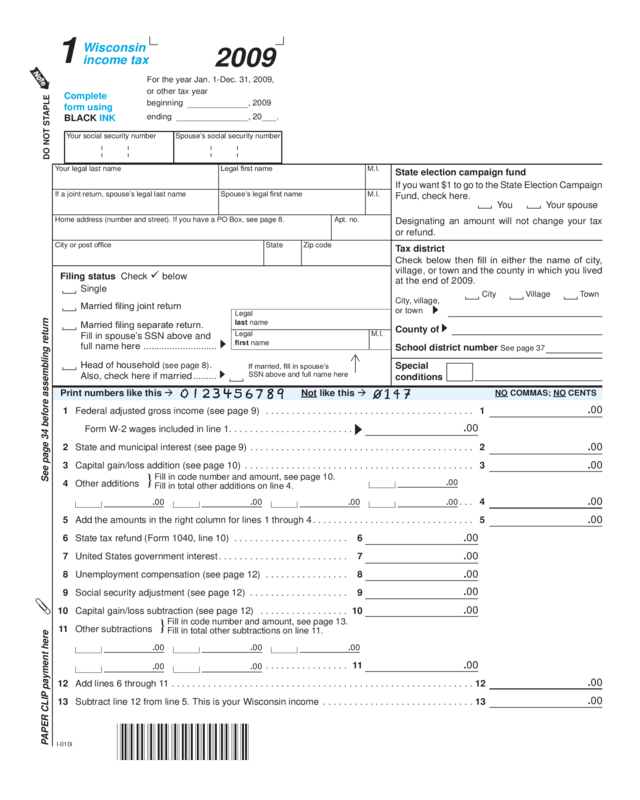

Wisconsin Income Tax Form 1

Wisconsin Income Tax Form 1 - Submit the payment with a 2022 wisconsin form 1‑es. Download your updated document, export it to the cloud, print it from the. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Estimated individual income tax return. It can be efiled or sent by mail. It can be efiled or sent by mail. 31, 2019, or other tax year 2019beginning , 2019 ending , 20. Web earned income tax credit. If you make $70,000 a year living in wisconsin you will be taxed $10,908. Web wisconsinincome tax check here if an amended returnfor the year jan.

It can be efiled or sent by mail. It can be efiled or sent by mail. If you make $70,000 a year living in wisconsin you will be taxed $10,908. Web income tax credit, they must recompute the federal earned income tax credit using their 2020 earned income amount for wisconsin purposes, as explained on page 25 of the. Web 153 rows 2021 individual income tax forms note: You can get this form at any department of revenue office or. Estimated individual income tax return. We last updated the income tax return (long form) in march. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web 185 rows form;

Estimated individual income tax return. Web wisconsin has a state income tax that ranges between 4% and 7.65% , which is administered by the wisconsin department of revenue. Web 153 rows 2021 individual income tax forms note: If you make $70,000 a year living in wisconsin you will be taxed $10,908. You can get this form at any department of revenue office or. We will update this page with a new version of the form for 2024 as soon as it is made available. Web we last updated the wisconsin form 1 instructional booklet in march 2023, so this is the latest version of income tax instructions, fully updated for tax year 2022. Web form 1 is the general income tax return (long form) for wisconsin residents. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing, alcohol, withholding, telco,.

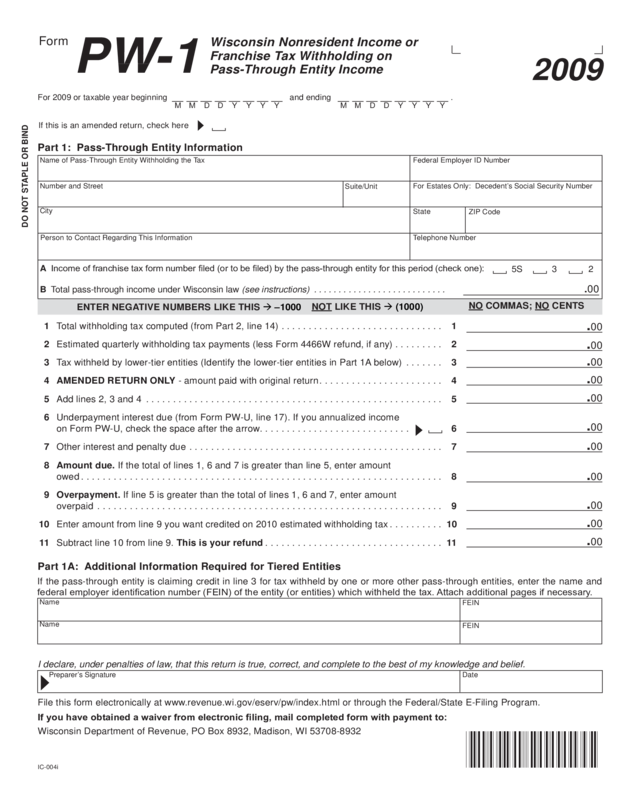

2009 Form 1 Wisconsin Tax (Pdf Fillable Format) Edit, Fill

Web this form is for income earned in tax year 2022, with tax returns due in april 2023. 31, 2019, or other tax year 2019beginning , 2019 ending , 20. It can be efiled or sent by mail. Web wisconsin has a state income tax that ranges between 4% and 7.65% , which is administered by the wisconsin department of.

