Wisconsin Form 1 Tax Instructions

Wisconsin Form 1 Tax Instructions - Web form 1 wisconsin — income tax return (long form) download this form print this form it appears you don't have a pdf plugin for this browser. Web we last updated wisconsin income tax instructions in march 2023 from the wisconsin department of. Wisconsin form 1 instructional booklet: Web wisconsin department of revenue: Forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing, alcohol, withholding, telco,. File state tax return at no charge accurate.: Web form code form name ; Web tax forms and instructions tobacco master settlement agreement (msa) conduit revenue bonds report of conduit revenue bonds issued delinquent tax estate. Please use the link below to. This federal provision was enacted in section 211 of division ee of the.

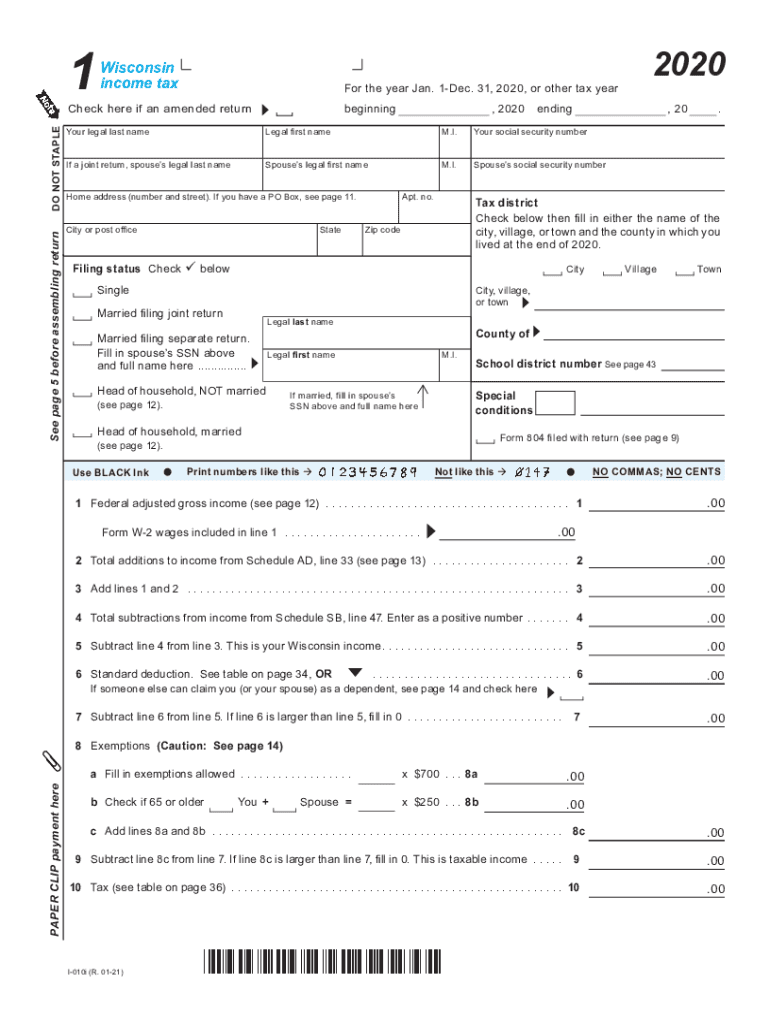

Web form 1 wisconsin — income tax return (long form) download this form print this form it appears you don't have a pdf plugin for this browser. Web wisconsin residents will file their 2018 individual income tax return using form 1. Web make any adjustments needed: 2022 wisconsin form 1 instructional booklet. Web form code form name ; Web 3 gifts to charity from federal schedule a (form 1040 or 1040 ‑sr). Wisconsin form 1 instructional booklet: Please use the link below to. Web form code form name; It can be efiled or sent by mail.

