Shipt Tax Form

Shipt Tax Form - Update bank account or debit card for payouts payout details is editable some platforms allow you to update your payout information within stripe express. Web shipt will file your 1099 tax form with the irs and relevant state tax authorities. You’ll need to pay use tax or provide proof that you either: You’ll need your 1099 tax form to file your taxes. You expect to owe at least $1,000 in tax for the current tax year, after subtracting your withholding and credits. Web shipt shoppers typically file personal tax returns by april 15th for the income you earned from january 1st to december 31st the prior year. Thus, as an independent contractor or a grocery delivery driver, you may be able to claim certain deductions with regard to your business income. You expect to owe at least $1,000 in tax for the current tax year, after subtracting your withholding and credits. Web view full report card. Web shipping date (please allow 15 business days for delivery) form 1040, u.s.

Does shipt take out taxes? The first way is to log into the shipt app and go to the account section. About our cost of living index did you know? Shipt will send a 1099 form to shoppers who earn above a certain amount at the end of the year. Get in touch with our support team 24/7 via phone or live chat. Shipt will send a 1099 form to shoppers who earn above a certain amount at the end of the year. You can get your shipt tax forms in a few ways. Update bank account or debit card for payouts payout details is editable some platforms allow you to update your payout information within stripe express. Web shipt does not withhold any taxes from our shoppers' weekly paychecks. Web shipt will file your 1099 tax form with the irs and relevant state tax authorities.

In january, we strongly suggest that you ensure all of your tax filing details and delivery preferences are up to date in stripe express. Web return to the login screen and enter your email and new password to log into your account. You expect to owe at least $1,000 in tax for the current tax year, after subtracting your withholding and credits. Web how do i get my shipt tax forms? You expect to owe at least $1,000 in tax for the current tax year, after subtracting your withholding and credits. The fawn creek time zone is central daylight time which is 6 hours behind coordinated universal time (utc). You’ll include the taxes on your form 1040 due on april 15th. Web start getting paid to shop with shipt. You expect your withholding and credits to be less than the smaller of: Irs deadline to file taxes.

9 Best Tax Deductions for Shipt Drivers in 2022 Everlance

Shipt will send a 1099 form to shoppers who earn above a certain amount at the end of the year. To update these details, click on the… You can get your shipt tax forms in a few ways. Thus, as an independent contractor or a grocery delivery driver, you may be able to claim certain deductions with regard to your.

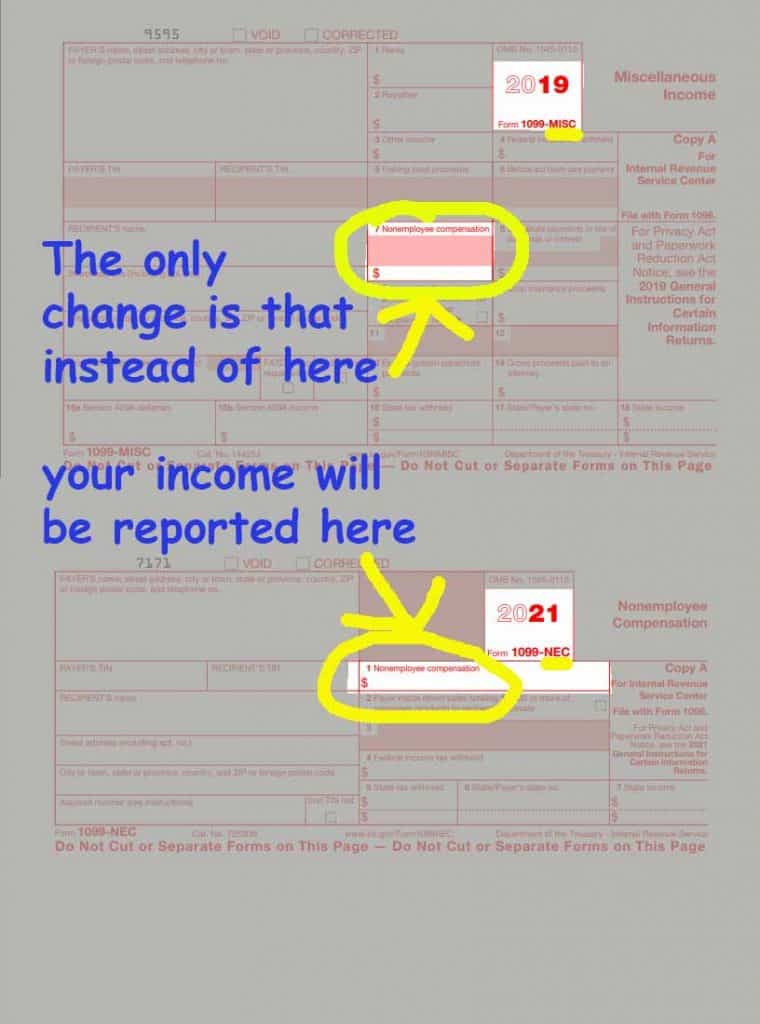

Why is Grubhub Changing to 1099NEC? EntreCourier

Learn about requirements, how to apply, faq, safety, shopper perks, and increasing your earnings! Fawn creek township is located in kansas with a population of 1,618. Web a use tax on the storage, use, or other consumption of tangible personal property in idaho on which you didn’t pay sales tax, unless an exemption applies. Fawn creek township is in montgomery.

