1099 C Form Pdf

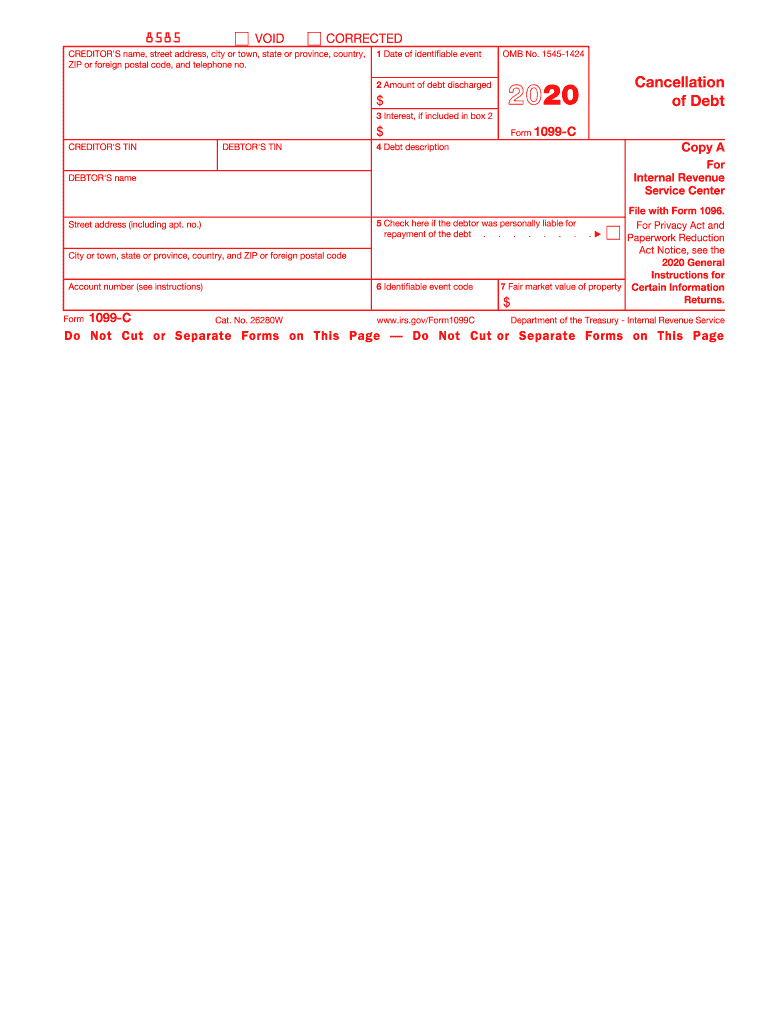

1099 C Form Pdf - The form is lately attached to the annual tax report by debtors. After that, they need to. This is important tax information and is being furnished to the irs. January 2022) cancellation of debt. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if taxable income results from this transaction Interest included in canceled debt. You can complete these copies online for furnishing statements to. For internal revenue service center. Web to ease statement furnishing requirements, copies b and c have been made fillable online in a pdf format available at irs.gov/ form1099a and irs.gov/form1099c. It is filed for every debtor who got the debt canceled by the lender.

Correctedfor privacy act and paperwork reduction act notice, see the. It is filed for every debtor who got the debt canceled by the lender. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if taxable income results from this transaction This article will help you understand how to report the cancelation of a debt and the income or loss recognized from property that was foreclosed on, was repossessed, was quitclaimed, or involved in a short sale. An applicable entity includes the following. This form is required for cases when lenders and creditors have repaid $ 600 debt or more. The form is lately attached to the annual tax report by debtors. Web to ease statement furnishing requirements, copies b and c have been made fillable online in a pdf format available at irs.gov/ form1099a and irs.gov/form1099c. For internal revenue service center. The form is not used if the amount of the canceled debt is less than $600.

Correctedfor privacy act and paperwork reduction act notice, see the. This article will help you understand how to report the cancelation of a debt and the income or loss recognized from property that was foreclosed on, was repossessed, was quitclaimed, or involved in a short sale. This form is required for cases when lenders and creditors have repaid $ 600 debt or more. This is important tax information and is being furnished to the irs. Solved•by intuit•21•updated july 19, 2022. Web to ease statement furnishing requirements, copies b and c have been made fillable online in a pdf format available at irs.gov/ form1099a and irs.gov/form1099c. After that, they need to. The form is not used if the amount of the canceled debt is less than $600. Interest included in canceled debt. The form is lately attached to the annual tax report by debtors.

