Arkansas State Withholding Form

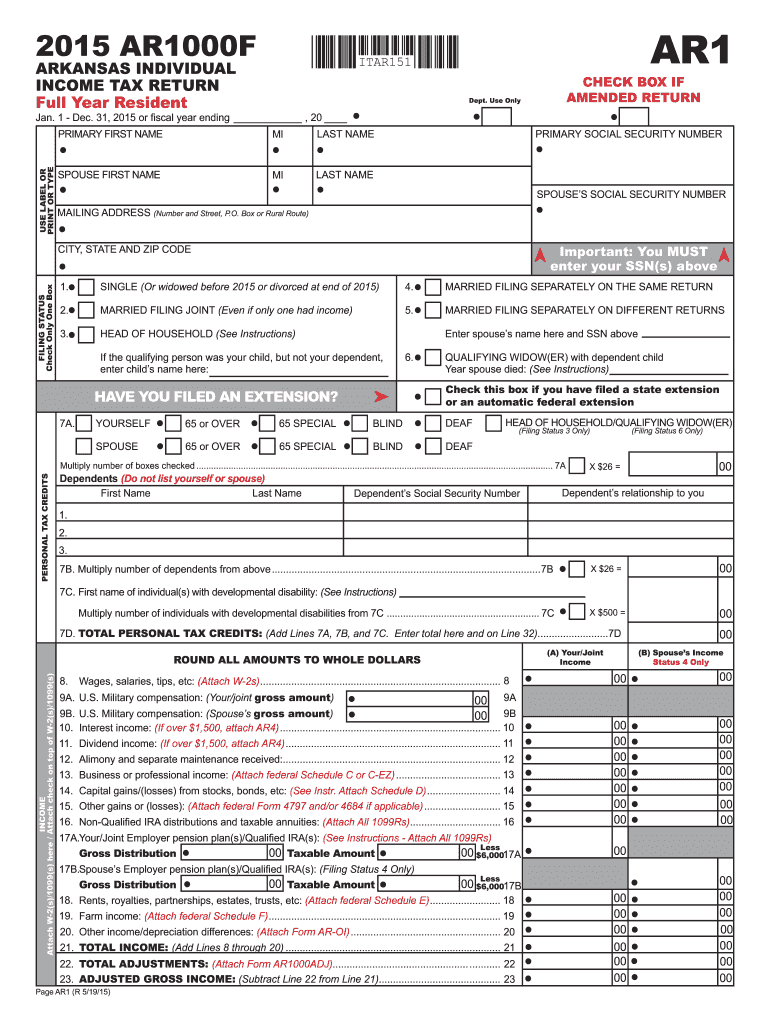

Arkansas State Withholding Form - Every employer with one (1) or more employees. If you make $70,000 a year living in arkansas you will be taxed $11,683. Ar1155 extension of time to file request: If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Web multiply total number of withholding exemptions claimed on form ar4ec times $20.00 to arrive at annual gross pay =$9,240.00 net taxable income =$7,240.00 net tax per year $108.40 2 Complete, edit or print tax forms instantly. Web ar4ec state of arkansas employee’s withholding exemption certificate print full name social security number print home address city state zip certify that the number of exemptions and dependents claimed on this certificate does not exceed the number to. Mail form ar4er to department of finance and administration,. Ad download or email ar1000f & more fillable forms, register and subscribe now! Department of finance and administration, withholding, p.o.

To change your address or to close your business for withholding purposes, please complete and submit the. File paper forms 1099 and 1096. Web multiply total number of withholding exemptions claimed on form ar4ec times $20.00 to arrive at annual gross pay =$9,240.00 net taxable income =$7,240.00 net tax per year $108.40 2 Web state of arkansas withholding tax revised: The income tax withholding tables have changed. Web the wage threshold to adjust annual net taxable income has changed from less than $50,000 to less than $87,001. Web ar4ec state of arkansas employee’s withholding exemption certificate print full name social security number print home address city state zip certify that the number of exemptions and dependents claimed on this certificate does not exceed the number to. Web of wage and tax statements to the arkansas withholding tax section. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. If too much is withheld, you will generally be due a refund.