2020 Form WI DoR WT7 Fill Online, Printable, Fillable, Blank pdfFiller

Wisconsin adopted section 211 of division ee of. Web income tax forms tax year 2022 individual fiduciary, estate & trust partnership corporation tax year 2023 individual fiduciary, estate & trust partnership corporation. Your average tax rate is 11.67% and your. Web form 1 is the general income tax return (long form) for wisconsin residents. Web 153 rows 2021 individual income.

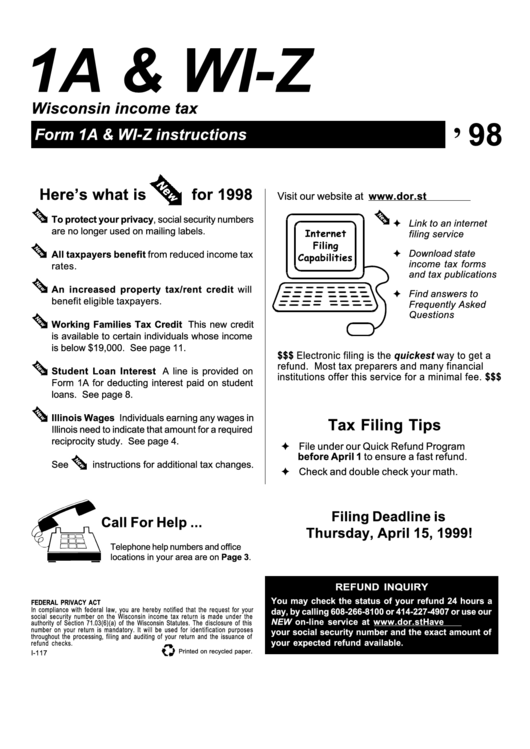

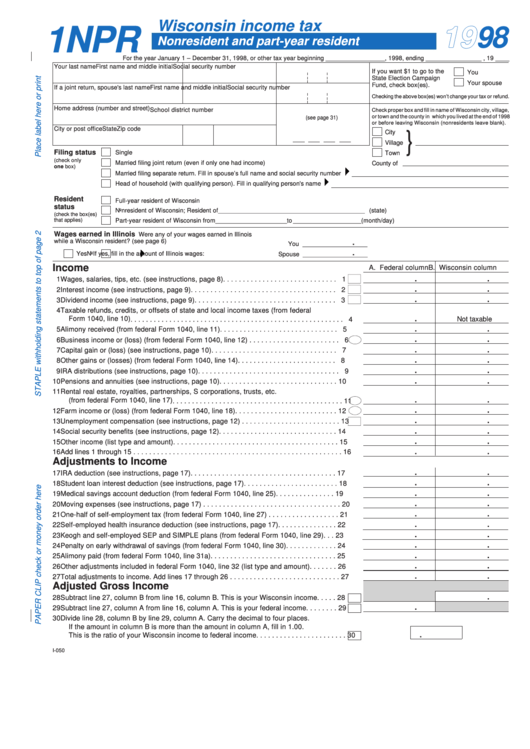

Instructions For Wisconsin Tax Form 1a/wiZ 1998 printable pdf

Web form 1 is the general income tax return (long form) for wisconsin residents. Web income tax forms tax year 2022 individual fiduciary, estate & trust partnership corporation tax year 2023 individual fiduciary, estate & trust partnership corporation. Web form 1 is the general income tax return (long form) for wisconsin residents. Web wisconsin has a state income tax that.

