Where To File Form 3922 On Tax Return

Where To File Form 3922 On Tax Return - Web to add form 3922 (transfer of stock acquired through employee stock purchase plan.): Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) solved • by intuit • 415 • updated july 14, 2022. Web 1 best answer. Don’t wait for the deadline. This form is provided to employees for informational purposes. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. If the deadline date falls on a saturday, sunday or legal. Select form 3922 from your dashboard. Click on take me to my return.

Web for the latest information about developments related to forms 3921 and 3922 and their instructions, such as legislation enacted after they were published, go to. Don’t wait for the deadline. Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) solved • by intuit • 415 • updated july 14, 2022. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your return. Select form 3922 from your dashboard. Web easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile now more salient. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. As with most information returns, it is. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan.

Keep the form for your records because you’ll need the information when you sell, assign, or. Web only if you sold stock that was purchased through an espp (employee stock purchase plan). Web to add form 3922 (transfer of stock acquired through employee stock purchase plan.): Web easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile now more salient. If the deadline date falls on a saturday, sunday or legal. This form is provided to employees for informational purposes. Web irs form 3922 is used by the companies to report the transfer of stock acquired by the employee through the employee stock purchase plan (espp) under. Web irs form 3922 is for informational purposes only and isn't entered into your return. Select form 3922 from your dashboard. Web save this form with your investment records.