Every employer with one (1) or more employees must file form ar4er. The income tax withholding tables have changed. Web form ar3mar is your annual reconciliation of monthly withholding. Complete, edit or print tax forms instantly. 10/01/2022 page 3 of 11 change of address. Ar2220 underpayment of estimated tax: Web of wage and tax statements to the arkansas withholding tax section. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Mail form ar4er to department of finance and administration,. Ad download or email ar1000f & more fillable forms, register and subscribe now!

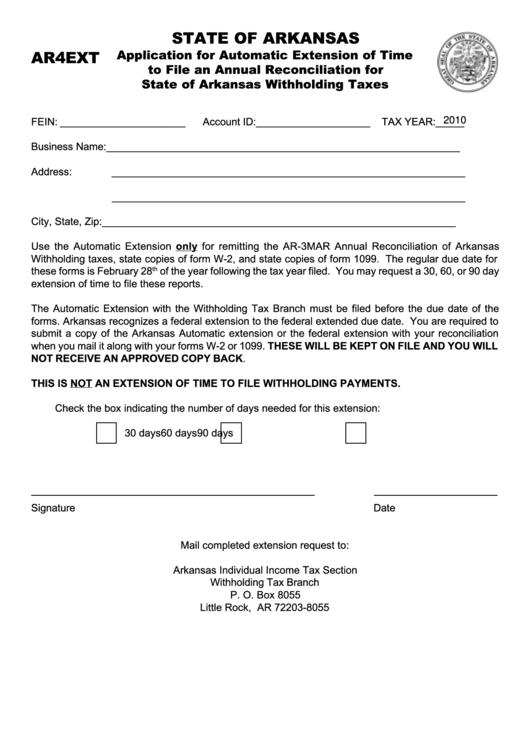

Fillable Form Ar4ext Application For Automatic Extension Of Time To

Web form ar3mar is your annual reconciliation of monthly withholding. To change your address or to close your business for withholding purposes, please complete and submit the. See page 2 for more information on each step, who can claim exemption from withholding, other details, and privacy. Your average tax rate is 11.67% and your. Every employer with one (1) or.

