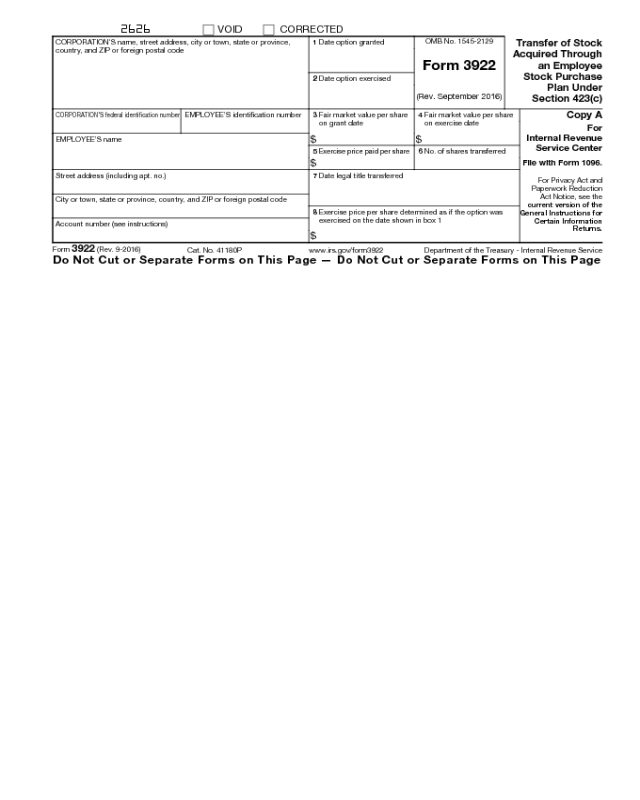

Fidelity Form 3922

Fidelity Form 3922 - Web if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates, related. Be sure to wait until you receive all your forms and documents. Every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option. Web fidelity stock plan services is providing a copy of form 3922 on sprint’s behalf. Web from the list below, you can download and access forms and applications. Web fidelity's stock plan services offer resources with features to help you successfully manage your account. Web 1 best answer tomyoung level 13 when you sell stocks that you've acquired via an espp, such a sale can create compensation income that can be included on. After logging in to the site, under account type, click on the account and then click on tax. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your.

Web up to $40 cash back edit your fidelity application form form online. A qualified 423 employee stock purchase plan allows employees under u.s. Every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option. Web what is a qualified section 423 plan? Web you may view and download copies of your 2022 tax forms at accounts.fidelity.com. View available forms ways to prepare. Web it sends two copies of form 3922—one to the employee and another to the irs—to document the transfer of the shares. Tax law to purchase stock at a discount from fair market. Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates, related. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your.

Select the document you want to sign and click upload. Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more. Web fidelity stock plan services is providing a copy of form 3922 on sprint’s behalf. Web who must file. Web a a tax information some of your 2022 tax forms may be ready to view. Web from the list below, you can download and access forms and applications. Every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option. Where available, links to online processes have been included for your convenience. Get tax rates and data, including capital gains estimates, corporate actions, and municipal and federal tax rules, for fidelity. Please save the form 3922.