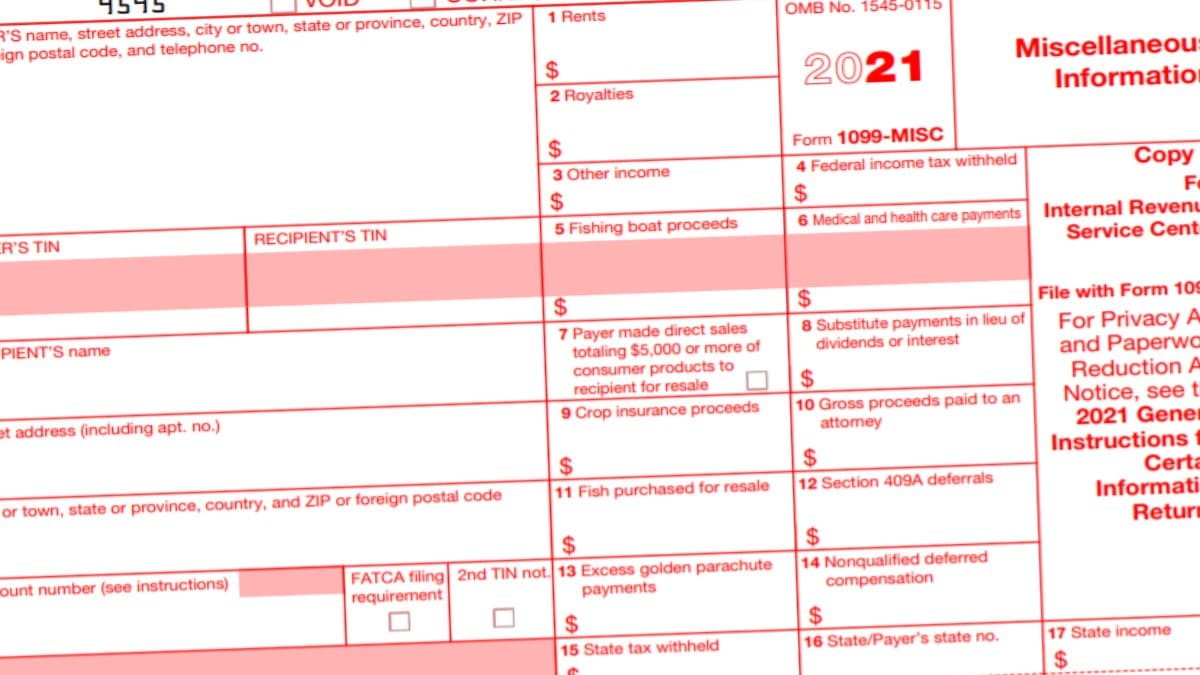

What is a 1099Misc Form? Financial Strategy Center

After that, they need to. The form is not used if the amount of the canceled debt is less than $600. Interest included in canceled debt. This form is required for cases when lenders and creditors have repaid $ 600 debt or more. This article will help you understand how to report the cancelation of a debt and the income.

Form 1099A Acquisition or Abandonment of Secured Property Definition

An applicable entity includes the following. Correctedfor privacy act and paperwork reduction act notice, see the. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if taxable income results from this transaction This is important tax information and is being furnished to the irs. This article will help you understand.

1099 MISC Form 2022 1099 Forms TaxUni

This form is required for cases when lenders and creditors have repaid $ 600 debt or more. After that, they need to. Any company that pays an individual $600 or more in a year is required to send the recipient a 1099. Web to ease statement furnishing requirements, copies b and c have been made fillable online in a pdf.

Form 1099 C Cancellation of Debt Form Fill Out and Sign Printable PDF

This form is required for cases when lenders and creditors have repaid $ 600 debt or more. Solved•by intuit•21•updated july 19, 2022. This is important tax information and is being furnished to the irs. January 2022) cancellation of debt. After that, they need to.

What to Do with the IRS 1099C Form for Cancellation of Debt

Correctedfor privacy act and paperwork reduction act notice, see the. You can complete these copies online for furnishing statements to. The form is lately attached to the annual tax report by debtors. It is filed for every debtor who got the debt canceled by the lender. January 2022) cancellation of debt.

[最も好ましい] 1099 c form 2020 1663152020 form 1099c cancellation of debt

Cancellation of debt is required by the internal revenue service (irs) to report various payments and transactions made to taxpayers by lenders and creditors. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if taxable income results from this transaction You can complete these copies online for furnishing statements to..

√100以上 1099c form 2020 157485How to complete a 1099c form

January 2022) cancellation of debt. This is important tax information and is being furnished to the irs. It is filed for every debtor who got the debt canceled by the lender. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if taxable income results from this transaction For internal revenue.

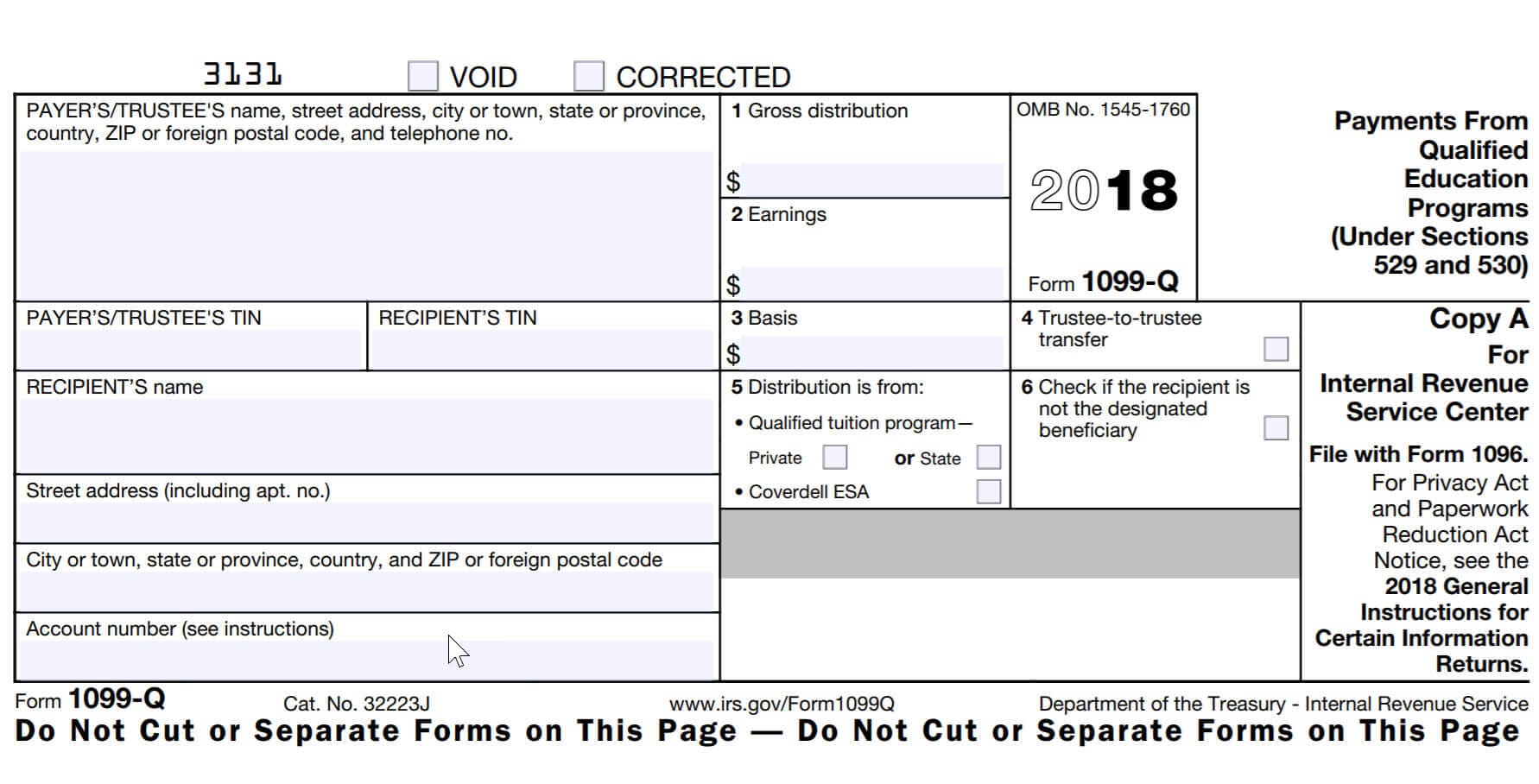

What is IRS Form 1099Q? TurboTax Tax Tips & Videos

The form is lately attached to the annual tax report by debtors. Any company that pays an individual $600 or more in a year is required to send the recipient a 1099. This article will help you understand how to report the cancelation of a debt and the income or loss recognized from property that was foreclosed on, was repossessed,.

What's Form 1099MISC Used For? Tax attorney, 1099 tax form, Tax forms

This form is required for cases when lenders and creditors have repaid $ 600 debt or more. It is filed for every debtor who got the debt canceled by the lender. January 2022) cancellation of debt. Any company that pays an individual $600 or more in a year is required to send the recipient a 1099. For internal revenue service.

Form 1099NEC Instructions and Tax Reporting Guide

This is important tax information and is being furnished to the irs. After that, they need to. For internal revenue service center. This article will help you understand how to report the cancelation of a debt and the income or loss recognized from property that was foreclosed on, was repossessed, was quitclaimed, or involved in a short sale. If you.

Interest Included In Canceled Debt.

Solved•by intuit•21•updated july 19, 2022. Any company that pays an individual $600 or more in a year is required to send the recipient a 1099. The form is not used if the amount of the canceled debt is less than $600. This is important tax information and is being furnished to the irs.

An Applicable Entity Includes The Following.

It is filed for every debtor who got the debt canceled by the lender. Web to ease statement furnishing requirements, copies b and c have been made fillable online in a pdf format available at irs.gov/ form1099a and irs.gov/form1099c. Cancellation of debt is required by the internal revenue service (irs) to report various payments and transactions made to taxpayers by lenders and creditors. For internal revenue service center.

After That, They Need To.

This form is required for cases when lenders and creditors have repaid $ 600 debt or more. This article will help you understand how to report the cancelation of a debt and the income or loss recognized from property that was foreclosed on, was repossessed, was quitclaimed, or involved in a short sale. The form is lately attached to the annual tax report by debtors. January 2022) cancellation of debt.

Correctedfor Privacy Act And Paperwork Reduction Act Notice, See The.

You can complete these copies online for furnishing statements to. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if taxable income results from this transaction

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at5.57.19PM-35858ecdbcb34072ba0d8da6aaf87b8a.png)