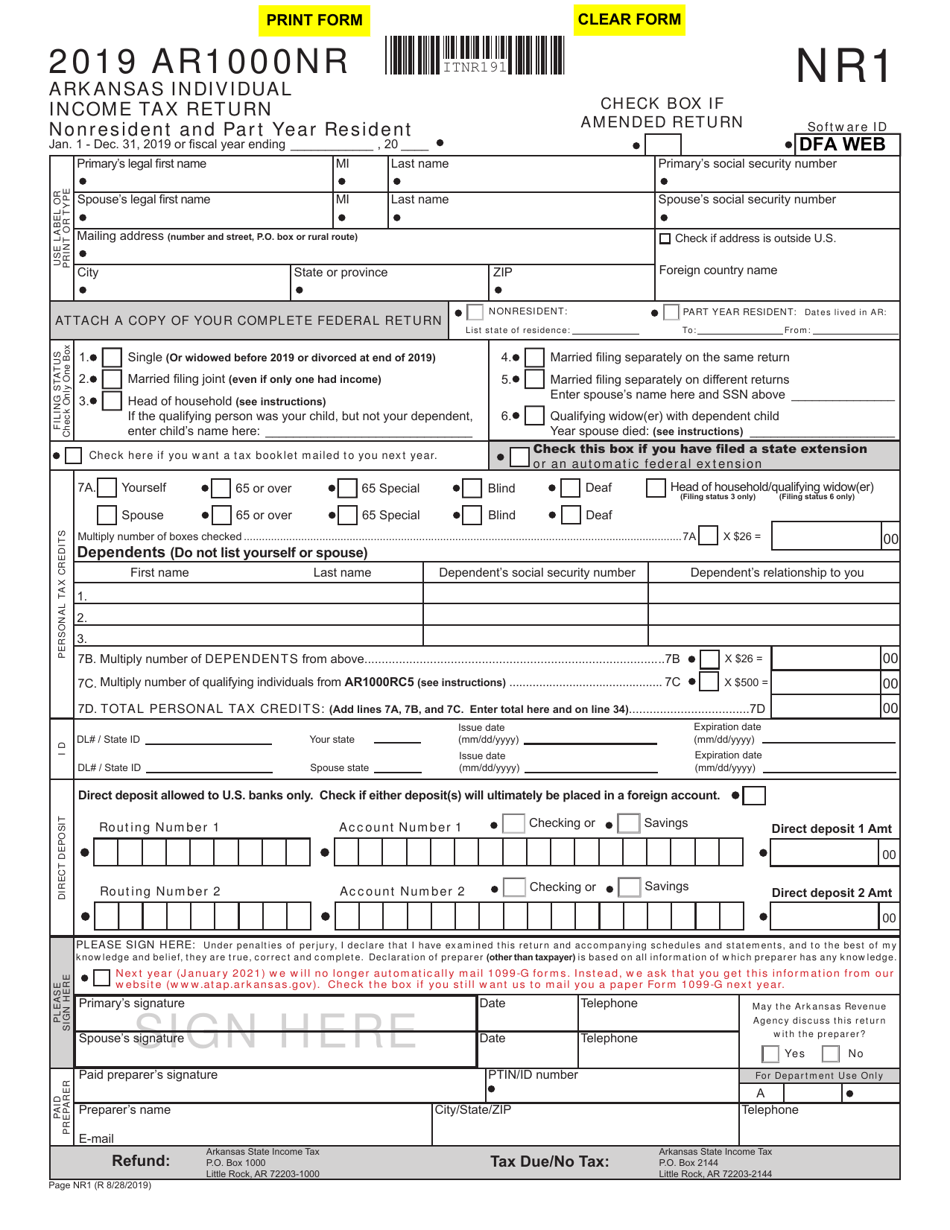

Form AR1000NR Download Fillable PDF or Fill Online Arkansas Individual

If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Every employer with one (1) or more employees must file form ar4er. Web of wage and tax statements to the arkansas withholding tax section. Ad download or email ar1000f & more fillable forms, register and subscribe now! Department of.

