147C Tax Form

147C Tax Form - It will also list the payments we've credited to your account for that tax. It will show the amount we applied to the following year's taxes. Follow the below process to. Use this address if you are not enclosing a payment use this. Web here’s how you request an ein verification letter (147c) the easiest way to get a copy of an ein verification letter is to call the irs. Web employer information to become an employer for the or fmas program you need an employer identification number (ein) from the internal revenue service (irs). Web the 147c letter is a document that is sent to businesses by the irs. Web an ein verification letter ( commonly known as a form 147c) is an official document from the internal revenue service that lists your employer identification number and confirms. Web there is a solution if you don’t have possession of the ein confirmation letter. Web popular forms & instructions;

Web popular forms & instructions; Web how to obtain a confirmation letter (147c letter) of the employer identification number (ein) if your clergy and/or employees are unable to e‐file their income tax returns because of. This number reaches the irs business & specialty tax department,. Your previously filed return should. Web there is a solution if you don’t have possession of the ein confirmation letter. It will show the amount we applied to the following year's taxes. Web here’s how you request an ein verification letter (147c) the easiest way to get a copy of an ein verification letter is to call the irs. Web find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein. Web the 147c letter is a document that is sent to businesses by the irs. Web read your notice carefully.

Get details on letters about the 2021 advance child tax credit payments: Web an ein verification letter ( commonly known as a form 147c) is an official document from the internal revenue service that lists your employer identification number and confirms. Use this address if you are not enclosing a payment use this. Web read your notice carefully. Web here’s how you request an ein verification letter (147c) the easiest way to get a copy of an ein verification letter is to call the irs. Web employer information to become an employer for the or fmas program you need an employer identification number (ein) from the internal revenue service (irs). No need to install software, just go to dochub, and sign up instantly and for free. Web advance child tax credit letters. The business can contact the irs directly and request a replacement confirmation letter called a 147c. This number reaches the irs business & specialty tax department,.

PPACAHEALTH REFORM UPDATES PPACAW2 REPORTINGIRS GUIDANCE CHART

No need to install software, just go to dochub, and sign up instantly and for free. This number reaches the irs business & specialty tax department,. Web an ein verification letter ( commonly known as a form 147c) is an official document from the internal revenue service that lists your employer identification number and confirms. Get details on letters about.

18 [pdf] 147C TAX IDENTIFICATION LETTER PRINTABLE DOCX ZIP DOWNLOAD

Use this address if you are not enclosing a payment use this. Follow the below process to. Web employer information to become an employer for the or fmas program you need an employer identification number (ein) from the internal revenue service (irs). It will show the amount we applied to the following year's taxes. The letter requests information about the.