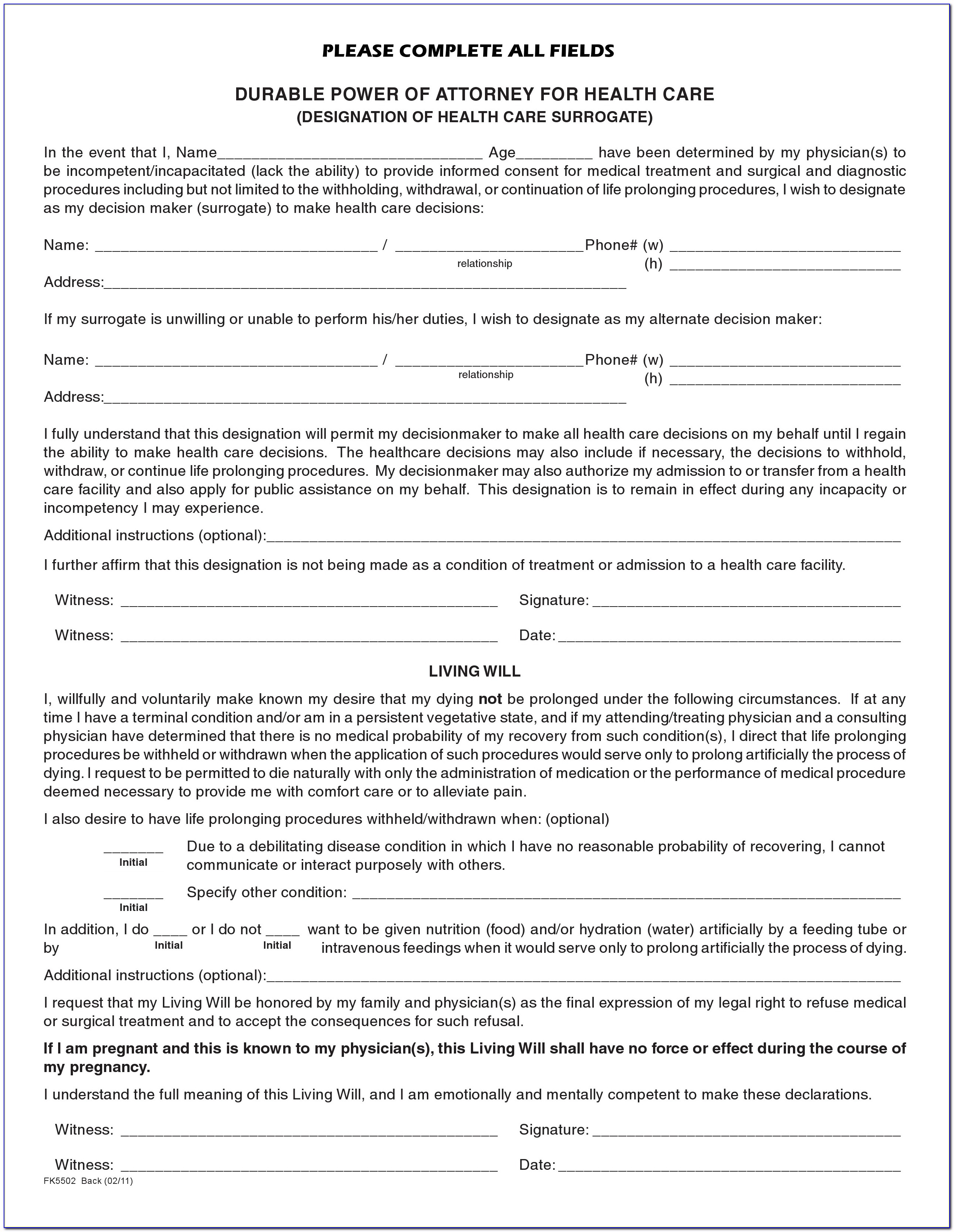

Piopac Fill Online, Printable, Fillable, Blank pdfFiller

Learn how to get started here. Web you may view and download copies of your 2022 tax forms at accounts.fidelity.com. Web who must file. Web it sends two copies of form 3922—one to the employee and another to the irs—to document the transfer of the shares. Please save the form 3922.

Fill Free fillable Fidelity Investments PDF forms

Web 1 best answer tomyoung level 13 when you sell stocks that you've acquired via an espp, such a sale can create compensation income that can be included on. Web from the list below, you can download and access forms and applications. Web who must file. Web if you purchased espp shares, your employer will send you form 3922, transfer.

3922 2020 Public Documents 1099 Pro Wiki

Every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option. Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more. After logging in to the site, under account type, click on the account and then click on tax..

Fill Free fillable Fidelity Form990 T Filing (Fidelity Investments

Select the document you want to sign and click upload. Web a a tax information some of your 2022 tax forms may be ready to view. Every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option. Web fidelity provides you the tax forms you’ll need.

Fidelity 401k Enrollment Form Form Resume Examples B8DVxyzOmb

Web 1 best answer tomyoung level 13 when you sell stocks that you've acquired via an espp, such a sale can create compensation income that can be included on. Please save the form 3922. A qualified 423 employee stock purchase plan allows employees under u.s. Get tax rates and data, including capital gains estimates, corporate actions, and municipal and federal.

