2020 Form 941 X

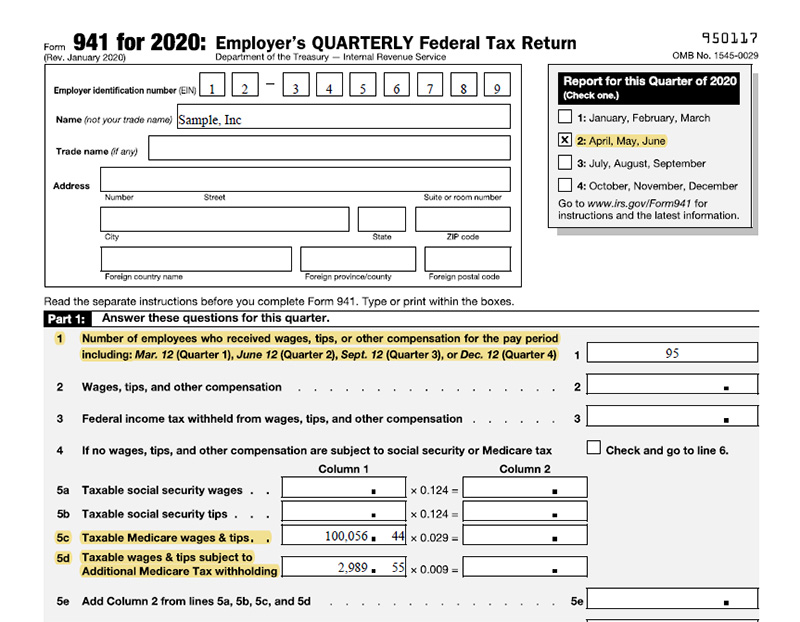

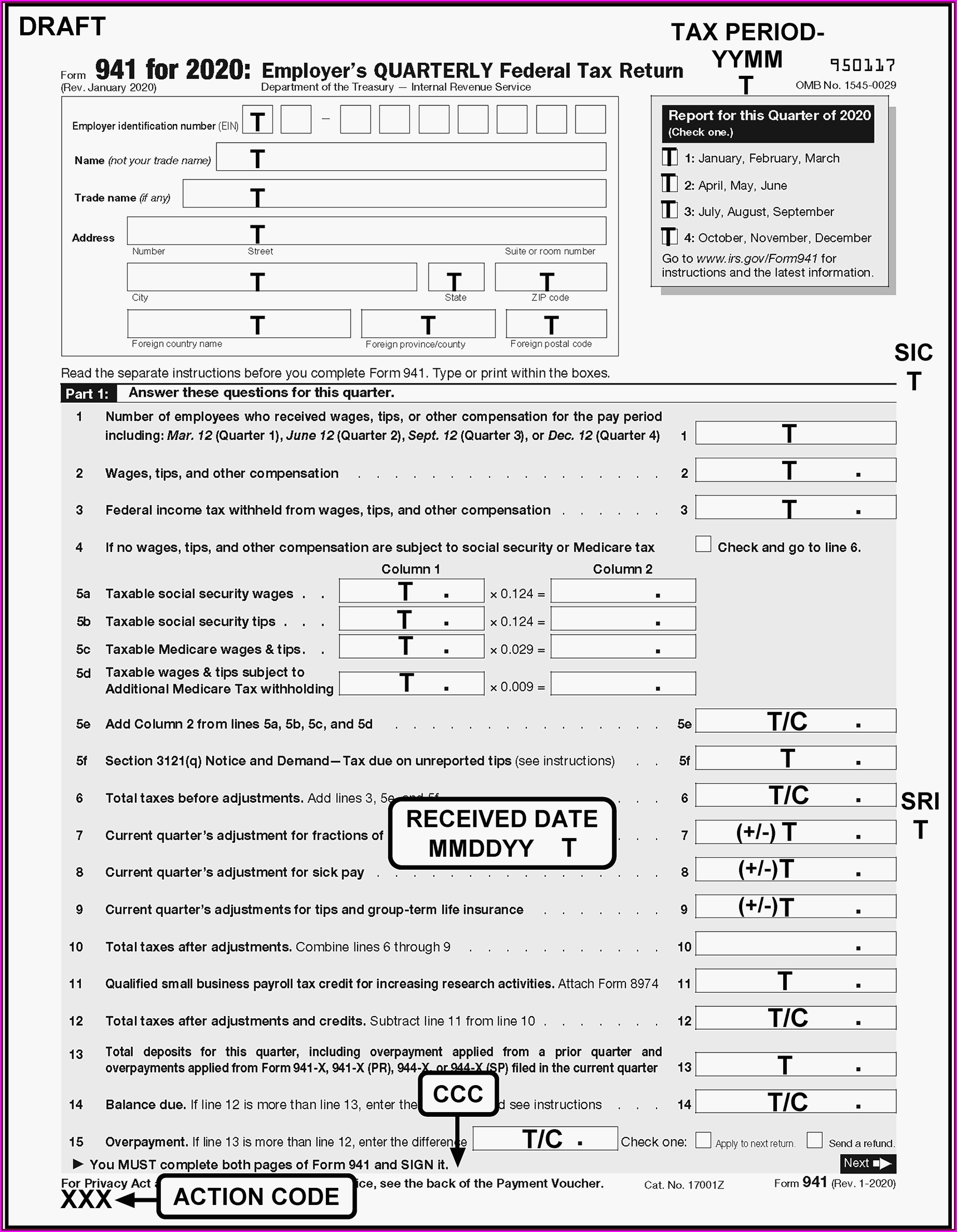

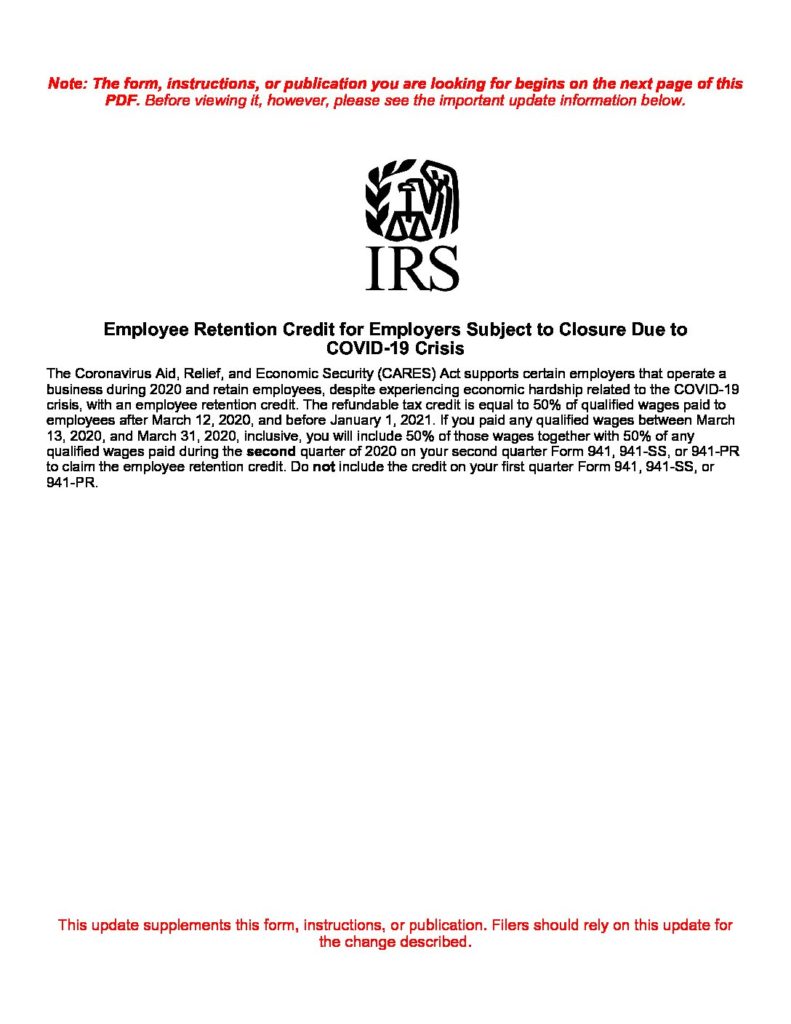

2020 Form 941 X - Web form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on or after september 1, 2020,. October 2020) employer identification number (ein) department of the treasury —. Web the instructions, which were earlier revised in july, address additional changes to the form, including the modified line 24, which now is used to correct data. Form 941 instructions, december 2021 revision pdf for additional information related to the erc for quarters in 2021;. Web you determined that your company is eligible for the employee retention credit (“erc”) and you have calculated the 2020 erc based on the qualified wages and. January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Web for 2020, the erc can be claimed by eligible employers who paid qualified wages after march 12, 2020, and before january 1, 2021, and who experienced a full or. Form 941 is used by employers. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. July 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) name.

