Where Do I Mail Form 941 X

Where Do I Mail Form 941 X - Connecticut, delaware, district of columbia, georgia,. Web form 941 mailing addresses are changed | irs encourages electronic filing of employment tax returns the irs announced that, effective immediately, the addresses where paper. Where to mail form 941? The mailing address depends on the state your business is in, whether you’re submitting payment with your return and what quarter. What kinds of errors can be. So, if you want a professional that's successfully prepared and filed payroll tax returns for over twenty years to do it for you,. If you decide to paper file your form 941 return, you must mail a copy of the return to the irs. Web amended irs form 941. How can i file or pay electronically? Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and.

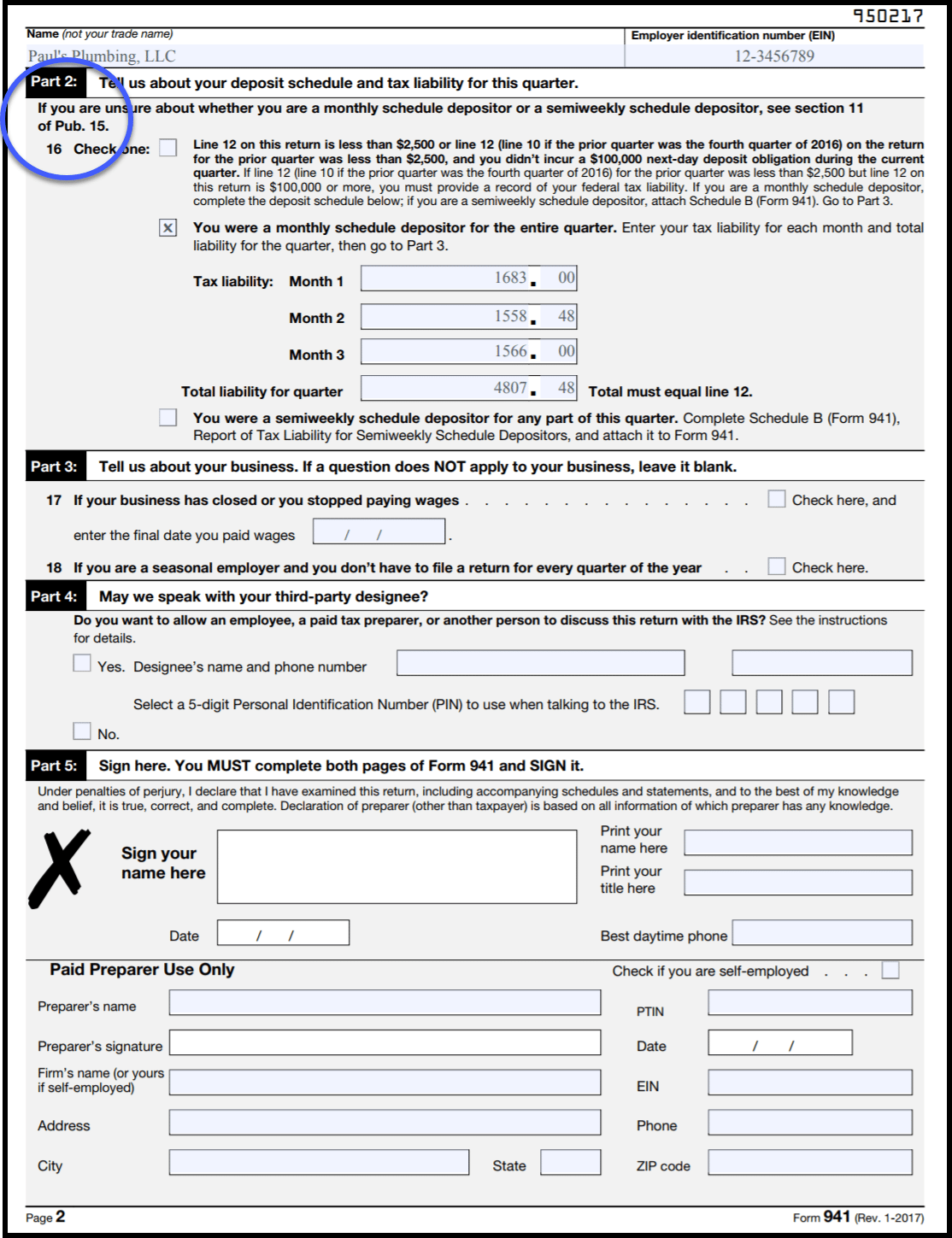

Form 941 is the employer’s quarterly tax return that. If you discover an error on. Web form 941 mailing addresses are changed | irs encourages electronic filing of employment tax returns the irs announced that, effective immediately, the addresses where paper. So, if you want a professional that's successfully prepared and filed payroll tax returns for over twenty years to do it for you,. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and. What kinds of errors can be. Web amended irs form 941. Web mailing addresses for forms 941. Web on form 941, you must report things like wages paid to employees, fica (social security and medicare) tax, and federal income taxes. Where to mail form 941?

