Az Form 309 Instructions

Az Form 309 Instructions - Enjoy smart fillable fields and interactivity. Activate the wizard mode on the top toolbar to obtain more recommendations. Web the income must have its source within arizona. 9 enter the amount of personal exemption claimed on arizona form 140, page 1, line 18 plus the amount. Web according to arizona form 309 instructions: Please see arizona form 309 instructions or income tax ruling. Web 2022 include with your return. Arizona credit for taxes paid to another state or country (form 309) form 309 is used to claim credit in arizona for taxes paid to another state or country. Web home forms tax credits forms nonrefundable individual tax credits and recapture nonrefundable individual tax credits and recapture summarization of. Web credit for taxes paid to another state or country arizona form 309 arizona form 309 2020 credit for taxes paid to another state or country include with your return.

Web credit for taxes paid to another state or country arizona form 309 arizona form 309 2020 credit for taxes paid to another state or country include with your return. Web the income must have its source within arizona. Web arizona form 309credit for taxes paid to another state or country2014 include with your return. Web home forms tax credits forms nonrefundable individual tax credits and recapture nonrefundable individual tax credits and recapture summarization of. Web arizona — credit for taxes paid to another state or country download this form print this form it appears you don't have a pdf plugin for this browser. Web 24 rows a nonrefundable individual tax credit against income tax imposed. Get your online template and fill it in using progressive features. If claiming a credit for more than one. Web 309 credit for taxes paid to another state or country 2020 arizona form 309credit for taxes paid to another state or country2020 include with your return. Web select the get form button to start modifying.

A separate form must be filed for each state or country for which a credit is. Web page 5 of the instructions for a list of state abbreviations. Enjoy smart fillable fields and interactivity. 9 enter the amount of personal exemption claimed on arizona form 140, page 1, line 18 plus the amount. Complete this form only if you. As an arizona resident, nonresident returns filed with the following states qualify for the credit: Web on july 9, 2021 governor ducey signed into law senate bill 1783 establishing title 43 chapter 17 (small businesses, which provides for an alternative tax for arizona small. Its purpose is to calculate the income subject to tax. Web arizona form 309credit for taxes paid to another state or country2014 include with your return. Web per the az form 309 instructions:

