Basic Form Perils

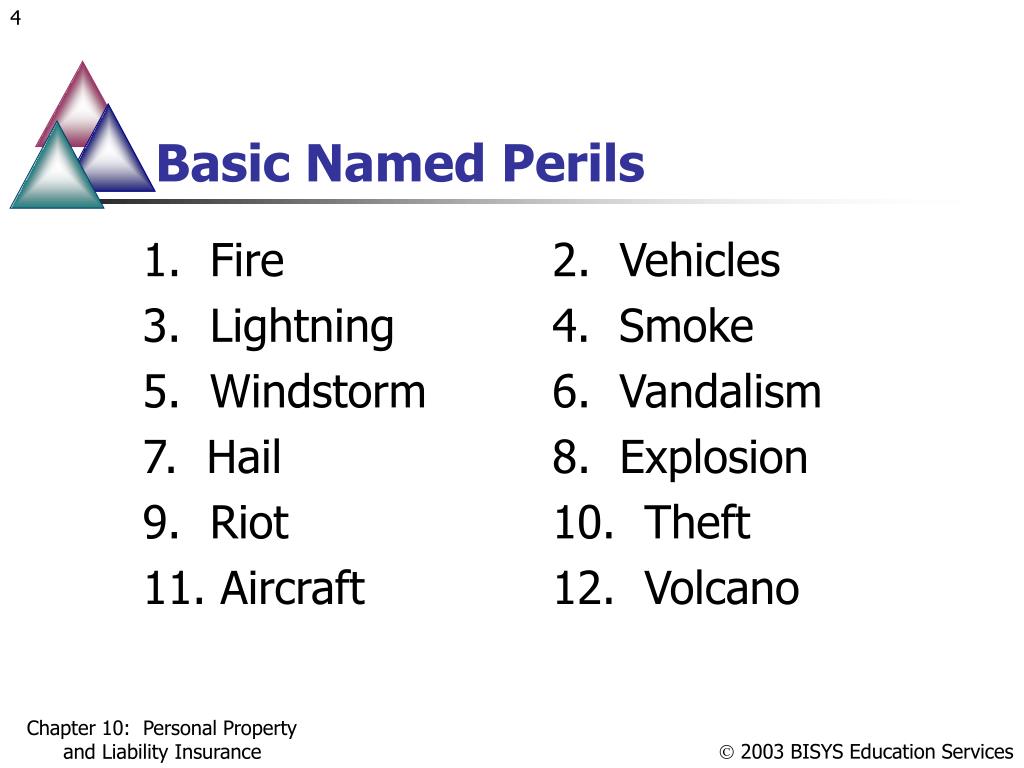

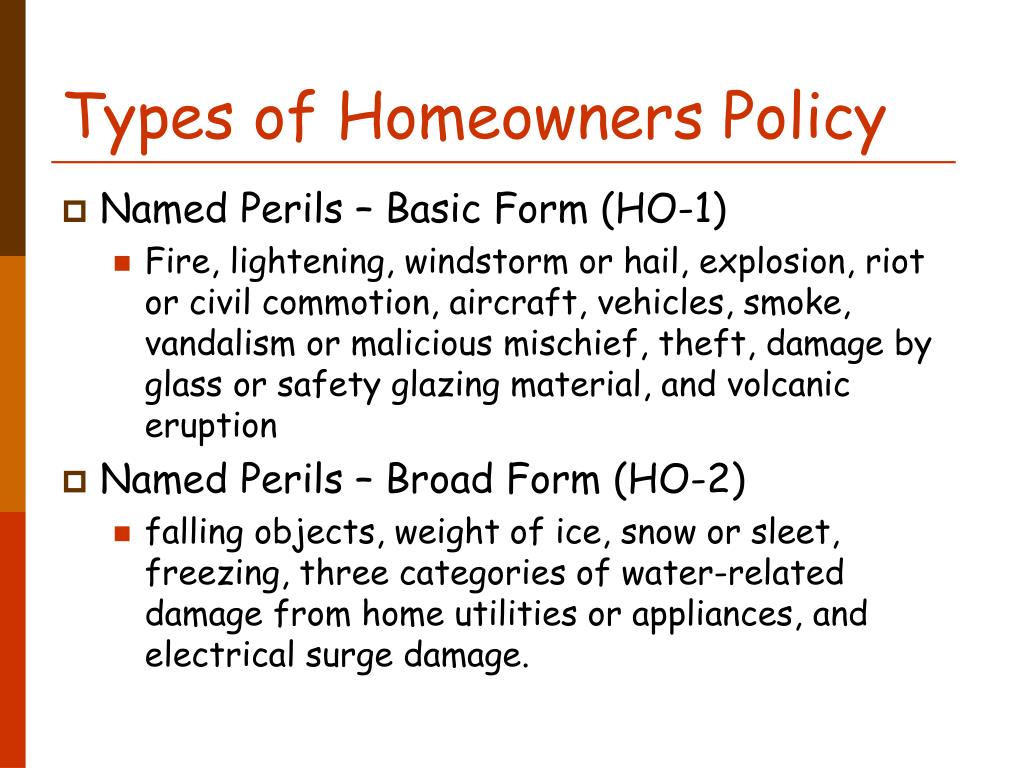

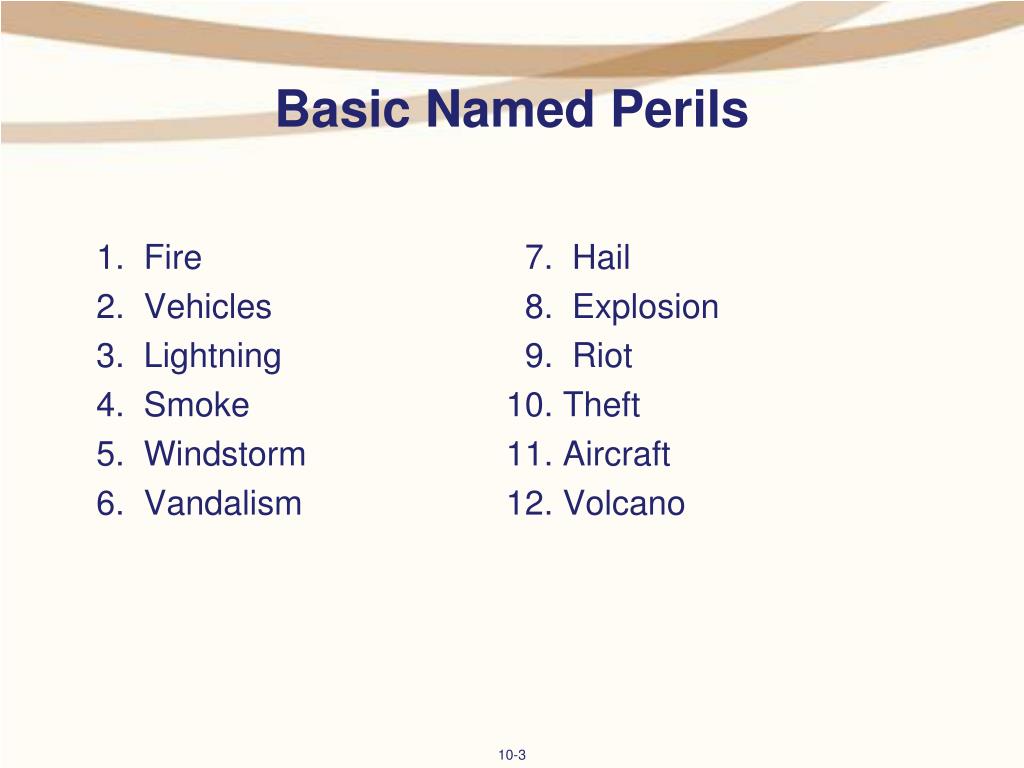

Basic Form Perils - Basic form the basic form is a “named perils” policy. The policy explicitly names what perils are covered and typically covers losses due to: Web basic form this form of coverage is, like its name, the one with the least “extra stuff” included. The basic form insures your property against only a short list of perils named in the policy. Web the basic causes of loss form (cp 10 10) provides coverage for the following named perils: Basic coverage is a “named peril” policy, which means that for a loss to be covered, the peril must be listed by name on the declarations page. Web basic form policies only include coverage for the specifically named perils. Fire or lightning, smoke, windstorm or hail, explosion, riot or civil commotion, aircraft (striking the property), vehicles (striking the property), glass breakage, vandalism & malicious mischief, theft, and volcanic eruption. Fire, lightning, explosion, smoke, windstorm, hail, riot, civil commotion, aircraft, vehicles, vandalism, sprinkler leakage, sinkhole collapse, and volcanic action. The broad form is not offered nearly as often, but we will cover it as well.

