (or consolidated tax group, if applicable), as reported. Web general information what is the purpose of schedule m? Where to file example 1. Web revenue code unless otherwise noted.

Web Revenue Code Unless Otherwise Noted.

The partnership's total assets at the end of the tax year are $10 million or more,. On form 1120, page 1, line 28. Where to file example 1. Corporation (or consolidated tax group, if applicable), as reported.

Schedule M, Other Additions And Subtractions, Allows You To Figure The Total Amount Of “Other Additions And Subtractions”.

Web general information what is the purpose of schedule m?