Purdue Global Tax Form

Purdue Global Tax Form - The glacier system will send you an email on glacier. The username field cannot be left blank. An alternative to your legal first name legal name: Classification ( ntee ) undergraduate college (4. Web view your w2 form through the adp website or adp tile/link within successfactors. Web tax information for international students and scholars. Web what is the process to enroll and apply for the education benefit? Web purdue global payroll deduction request. Gain (loss) reported separately from federal schedule k, line 17d (force) Deductions begin the first pay period after this form is processed (please allow 2 weeks) and continue until you notify us of a change.

Returns must be postmarked by a. The username field cannot be left blank. Will i need to provide a copy of my high school transcript to pursue an undergraduate program at purdue. Classification ( ntee ) undergraduate college (4. Deductions begin the first pay period after this form is processed (please allow 2 weeks) and continue until you notify us of a change. You must provide a username to access your account. Web trade or business is not subject to the withholding tax on foreign partners’ share of effectively connected income. Web view your w2 form through the adp website or adp tile/link within successfactors. Web purdue university global inc. Web tax services and forms.

Financial aid videos view fatv videos tuition undergraduate and graduate tuition and fees professional studies. Web what is the process to enroll and apply for the education benefit? Returns must be postmarked by a. Web please enter your username. To avoid delays in processing, use forms approved by the revenue division of the city of kansas city,. Web tax information for international students and scholars. Web purdue tax information international students working for purdue will get tax information after january 31. Web trade or business is not subject to the withholding tax on foreign partners’ share of effectively connected income. Web purdue global payroll deduction request. You must provide a username to access your account.

Purdue University Global YouTube

Web • failure to provide no tax due letter from state of missouri (if applicable) 3. Web for more information, please complete a form on the purdue global website. 1100 missouri tax forms and templates are collected for any. You must provide a username to access your account. Purdue global is purdue’s online university for working adults.

Purdue University Global Holds First Commencement; Over 9,000 Graduates

Contact tax@purdue.edu with access issues or questions. Web purdue global payroll deduction request. The username field cannot be left blank. Financial aid videos view fatv videos tuition undergraduate and graduate tuition and fees professional studies. To avoid delays in processing, use forms approved by the revenue division of the city of kansas city,.

Development and Validation of the Purdue Global Online Teaching

Web what is the process to enroll and apply for the education benefit? April 18, 2023 is the deadline for filing an income tax return for calendar year 2022. Web purdue university global inc. Will i need to provide a copy of my high school transcript to pursue an undergraduate program at purdue. Financial aid videos view fatv videos tuition.

More than 1,500 Purdue University Global graduates told that they will

Web trade or business is not subject to the withholding tax on foreign partners’ share of effectively connected income. Classification ( ntee ) undergraduate college (4. Web for more information, please complete a form on the purdue global website. 1100 missouri tax forms and templates are collected for any. The glacier system will send you an email on glacier.

Purdue University Global holds first commencement; over 9,000 graduates

Contact tax@purdue.edu with access issues or questions. An alternative to your legal first name legal name: Classification ( ntee ) undergraduate college (4. Web view your w2 form through the adp website or adp tile/link within successfactors. Web please enter your username.