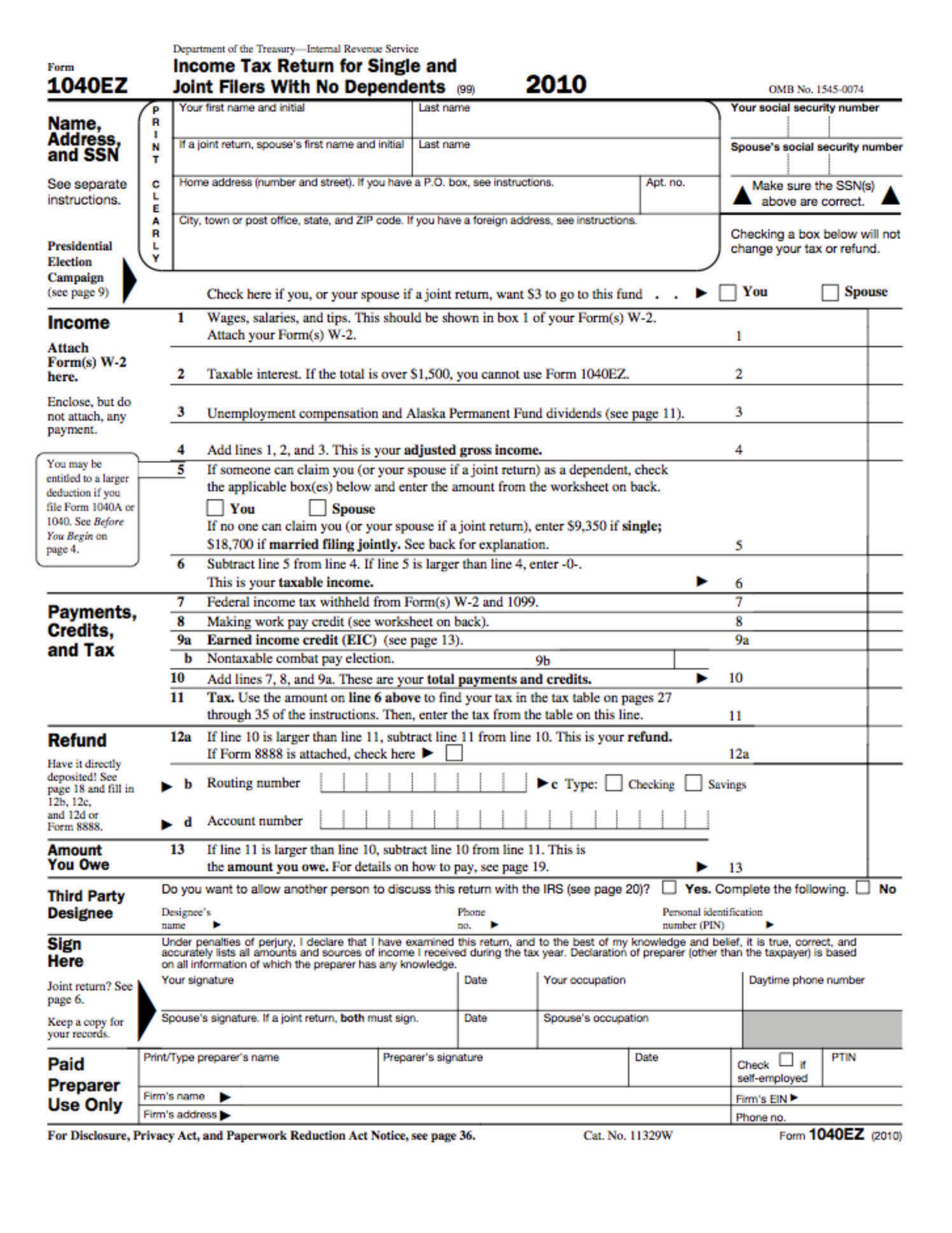

Taxes

Web 185 rows form; Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Your average tax rate is 11.67% and your. Web earned income tax credit. Please carefully read each state's instructions to.

2009 Form 1 Wisconsin Tax (Pdf Fillable Format) Edit, Fill

Complete, edit or print tax forms instantly. Forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing, alcohol, withholding, telco,. Web we last updated the wisconsin form 1 instructional booklet in march 2023, so this is the latest version of income tax instructions, fully updated for tax year 2022. Web catch the top stories of the day on.

2009 Ic004 Form Pw1 Wisconsin Nonresident Or Franchise Tax

We last updated the income tax return (long form) in march. Web the extension period by paying the tax by april 18, 2023. It can be efiled or sent by mail. Web 153 rows 2021 individual income tax forms note: Web form 1 wisconsin — income tax return (long form) download this form print this form it appears you don't.

