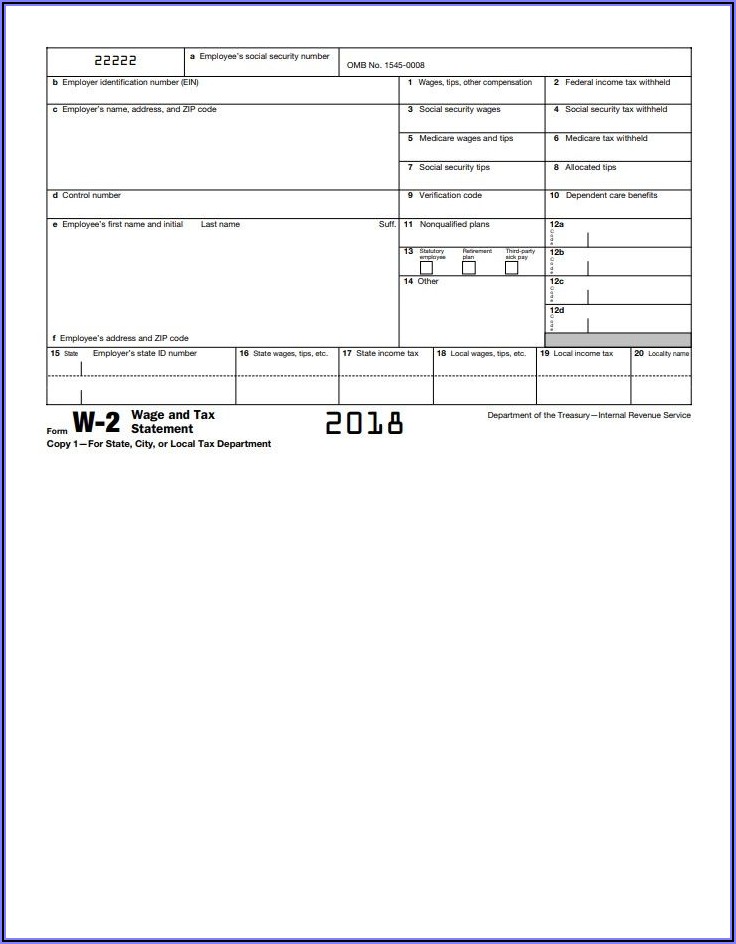

Fake 1099 Tax Form

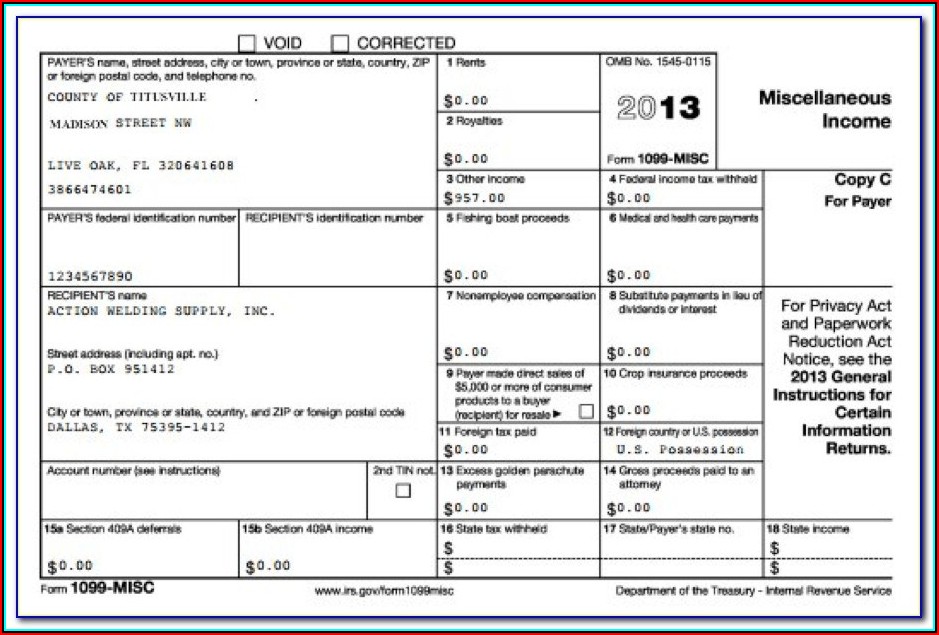

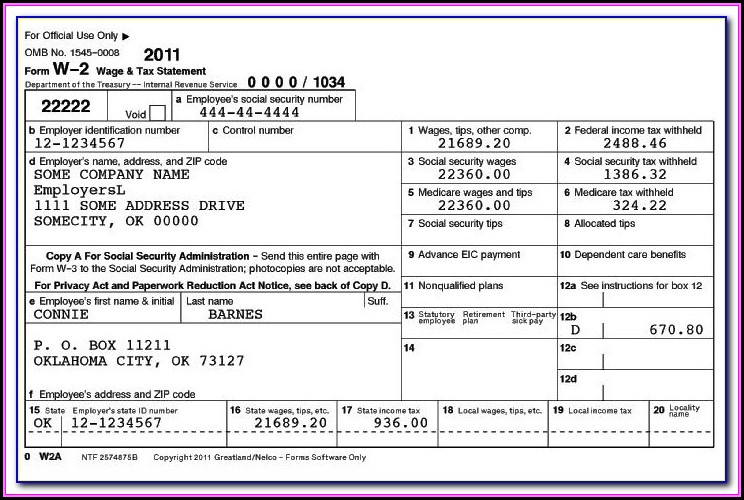

Fake 1099 Tax Form - The irs cautions taxpayers to avoid getting caught up in schemes disguised as a debt payment option for credit cards or mortgage debt. The form reports the interest income you. Web some individuals or entities may create fake 1099 forms to falsely report income or payments made to someone. Do not miss the deadline Web form 1099 is one of several irs tax forms (see the variants section) used in the united states to prepare and file an information return to report various types of income other. Web a false or altered document failure to pay tax unreported income organized crime failure to withhold failure to follow the tax laws rewards to claim a reward for. Register and subscribe now to work on irs nonemployee compensation & more fillable forms. Fraudsters (identity thieves, cybercriminals, and other scammers). At least $10 of royalties or brokerage payments instead of dividends or tax. Web form 1099 misc must be completed and filed for each person paid by your company during the year:

Register and subscribe now to work on irs nonemployee compensation & more fillable forms. Many other versions of a 1099 form also can. Web a ma msa is an archer msa chosen by medicare to be used solely to pay qualified medical expenses of the account holder enrolled in medicare. The form reports the interest income you. Web payments made on these fraudulent claims went to the identity thieves. Web washington — the internal revenue service today warned taxpayers to avoid schemes involving falsifying income, including the creation of bogus forms 1099. Web if you continue to run in to problems addressing