Online form to cancel your Shipt membership

If you work for shipt as a shopper in the us, visit our stripe express support site to learn more about 1099s, and how to review your tax information and download your tax forms. You’ll need your 1099 tax form to file your taxes. Irs deadline to file taxes. Web shipt does not withhold any taxes from our shoppers' weekly.

Don't make checks out to 'IRS' for federal taxes, or your payment could

Update bank account or debit card for payouts payout details is editable some platforms allow you to update your payout information within stripe express. If you work for shipt as a shopper in the us, visit our stripe express support site to learn more about 1099s, and how to review your tax information and download your tax forms. Shipt will.

Forms 1099 The Basics You Should Know Kelly CPA

Web schools in fawn creek, kansas fawn creek, ks is a small rural town in the heartland of america. Web how do i get my shipt tax forms? Shipt will send tax forms to all drivers who earned more than $600 during the year. Web manage and download tax forms, track payments in real time, see upcoming payouts, and understand.

Tax Prep Checklist Free Printable Checklist Tax prep

You’ll need your 1099 tax form to file your taxes. The fawn creek time zone is central daylight time which is 6 hours behind coordinated universal time (utc). Web shipt shoppers typically file personal tax returns by april 15th for the income you earned from january 1st to december 31st the prior year. Web a use tax on the storage,.

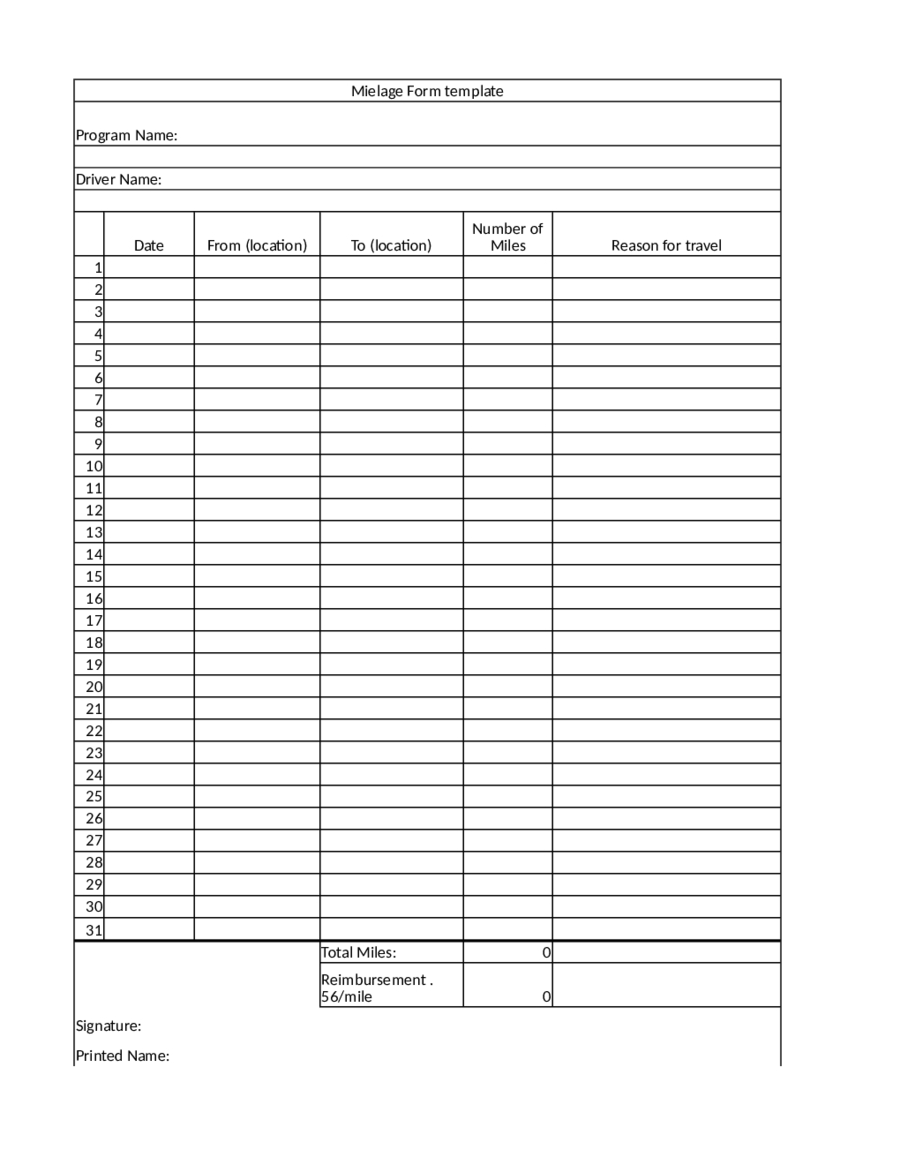

Mileage Report Template

Web how do i get my shipt tax forms? You expect to owe at least $1,000 in tax for the current tax year, after subtracting your withholding and credits. Web shipping date (please allow 15 business days for delivery) form 1040, u.s. You’ll need your 1099 tax form to file your taxes. Below 100 means cheaper than the us average.

