Louisiana W9 Form

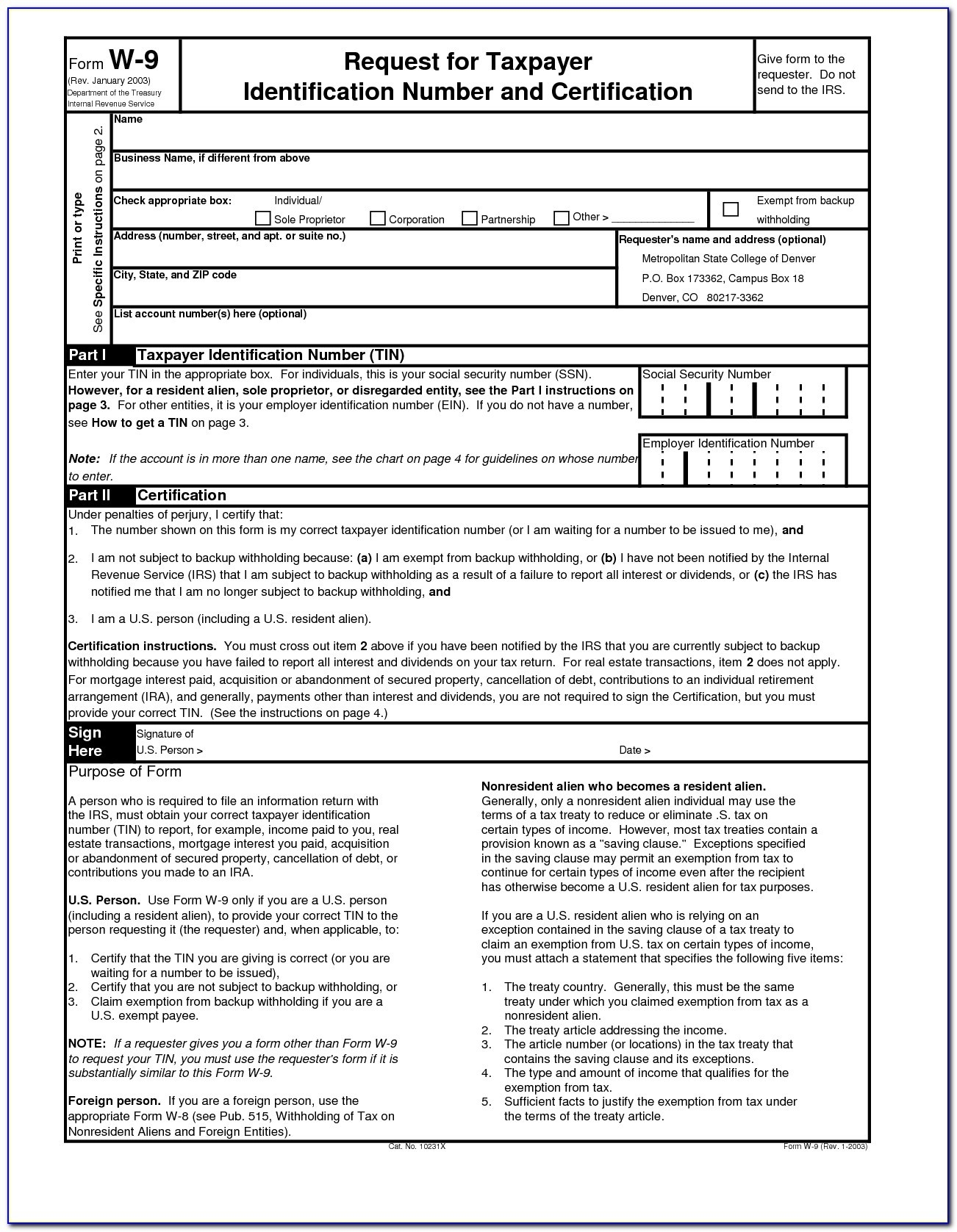

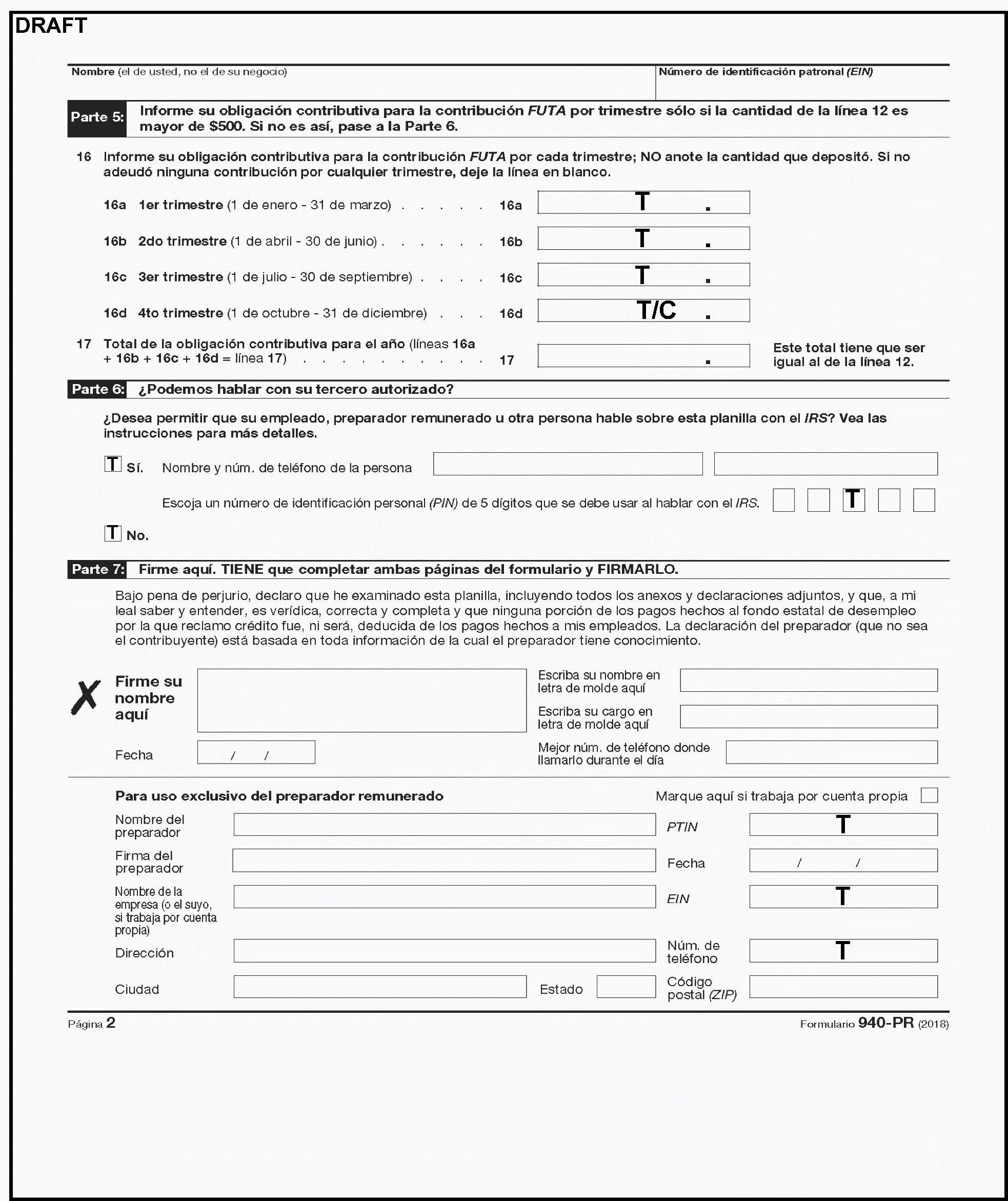

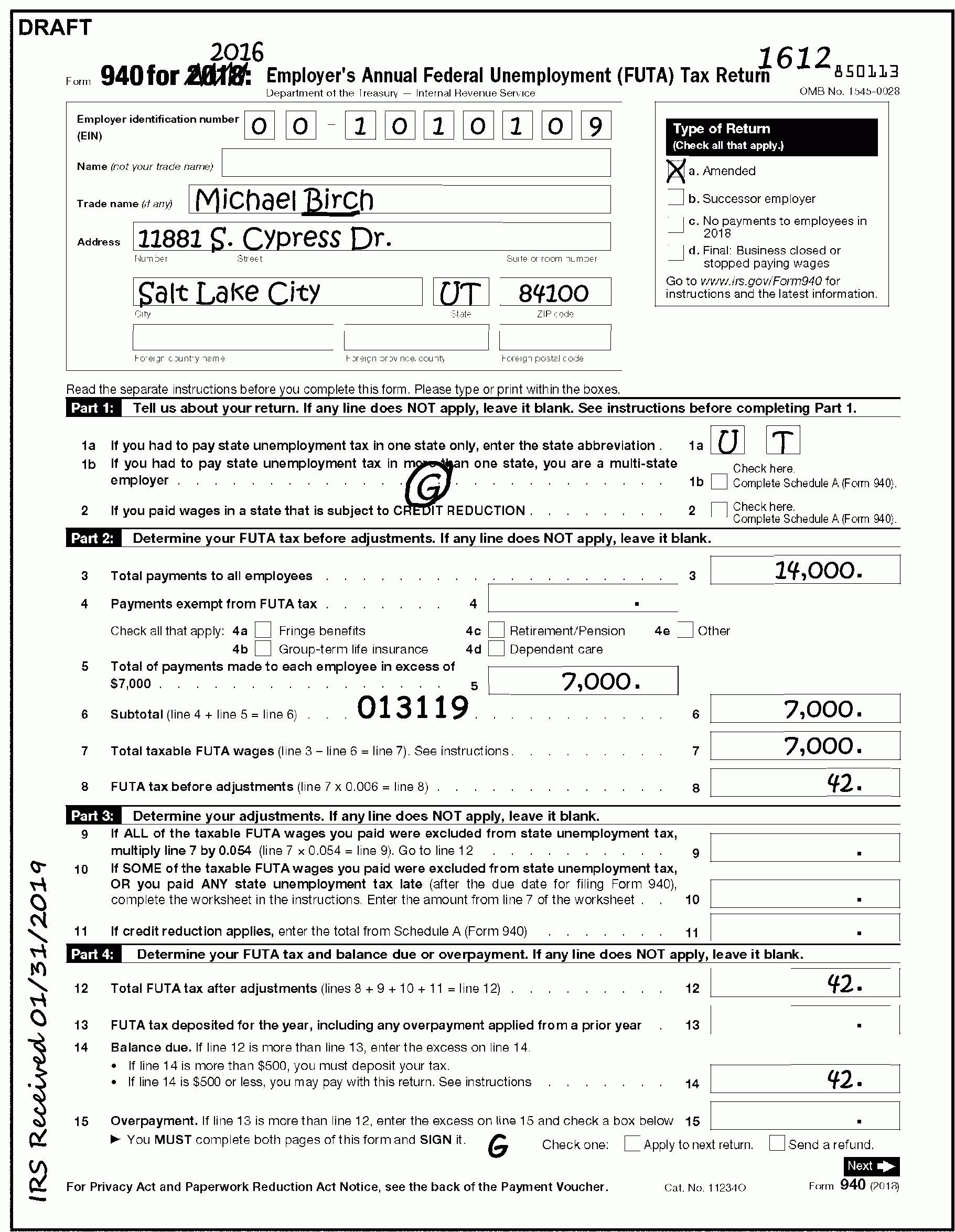

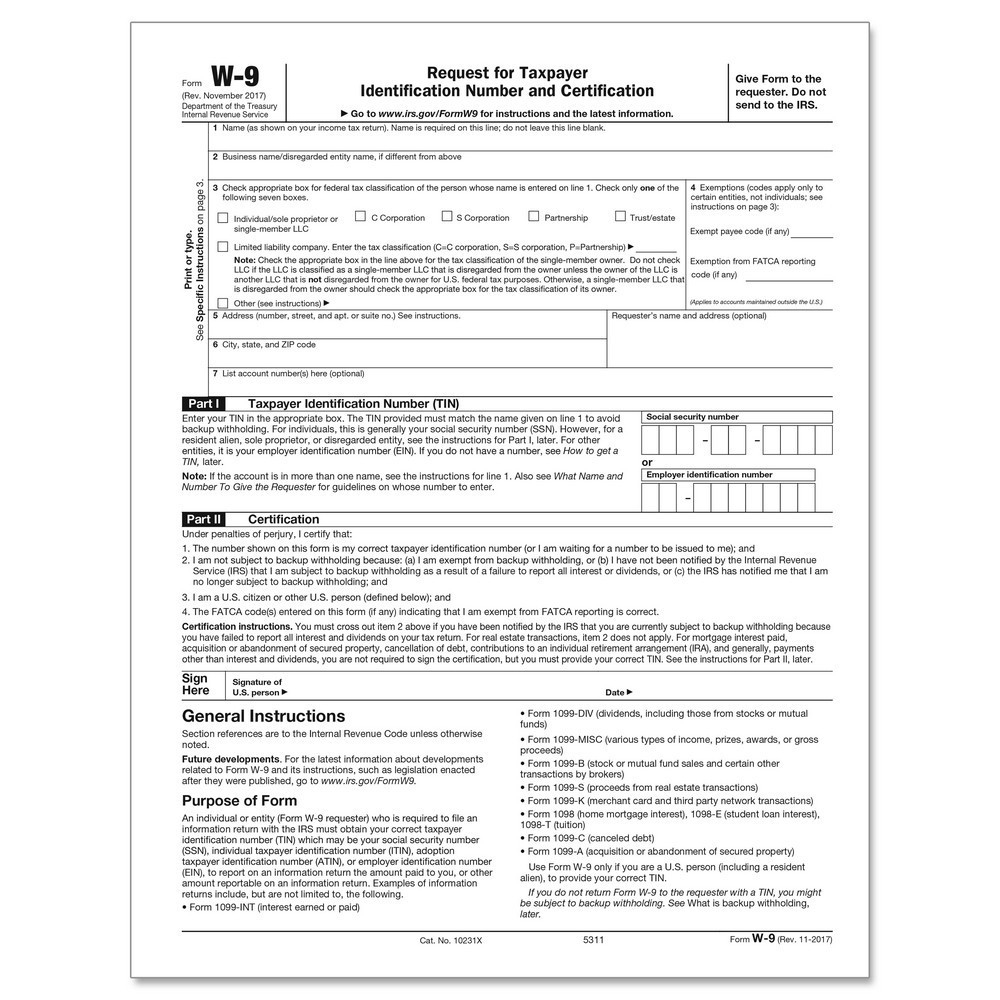

Louisiana W9 Form - Status and avoiding withholding on its allocable share of net income from the partnership conducting a trade or business in the united states is in the following cases: Web popular forms & instructions; Web downloadable forms & informational documents. Person (including a resident alien), to provide your correct tin. What is backup withholding, later. You can register and maintain your profile in lagov here. Find out when all state tax returns are due. November 2017) department of the treasury internal revenue service. See the estimated amount of cap available for solar tax credits and motion picture investor and infrastructure tax credits. Request for taxpayer identification number and certification.

