Empower Retirement Withdrawal Tax Form

Empower Retirement Withdrawal Tax Form - Web you can withdraw money from your ira at any time. Orchard road, greenwood village, co 80111 : The content of this site is for your informational and educational purposes only. Qualified birth or adoption distribution form use this form to request a. To initiate a withdrawal, call the soonersave record keeper empower. Web step 1 log in to your account. Web empower employees can access their retirement accounts to check balances, view retirement plan activity and more. What you need to know: However, a 10% additional tax generally applies if you withdraw ira or retirement plan assets before you reach age. Web see 401(a) special tax notice.

Web you can withdraw money from your ira at any time. There are two possible reasons: Orchard road, greenwood village, co 80111 : To initiate a withdrawal, call the soonersave record keeper empower. What do i need to do to begin distributions from my account? Personalized features and modern tools that make retirement planning easier for individuals, plan sponsors and financial professionals. Web distributions from your plan may also have an impact on your income taxes. Web empower employees can access their retirement accounts to check balances, view retirement plan activity and more. However, a 10% additional tax generally applies if you withdraw ira or retirement plan assets before you reach age. Web see 401(a) special tax notice.

Web empower employees can access their retirement accounts to check balances, view retirement plan activity and more. Web v e r v i e w plan may allow a participant to take a hardship withdrawal from their retirement plan account when they experience an immediate and heavy financial need. You were not paid more than $10 in interest from nbkc bank during the. Web step 1 log in to your account. Taxpayers who took an early withdrawal last year may have to file form 5329 with their federal tax return. You may make withdrawals without penalty from your traditional ira after you reach age 59½. The content of this site is for your informational and educational purposes only. However, a 10% additional tax generally applies if you withdraw ira or retirement plan assets before you reach age. What you need to know: 20% may be withheld from your distribution for.

Retirement Withdrawal Strategies Systematic vs. Bucket — Prestige

There are two possible reasons: What do i need to do to begin distributions from my account? Web step 1 log in to your account. Web empower retirement website terms and conditions. You may make withdrawals without penalty from your traditional ira after you reach age 59½.

