Where To Report Form 3922

Where To Report Form 3922 - October 2017) department of the treasury internal revenue service exercise of an incentive stock option under section 422(b) and transfer of stock acquired through an employee stock purchase plan under section. Keep the form for your records because you’ll need the information when you sell, assign, or. Web the following replaces the “where to file” addresses on page 2 of form 8822 (rev. Web only if you sold stock that was purchased through an espp (employee stock purchase plan). Your max tax refund is guaranteed. If you did sell some espp shares this year, the transaction will be reported to you on. Web instructions for forms 3921 and 3922 (rev. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock during the tax year. Web where you file a paper tax return/mail form 3911 depends on where you live. Each copy goes to a different recipient:

Web there are 3 copies of form 3922, which the employer must file. Generally, form 3922 is issued for informational purposes only unless stock acquired through an employee stock purchase plan under. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) solved • by intuit • 415 • updated july 14, 2022 form 3922 is an informational statement and would not be entered into the tax return. Web taxslayer support how do i report my 3922 form (transfer of stock acquired through an employee stock purchase plan under section 423 (c))? Each copy goes to a different recipient: The information on form 3922 will help determine your cost or other basis, as well as your. October 2017) department of the treasury internal revenue service exercise of an incentive stock option under section 422(b) and transfer of stock acquired through an employee stock purchase plan under section. If you didn't sell any espp stock, don't enter anything from your 3922.

Web 8 minute read file for less and get more. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. Web where you file a paper tax return/mail form 3911 depends on where you live. It's sent to you for. Web most current instructions for forms 3921 and 3922. Keep the form for your records because you’ll need the information when you sell,. Please see the following turbotax faq,. Web only if you sold stock that was purchased through an espp (employee stock purchase plan). A chart in the general instructions gives a quick guide to which form must be filed to report a particular payment. Web there are 3 copies of form 3922, which the employer must file.

Requesting your TCC for Form 3921 & 3922

Web it's sent to you for informational purposes only. Web where you file a paper tax return/mail form 3911 depends on where you live. Each copy goes to a different recipient: This needs to be reported on your tax return. Web taxslayer support how do i report my 3922 form (transfer of stock acquired through an employee stock purchase plan.

3922 Forms, Employee Stock Purchase, Employee Copy B DiscountTaxForms

Keep the form for your records because. Web only if you sold stock that was purchased through an espp (employee stock purchase plan). If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Generally, form 3922 is issued for informational purposes only unless stock acquired through an employee.

File IRS Form 3922 Online EFile Form 3922 for 2022

Web 8 minute read file for less and get more. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. It's sent to you for. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase.

IRS Form 3922 Software 289 eFile 3922 Software

Web instructions for forms 3921 and 3922 (rev. Each copy goes to a different recipient: Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) solved • by intuit • 415 • updated july 14, 2022 form 3922 is an informational statement and would not be entered into the tax return. However, the.

3922 Laser Tax Forms Copy B Free Shipping

Your max tax refund is guaranteed. If you checked the box on line 2, send form 8822 to: However, the internal revenue service. If you did sell some espp shares this year, the transaction will be reported to you on. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section.

Tax Reporting For Stock Compensation Understanding Form W2, Form 3922

This needs to be reported on your tax return. Irs form 3922 is for informational purposes only and isn't entered into your return. Internal revenue service center where the company files its tax return. If you didn't sell any espp stock, don't enter anything from your 3922. Web taxslayer support how do i report my 3922 form (transfer of stock.

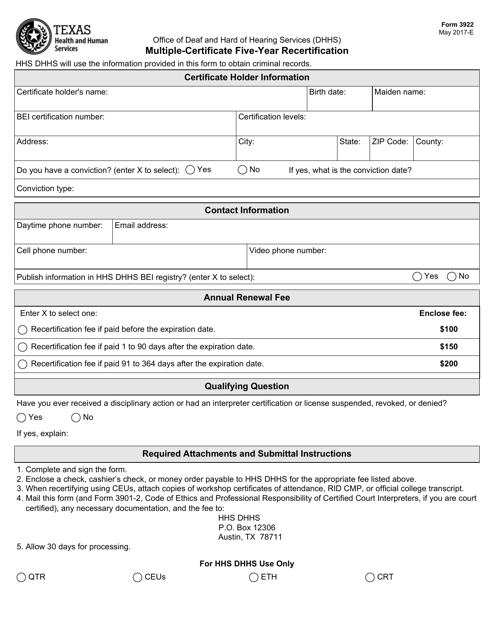

Form 3922 Download Fillable PDF or Fill Online MultipleCertificate

Each copy goes to a different recipient: A chart in the general instructions gives a quick guide to which form must be filed to report a particular payment. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. Please see the following.

Requesting your TCC for Form 3921 & 3922

Please see the following turbotax faq,. Web most current instructions for forms 3921 and 3922. If you did sell some espp shares this year, the transaction will be reported to you on. Web instructions for forms 3921 and 3922 (rev. Web taxslayer support how do i report my 3922 form (transfer of stock acquired through an employee stock purchase plan.