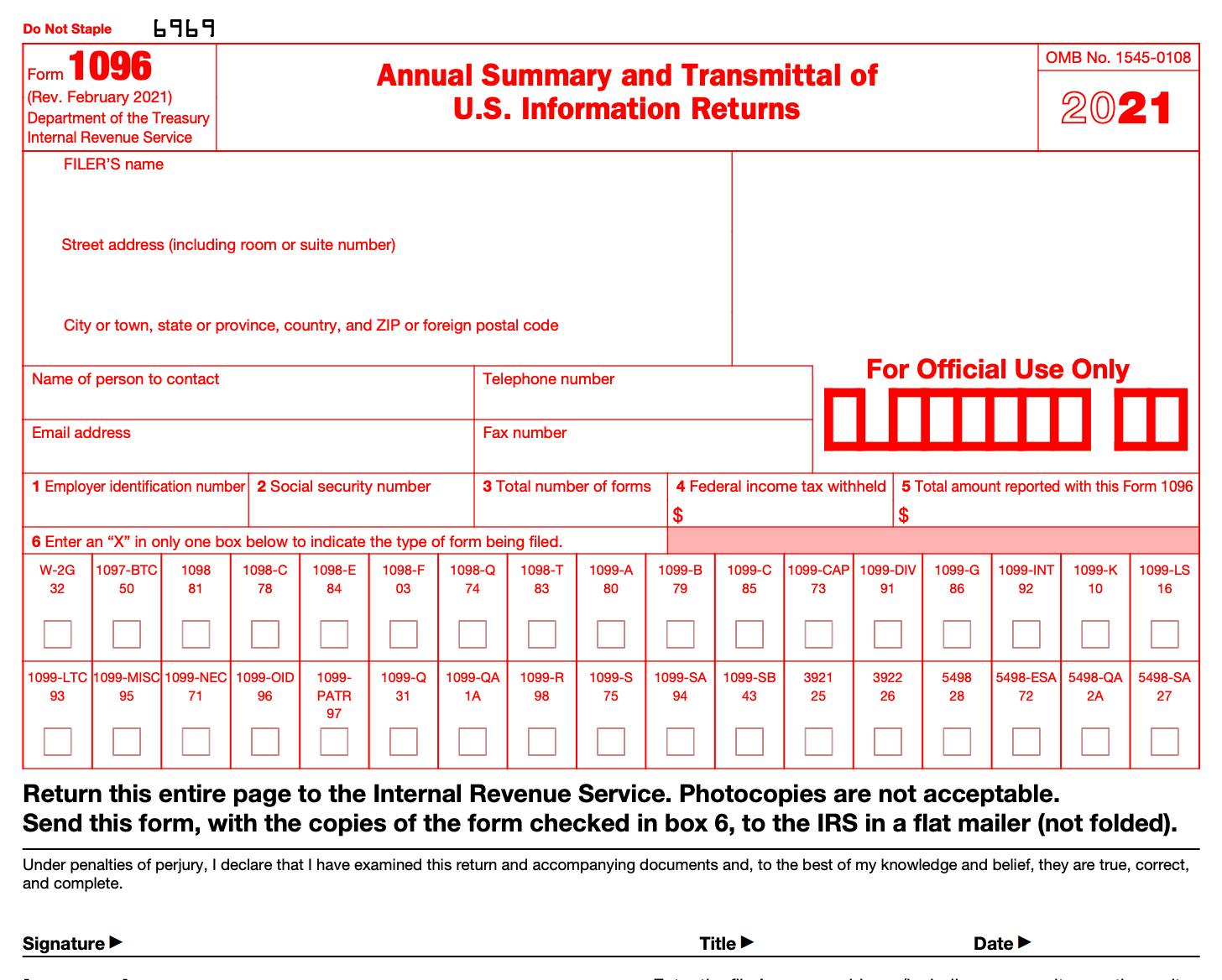

What is a 1096 Form? A Guide for US Employers Remote

You can efile form 3922 online for the year 2020 using tax1099. Sign in or open turbotax. Web do i need to file form 3922 with my income tax return? Web irs form 3922 is used by the companies to report the transfer of stock acquired by the employee through the employee stock purchase plan (espp) under. Web irs form.