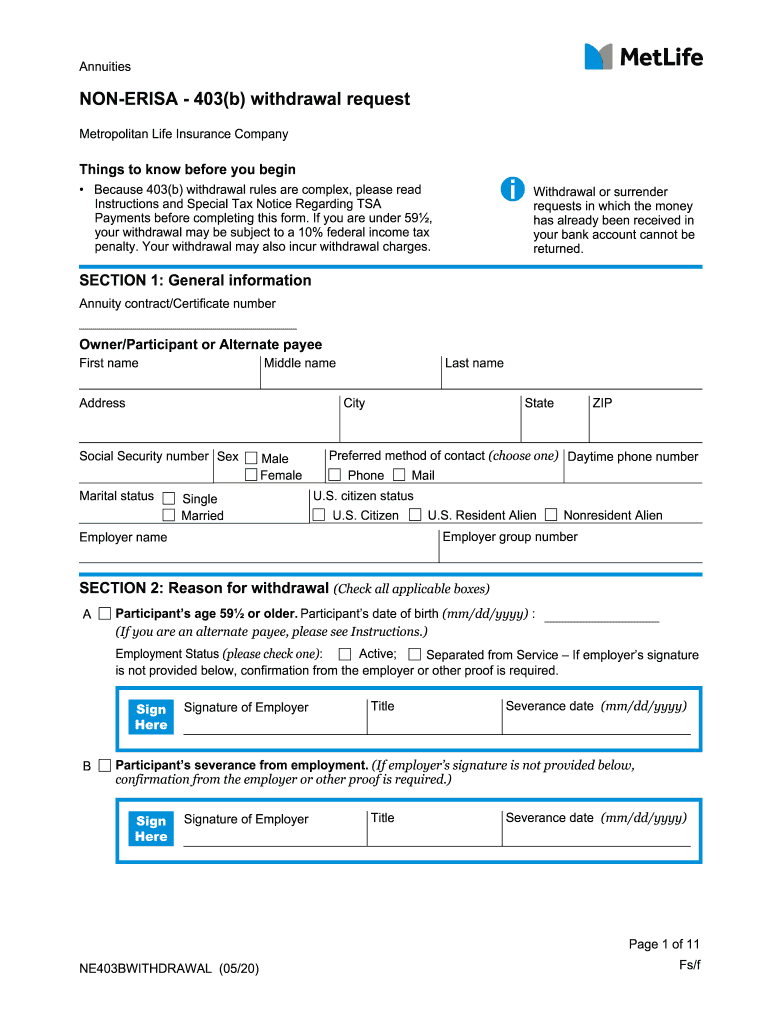

403b Hardship Withdrawal Request Qualified Plans MetLife Fill Out and

Personalized features and modern tools that make retirement planning easier for individuals, plan sponsors and financial professionals. Orchard road, greenwood village, co 80111 : However, a 10% additional tax generally applies if you withdraw ira or retirement plan assets before you reach age. Web v e r v i e w plan may allow a participant to take a hardship.

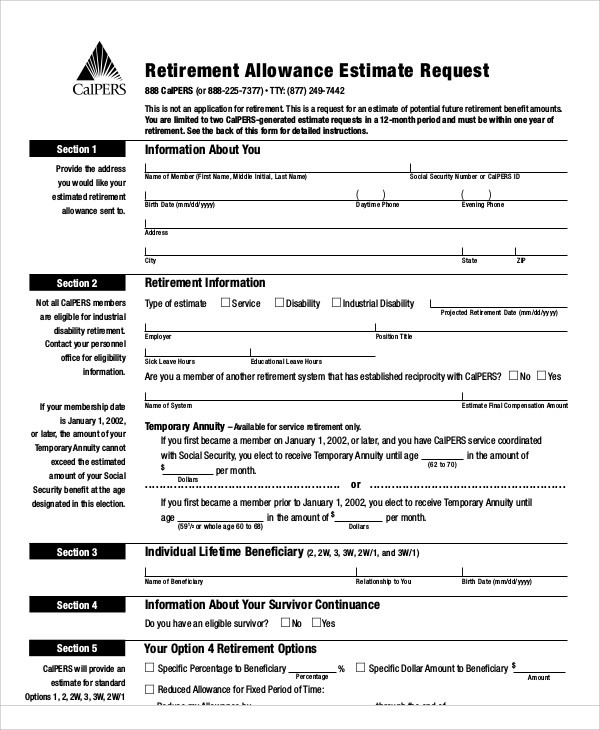

Retirement Application Form Sample The Document Template

Web v e r v i e w plan may allow a participant to take a hardship withdrawal from their retirement plan account when they experience an immediate and heavy financial need. There are two possible reasons: Web distributions from your plan may also have an impact on your income taxes. Qualified birth or adoption distribution form use this form.

Empower retirement early withdrawal 401k Early Retirement

20% may be withheld from your distribution for. What do i need to do to begin distributions from my account? Web v e r v i e w plan may allow a participant to take a hardship withdrawal from their retirement plan account when they experience an immediate and heavy financial need. Your taxable distribution is subject to ordinary income.

Distribution From 401K Fill Out and Sign Printable PDF Template signNow

Qualified birth or adoption distribution form use this form to request a. Web step 1 log in to your account. Web request for hardship withdrawal pdf file opens in a new window; Web it should arrive by 2/14/2023. To initiate a withdrawal, call the soonersave record keeper empower.

Retirement Account Withdrawal Tax Strategies Trippon Wealth Management

Web distributions from your plan may also have an impact on your income taxes. Your taxable distribution is subject to ordinary income tax, including. Web empower employees can access their retirement accounts to check balances, view retirement plan activity and more. The content of this site is for your informational and educational purposes only. You were not paid more than.