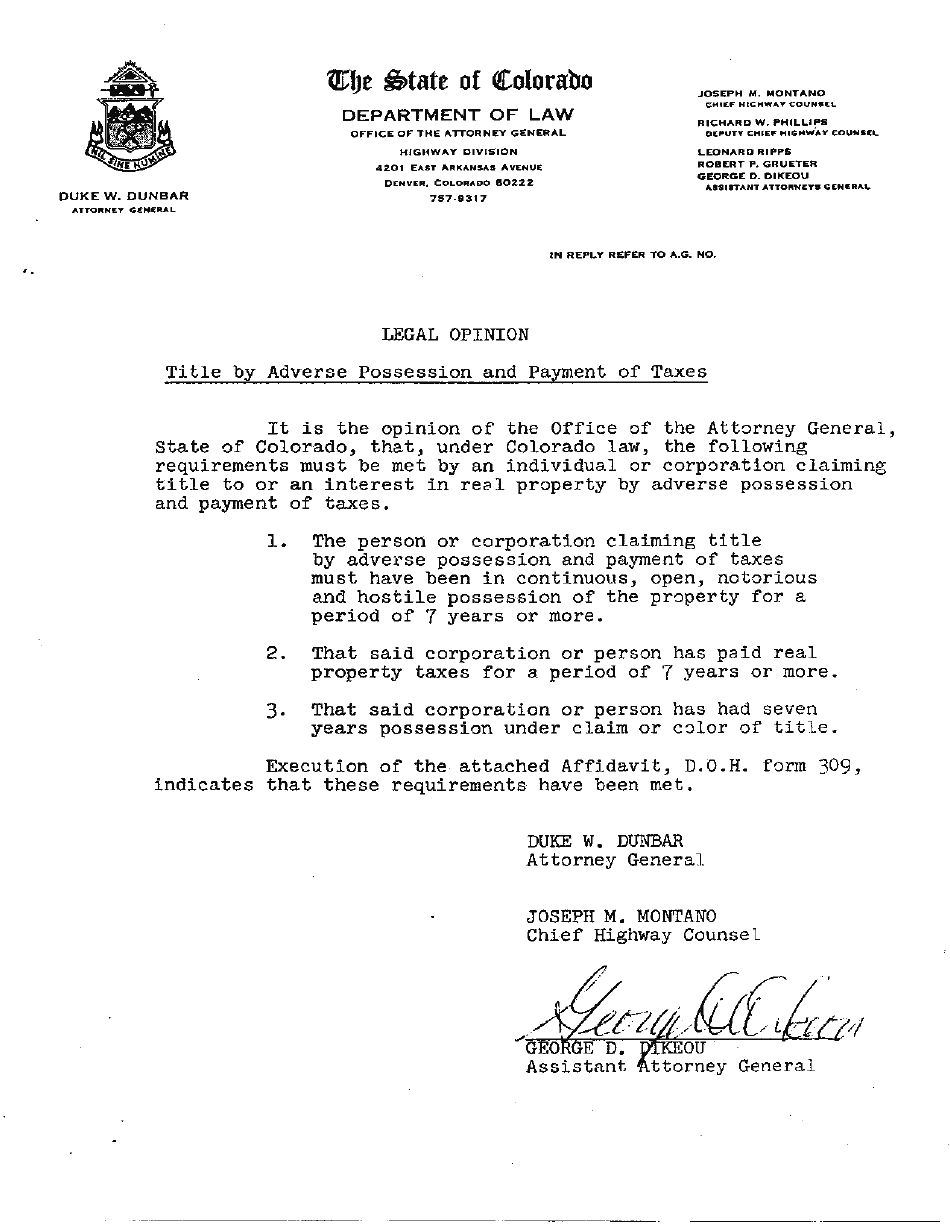

CDOT Form 309 Download Printable PDF or Fill Online Affidavit of Title

Get your online template and fill it in using progressive features. Web according to arizona form 309 instructions: Web page 5 of the instructions for a list of state abbreviations. Complete this form only if you. Web on july 9, 2021 governor ducey signed into law senate bill 1783 establishing title 43 chapter 17 (small businesses, which provides for an.

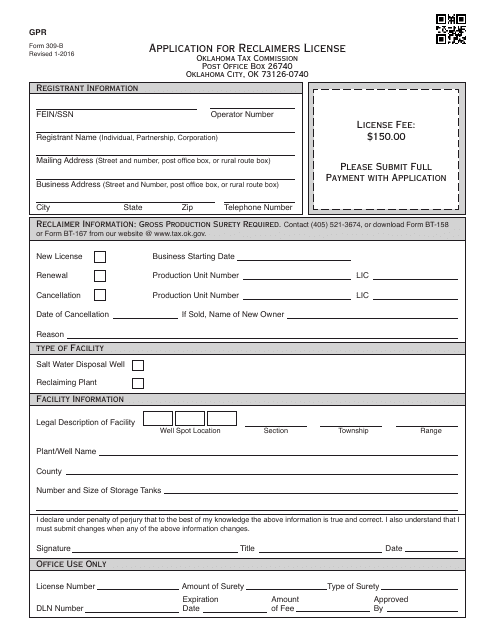

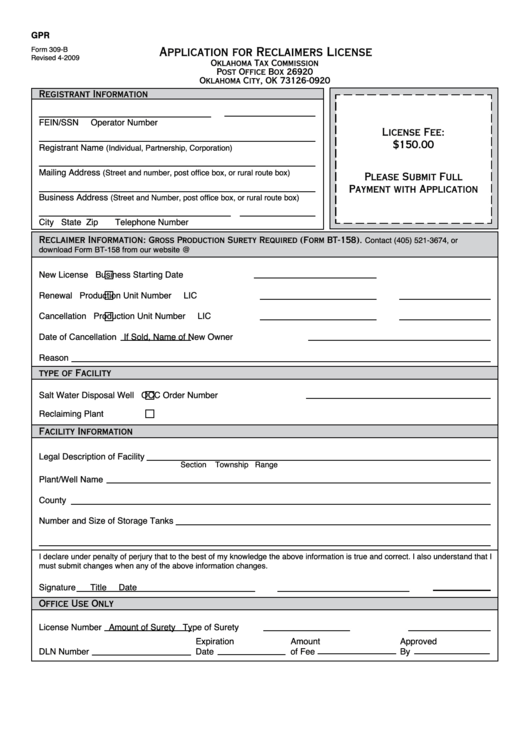

OTC Form 309B Download Printable PDF or Fill Online Application for

9 enter the amount of personal exemption claimed on arizona form 140, page 1, line 18 plus the amount. Activate the wizard mode on the top toolbar to obtain more recommendations. Web the income must have its source within arizona. Arizona credit for taxes paid to another state or country (form 309) form 309 is used to claim credit in.