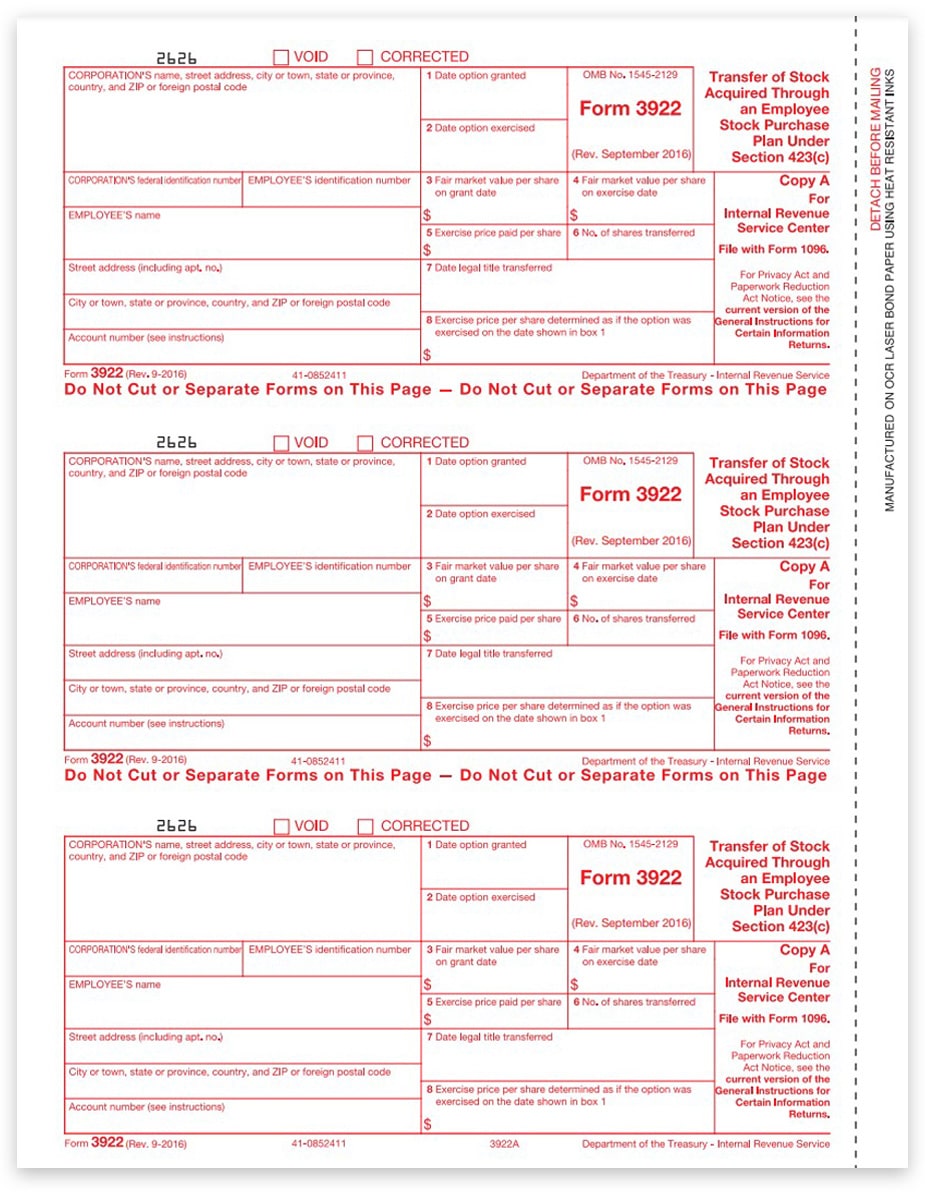

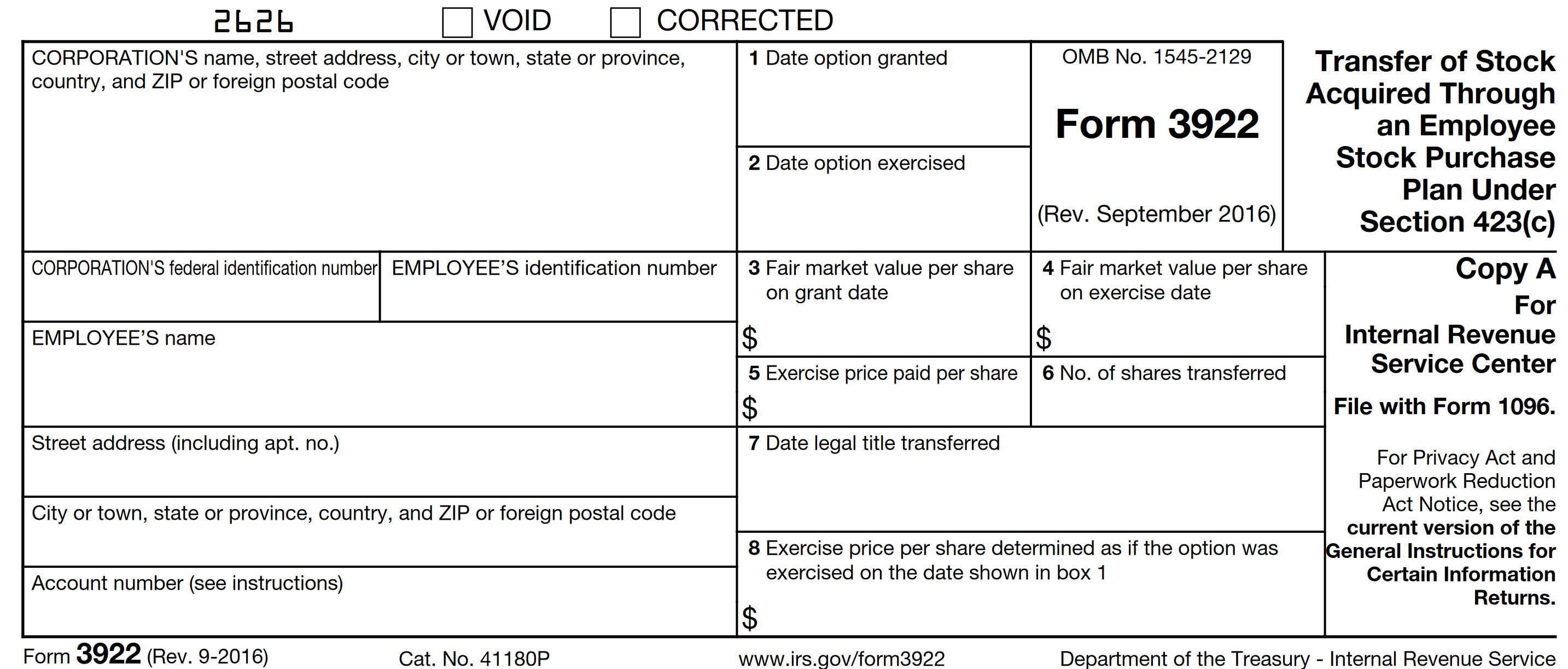

IRS Form 3922

Web for the latest information about developments related to forms 3921 and 3922 and their instructions, such as legislation enacted after they were published, go to irs.gov/. Sign in or open turbotax. Until you sell the unites, you don’t have to enter information from form 3921 into your tax return. Web form 3922, transfer of stock acquired through an employee.

3922 Forms, Employee Stock Purchase, IRS Copy A DiscountTaxForms