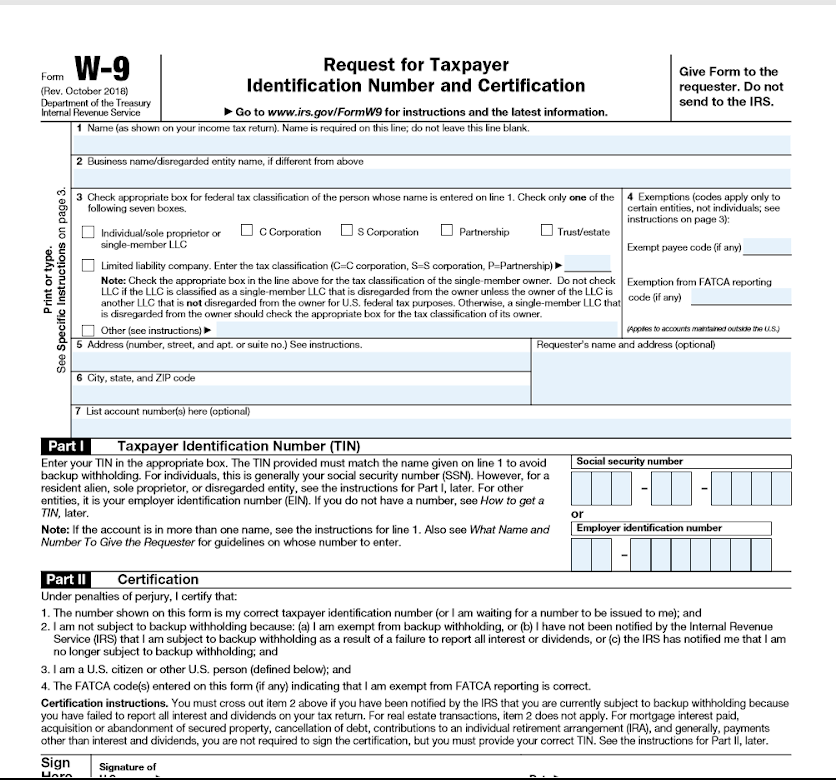

October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification > go to www.irs.gov/formw9 for instructions and the latest information. Request for taxpayer identification number (tin) and certification form 4506. These forms must be completed and sent to start saving program. What is backup withholding, later. Do not send to the irs. Name (as shown on your income tax return). Give form to the requester. Find out when all state tax returns are due. To create a new account or manage an existing account online click log in. File your clients' individual, corporate and composite partnership extension in bulk.

Owner of a disregarded entity and not the entity, To create a new account or manage an existing account online click log in. November 2017) department of the treasury internal revenue service. File your clients' individual, corporate and composite partnership extension in bulk. See the estimated amount of cap available for solar tax credits and motion picture investor and infrastructure tax credits. You must submit a federal w‐9 form (request for taxpayer identification number and certification) before any awards / purchase orders can be issued to your company. Web downloadable forms & informational documents. Give form to the requester. Give form to the requester. Do not send to the irs.

W9 Blank Form For Louisiana 2020 Calendar Template Printable

For individuals, this is your social security number (ssn). Internal revenue service part i taxpayer identification number (tin) enter your tin in the appropriate box. October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification > go to www.irs.gov/formw9 for instructions and the latest information. File your clients' individual, corporate and composite partnership extension.

Blank W9 Form 2020 Printable Calendar Template Printable

Do not send to the irs. To create a new account or manage an existing account online click log in. What is backup withholding, later. File your clients' individual, corporate and composite partnership extension in bulk. Owner of a disregarded entity and not the entity,

W9 Form Louisiana 9 Easy Rules Of W9 Form Louisiana AH STUDIO Blog

Owner of a disregarded entity and not the entity, You must submit a federal w‐9 form (request for taxpayer identification number and certification) before any awards / purchase orders can be issued to your company. Name (as shown on your income tax return). See the estimated amount of cap available for solar tax credits and motion picture investor and infrastructure.

W9 Blank Form For Louisiana 2020 Calendar Template Printable

To create a new account or manage an existing account online click log in. See the estimated amount of cap available for solar tax credits and motion picture investor and infrastructure tax credits. Name (as shown on your income tax return). Do not send to the irs. Do not send to the irs.

W9 Blank Form For Louisiana 2020 Calendar Template Printable

File your clients' individual, corporate and composite partnership extension in bulk. November 2017) department of the treasury internal revenue service. Web popular forms & instructions; Do not send to the irs. See the estimated amount of cap available for solar tax credits and motion picture investor and infrastructure tax credits.

W9 Blank Form For Louisiana 2020 Calendar Template Printable

Web popular forms & instructions; You can register and maintain your profile in lagov here. Name (as shown on your income tax return). These forms must be completed and sent to start saving program. What does my company need to do to become a registered vendor for the state of louisiana?

W9 Download and Print PDF Templates

File your clients' individual, corporate and composite partnership extension in bulk. Status and avoiding withholding on its allocable share of net income from the partnership conducting a trade or business in the united states is in the following cases: Web popular forms & instructions; Request for taxpayer identification number (tin) and certification form 4506. To create a new account or.

Michigan W9 Tax Form

For individuals, this is your social security number (ssn). October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification > go to www.irs.gov/formw9 for instructions and the latest information. Request for taxpayer identification number (tin) and certification form 4506. Do not send to the irs. Do not send to the irs.