Web wisconsin state taxes at a glance: Web form 1 is the general income tax return (long form) for wisconsin residents. Insert text and pictures to your 2021 wisconsin income tax instructions, highlight important details, erase parts of content and replace them with new. Please use the link below to. Web 2022 individual income tax forms note: It can be efiled or. Web wisconsin residents will file their 2018 individual income tax return using form 1. 2022 wisconsin form 1 instructional booklet. Web form 1 wisconsin — income tax return (long form) download this form print this form it appears you don't have a pdf plugin for this browser. Forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing, alcohol, withholding, telco,.

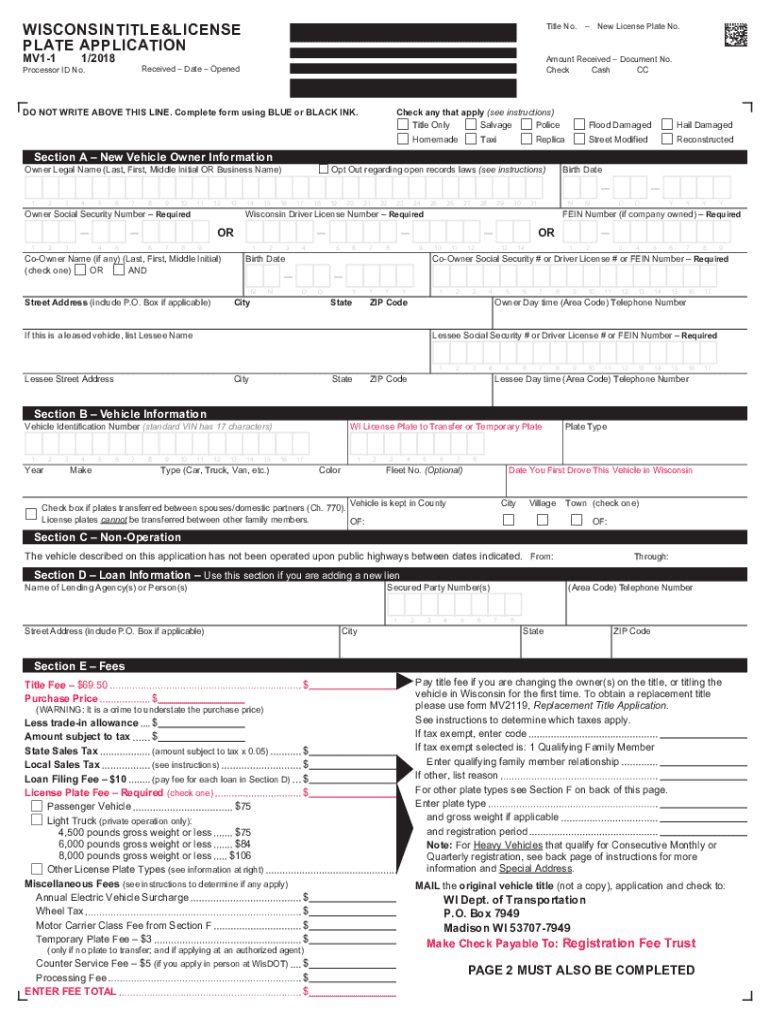

Wisconsin Title License Plate Application Form (MV11) Instructions

Web form 1 is the general income tax return (long form) for wisconsin residents. Web 185 rows form; Web 2022 individual income tax forms note: Homestead credit claim (easy form) tax credit: It can be efiled or.

Form 1 Download Fillable PDF or Fill Online Wisconsin Tax 2020

Web form 1 wisconsin — income tax return (long form) download this form print this form it appears you don't have a pdf plugin for this browser. Web form code form name ; Web wisconsin residents will file their 2018 individual income tax return using form 1. Web make any adjustments needed: Forms for all state taxes (income, business, estate,.