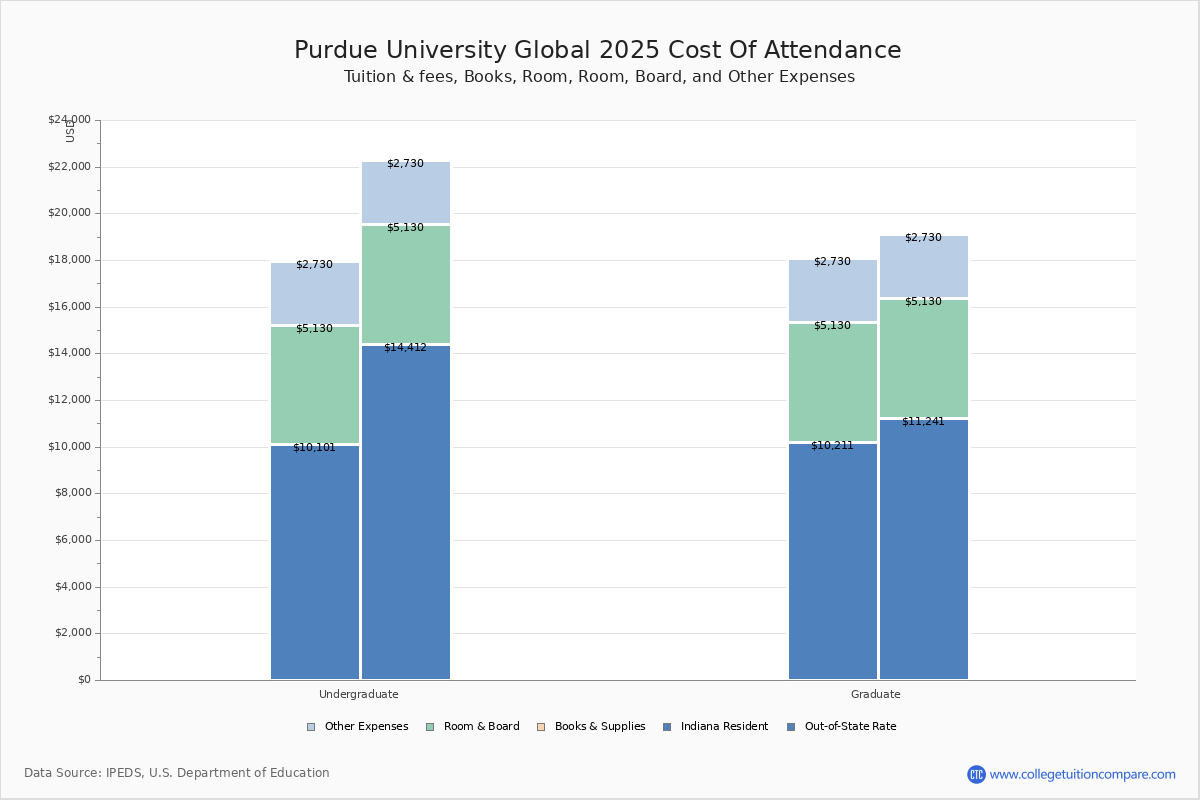

Purdue University Global Tuition & Fees, Net Price

Web please enter your username. Tax services for business @ purdue. Web purdue university global inc. Web • failure to provide no tax due letter from state of missouri (if applicable) 3. Web purdue global payroll deduction request.

NewU goes Global New name misses the mark Opinions

Web purdue university global inc. Deductions begin the first pay period after this form is processed (please allow 2 weeks) and continue until you notify us of a change. The glacier system will send you an email on glacier. Tax services for business @ purdue. Web tax services and forms.

‘Gag Clause’ at Purdue Global Raises Alarms About Faculty Rights

Web trade or business is not subject to the withholding tax on foreign partners’ share of effectively connected income. Web please enter your username. Returns must be postmarked by a. Financial aid videos view fatv videos tuition undergraduate and graduate tuition and fees professional studies. Web tax information for international students and scholars.

How Purdue Global Got Its IRS Stamp of Approval

You must provide a username to access your account. Web trade or business is not subject to the withholding tax on foreign partners’ share of effectively connected income. Web tax information for international students and scholars. Tax services for business @ purdue. Web purdue global payroll deduction request.

Purdue Global University Reviews 2023 Best Online College

Web purdue tax information international students working for purdue will get tax information after january 31. 1100 missouri tax forms and templates are collected for any. Deductions begin the first pay period after this form is processed (please allow 2 weeks) and continue until you notify us of a change. Purdue global is purdue’s online university for working adults. Contact.

Web Tax Services And Forms.

Web purdue university global inc. Web for more information, please complete a form on the purdue global website. Deductions begin the first pay period after this form is processed (please allow 2 weeks) and continue until you notify us of a change. Returns must be postmarked by a.

Web Purdue Global Payroll Deduction Request.

Contact tax@purdue.edu with access issues or questions. Web view your w2 form through the adp website or adp tile/link within successfactors. Gain (loss) reported separately from federal schedule k, line 17d (force) Will i need to provide a copy of my high school transcript to pursue an undergraduate program at purdue.

Web Sale Of Property With Section 179 Expense.

To avoid delays in processing, use forms approved by the revenue division of the city of kansas city,. You must provide a username to access your account. Financial aid videos view fatv videos tuition undergraduate and graduate tuition and fees professional studies. Purdue global is purdue’s online university for working adults.

Classification ( Ntee ) Undergraduate College (4.

Web what is the process to enroll and apply for the education benefit? Web purdue tax information international students working for purdue will get tax information after january 31. Web tax information for international students and scholars. Web trade or business is not subject to the withholding tax on foreign partners’ share of effectively connected income.