IRS Form 3922 Software 289 eFile 3922 Software

Web fidelity's stock plan services offer resources with features to help you successfully manage your account. It contains important tax information to help you file your taxes in. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your. Web what is a.

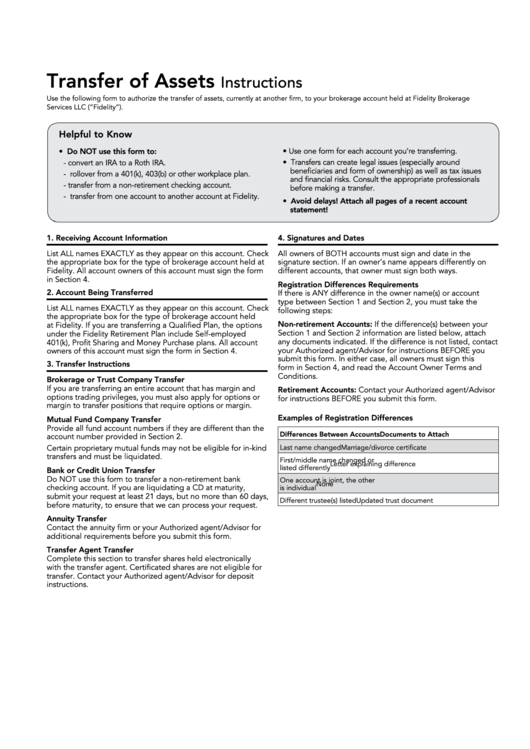

Fillable Transfer Of Assets Form Fidelity Investments printable pdf

Select the document you want to sign and click upload. Web who must file. Web fidelity stock plan services is providing a copy of form 3922 on sprint’s behalf. Web up to $40 cash back edit your fidelity application form form online. Web from the list below, you can download and access forms and applications.

Documents to Bring To Tax Preparer Tax Documents Checklist

Web up to $40 cash back edit your fidelity application form form online. Web 1 best answer tomyoung level 13 when you sell stocks that you've acquired via an espp, such a sale can create compensation income that can be included on. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan.

Form 3922 Edit, Fill, Sign Online Handypdf

Web fidelity provides you the tax forms you’ll need based on what you did with your stock during the prior year. Select the document you want to sign and click upload. Web if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web a a tax information some.

OK American Fidelity Form BN451 2017 Fill and Sign Printable

Select the document you want to sign and click upload. Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more. Web it sends two copies of form 3922—one to the employee and another to the irs—to document the transfer of the shares. Web who must file. A qualified 423 employee stock purchase plan.

Web What Is A Qualified Section 423 Plan?

Web fidelity's stock plan services offer resources with features to help you successfully manage your account. Please save the form 3922. Be sure to wait until you receive all your forms and documents. Select the document you want to sign and click upload.

Every Corporation Which In Any Calendar Year Transfers To Any Person A Share Of Stock Pursuant To That Person's Exercise Of An Incentive Stock Option.

Return here any time to access documents from previous years. Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates, related. Web 1 best answer tomyoung level 13 when you sell stocks that you've acquired via an espp, such a sale can create compensation income that can be included on. Web it sends two copies of form 3922—one to the employee and another to the irs—to document the transfer of the shares.

Web Your Employer Will Send You Form 3922, Transfer Of Stock Acquired Through An Employee Stock Purchase Plan Under Section 423 (C), If You Purchased Espp Stock.

Web fidelity stock plan services is providing a copy of form 3922 on sprint’s behalf. Web fidelity stock plan services, llc, provides recordkeeping and/or administrative services to your company’s equity compensation plan, in addition to any services provided directly to. Web fidelity provides you the tax forms you’ll need based on what you did with your stock during the prior year. It contains important tax information to help you file your taxes in.

Web From The List Below, You Can Download And Access Forms And Applications.

Where available, links to online processes have been included for your convenience. Web who must file. A qualified 423 employee stock purchase plan allows employees under u.s. View available forms ways to prepare.