Guide to 1099 tax forms for Shipt Shoppers Stripe Help & Support

In january, we strongly suggest that you ensure all of your tax filing details and delivery preferences are up to date in stripe express. Nearby cities include dearing, cotton. 90% of the tax to be shown on your current year’s tax return, or 100% of the tax shown on your prior year’s tax return. Say hello to your next step..

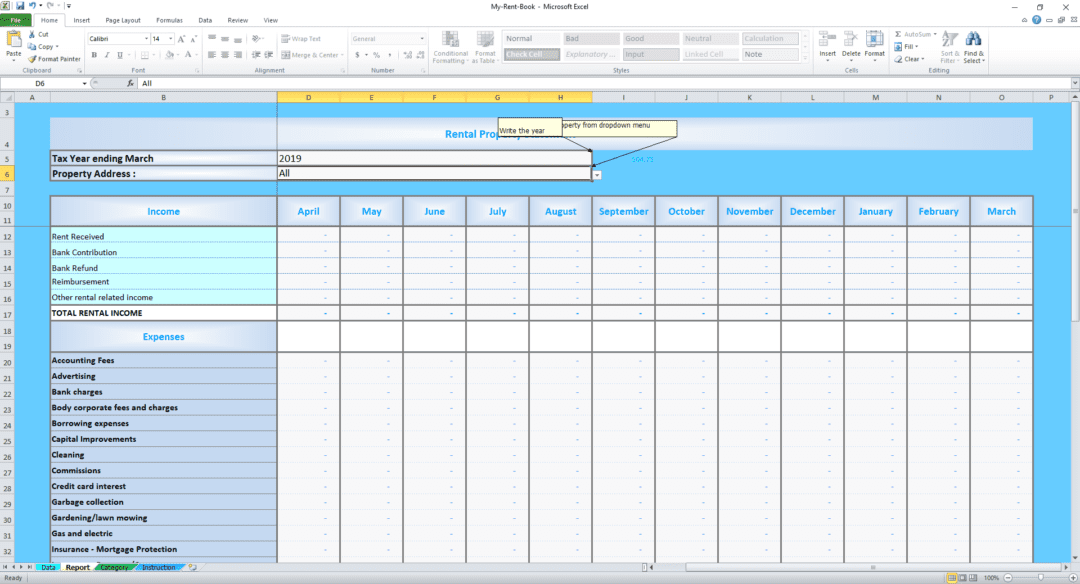

Free Tax Return Spreadsheet NZ Rental Tax Services

Say hello to your next step. As independent contractors, shoppers with shipt are responsible for filing their own taxes. Residents of fawn creek township tend to be conservative. Shipt will send a 1099 form to shoppers who earn above a certain amount at the end of the year. The first way is to log into the shipt app and go.

Shipt Tax Forms, Deductions & Ways To File In 2022

You’ll need your 1099 tax form to file your taxes. Shipt will send a 1099 form to shoppers who earn above a certain amount at the end of the year. To update these details, click on the… You’ll need your 1099 tax form to file your taxes. You’ll need to pay use tax or provide proof that you either:

In January, We Strongly Suggest That You Ensure All Of Your Tax Filing Details And Delivery Preferences Are Up To Date In Stripe Express.

Web return to the login screen and enter your email and new password to log into your account. The second way is to wait for shipt to send you the forms in the mail. If you work for shipt as a shopper in the us, visit our stripe express support site to learn more about 1099s, and how to review your tax information and download your tax forms. About our cost of living index did you know?

Web Shipping Date (Please Allow 15 Business Days For Delivery) Form 1040, U.s.

Web a use tax on the storage, use, or other consumption of tangible personal property in idaho on which you didn’t pay sales tax, unless an exemption applies. It has a reputation for excellent public schools, which are highly rated and offer a quality education to the children of the community. This is why we are now offering a premium salary & cost. Shipt will send a 1099 form to shoppers who earn above a certain amount at the end of the year.

Shipt Partners With Stripe To File 1099 Tax Forms That Summarize Shoppers’ Earnings.

You expect to owe at least $1,000 in tax for the current tax year, after subtracting your withholding and credits. You expect to owe at least $1,000 in tax for the current tax year, after subtracting your withholding and credits. Web view full report card. Below 100 means cheaper than the us average.

Web 100 = Us Average.

Learn about requirements, how to apply, faq, safety, shopper perks, and increasing your earnings! 90% of the tax to be shown on your current year’s tax return, or 100% of the tax shown on your prior year’s tax return. You’ll need your 1099 tax form to file your taxes. Irs deadline to file taxes.