Until you sell the unites, you don’t have to enter information from form 3921 into your tax return. Web easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile now more salient. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for.

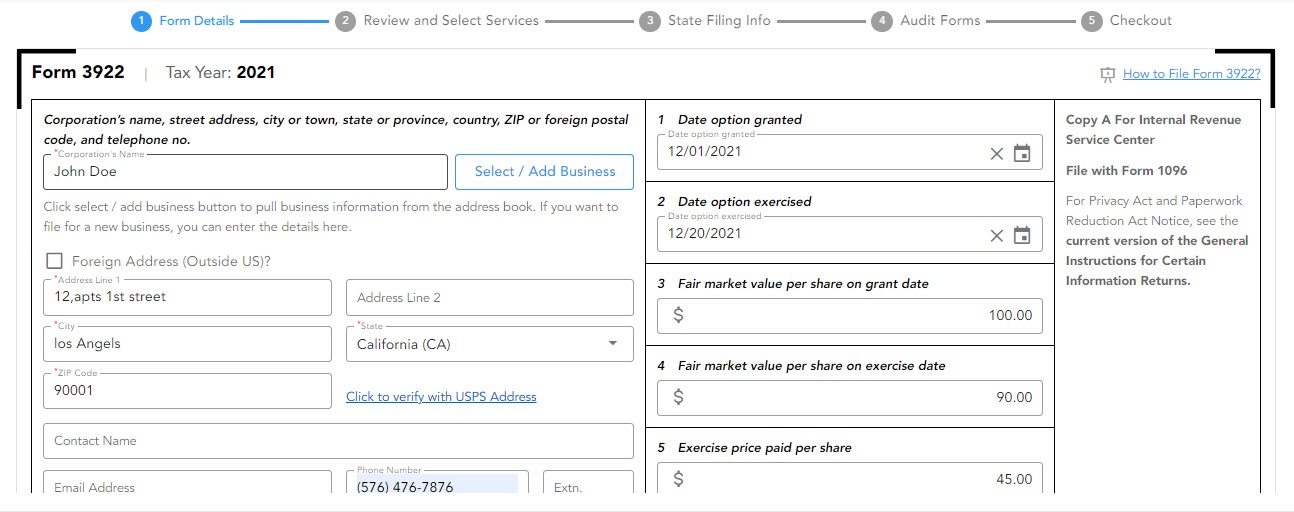

3922, Tax Reporting Instructions & Filing Requirements for Form 3922

Web the form is required to be furnished to a taxpayer by january 31 of the year following the year of first transfer of the stock acquired through the espp. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your return. You can efile.