20192023 Form SC DoR I309 Fill Online, Printable, Fillable, Blank

Web select the get form button to start modifying. Web page 5 of the instructions for a list of state abbreviations. Complete this form only if you. Web according to arizona form 309 instructions: A separate form must be filed for each state or country for which a credit is claimed.

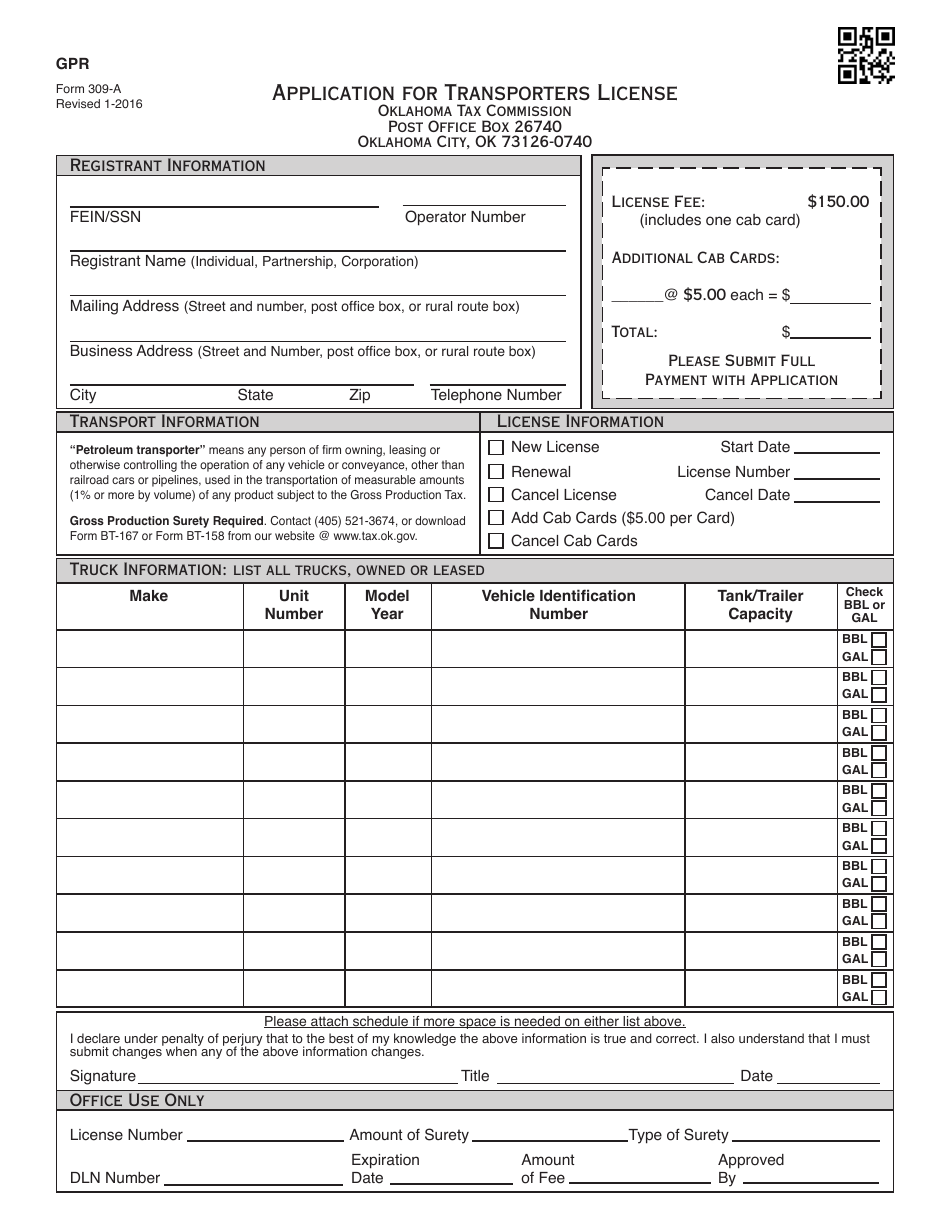

OTC Form 309A Download Printable PDF or Fill Online Application for

Web per the az form 309 instructions: Web 309 credit for taxes paid to another state or country 2020 arizona form 309credit for taxes paid to another state or country2020 include with your return. A separate form must be filed for each state or country for which a credit is. Enjoy smart fillable fields and interactivity. Web on july 9,.