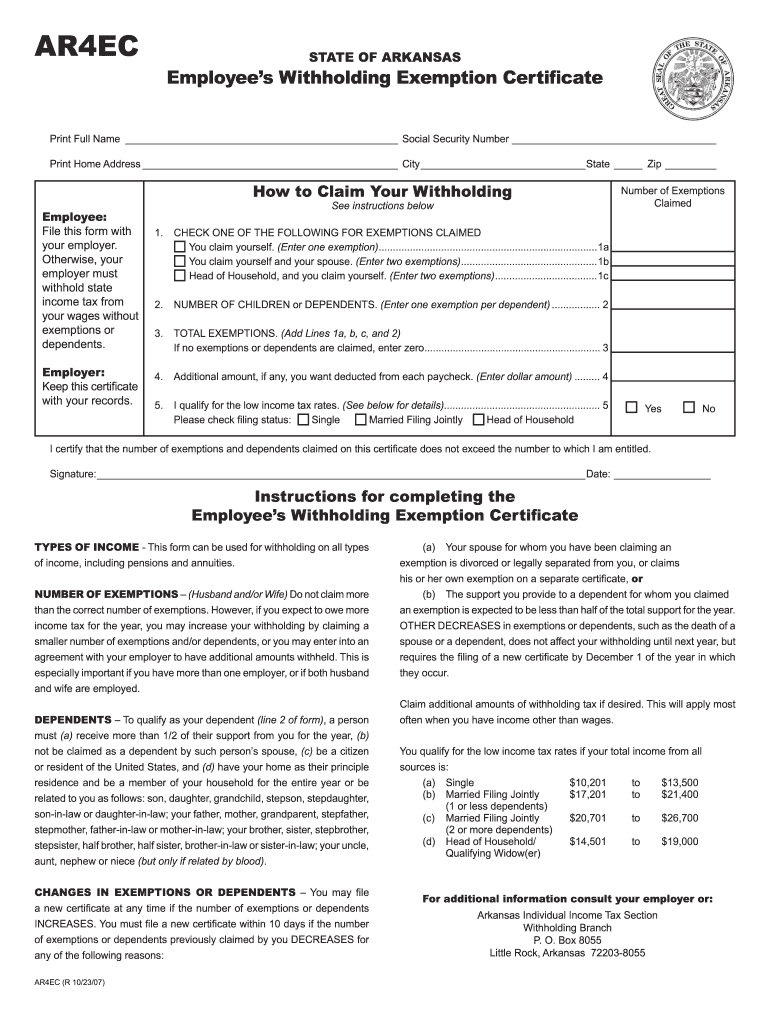

Employee's Withholding Exemption Certificate Arkansas Free Download

Complete, edit or print tax forms instantly. From individual retirement arrangements (iras); If you make $70,000 a year living in arkansas you will be taxed $11,683. Web individual income tax section withholding branch p.o. By march 15 furnish forms ar1099pt.

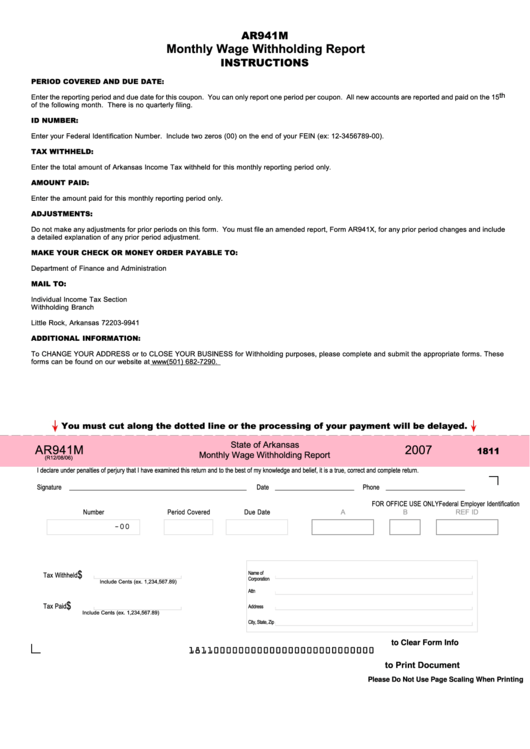

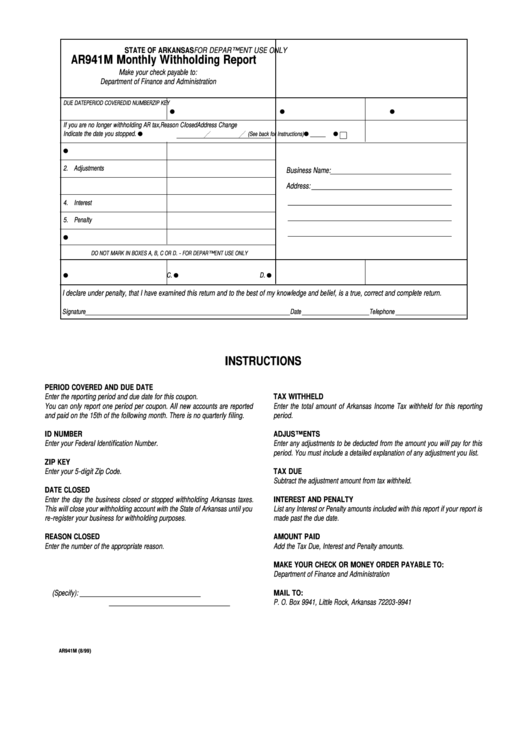

Fillable Form Ar941m State Of Arkansas Monthly Wage Withholding

Mail form ar4er to department of finance and administration,. From individual retirement arrangements (iras); If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Complete, edit or print tax forms instantly. Web of wage and tax statements to the arkansas withholding tax section.

Ar4ec Fill out & sign online DocHub

The income tax withholding tables have changed. See page 2 for more information on each step, who can claim exemption from withholding, other details, and privacy. File paper forms 1099 and 1096. Mail form ar4er to department of finance and administration,. To change your address or to close your business for withholding purposes, please complete and submit the.