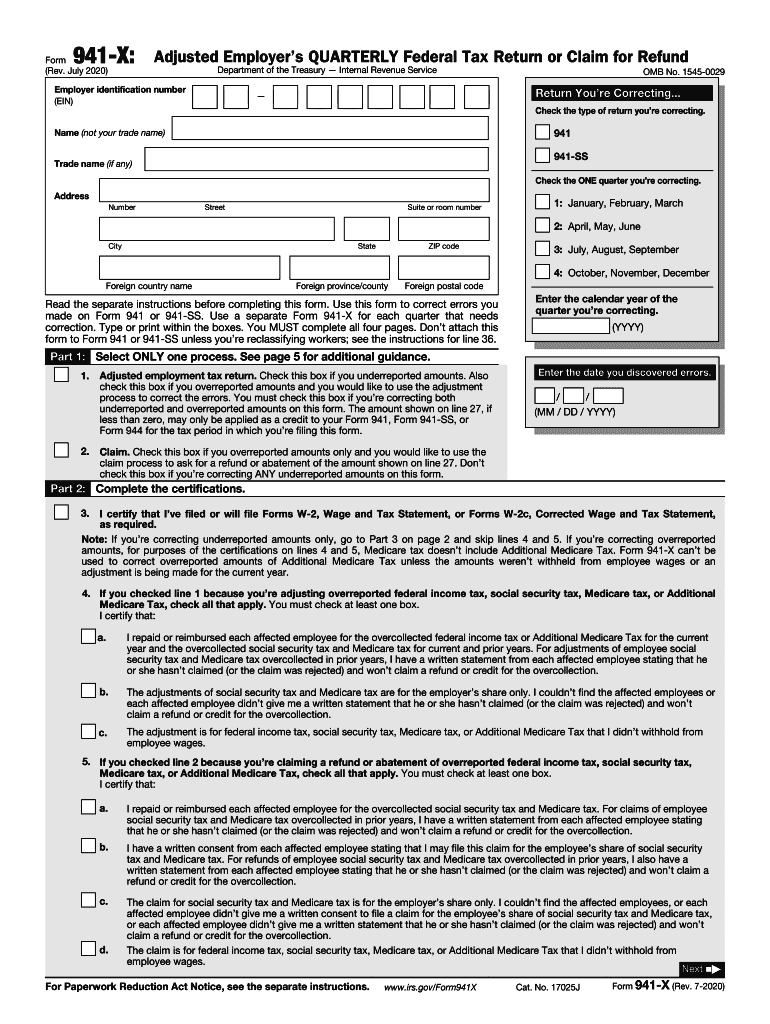

Web for 2020, the erc can be claimed by eligible employers who paid qualified wages after march 12, 2020, and before january 1, 2021, and who experienced a full or. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Try it for free now! Form 941 instructions, december 2021 revision pdf for additional information related to the erc for quarters in 2021;. Adjusted employer’s quarterly federal tax return or claim for refund (rev. Adjusted employer's quarterly federal tax return or claim for refund keywords: Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. October 2020) employer identification number (ein) department of the treasury —. Upload, modify or create forms. Web you determined that your company is eligible for the employee retention credit (“erc”) and you have calculated the 2020 erc based on the qualified wages and.

January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Adjusted employer’s quarterly federal tax return or claim for refund (rev. October 2020) employer identification number (ein) department of the treasury —. Web for 2020, the erc can be claimed by eligible employers who paid qualified wages after march 12, 2020, and before january 1, 2021, and who experienced a full or. Web form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on or after september 1, 2020,. Form 941 instructions, december 2021 revision pdf for additional information related to the erc for quarters in 2021;. Adjusted employer's quarterly federal tax return or claim for refund keywords: Complete, edit or print tax forms instantly. Upload, modify or create forms. July 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) name.