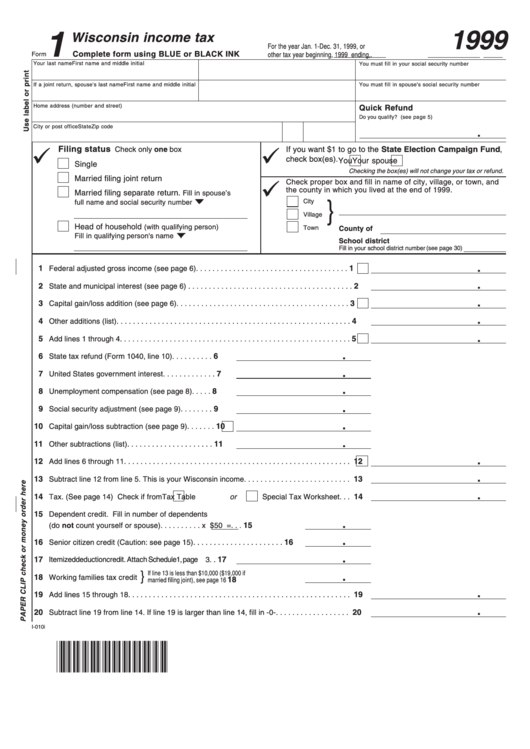

Form 1 Wisconsin Tax Wisconsin Department Of Revenue 1999

Estimated individual income tax return. Complete, edit or print tax forms instantly. Web earned income tax credit. Web wisconsinincome tax check here if an amended returnfor the year jan. Web 185 rows form;

Fillable Wisconsin Tax Form Nonresident And PartYear Resident

Web form 1 wisconsin — income tax return (long form) download this form print this form it appears you don't have a pdf plugin for this browser. Download your updated document, export it to the cloud, print it from the. Web we last updated the wisconsin form 1 instructional booklet in march 2023, so this is the latest version of.

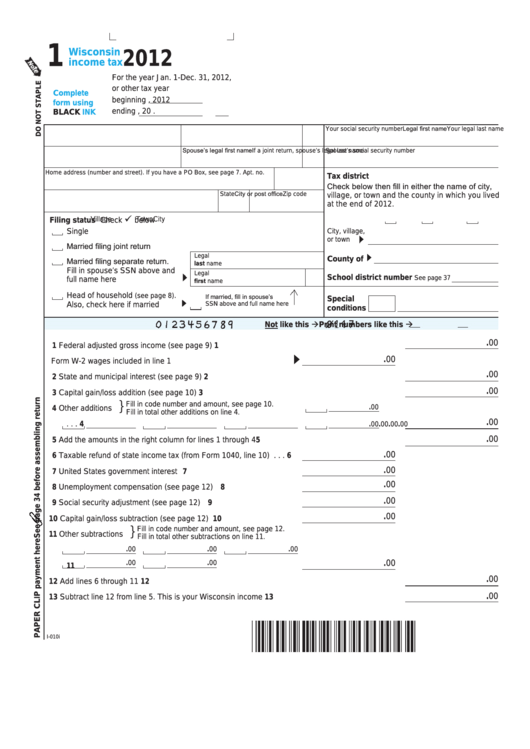

Fillable Form 1 Wisconsin Tax 2012 printable pdf download

Complete, edit or print tax forms instantly. Web we last updated the wisconsin form 1 instructional booklet in march 2023, so this is the latest version of income tax instructions, fully updated for tax year 2022. Web form 1 wisconsin — income tax return (long form) download this form print this form it appears you don't have a pdf plugin.

2009 Form 1 Wisconsin Tax (Pdf Fillable Format) Edit, Fill

Wisconsin adopted section 211 of division ee of. Please carefully read each state's instructions to. Download your updated document, export it to the cloud, print it from the. It can be efiled or sent by mail. You may be required to file state income tax return(s) for each state in which you resided and/or earned income.

Web Income Tax Credit, They Must Recompute The Federal Earned Income Tax Credit Using Their 2020 Earned Income Amount For Wisconsin Purposes, As Explained On Page 25 Of The.

Web wisconsin has a state income tax that ranges between 4% and 7.65% , which is administered by the wisconsin department of revenue. Web form 1 is the general income tax return (long form) for wisconsin residents. Web 153 rows 2021 individual income tax forms note: Please use the link below.

Web Wisconsin Dor My Tax Account Allows Taxpayers To Register Tax Accounts, File Taxes, Make Payments, Check Refund Statuses, Search For Unclaimed Property, And Manage Audits.

Web we last updated the wisconsin form 1 instructional booklet in march 2023, so this is the latest version of income tax instructions, fully updated for tax year 2022. Web the extension period by paying the tax by april 18, 2023. 31, 2019, or other tax year 2019beginning , 2019 ending , 20. You may be required to file state income tax return(s) for each state in which you resided and/or earned income.

Estimated Individual Income Tax Return.

Web earned income tax credit. Please carefully read each state's instructions to. We last updated the income tax return (long form) in march. Your average tax rate is 11.67% and your.

Complete, Edit Or Print Tax Forms Instantly.

Web this form is for income earned in tax year 2022, with tax returns due in april 2023. It can be efiled or sent by mail. You can get this form at any department of revenue office or. Wisconsin adopted section 211 of division ee of.