Web the basic causes of loss form (cp 10 10) provides coverage for the following named perils: The broad form is not offered nearly as often, but we will cover it as well. Web the named perils covered in a basic form include: What this equates to that if a coverage is not specifically listed, or named, in the insurance policy, there is no coverage. Web many of the common insurance coverages in a basic form include the following: This is the most common type of. The policy explicitly names what perils are covered and typically covers losses due to: Fire, lightning, explosion, smoke, windstorm, hail, riot, civil commotion, aircraft, vehicles, vandalism, sprinkler leakage, sinkhole collapse, and volcanic action. Web basic form covers these 11 “perils” or causes of loss: The basic form insures your property against only a short list of perils named in the policy.

Basic form policies are typically very restricted and should be considered with caution. Web basic form this form of coverage is, like its name, the one with the least “extra stuff” included. Web the basic causes of loss form (cp 10 10) provides coverage for the following named perils: The policy explicitly names what perils are covered and typically covers losses due to: Web the named perils covered in a basic form include: What this equates to that if a coverage is not specifically listed, or named, in the insurance policy, there is no coverage. Web basic is the least inclusive of the three coverage forms because it covers only named perils. Web nreig offers either a basic or special coverage form option. You’ll have coverage for 11 perils and those 11 perils only. Web basic form policies only include coverage for the specifically named perils.

Is It Covered? Burst Pipes Insurance NREIG

Web basic form policies only include coverage for the specifically named perils. Fire lightning windstorm or hail explosion smoke vandalism aircraft or vehicle collision riot or civil commotion sinkhole collapse volcanic activity It is the silver package of the three forms and gives you the bare minimum for the most common losses that can take place. The broad form policy.

PPT Chapter 10 PowerPoint Presentation, free download ID3201947

Web basic form policies only include coverage for the specifically named perils. Web basic form this form of coverage is, like its name, the one with the least “extra stuff” included. This is the most common type of. The policy explicitly names what perils are covered and typically covers losses due to: Basic form the basic form is a “named.

PPT Chapter 10 PowerPoint Presentation, free download ID68509

The policy explicitly names what perils are covered and typically covers losses due to: Web the named perils covered in a basic form include: You’ll have coverage for 11 perils and those 11 perils only. This is the most common type of. Web nreig offers either a basic or special coverage form option.

PPT Chapter 10 PowerPoint Presentation, free download ID68509

The broad form is not offered nearly as often, but we will cover it as well. Basic form policies are typically very restricted and should be considered with caution. This is the most common type of. Web basic form covers these 11 “perils” or causes of loss: Fire or lightning, smoke, windstorm or hail, explosion, riot or civil commotion, aircraft.

Covered Perils Broad form vs. Basic Form • REI Choice Insurance

Basic coverage is a “named peril” policy, which means that for a loss to be covered, the peril must be listed by name on the declarations page. The broad form policy includes all of the basic form perils, plus other named perils such as theft and. The basic form insures your property against only a short list of perils named.

PPT Topic 13. Homeowners Insurance PowerPoint Presentation, free

Basic form policies are typically very restricted and should be considered with caution. Web nreig offers either a basic or special coverage form option. Web the named perils covered in a basic form include: The policy explicitly names what perils are covered and typically covers losses due to: • fire • lightning • windstorm or hail • explosion • smoke.

Peril classification at the Family, Main Event and Peril levels without

• fire • lightning • windstorm or hail • explosion • smoke • vandalism • aircraft or vehicle collision • riot or civil commotion • sinkhole collapse • volcanic activity hiring a subcontractor, what you need to know for. Web basic form covers these 11 “perils” or causes of loss: It is the silver package of the three forms and.