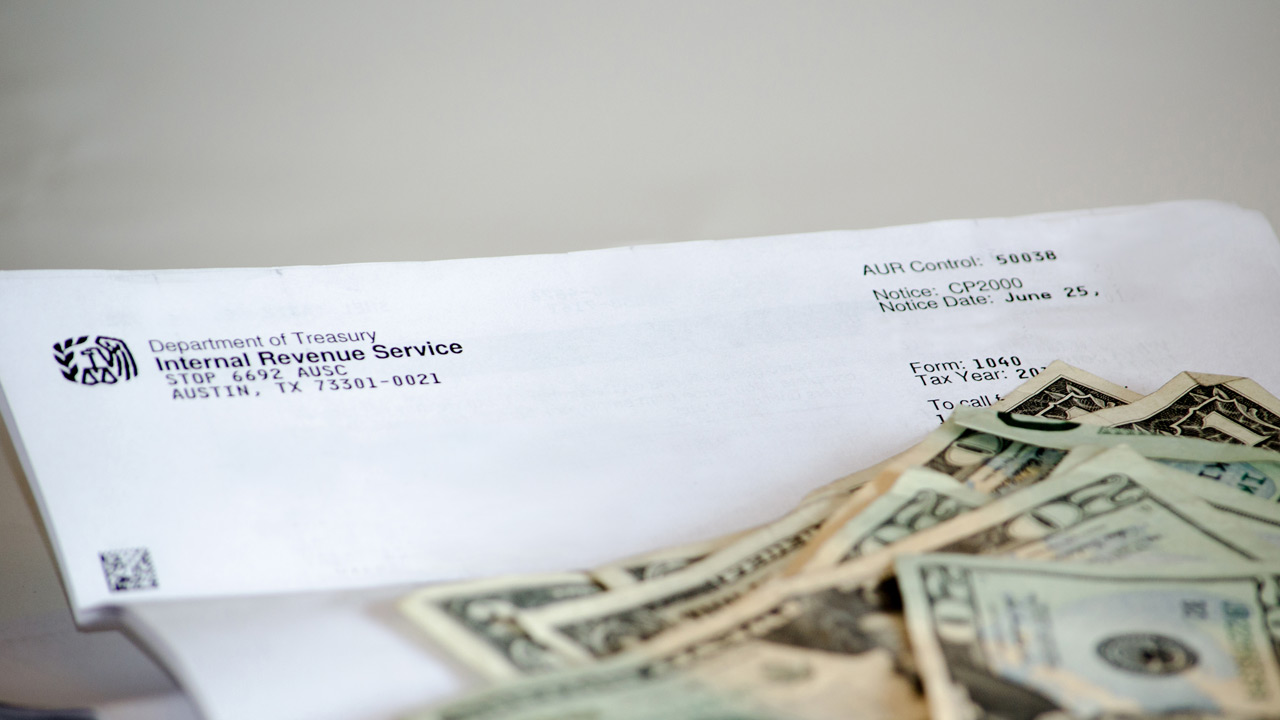

CARES Act Retirement Withdrawal Tax Burdens

Taxpayers who took an early withdrawal last year may have to file form 5329 with their federal tax return. Qualified birth or adoption distribution form use this form to request a. Your taxable distribution is subject to ordinary income tax, including. Withdrawing money from your plan can cost you. Web v e r v i e w plan may allow.

Empower 401k Withdrawal Form Universal Network

Web v e r v i e w plan may allow a participant to take a hardship withdrawal from their retirement plan account when they experience an immediate and heavy financial need. What you need to know: Web you can withdraw money from your ira at any time. 20% may be withheld from your distribution for. Taxpayers who took an.