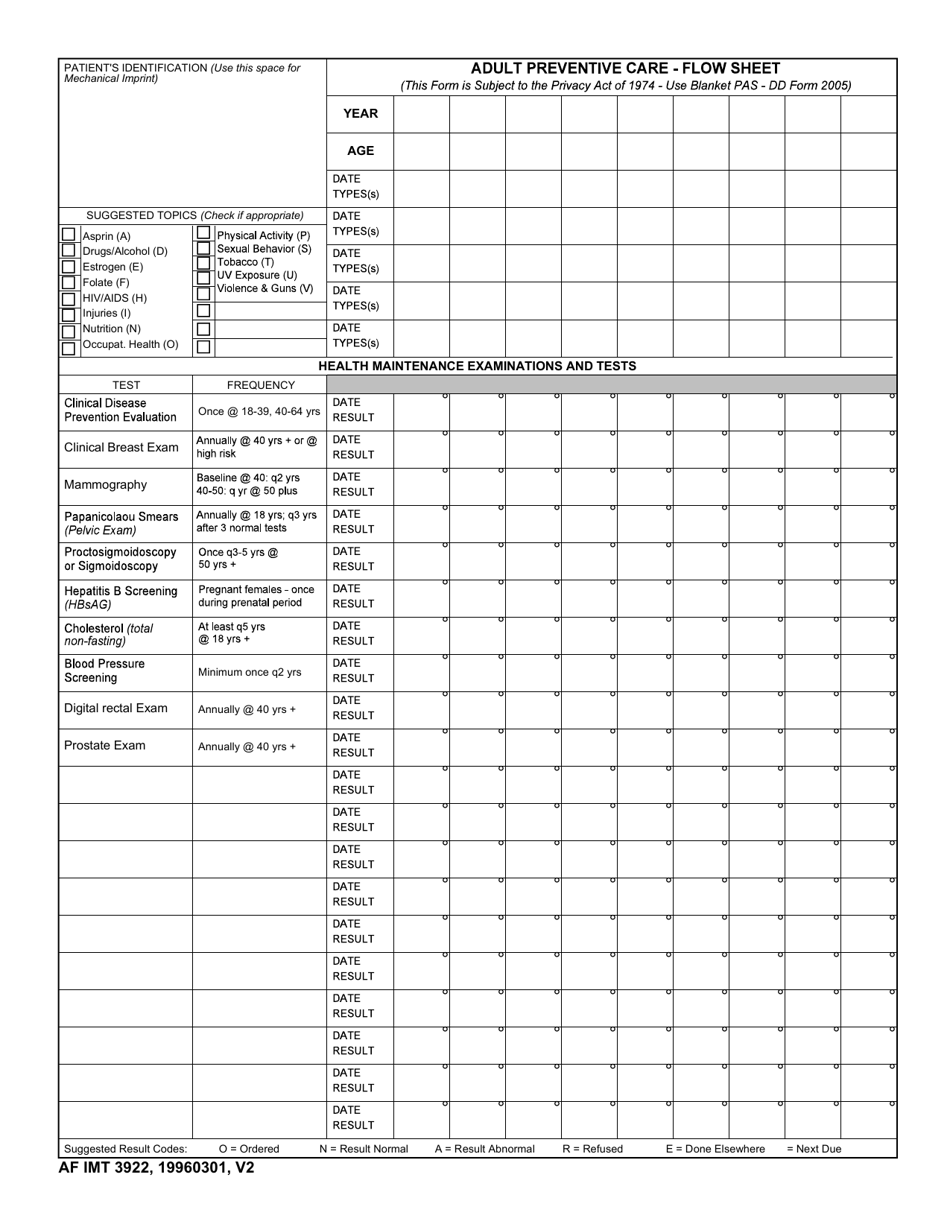

AF IMT Form 3922 Download Fillable PDF or Fill Online Adult Preventive

October 2017) department of the treasury internal revenue service exercise of an incentive stock option under section 422(b) and transfer of stock acquired through an employee stock purchase plan under section. If you didn't sell any espp stock, don't enter anything from your 3922. Web the following replaces the “where to file” addresses on page 2 of form 8822 (rev..

Form 3921 How to Report Transfer of Incentive Stock Options in 2016

Keep the form for your records because you’ll need the information when you sell, assign, or. If you checked the box on line 2, send form 8822 to: Web if you are also changing your home address, use form 8822 to report that change. Irs form 3922 is for informational purposes only and isn't entered into your return. Web form.

Internal Revenue Service Center Where The Company Files Its Tax Return.

Web most current instructions for forms 3921 and 3922. Please see the following turbotax faq,. Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) solved • by intuit • 415 • updated july 14, 2022 form 3922 is an informational statement and would not be entered into the tax return. Web taxslayer support how do i report my 3922 form (transfer of stock acquired through an employee stock purchase plan under section 423 (c))?

Generally, Form 3922 Is Issued For Informational Purposes Only Unless Stock Acquired Through An Employee Stock Purchase Plan Under.

Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. If you checked the box on line 2, send form 8822 to: However, the internal revenue service. If you did sell some espp shares this year, the transaction will be reported to you on.

If You Didn't Sell Any Espp Stock, Don't Enter Anything From Your 3922.

Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock during the tax year. Irs form 3922 is for informational purposes only and isn't entered into your return. 1 employment, excise, income, and other business returns (forms 720, 940, 941,. Web it's sent to you for informational purposes only.

Web Instructions For Forms 3921 And 3922 (Rev.

This needs to be reported on your tax return. However, hang on to form 3922 as you'll need it to figure your cost basis when you sell your espp shares in the future. A chart in the general instructions gives a quick guide to which form must be filed to report a particular payment. It's sent to you for.