File IRS Form 3922 Online EFile Form 3922 for 2022

Web do i need to file form 3922 with my income tax return? Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your. Select form 3922 from your dashboard. Web irs form 3922 is for informational purposes only and isn't entered into.

Documents to Bring To Tax Preparer Tax Documents Checklist

Web the form is required to be furnished to a taxpayer by january 31 of the year following the year of first transfer of the stock acquired through the espp. If the deadline date falls on a saturday, sunday or legal. Web only if you sold stock that was purchased through an espp (employee stock purchase plan). Sign in or.

How to Enter Form 1098E, Student Loan Interest Statement, in a Tax Return

Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your return. Web do i need to.

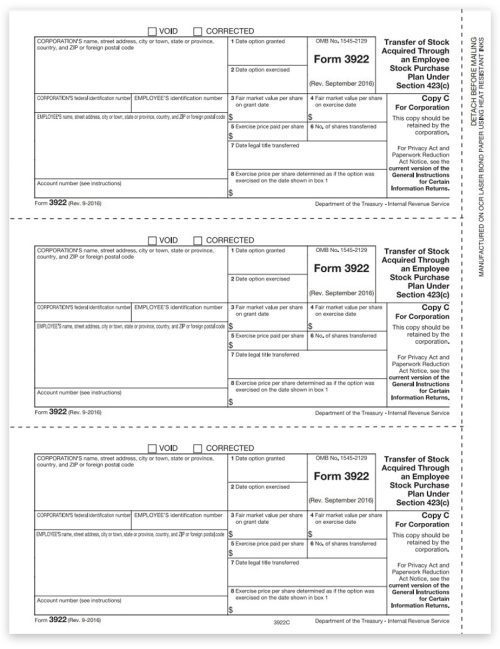

3922 Forms, Employee Stock Purchase, Corporation Copy C DiscountTaxForms

Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web 1 best answer. Click on take me to my return..

A Quick Guide to Form 3922 YouTube

Web to add form 3922 (transfer of stock acquired through employee stock purchase plan.): This form is provided to employees for informational purposes. Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) solved • by intuit • 415 • updated july 14, 2022. Web irs form 3922 is used by the companies.

IRS Form 3922 Software 289 eFile 3922 Software

Don’t wait for the deadline. Click on take me to my return. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web do i need to file form 3922 with my income tax return? Web for the latest information about developments related to forms 3921 and 3922.

Sign In Or Open Turbotax.

Web the deadline to file 3922 forms with the irs is february 28th if filing on paper, or march 31st if filing electronically. Enter the required information to file form 3922. Web for the latest information about developments related to forms 3921 and 3922 and their instructions, such as legislation enacted after they were published, go to irs.gov/. Click on take me to my return.

Web Form 3922 Transfer Of Stock Acquired Through An Employee Stock Purchase Plan Under Section 423(C) Is For Informational Purposes Only And Isn't Entered Into Your Return.

Web save this form with your investment records. As with most information returns, it is. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your. Web irs form 3922 is for informational purposes only and isn't entered into your return.

Web Easy And Secure Efiling Quick And Accurate Reporting State Filing Compliance Supports Bulk Efiling Usps Address Validation Notice Management Efile Now More Salient.

Web irs form 3922 is used by the companies to report the transfer of stock acquired by the employee through the employee stock purchase plan (espp) under. Web for the latest information about developments related to forms 3921 and 3922 and their instructions, such as legislation enacted after they were published, go to. Transfer of stock acquired through an employee stock purchase plan under section 423(c) copy a. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan.

Web Only If You Sold Stock That Was Purchased Through An Espp (Employee Stock Purchase Plan).

Web 1 best answer. Until you sell the unites, you don’t have to enter information from form 3921 into your tax return. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. Keep the form for your records because you’ll need the information when you sell, assign, or.