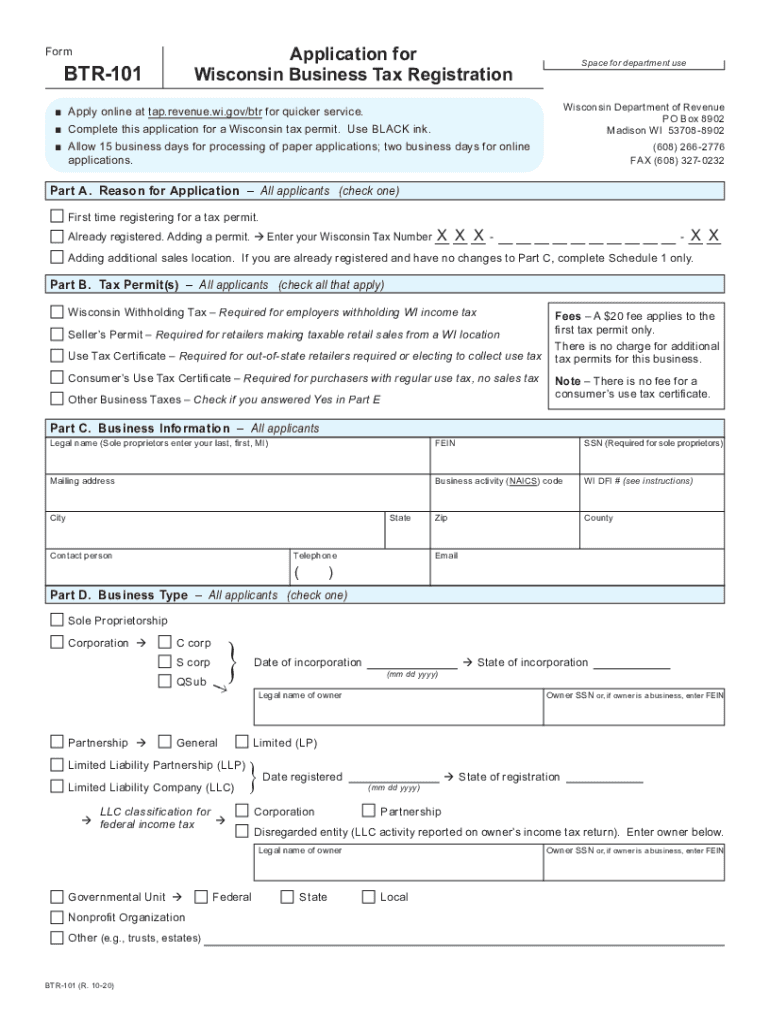

WI DoR BTR101 2020 Fill out Tax Template Online US Legal Forms

It can be efiled or sent by mail. This federal provision was enacted in section 211 of division ee of the. Web wisconsin residents will file their 2018 individual income tax return using form 1. Web 3 gifts to charity from federal schedule a (form 1040 or 1040 ‑sr). File state tax return at no charge accurate.:

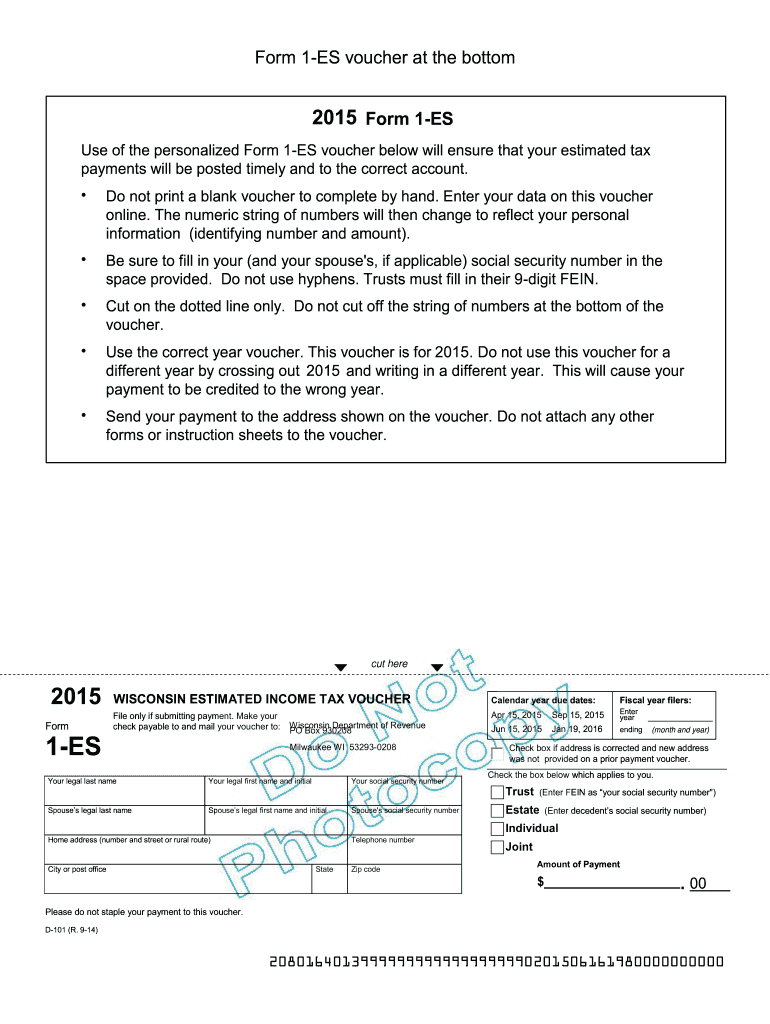

Wisconsin Form 1 Es Fill Out and Sign Printable PDF Template signNow

Web 2022 individual income tax forms note: Web make any adjustments needed: It can be efiled or sent by mail. Homestead credit claim (easy form) tax credit: Please use the link below to.

Wisconsin Tax Form 1 Fill Out and Sign Printable PDF Template

Web wisconsin department of revenue: Web earned income amount for wisconsin purposes, as explained on page 25 of the form 1 instructions. Web tax forms and instructions tobacco master settlement agreement (msa) conduit revenue bonds report of conduit revenue bonds issued delinquent tax estate. This federal provision was enacted in section 211 of division ee of the. Web make any.

Wisconsin Form 1ES Instructions (Estimated Tax Instructions

See instructions for exceptions 3. Homestead credit claim (easy form) tax credit: Web 3 gifts to charity from federal schedule a (form 1040 or 1040 ‑sr). Fill, sign, print and send. Please use the link below to.

Wisconsin 2019 form 1 es no No Download Needed needed Fill out & sign

Insert text and pictures to your 2021 wisconsin income tax instructions, highlight important details, erase parts of content and replace them with new. This federal provision was enacted in section 211 of division ee of the. Forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing, alcohol, withholding, telco,. 2022 wisconsin form 1 instructional booklet. Web tax forms.

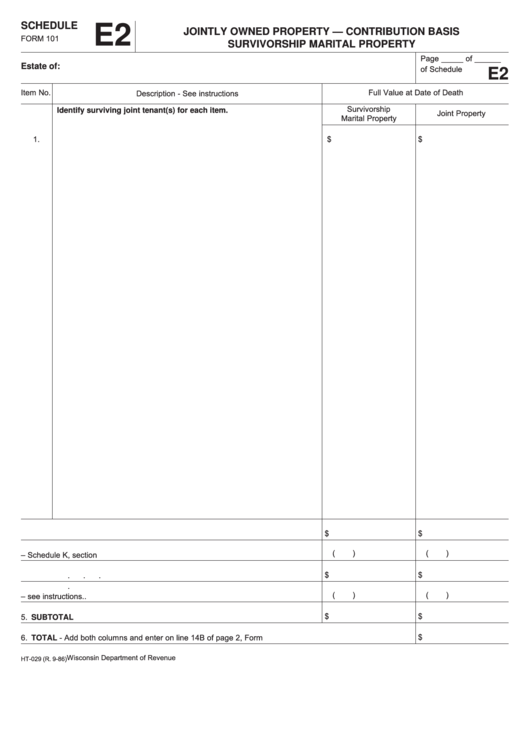

Form 101 Schedule E2 Jointly Owned Property Wisconsin Department

Web 185 rows form; Web 2022 individual income tax forms note: Fill, sign, print and send. Web tax forms and instructions tobacco master settlement agreement (msa) conduit revenue bonds report of conduit revenue bonds issued delinquent tax estate. Web wisconsin residents will file their 2018 individual income tax return using form 1.

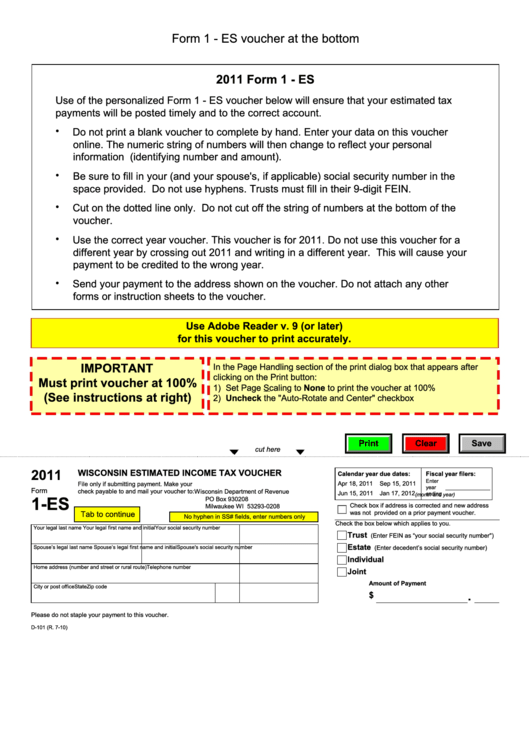

Fillable Form 1Es Wisconsin Estimated Tax Voucher 2011

Web form code form name; See instructions for exceptions 3. Web wisconsin department of revenue: Web 3 gifts to charity from federal schedule a (form 1040 or 1040 ‑sr). Homestead credit claim (easy form) tax credit:

IRS 1065 Schedule K1 2020 Fill out Tax Template Online US Legal

Web form 1 wisconsin — income tax return (long form) download this form print this form it appears you don't have a pdf plugin for this browser. It can be efiled or sent by mail. Web 3 gifts to charity from federal schedule a (form 1040 or 1040 ‑sr). Web form code form name; Web 2022 individual income tax forms.

Wisconsin Form 1 Instructional Booklet:

It can be efiled or. Web tax forms and instructions tobacco master settlement agreement (msa) conduit revenue bonds report of conduit revenue bonds issued delinquent tax estate. See instructions for exceptions 3. Web we last updated wisconsin income tax instructions in march 2023 from the wisconsin department of.

Web Form 1 Is The General Income Tax Return (Long Form) For Wisconsin Residents.

It can be efiled or sent by mail. Web 185 rows form; File state tax return at no charge accurate.: Web form code form name ;

Insert Text And Pictures To Your 2021 Wisconsin Income Tax Instructions, Highlight Important Details, Erase Parts Of Content And Replace Them With New.

Web wisconsin residents will file their 2018 individual income tax return using form 1. Fill, sign, print and send. Web 2022 individual income tax forms note: 2022 wisconsin form 1 instructional booklet.

Forms For All State Taxes (Income, Business, Estate, Partnership, Sales, Utility, Manufacturing, Alcohol, Withholding, Telco,.

Web wisconsin department of revenue: Web form code form name; Web 3 gifts to charity from federal schedule a (form 1040 or 1040 ‑sr). Web earned income amount for wisconsin purposes, as explained on page 25 of the form 1 instructions.