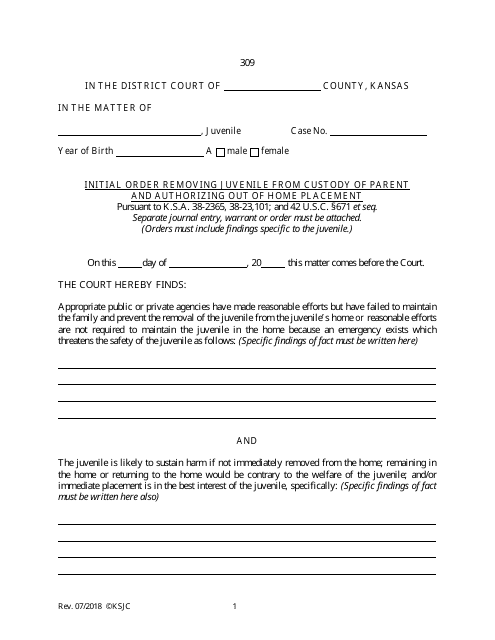

Form 309 Download Fillable PDF or Fill Online Initial Order Removing

If claiming a credit for more than one. Web page 5 of the instructions for a list of state abbreviations. As an arizona resident, nonresident returns filed with the following states qualify for the credit: Web those individuals taxed on income earned in another state and in arizona may earn a credit for taxes paid. Fill out each fillable area.

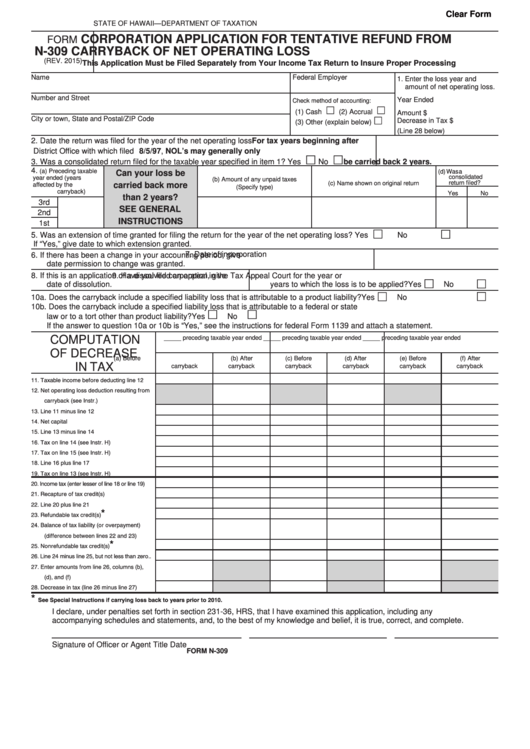

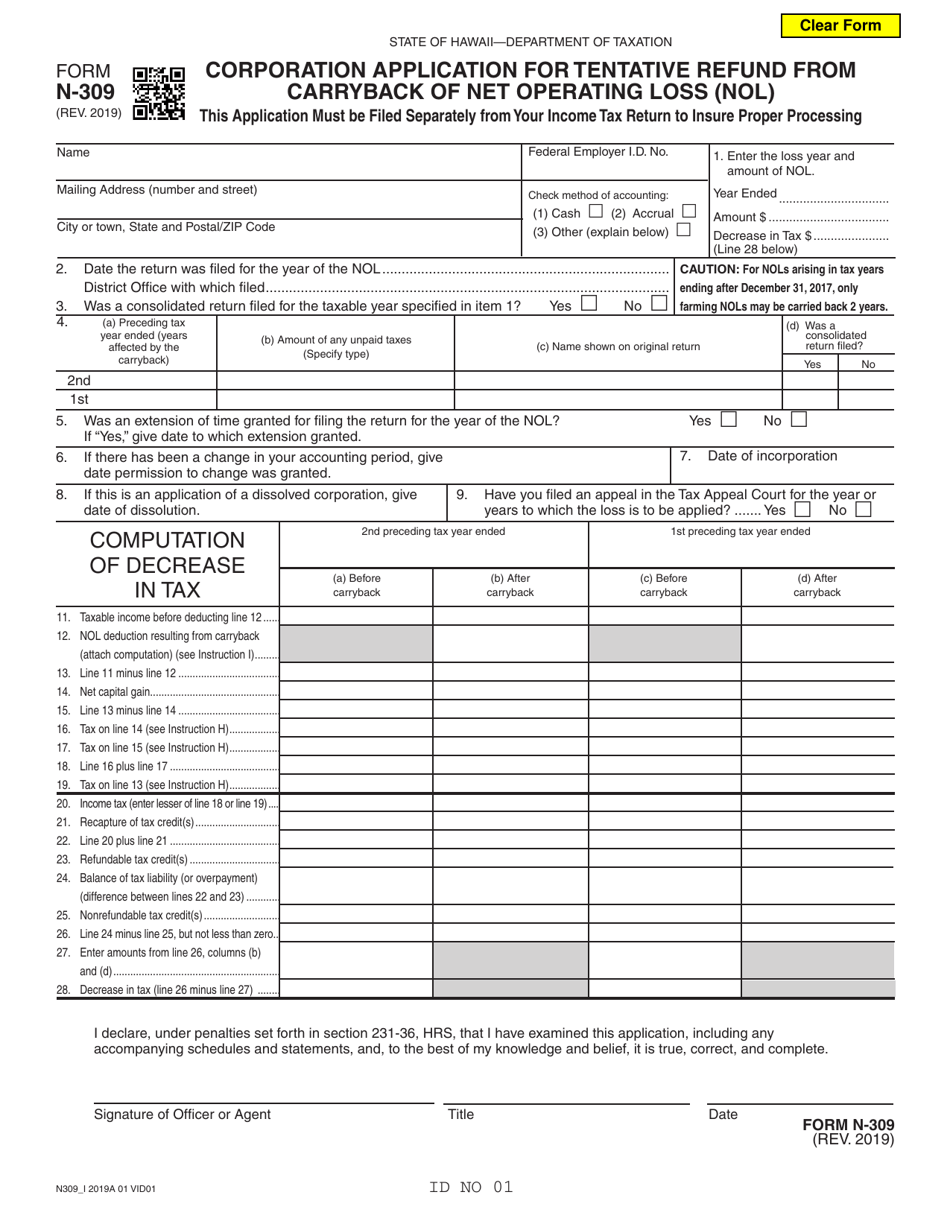

Fillable Form N309 Corporation Application For Tentative Refund From

Enjoy smart fillable fields and interactivity. Web on july 9, 2021 governor ducey signed into law senate bill 1783 establishing title 43 chapter 17 (small businesses, which provides for an alternative tax for arizona small. Web arizona form 309credit for taxes paid to another state or country2014 include with your return. Complete this form only if you. Web per the.