Revised ABC's and 123's Part 2 Non CA Specific

Fire or lightning, smoke, windstorm or hail, explosion, riot or civil commotion, aircraft (striking the property), vehicles (striking the property), glass breakage, vandalism & malicious mischief, theft, and volcanic eruption. Web covered perils basic form. You’ll have coverage for 11 perils and those 11 perils only. Basic form policies are typically very restricted and should be considered with caution. Basic.

Great Lakes Mutual Insurance Dwelling Properties Insurance

Web nreig offers either a basic or special coverage form option. Web covered perils basic form. Web many of the common insurance coverages in a basic form include the following: Web basic form covers these 11 “perils” or causes of loss: This is the most common type of.

PPT Chapter 10 PowerPoint Presentation, free download ID3201947

Basic coverage is a “named peril” policy, which means that for a loss to be covered, the peril must be listed by name on the declarations page. Web basic is the least inclusive of the three coverage forms because it covers only named perils. Basic form policies are typically very restricted and should be considered with caution. It is the.

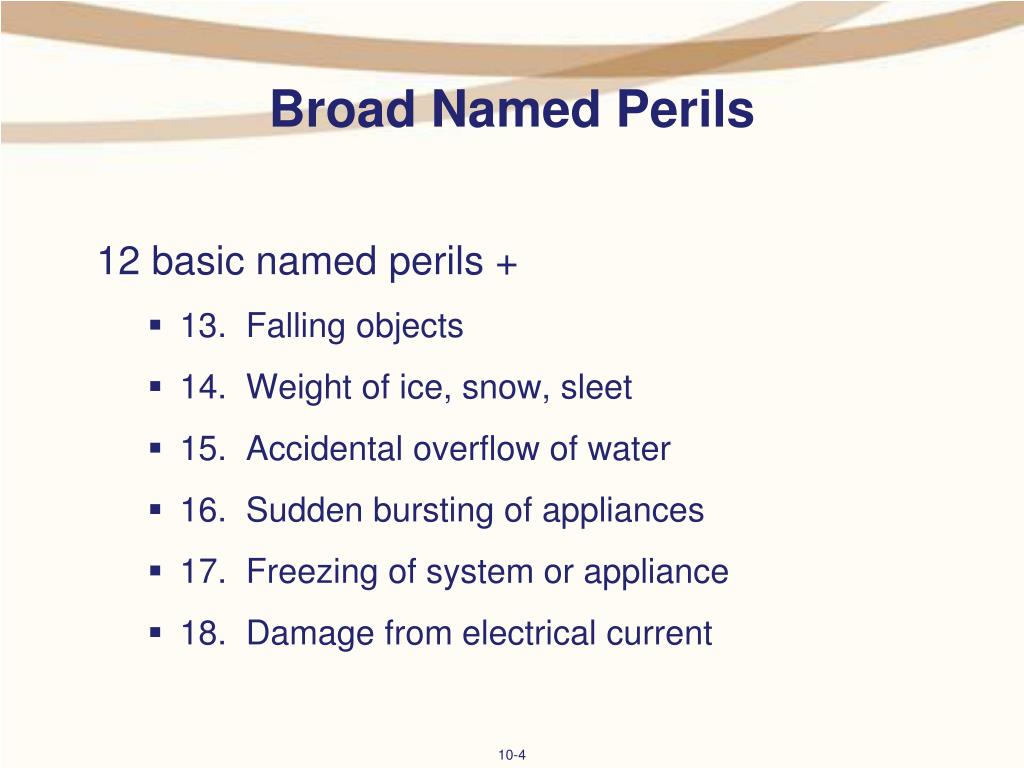

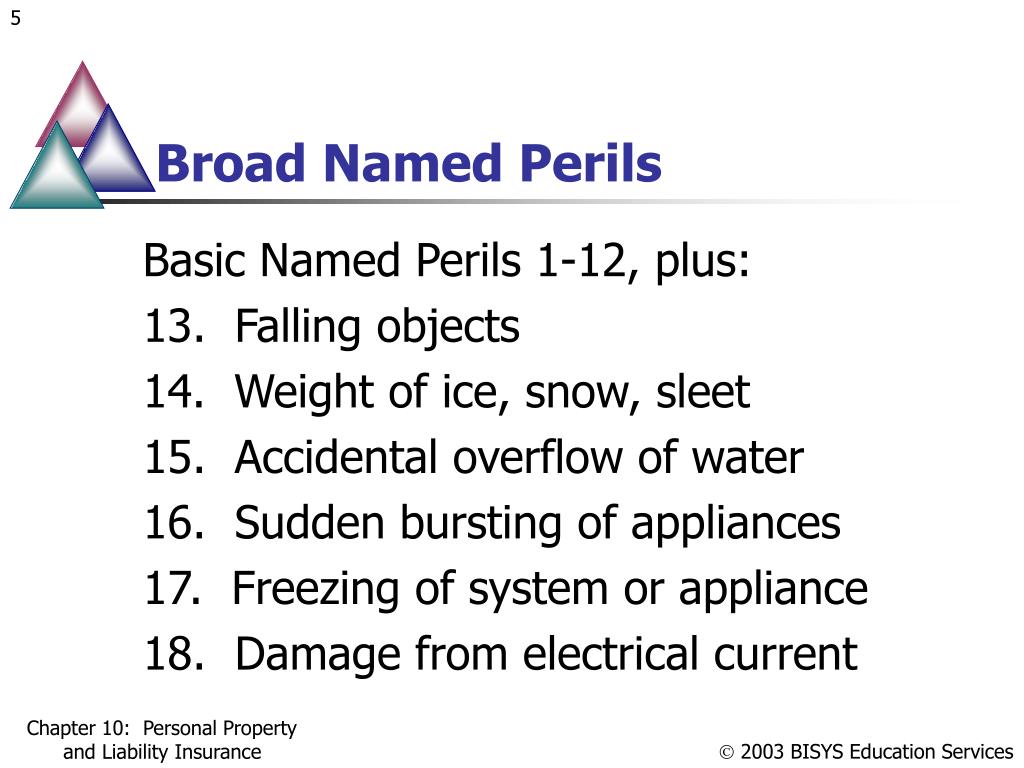

The Broad Form Is Not Offered Nearly As Often, But We Will Cover It As Well.

The policy explicitly names what perils are covered and typically covers losses due to: Fire lightning windstorm or hail explosion smoke vandalism aircraft or vehicle collision riot or civil commotion sinkhole collapse volcanic activity Basic coverage is a “named peril” policy, which means that for a loss to be covered, the peril must be listed by name on the declarations page. The broad form policy includes all of the basic form perils, plus other named perils such as theft and.