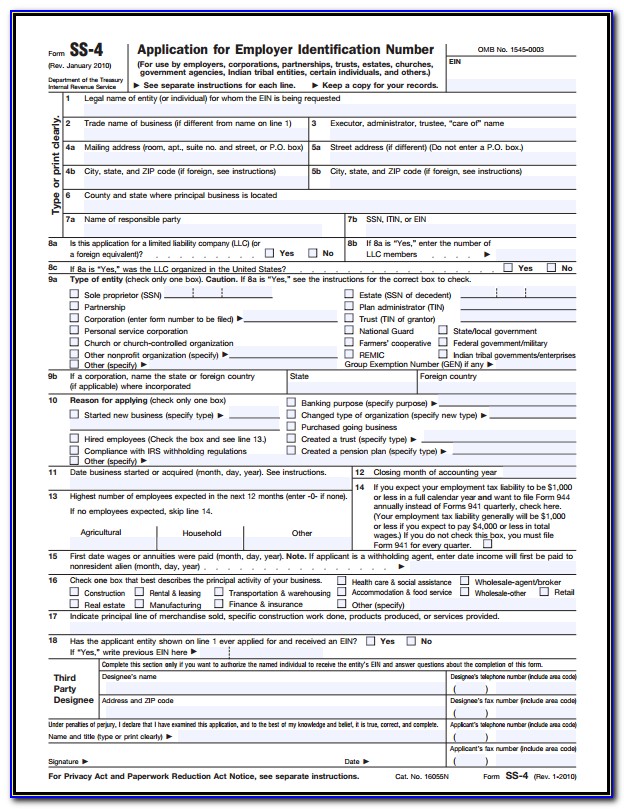

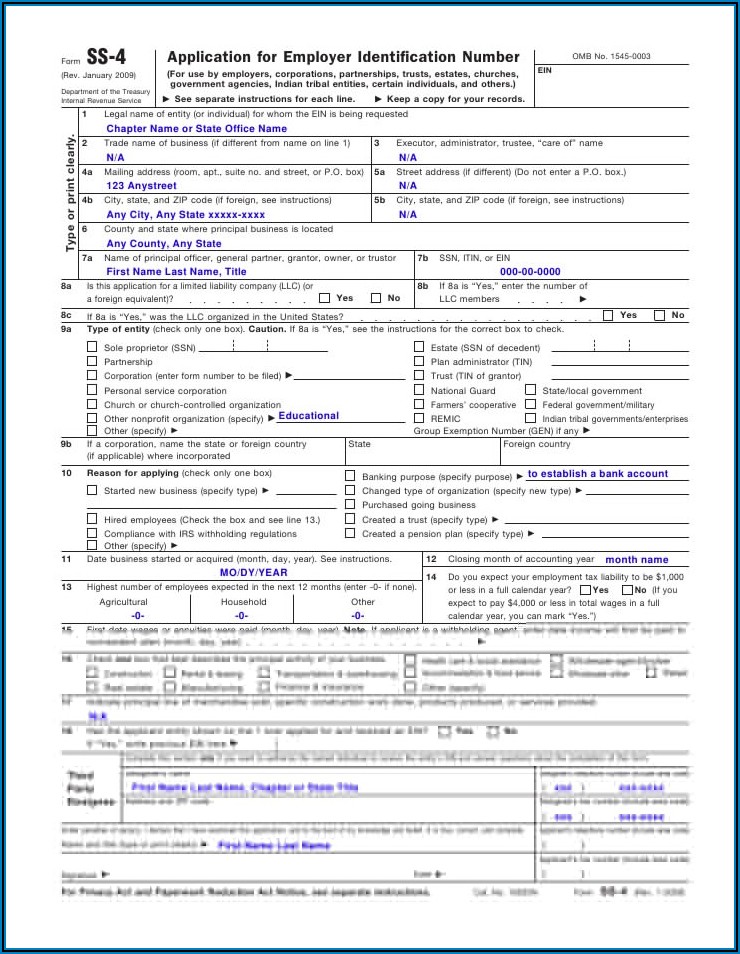

Application Form 0809 Irs Tax Forms Business

Web how to obtain a confirmation letter (147c letter) of the employer identification number (ein) if your clergy and/or employees are unable to e‐file their income tax returns because of. Web find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein. The business can contact.

Irs Form 147c Letter Letter Resume Examples QBD3EAp2OX

Individual tax return form 1040 instructions; Get details on letters about the 2021 advance child tax credit payments: Web an ein verification letter ( commonly known as a form 147c) is an official document from the internal revenue service that lists your employer identification number and confirms. Use this address if you are not enclosing a payment use this. The.

irs letter 147c

Your previously filed return should. It will also list the payments we've credited to your account for that tax. Web here’s how you request an ein verification letter (147c) the easiest way to get a copy of an ein verification letter is to call the irs. No need to install software, just go to dochub, and sign up instantly and.

How can I get a copy of my EIN Verification Letter (147C) from the IRS

Web an ein verification letter ( commonly known as a form 147c) is an official document from the internal revenue service that lists your employer identification number and confirms. Get details on letters about the 2021 advance child tax credit payments: Web here’s how you request an ein verification letter (147c) the easiest way to get a copy of an.

Irs Letter 147c Sample Letter Resume Template Collections NLzn2jOz2Q

No need to install software, just go to dochub, and sign up instantly and for free. Your previously filed return should. Web there is a solution if you don’t have possession of the ein confirmation letter. It will also list the payments we've credited to your account for that tax. Web employer information to become an employer for the or.

What Is Form CP575? Gusto

Web read your notice carefully. Individual tax return form 1040 instructions; Web edit, sign, and share irs form 147c pdf online. It will also list the payments we've credited to your account for that tax. No need to install software, just go to dochub, and sign up instantly and for free.

IRS FORM 147C PDF

It will show the amount we applied to the following year's taxes. This number reaches the irs business & specialty tax department,. Web there is a solution if you don’t have possession of the ein confirmation letter. The letter requests information about the business’s ein or employer identification number. Web edit, sign, and share irs form 147c pdf online.

Irs Letter 147c Sample

The business can contact the irs directly and request a replacement confirmation letter called a 147c. Use this address if you are not enclosing a payment use this. Web popular forms & instructions; It will show the amount we applied to the following year's taxes. Get details on letters about the 2021 advance child tax credit payments:

Your Previously Filed Return Should.

Web the 147c letter is a document that is sent to businesses by the irs. Individual tax return form 1040 instructions; Web an ein verification letter ( commonly known as a form 147c) is an official document from the internal revenue service that lists your employer identification number and confirms. Follow the below process to.

They Are Open Monday Through Friday From 7:00 Am To 7:00 Pm,.

Web find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein. Web read your notice carefully. Web advance child tax credit letters. Use this address if you are not enclosing a payment use this.

Web Popular Forms & Instructions;

Web how to obtain a confirmation letter (147c letter) of the employer identification number (ein) if your clergy and/or employees are unable to e‐file their income tax returns because of. Get details on letters about the 2021 advance child tax credit payments: Web edit, sign, and share irs form 147c pdf online. It will also list the payments we've credited to your account for that tax.

The Letter Requests Information About The Business’s Ein Or Employer Identification Number.

This number reaches the irs business & specialty tax department,. No need to install software, just go to dochub, and sign up instantly and for free. The business can contact the irs directly and request a replacement confirmation letter called a 147c. Web employer information to become an employer for the or fmas program you need an employer identification number (ein) from the internal revenue service (irs).