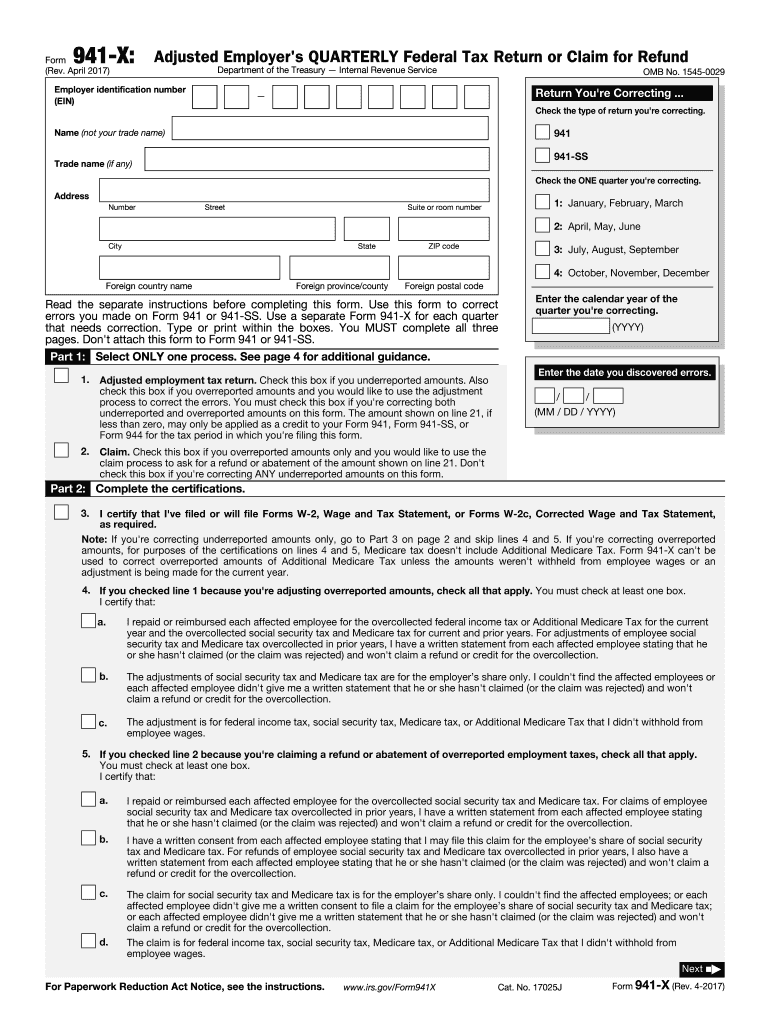

941 X Form Fill Out and Sign Printable PDF Template signNow

Complete, edit or print tax forms instantly. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Web the instructions, which were earlier revised in july, address additional changes to the form, including the modified line 24, which now is used to correct data. Adjusted employer's quarterly federal.

2020 Form IRS 941SS Fill Online, Printable, Fillable, Blank pdfFiller

Form 941 is used by employers. Complete, edit or print tax forms instantly. Form 941 instructions, december 2021 revision pdf for additional information related to the erc for quarters in 2021;. Web for 2020, the erc can be claimed by eligible employers who paid qualified wages after march 12, 2020, and before january 1, 2021, and who experienced a full.

ERC Calculator Tool ERTC Funding

Complete, edit or print tax forms instantly. Web form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on or after september 1, 2020,. Adjusted employer's quarterly federal tax return or claim for refund keywords: January 2020) employer’s quarterly federal tax return department of the.

How To Fill Out Form 941 X For Employee Retention Credit In 2020

Try it for free now! Form 941 instructions, december 2021 revision pdf for additional information related to the erc for quarters in 2021;. Upload, modify or create forms. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web form 941 has been revised to allow employers that defer.

Irs.gov Form 941 X Instructions Form Resume Examples 1ZV8dX3V3X

Form 941 is used by employers. Web form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on or after september 1, 2020,. Adjusted employer's quarterly federal tax return or claim for refund keywords: January 2020) employer’s quarterly federal tax return department of the treasury.

2020 Form IRS Instructions 941 Fill Online, Printable, Fillable, Blank

July 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) name. Adjusted employer's quarterly federal tax return or claim for refund keywords: Web form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on or after.