Form Ar941m State Of Arkansas Monthly Withholding Report 1999

Ar2220 underpayment of estimated tax: Every employer with one (1) or more employees must file form ar4er. Web of wage and tax statements to the arkansas withholding tax section. Your average tax rate is 11.67% and your. Ad download or email ar1000f & more fillable forms, register and subscribe now!

Arkansas State Tax Withholding Tables 2018

File paper forms 1099 and 1096. To change your address or to close your business for withholding purposes, please complete and submit the. Department of finance and administration, withholding, p.o. Every employer with one (1) or more employees. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty.

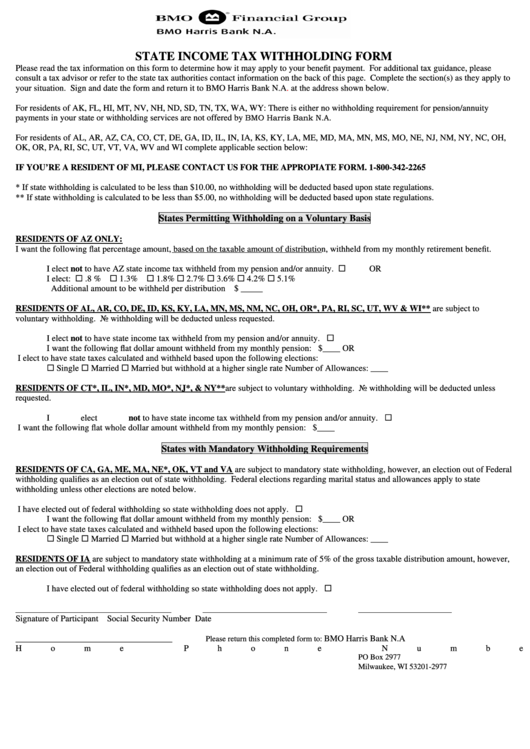

State Tax Withholding Form Bmo Harris Bank N.a printable pdf

Complete, edit or print tax forms instantly. Web form ar3mar is your annual reconciliation of monthly withholding. The income tax withholding tables have changed. No action on the part of the employee or the personnel office is necessary. 10/01/2022 page 3 of 11 change of address.

Tax Form Ar Fill Out and Sign Printable PDF Template signNow

Otherwise, skip to step 5. Every employer with one (1) or more employees. See page 2 for more information on each step, who can claim exemption from withholding, other details, and privacy. The income tax withholding tables have changed. Web ar4ec state of arkansas employee’s withholding exemption certificate print full name social security number print home address city state zip.

Arkansas State Tax Withholding Tables 2018

Web state of arkansas withholding tax revised: Otherwise, skip to step 5. If too much is withheld, you will generally be due a refund. Every employer with one (1) or more employees must file form ar4er. Mail form ar4er to department of finance and administration,.

Ad Download Or Email Ar1000F & More Fillable Forms, Register And Subscribe Now!

To change your address or to close your business for withholding purposes, please complete and submit the. Web ar4ec state of arkansas employee’s withholding exemption certificate print full name social security number print home address city state zip certify that the number of exemptions and dependents claimed on this certificate does not exceed the number to. No action on the part of the employee or the personnel office is necessary. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty.

Download Or Email Ar Ar4Ec & More Fillable Forms, Register And Subscribe Now!

Complete, edit or print tax forms instantly. Web multiply total number of withholding exemptions claimed on form ar4ec times $20.00 to arrive at annual gross pay =$9,240.00 net taxable income =$7,240.00 net tax per year $108.40 2 Web form ar3mar is your annual reconciliation of monthly withholding. By march 15 furnish forms ar1099pt.

Every Employer With One (1) Or More Employees Must File Form Ar4Er.

10/01/2022 page 3 of 11 change of address. Web of wage and tax statements to the arkansas withholding tax section. If too much is withheld, you will generally be due a refund. The income tax withholding tables have changed.

If You Make $70,000 A Year Living In Arkansas You Will Be Taxed $11,683.

Web the wage threshold to adjust annual net taxable income has changed from less than $50,000 to less than $87,001. Otherwise, skip to step 5. From individual retirement arrangements (iras); Web state of arkansas withholding tax revised: