Who Is The Withholding Agent On Form 590

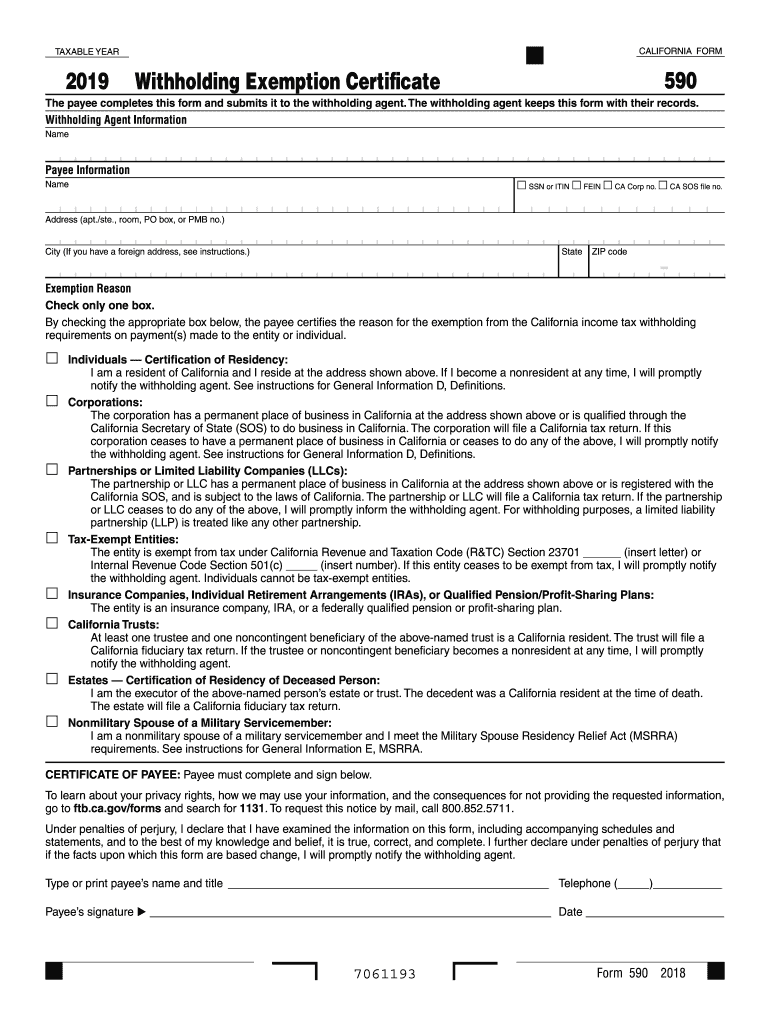

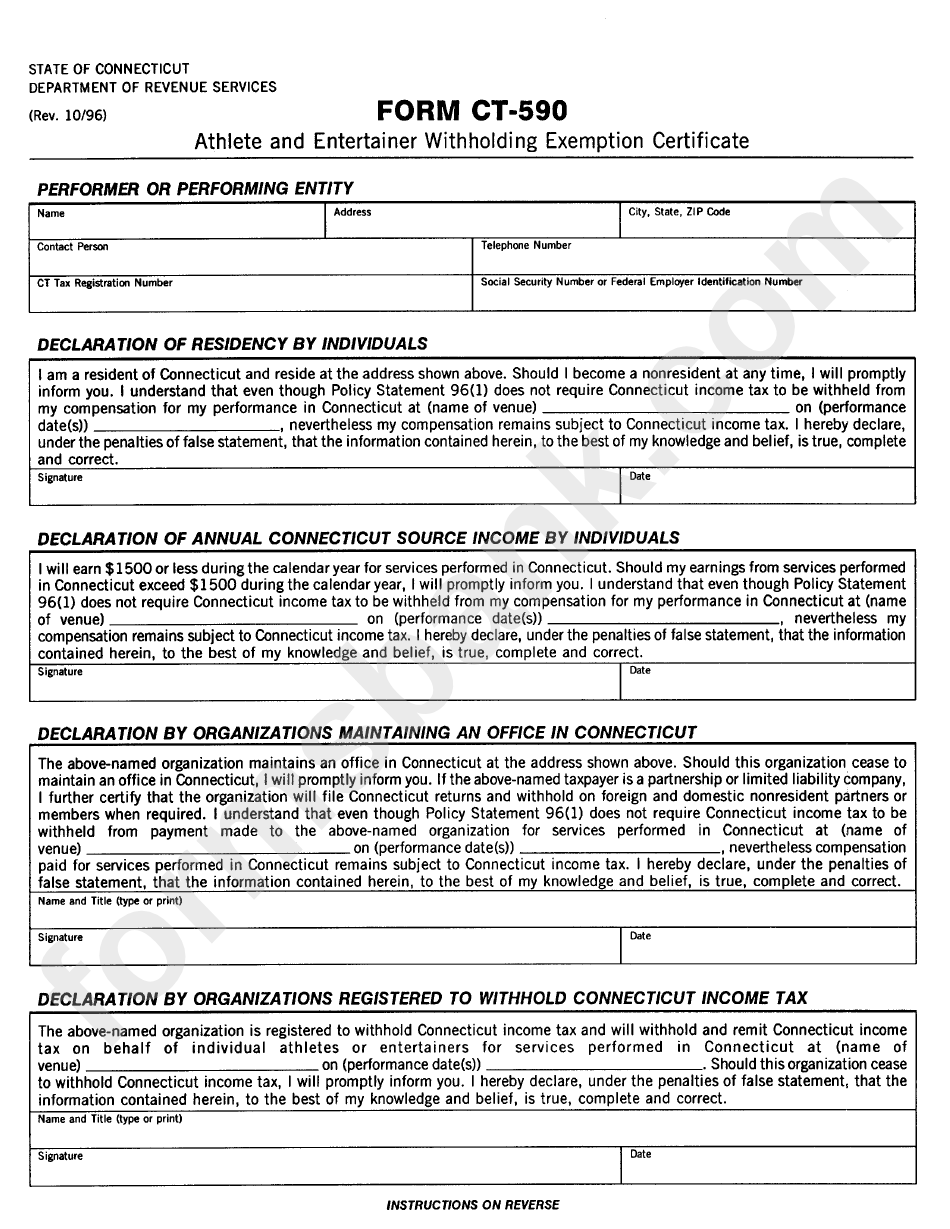

Who Is The Withholding Agent On Form 590 - Am a resident of california and i reside at the address shown above. Web he was actively participating and doing a benefit to this foreign agent for this foreign country and he was withholding american tax dollars in the form of foreign aid. For more information, go to ftb.ca.gov and search for backup withholding. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Web r&tc section 18668 makes the withholding agent liable to remit the tax withholding required. Or foreign person that has control, receipt, custody, disposal, or payment of any item of. Web withholding agent makes payment to nonresident payee. Web the withholding agent must then withhold and report the withholding using form 592, resident and nonresident withholding statement, and remit the withholding using. We last updated the withholding exemption. I have california based company.

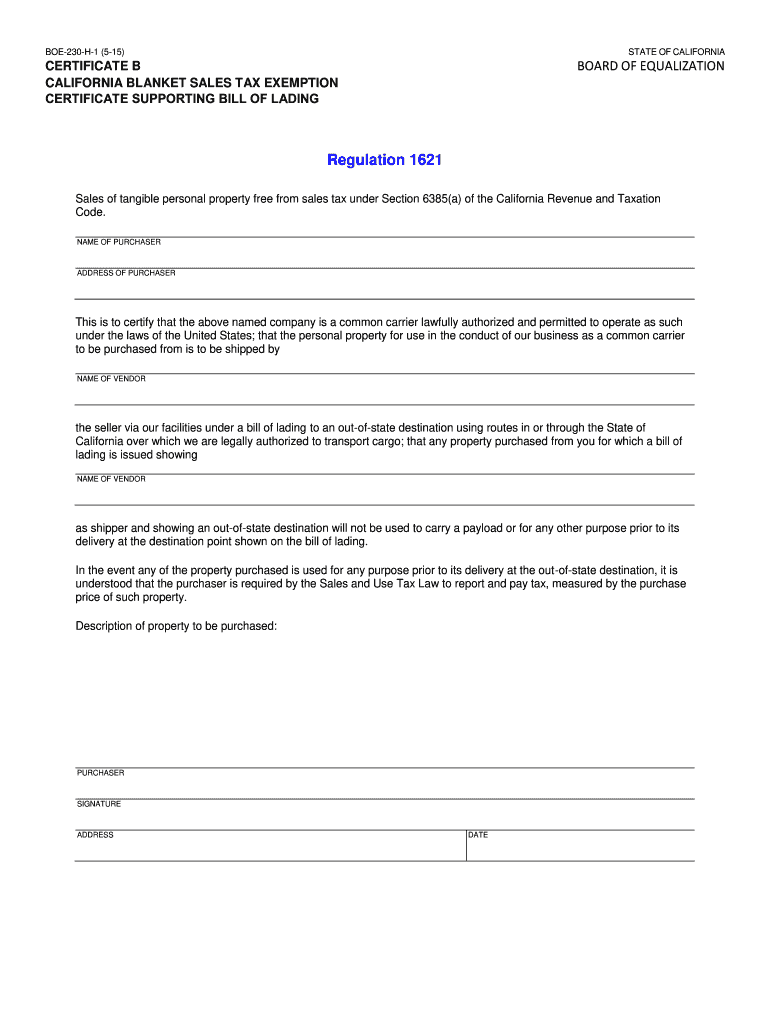

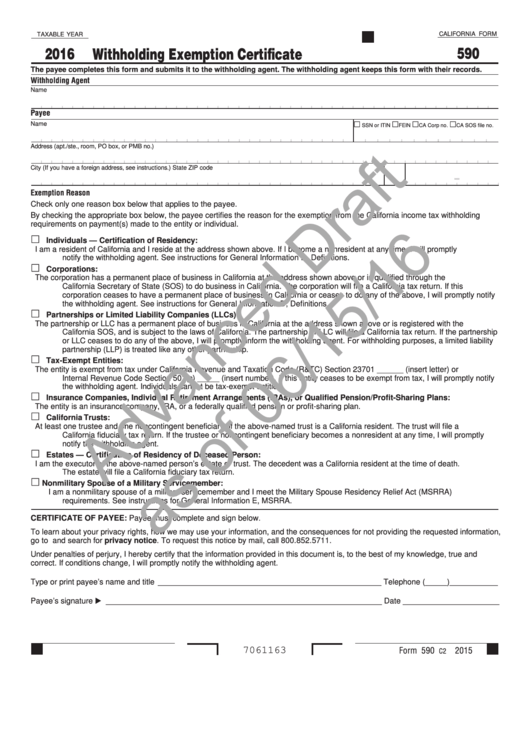

We last updated the withholding exemption. Or foreign person that has control, receipt, custody, disposal, or payment of any item of. Withholding agent (type or print) name california form 590 payee exemption reason check. If i become a nonresident at any time, i will promptly notify the. Web the payee completes this form and submits it to the withholding agent. Payee who is a california resident or a business with resident. Web who is the withholding agent on form 590? Web he was actively participating and doing a benefit to this foreign agent for this foreign country and he was withholding american tax dollars in the form of foreign aid. The payments are for wages to. For more information, go to ftb.ca.gov and search for backup withholding.

Web notify the withholding agent. The withholding agent keeps this. Or foreign person that has control, receipt, custody, disposal, or payment of any item of. We last updated the withholding exemption. If i become a nonresident at any time, i will promptly notify the. Web 2023 withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent. California residents or entities should complete and present form 590 to. Web individuals — certification of residency: Web the payee completes this form and submits it to the withholding agent. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding.

What Is A Us Withholding Agent SWHOI

Web individuals — certification of residency: For more information, go to ftb.ca.gov and search for backup withholding. Web 2023 withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent. Web who is the withholding agent on form 590? Or foreign person that has control, receipt, custody, disposal, or payment of any item.

Ca590 Fill Out and Sign Printable PDF Template signNow

Web notify the withholding agent. Web 2023 withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent. R&tc section 17951 contains the provision requiring nonresidents to be taxed. Web the withholding agent must then withhold and report the withholding using form 592, resident and nonresident withholding statement, and remit the withholding using..

California Form 590 C2 Withholding Exemption Certificate 2002

Payee who is a california resident or a business with resident. Web he was actively participating and doing a benefit to this foreign agent for this foreign country and he was withholding american tax dollars in the form of foreign aid. Withholding agent (type or print) name california form 590 payee exemption reason check. Am a resident of california and.

Fillable Form Ct590 Athlete And Entertainer Withholding Exemption

Web withholding agent makes payment to nonresident payee. Web the withholding agent must then withhold and report the withholding using form 592, resident and nonresident withholding statement, and remit the withholding using. The withholding agent keeps this form with their records. Web 2023 withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding.

California Tax Withholding Form Escrow

Am a resident of california and i reside at the address shown above. The withholding agent keeps this. Web withholding agent makes payment to nonresident payee. Web 2023 withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent. A company i work for sent me form 590 to submit to them.

3.21.15 Withholding on Foreign Partners Internal Revenue Service

The withholding agent keeps this. Web he was actively participating and doing a benefit to this foreign agent for this foreign country and he was withholding american tax dollars in the form of foreign aid. Ftb form 590, withholding exemption certificate : Am a resident of california and i reside at the address shown above. Withholding agent (type or print).

California Form 590 Draft Withholding Exemption Certificate 2016

Web withholding agent makes payment to nonresident payee. Or foreign person that has control, receipt, custody, disposal, or payment of any item of. The payments are for wages to. Web 2023 withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent. Web r&tc section 18668 makes the withholding agent liable to remit.

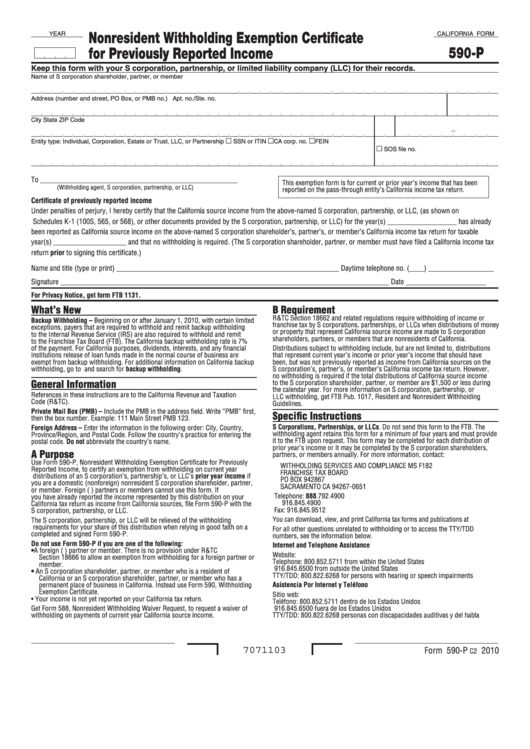

Fillable California Form 590P Nonresident Withholding Exemption

California residents or entities should complete and present form 590 to. The withholding agent keeps this. For more information, go to ftb.ca.gov and search for backup withholding. I have california based company. Web withholding agent makes payment to nonresident payee.

Print Ca Form 1032 Ncnfb2mvd7udwm

Withholding agent (type or print) name california form 590 payee exemption reason check. If i become a nonresident at any time, i will promptly notify the. A company i work for sent me form 590 to submit to them. Web withholding agent makes payment to nonresident payee. Ftb form 590, withholding exemption certificate :

2016 Form 590 Withholding Exemption Certificate Edit, Fill, Sign

Web the payee completes this form and submits it to the withholding agent. Ftb form 590, withholding exemption certificate : Web 2023 withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent. Web r&tc section 18668 makes the withholding agent liable to remit the tax withholding required. The payments are for wages.

For More Information, Go To Ftb.ca.gov And Search For Backup Withholding.

Estates — certification of residency of deceased person: The payments are subject to backup withholding. Web enter the withholding agent’s name and the s corporation shareholder’s, partnership partner’s, or llc member’s information, including the taxpayer identification number. The payments are for wages to.

Payee Who Is A California Resident Or A Business With Resident.

Web individuals — certification of residency: Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. R&tc section 17951 contains the provision requiring nonresidents to be taxed. The withholding agent keeps this.

Web The Withholding Agent Must Then Withhold And Report The Withholding Using Form 592, Resident And Nonresident Withholding Statement, And Remit The Withholding Using.

If i become a nonresident at any time, i will promptly inform the. Ftb form 590, withholding exemption certificate : If i become a nonresident at any time, i will promptly notify the. Web notify the withholding agent.

Withholding Agent (Type Or Print) Name California Form 590 Payee Exemption Reason Check.

Am a resident of california and i reside at the address shown above. California residents or entities should complete and present form 590 to. Web he was actively participating and doing a benefit to this foreign agent for this foreign country and he was withholding american tax dollars in the form of foreign aid. Or foreign person that has control, receipt, custody, disposal, or payment of any item of.