W9

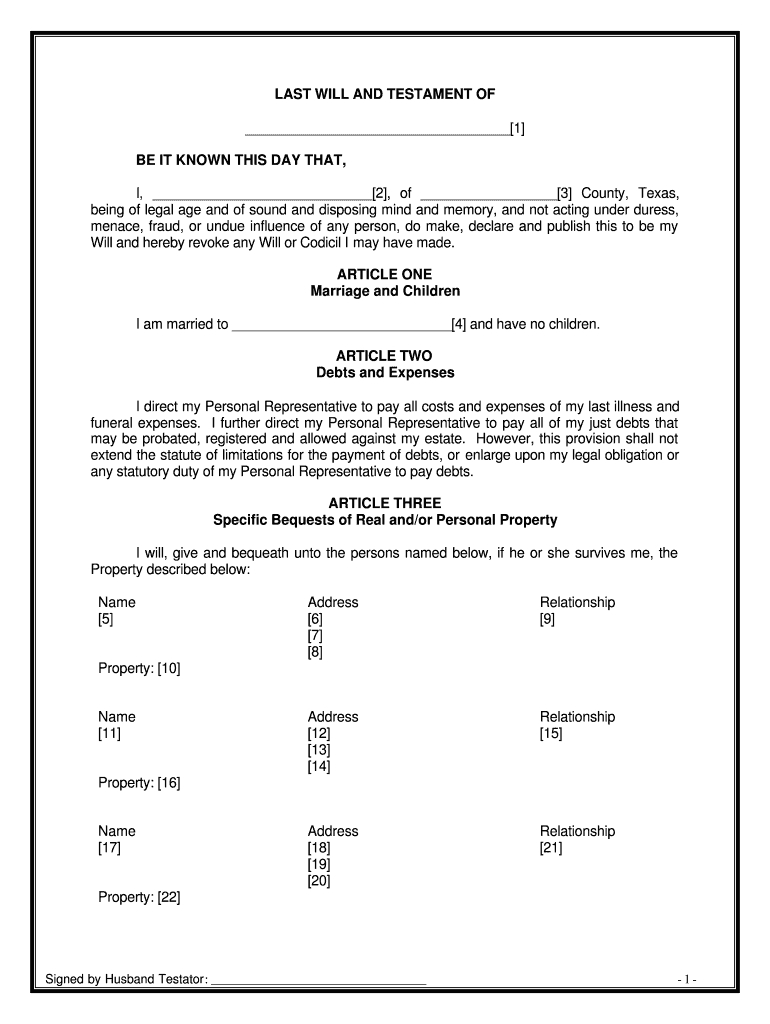

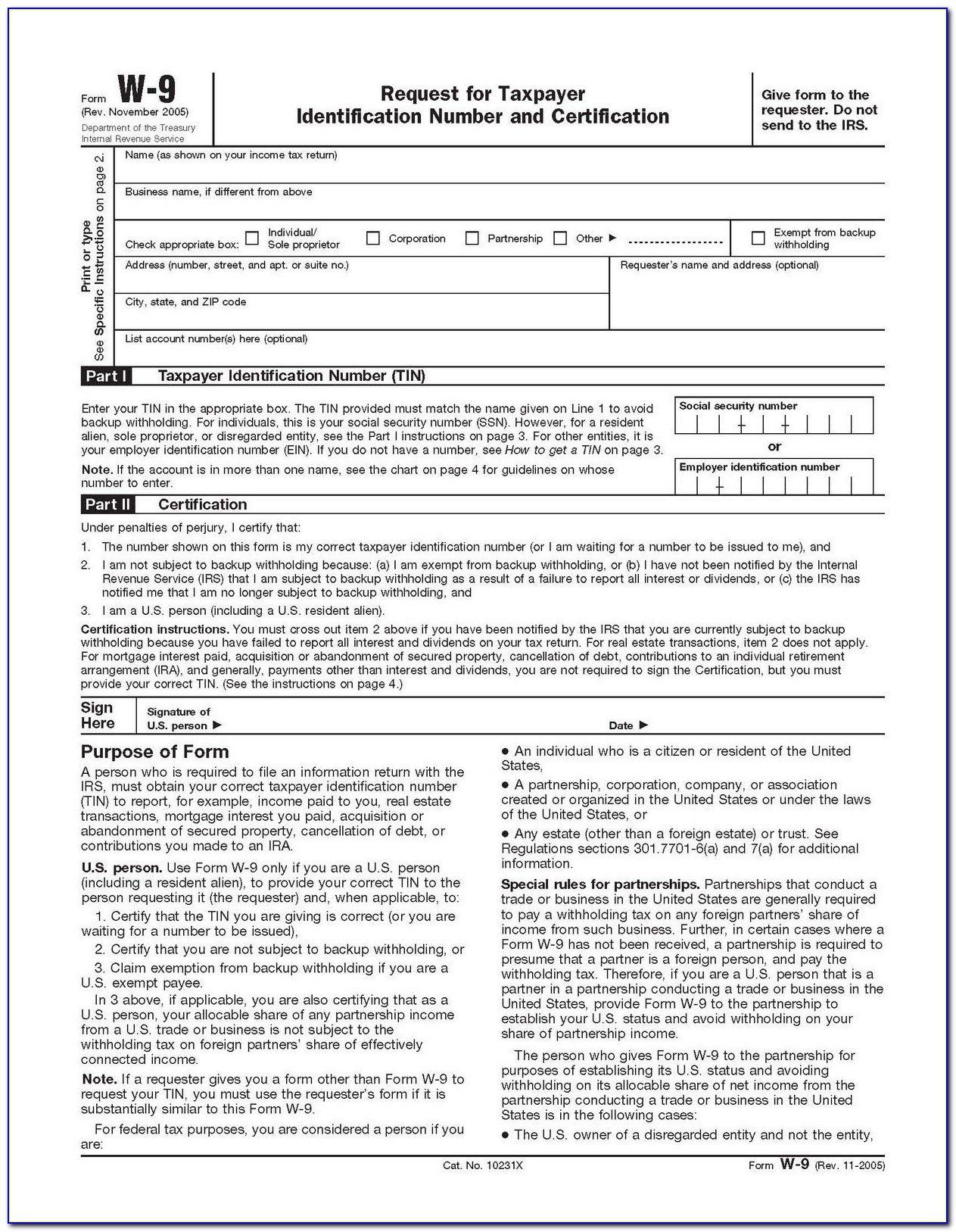

Individual tax return form 1040 instructions; Web downloadable forms & informational documents. Owner of a disregarded entity and not the entity, January 2003) department of the treasury request for taxpayer identification number and certification give form to the requester. Give form to the requester.

How To Fill Out A W9 Form Online Hellosign Blog Free Printable W 9

Request for taxpayer identification number and certification. Individual tax return form 1040 instructions; Request for taxpayer identification number (tin) and certification form 4506. Give form to the requester. Do not send to the irs.

You Must Submit A Federal W‐9 Form (Request For Taxpayer Identification Number And Certification) Before Any Awards / Purchase Orders Can Be Issued To Your Company.

Request for taxpayer identification number and certification. What does my company need to do to become a registered vendor for the state of louisiana? File your clients' individual, corporate and composite partnership extension in bulk. Individual tax return form 1040 instructions;

Give Form To The Requester.

Web downloadable forms & informational documents. Name (as shown on your income tax return). Person (including a resident alien), to provide your correct tin. Do not send to the irs.

Status And Avoiding Withholding On Its Allocable Share Of Net Income From The Partnership Conducting A Trade Or Business In The United States Is In The Following Cases:

Give form to the requester. Owner of a disregarded entity and not the entity, January 2003) department of the treasury request for taxpayer identification number and certification give form to the requester. Web popular forms & instructions;

October 2018) Department Of The Treasury Internal Revenue Service Request For Taxpayer Identification Number And Certification > Go To Www.irs.gov/Formw9 For Instructions And The Latest Information.

These forms must be completed and sent to start saving program. Internal revenue service part i taxpayer identification number (tin) enter your tin in the appropriate box. November 2017) department of the treasury internal revenue service. Do not send to the irs.