Irs Form Ssa 44

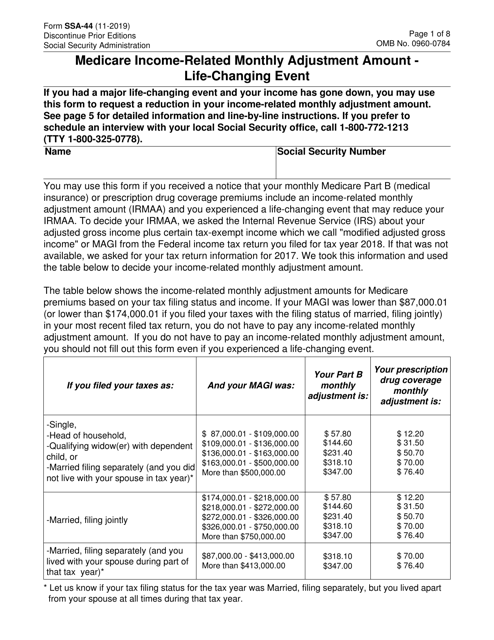

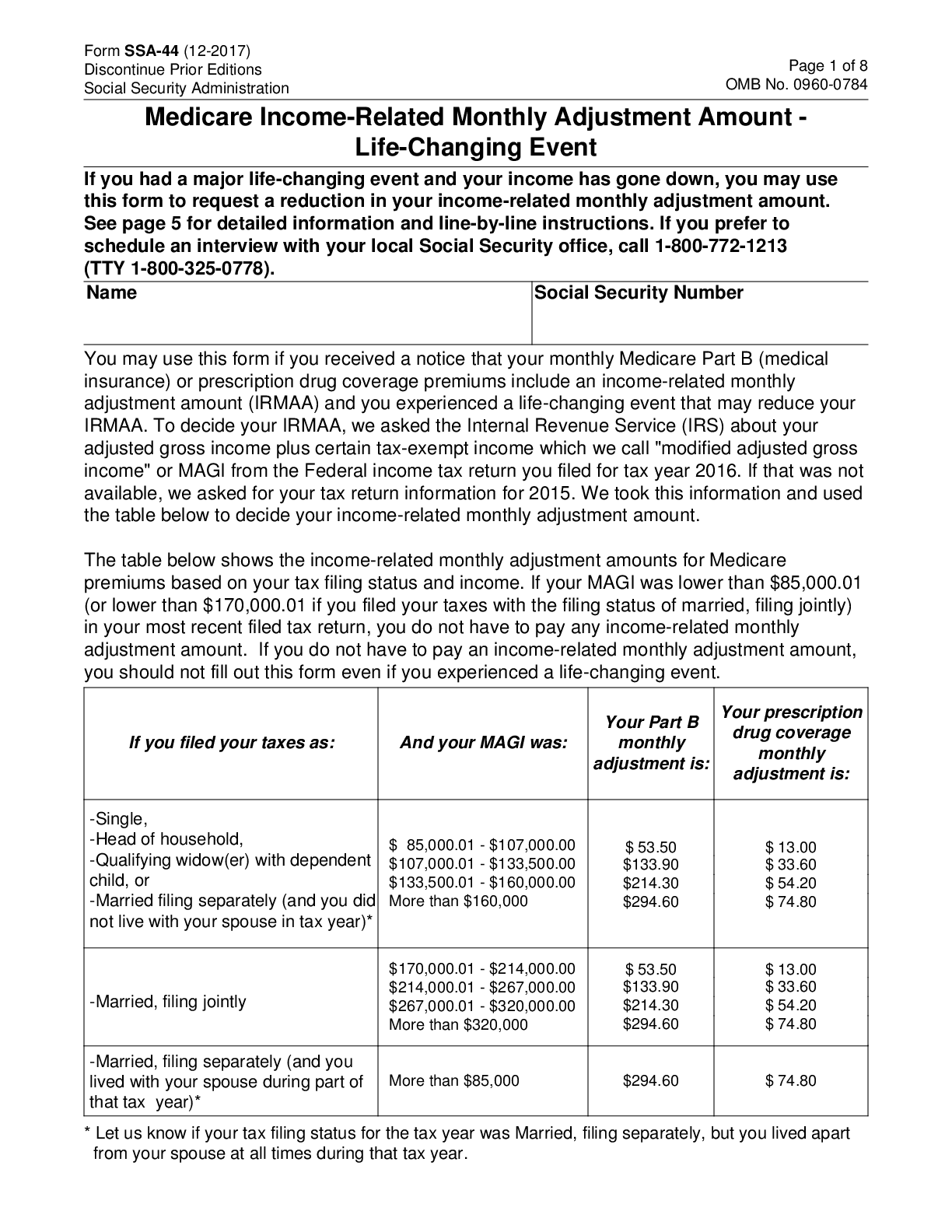

Irs Form Ssa 44 - You’ll pay monthly part b premiums equal to 35%, 50%, 65%, 80%, or 85% of the total cost, depending on what you report to the irs. In other words, the united states government uses your tax returns to determine whether you should pay more for medicare than the standard premium. Page 1 of 8 omb no. Such a request can be triggered when an individual encounters a significant life. However, the standard part b rate fell 3 percent in 2023, from the current $170.10 a month to $164.90. Authorization for the social security administration to release social security number (ssn) verification: Fax or mail your completed form and evidence to a social security office. Keep in mind standard medicare premiums can, and typically do, go up from year to year.

You’ll pay monthly part b premiums equal to 35%, 50%, 65%, 80%, or 85% of the total cost, depending on what you report to the irs. However, the standard part b rate fell 3 percent in 2023, from the current $170.10 a month to $164.90. Authorization for the social security administration to release social security number (ssn) verification: Such a request can be triggered when an individual encounters a significant life. In other words, the united states government uses your tax returns to determine whether you should pay more for medicare than the standard premium. Page 1 of 8 omb no. Fax or mail your completed form and evidence to a social security office. Keep in mind standard medicare premiums can, and typically do, go up from year to year.

Such a request can be triggered when an individual encounters a significant life. However, the standard part b rate fell 3 percent in 2023, from the current $170.10 a month to $164.90. Fax or mail your completed form and evidence to a social security office. Authorization for the social security administration to release social security number (ssn) verification: You’ll pay monthly part b premiums equal to 35%, 50%, 65%, 80%, or 85% of the total cost, depending on what you report to the irs. In other words, the united states government uses your tax returns to determine whether you should pay more for medicare than the standard premium. Keep in mind standard medicare premiums can, and typically do, go up from year to year. Page 1 of 8 omb no.

Form SSA44 Fill Out, Sign Online and Download Fillable PDF

In other words, the united states government uses your tax returns to determine whether you should pay more for medicare than the standard premium. Keep in mind standard medicare premiums can, and typically do, go up from year to year. Page 1 of 8 omb no. Authorization for the social security administration to release social security number (ssn) verification: Fax.

SSA44 A Step By Step Guide For 2022

You’ll pay monthly part b premiums equal to 35%, 50%, 65%, 80%, or 85% of the total cost, depending on what you report to the irs. Such a request can be triggered when an individual encounters a significant life. However, the standard part b rate fell 3 percent in 2023, from the current $170.10 a month to $164.90. Authorization for.

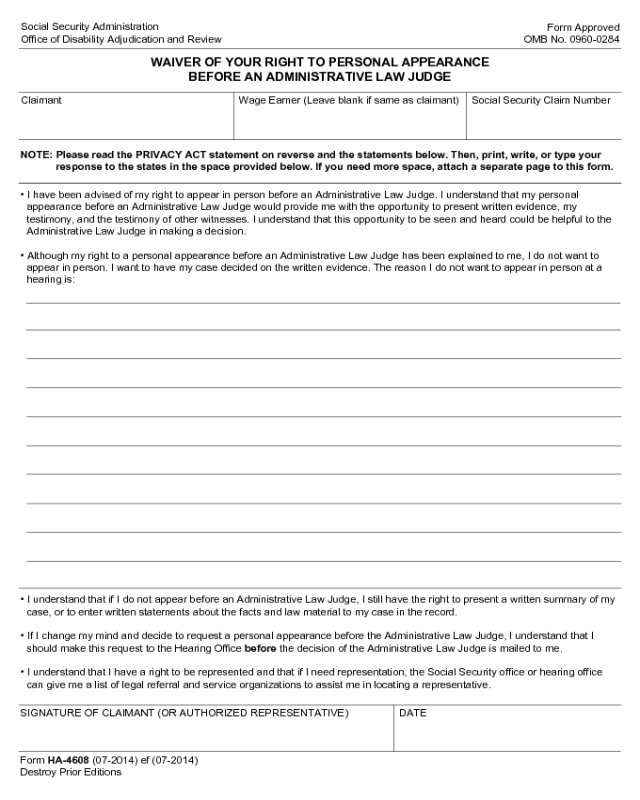

Can You Change Social Security Tax Withholding Online Fill Out and

However, the standard part b rate fell 3 percent in 2023, from the current $170.10 a month to $164.90. Fax or mail your completed form and evidence to a social security office. Such a request can be triggered when an individual encounters a significant life. Authorization for the social security administration to release social security number (ssn) verification: You’ll pay.

Form SSA44 Edit, Fill, Sign Online Handypdf

Keep in mind standard medicare premiums can, and typically do, go up from year to year. However, the standard part b rate fell 3 percent in 2023, from the current $170.10 a month to $164.90. Fax or mail your completed form and evidence to a social security office. Page 1 of 8 omb no. Such a request can be triggered.

2022 SSA Gov Forms Fillable, Printable PDF & Forms Handypdf

You’ll pay monthly part b premiums equal to 35%, 50%, 65%, 80%, or 85% of the total cost, depending on what you report to the irs. However, the standard part b rate fell 3 percent in 2023, from the current $170.10 a month to $164.90. Keep in mind standard medicare premiums can, and typically do, go up from year to.

2019 SSA Gov Forms Fillable, Printable PDF & Forms Handypdf

Page 1 of 8 omb no. Such a request can be triggered when an individual encounters a significant life. Authorization for the social security administration to release social security number (ssn) verification: You’ll pay monthly part b premiums equal to 35%, 50%, 65%, 80%, or 85% of the total cost, depending on what you report to the irs. Fax or.

2023 SSA Gov Forms Fillable, Printable PDF & Forms Handypdf

Fax or mail your completed form and evidence to a social security office. In other words, the united states government uses your tax returns to determine whether you should pay more for medicare than the standard premium. Such a request can be triggered when an individual encounters a significant life. Page 1 of 8 omb no. You’ll pay monthly part.

2023 SSA Gov Forms Fillable, Printable PDF & Forms Handypdf

However, the standard part b rate fell 3 percent in 2023, from the current $170.10 a month to $164.90. Page 1 of 8 omb no. Such a request can be triggered when an individual encounters a significant life. You’ll pay monthly part b premiums equal to 35%, 50%, 65%, 80%, or 85% of the total cost, depending on what you.

Ssa 44 Printable Form Printable Form 2022

Such a request can be triggered when an individual encounters a significant life. In other words, the united states government uses your tax returns to determine whether you should pay more for medicare than the standard premium. However, the standard part b rate fell 3 percent in 2023, from the current $170.10 a month to $164.90. Keep in mind standard.

Fill Free fillable Form SSA44 Medicare Monthly

Page 1 of 8 omb no. Keep in mind standard medicare premiums can, and typically do, go up from year to year. However, the standard part b rate fell 3 percent in 2023, from the current $170.10 a month to $164.90. In other words, the united states government uses your tax returns to determine whether you should pay more for.

Authorization For The Social Security Administration To Release Social Security Number (Ssn) Verification:

Page 1 of 8 omb no. Such a request can be triggered when an individual encounters a significant life. In other words, the united states government uses your tax returns to determine whether you should pay more for medicare than the standard premium. Fax or mail your completed form and evidence to a social security office.

You’ll Pay Monthly Part B Premiums Equal To 35%, 50%, 65%, 80%, Or 85% Of The Total Cost, Depending On What You Report To The Irs.

Keep in mind standard medicare premiums can, and typically do, go up from year to year. However, the standard part b rate fell 3 percent in 2023, from the current $170.10 a month to $164.90.