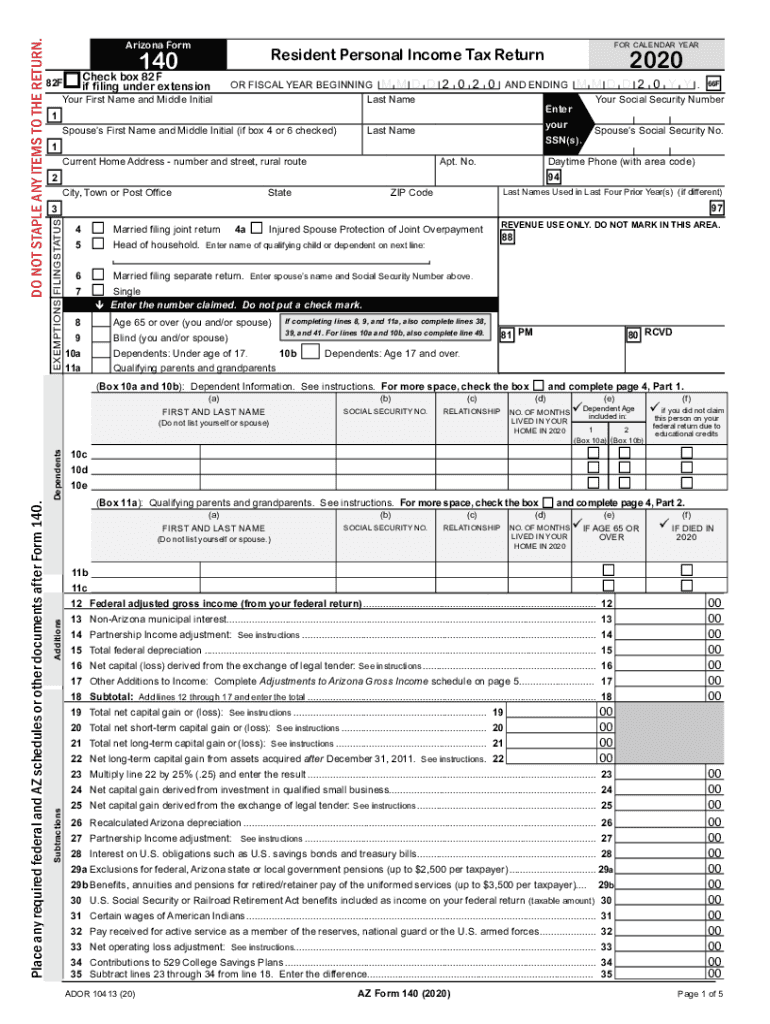

2020 AZ Form 140 Fill Online, Printable, Fillable, Blank pdfFiller

If claiming a credit for more than one. Web page 5 of the instructions for a list of state abbreviations. Web 309 credit for taxes paid to another state or country 2020 arizona form 309credit for taxes paid to another state or country2020 include with your return. 9 enter the amount of personal exemption claimed on arizona form 140, page.

Form 309B Application For Reclaimers License 2009 printable pdf

A separate form must be filed for each state or country for which a credit is. As an arizona resident, nonresident returns filed with the following states qualify for the credit: Web 309 credit for taxes paid to another state or country 2020 arizona form 309credit for taxes paid to another state or country2020 include with your return. Its purpose.

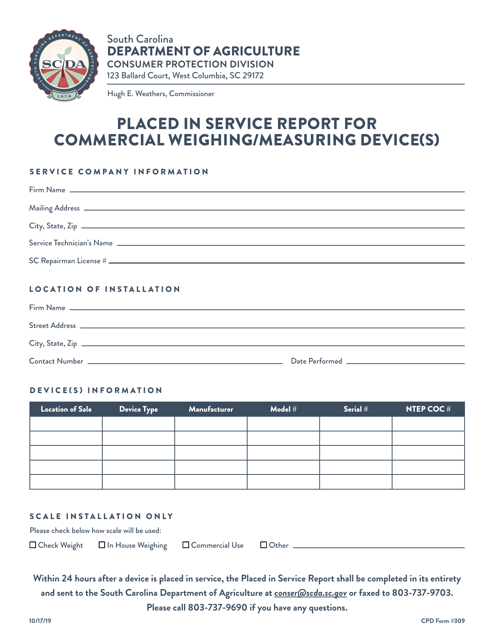

CPD Form 309 Download Fillable PDF or Fill Online Placed in Service

Its purpose is to calculate the income subject to tax. As an arizona resident, nonresident returns filed with the following states qualify for the credit: Web page 5 of the instructions for a list of state abbreviations. Web the income must have its source within arizona. Web credit for taxes paid to another state or country arizona form 309 arizona.

Form N309 Download Fillable PDF or Fill Online Corporation Application

Web 309 credit for taxes paid to another state or country 2020 arizona form 309credit for taxes paid to another state or country2020 include with your return. If claiming a credit for more than one. Web per the az form 309 instructions: As an arizona resident, nonresident returns filed with the following states qualify for the credit: Arizona credit for.

Its Purpose Is To Calculate The Income Subject To Tax.

Web how to fill out and sign arizona form 309 instructions online? Web page 5 of the instructions for a list of state abbreviations. Please see arizona form 309 instructions or income tax ruling. Fill out each fillable area.

Complete This Form Only If You.

Web according to arizona form 309 instructions: Web per the az form 309 instructions: A separate form must be filed for each state or country for which a credit is. Web arizona form 301, nonrefundable individual tax credits and recapture, and include form 301 and form(s) 309 with your tax return to claim this credit.

Arizona Credit For Taxes Paid To Another State Or Country (Form 309) Form 309 Is Used To Claim Credit In Arizona For Taxes Paid To Another State Or Country.

Activate the wizard mode on the top toolbar to obtain more recommendations. Web those individuals taxed on income earned in another state and in arizona may earn a credit for taxes paid. Web arizona form 309credit for taxes paid to another state or country2014 include with your return. Web on july 9, 2021 governor ducey signed into law senate bill 1783 establishing title 43 chapter 17 (small businesses, which provides for an alternative tax for arizona small.

Web The Income Must Have Its Source Within Arizona.

Get your online template and fill it in using progressive features. Web home forms tax credits forms nonrefundable individual tax credits and recapture nonrefundable individual tax credits and recapture summarization of. A separate form must be filed for each state or country for which a credit is. If claiming a credit for more than one.