This Is The Most Common Type Of.

Web many of the common insurance coverages in a basic form include the following: • fire • lightning • windstorm or hail • explosion • smoke • vandalism • aircraft or vehicle collision • riot or civil commotion • sinkhole collapse • volcanic activity hiring a subcontractor, what you need to know for. Web basic is the least inclusive of the three coverage forms because it covers only named perils. Web basic form covers these 11 “perils” or causes of loss:

The Basic Form Insures Your Property Against Only A Short List Of Perils Named In The Policy.

Basic form the basic form is a “named perils” policy. Fire, lightning, explosion, smoke, windstorm, hail, riot, civil commotion, aircraft, vehicles, vandalism, sprinkler leakage, sinkhole collapse, and volcanic action. You’ll have coverage for 11 perils and those 11 perils only. Web covered perils basic form.

Web Basic Form This Form Of Coverage Is, Like Its Name, The One With The Least “Extra Stuff” Included.

What this equates to that if a coverage is not specifically listed, or named, in the insurance policy, there is no coverage. Basic form policies are typically very restricted and should be considered with caution. Web basic form policies only include coverage for the specifically named perils. Fire or lightning, smoke, windstorm or hail, explosion, riot or civil commotion, aircraft (striking the property), vehicles (striking the property), glass breakage, vandalism & malicious mischief, theft, and volcanic eruption.