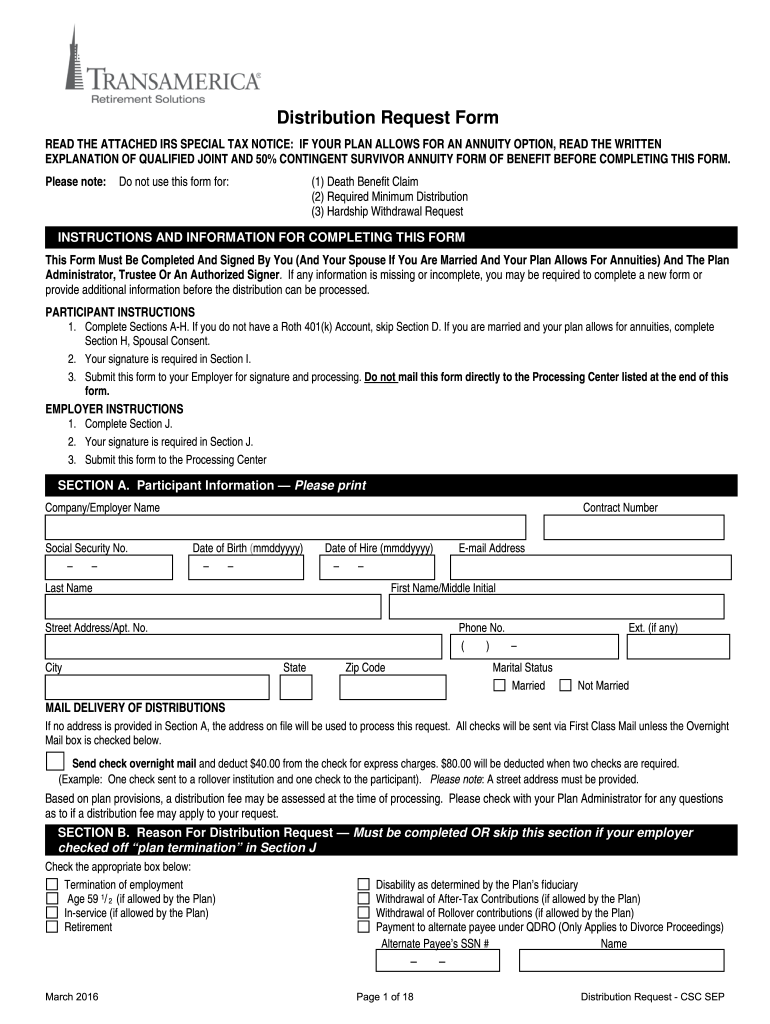

Fillable Online transamerica 401k withdrawal form Fax Email Print

20% may be withheld from your distribution for. Web see 401(a) special tax notice. Withdrawing money from your plan can cost you. Web distributions from your plan may also have an impact on your income taxes. What you need to know:

Online Terms Conditions With Withdrawal From Empower Retirement US

The content of this site is for your informational and educational purposes only. To initiate a withdrawal, call the soonersave record keeper empower. However, a 10% additional tax generally applies if you withdraw ira or retirement plan assets before you reach age. What do i need to do to begin distributions from my account? 20% may be withheld from your.

What You Need To Know:

Qualified birth or adoption distribution form use this form to request a. Web see 401(a) special tax notice. Web distributions from your plan may also have an impact on your income taxes. Box 600087 dallas, tx 75360 for questions:

The Content Of This Site Is For Your Informational And Educational Purposes Only.

20% may be withheld from your distribution for. You were not paid more than $10 in interest from nbkc bank during the. Web empower retirement website terms and conditions. Withdrawing money from your plan can cost you.

Gwfs Is An Affiliate Of Empower Retirement, Llc;

There are two possible reasons: Web request for hardship withdrawal pdf file opens in a new window; Taxpayers who took an early withdrawal last year may have to file form 5329 with their federal tax return. Web v e r v i e w plan may allow a participant to take a hardship withdrawal from their retirement plan account when they experience an immediate and heavy financial need.

Your Taxable Distribution Is Subject To Ordinary Income Tax, Including.

Personalized features and modern tools that make retirement planning easier for individuals, plan sponsors and financial professionals. None of the information provided through. Web you can withdraw money from your ira at any time. Step 2 from the homepage click on my documents from the navigation bar, then select your plan on the next page.