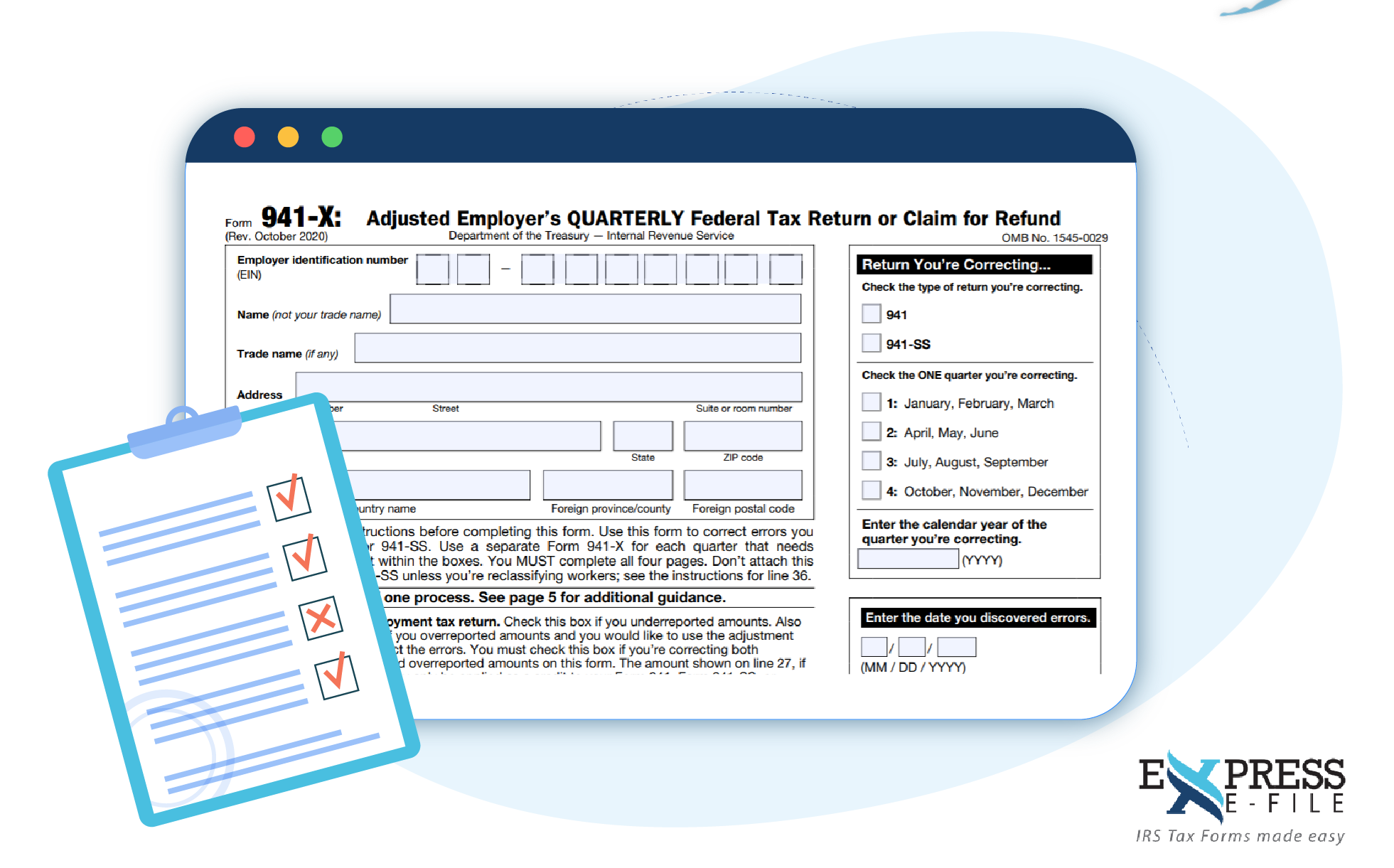

Complete Form 941X for 2020 with TaxBandits YouTube

Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Form 941 is used by employers. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Upload, modify or create forms. Form 941 instructions, december 2021 revision.

How to Fill Out 2020 Form 941 Employer’s Quarterly Federal Tax Return

Adjusted employer’s quarterly federal tax return or claim for refund (rev. Form 941 is used by employers. Upload, modify or create forms. October 2020) employer identification number (ein) department of the treasury —. Form 941 instructions, december 2021 revision pdf for additional information related to the erc for quarters in 2021;.

20172020 Form IRS 941X Fill Online, Printable, Fillable, Blank

Adjusted employer's quarterly federal tax return or claim for refund keywords: Web for 2020, the erc can be claimed by eligible employers who paid qualified wages after march 12, 2020, and before january 1, 2021, and who experienced a full or. Web form 941 has been revised to allow employers that defer the withholding and payment of the employee share.

What You Need to Know About Just Released IRS Form 941X Blog

Web the instructions, which were earlier revised in july, address additional changes to the form, including the modified line 24, which now is used to correct data. Web you determined that your company is eligible for the employee retention credit (“erc”) and you have calculated the 2020 erc based on the qualified wages and. July 2020) adjusted employer’s quarterly federal.

October 2020) Employer Identification Number (Ein) Department Of The Treasury —.

Adjusted employer’s quarterly federal tax return or claim for refund (rev. Form 941 is used by employers. Web form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on or after september 1, 2020,. Adjusted employer's quarterly federal tax return or claim for refund keywords:

Form 941 Instructions, December 2021 Revision Pdf For Additional Information Related To The Erc For Quarters In 2021;.

Upload, modify or create forms. Web you determined that your company is eligible for the employee retention credit (“erc”) and you have calculated the 2020 erc based on the qualified wages and. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file.

Web For 2020, The Erc Can Be Claimed By Eligible Employers Who Paid Qualified Wages After March 12, 2020, And Before January 1, 2021, And Who Experienced A Full Or.

January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Web the instructions, which were earlier revised in july, address additional changes to the form, including the modified line 24, which now is used to correct data. July 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) name. Complete, edit or print tax forms instantly.