an incorrect 1099, legal representation may be your best option. This is a form of tax fraud and can result in. Web form 1099 is one of several irs tax forms (see the variants section) used in the united states to prepare and file an information return to report various types of income other. Fraudsters (identity thieves, cybercriminals, and other scammers).

Fraudsters (identity thieves, cybercriminals, and other scammers). Web taxpayers and tax professionals should be alert to fake communications from scammers posing as legitimate organizations in the tax and financial community,. Web washington — the internal revenue service today warned taxpayers to avoid schemes involving falsifying income, including the creation of bogus forms 1099. Web payments made on these fraudulent claims went to the identity thieves. Do not miss the deadline Web then he got a bogus 1099. Web in recent years, the irs has observed variations of these scams where fake irs documents are used in to lend legitimacy to the bogus request. The payer fills out the 1099 form and sends copies to you and. Web form 1099 is one of several irs tax forms (see the variants section) used in the united states to prepare and file an information return to report various types of income other. Fill, edit, sign, download & print.

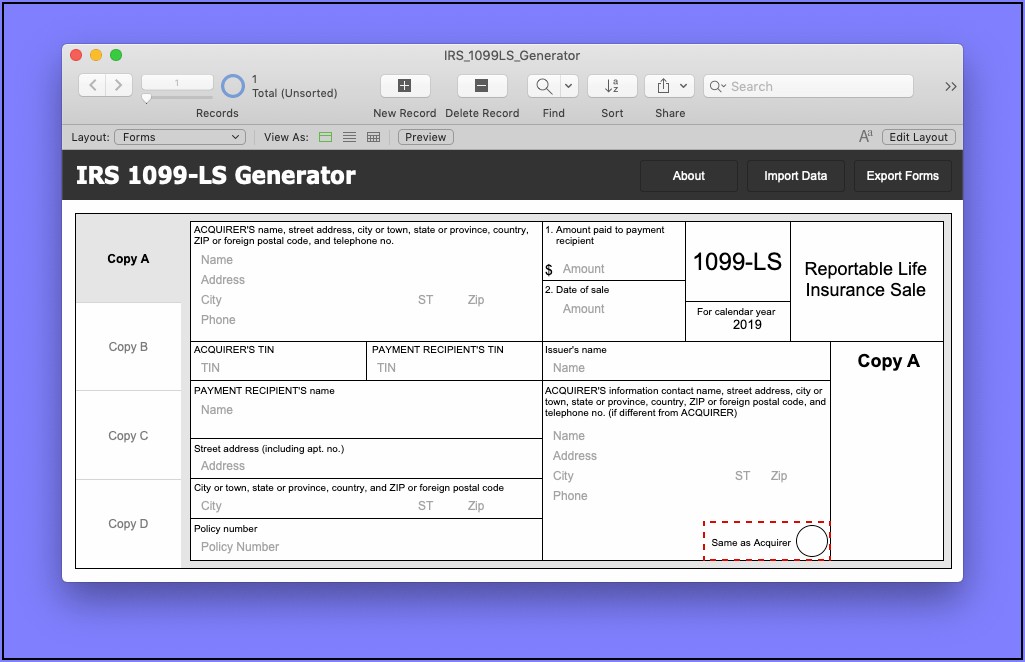

Fake 1099 Form Generator Form Resume Examples nO9bzmvA94

Someone used his social security number to get contract work with an arizona company. Web washington — the internal revenue service today warned taxpayers to avoid schemes involving falsifying income, including the creation of bogus forms 1099. At least $10 of royalties or brokerage payments instead of dividends or tax. Web then he got a bogus 1099. Ad get the.

Tax Form 1099 DIV Federal Copy A Free Shipping

Fake form 1099 scams, falsified income make 2019 “dirty dozen” tax fraud list irs cautions against “falsifying income” on your return this tax season. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. This is a form of tax fraud and.

Download Form 1099 Misc 2018 Form Resume Examples L71x2ky3MX

Fraudsters (identity thieves, cybercriminals, and other scammers). Web payments made on these fraudulent claims went to the identity thieves. Web taxpayers and tax professionals should be alert to fake communications from scammers posing as legitimate organizations in the tax and financial community,. Fill, edit, sign, download & print. Web a 1099 form is a record that an entity or person.

Example Of Non Ssa 1099 Form / Printable IRS Form 1099MISC for 2015

The form reports the interest income you. Employment authorization document issued by the department of homeland. Web a ma msa is an archer msa chosen by medicare to be used solely to pay qualified medical expenses of the account holder enrolled in medicare. Fake form 1099 scams, falsified income make 2019 “dirty dozen” tax fraud list irs cautions against “falsifying.

1099 Int Form Fillable Pdf Template Download Here!

Ad get the latest 1099 misc online. The attorneys at robinson & henry can help. Many other versions of a 1099 form also can. Web this little known plugin reveals the answer. Web form 1099 misc must be completed and filed for each person paid by your company during the year:

Irs Printable 1099 Form Printable Form 2022

Web washington — the internal revenue service today warned taxpayers to avoid schemes involving falsifying income, including the creation of bogus forms 1099. Web form 1099 misc must be completed and filed for each person paid by your company during the year: Ad get the latest 1099 misc online. Web a 1099 form is a record that an entity or.

form 1099 Gary M. Kaplan, C.P.A., P.A.

Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Fraudsters (identity thieves, cybercriminals, and other scammers). Web a 1099 form is a record that an entity or person other than your employer gave or paid you money. If the fake form.

Fake 1099 Forms Online Form Resume Examples aL16Ngy1X7

The form reports the interest income you. Ad get the latest 1099 misc online. Someone used his social security number to get contract work with an arizona company. Web form 1099 misc must be completed and filed for each person paid by your company during the year: Register and subscribe now to work on irs nonemployee compensation & more fillable.

Fake 1099 Form Generator Form Resume Examples nO9bzmvA94

Web instructions for recipient recipient’s taxpayer identification number (tin). The form reports the interest income you. Do not miss the deadline The payer fills out the 1099 form and sends copies to you and. Web this little known plugin reveals the answer.

Fake 1099 Forms Form Resume Examples xz20dnd2ql

Ad get the latest 1099 misc online. The irs cautions taxpayers to avoid getting caught up in schemes disguised as a debt payment option for credit cards or mortgage debt. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web a.

This Is A Form Of Tax Fraud And Can Result In.

Web washington — the internal revenue service today warned taxpayers to avoid schemes involving falsifying income, including the creation of bogus forms 1099. Web form 1099 misc must be completed and filed for each person paid by your company during the year: Many other versions of a 1099 form also can. The form reports the interest income you.

Web In Recent Years, The Irs Has Observed Variations Of These Scams Where Fake Irs Documents Are Used In To Lend Legitimacy To The Bogus Request.

Register and subscribe now to work on irs nonemployee compensation & more fillable forms. Web if you continue to run in to problems addressing an incorrect 1099, legal representation may be your best option. The irs cautions taxpayers to avoid getting caught up in schemes disguised as a debt payment option for credit cards or mortgage debt. Fraudsters (identity thieves, cybercriminals, and other scammers).

Fill, Edit, Sign, Download & Print.

Ad get the latest 1099 misc online. Web a ma msa is an archer msa chosen by medicare to be used solely to pay qualified medical expenses of the account holder enrolled in medicare. Web then he got a bogus 1099. Web form 1099 is one of several irs tax forms (see the variants section) used in the united states to prepare and file an information return to report various types of income other.

The Attorneys At Robinson & Henry Can Help.

Web payments made on these fraudulent claims went to the identity thieves. For your protection, this form may show only the last four digits of your social security number. Web instructions for recipient recipient’s taxpayer identification number (tin). Do not miss the deadline