Where to mail form 941? So, if you want a professional that's successfully prepared and filed payroll tax returns for over twenty years to do it for you,. Form 941 is the employer’s quarterly tax return that. Web amended irs form 941. How can i file or pay electronically? Connecticut, delaware, district of columbia, georgia,. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and. Web on form 941, you must report things like wages paid to employees, fica (social security and medicare) tax, and federal income taxes. The mailing address depends on the state your business is in, whether you’re submitting payment with your return and what quarter. If you decide to paper file your form 941 return, you must mail a copy of the return to the irs.

Where do I mail Form 941?

If you discover an error on. Where to mail form 941? The mailing address depends on the state your business is in, whether you’re submitting payment with your return and what quarter. If you decide to paper file your form 941 return, you must mail a copy of the return to the irs. So, if you want a professional that's.

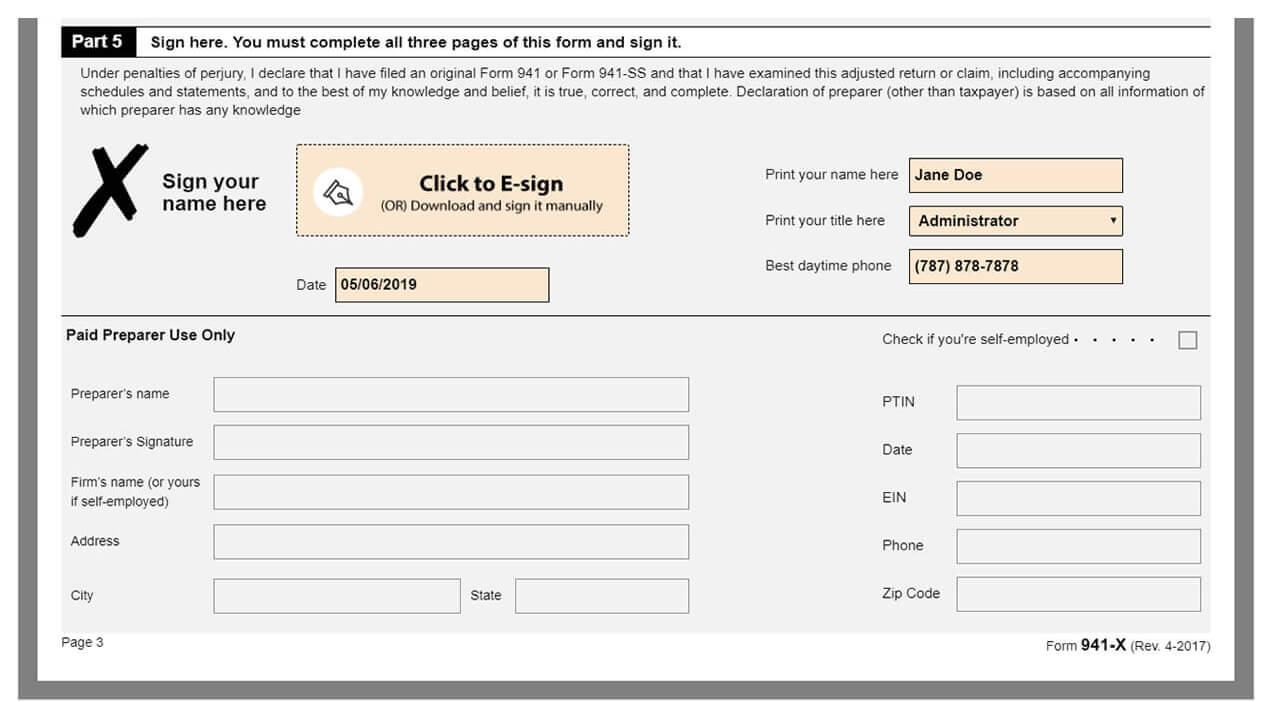

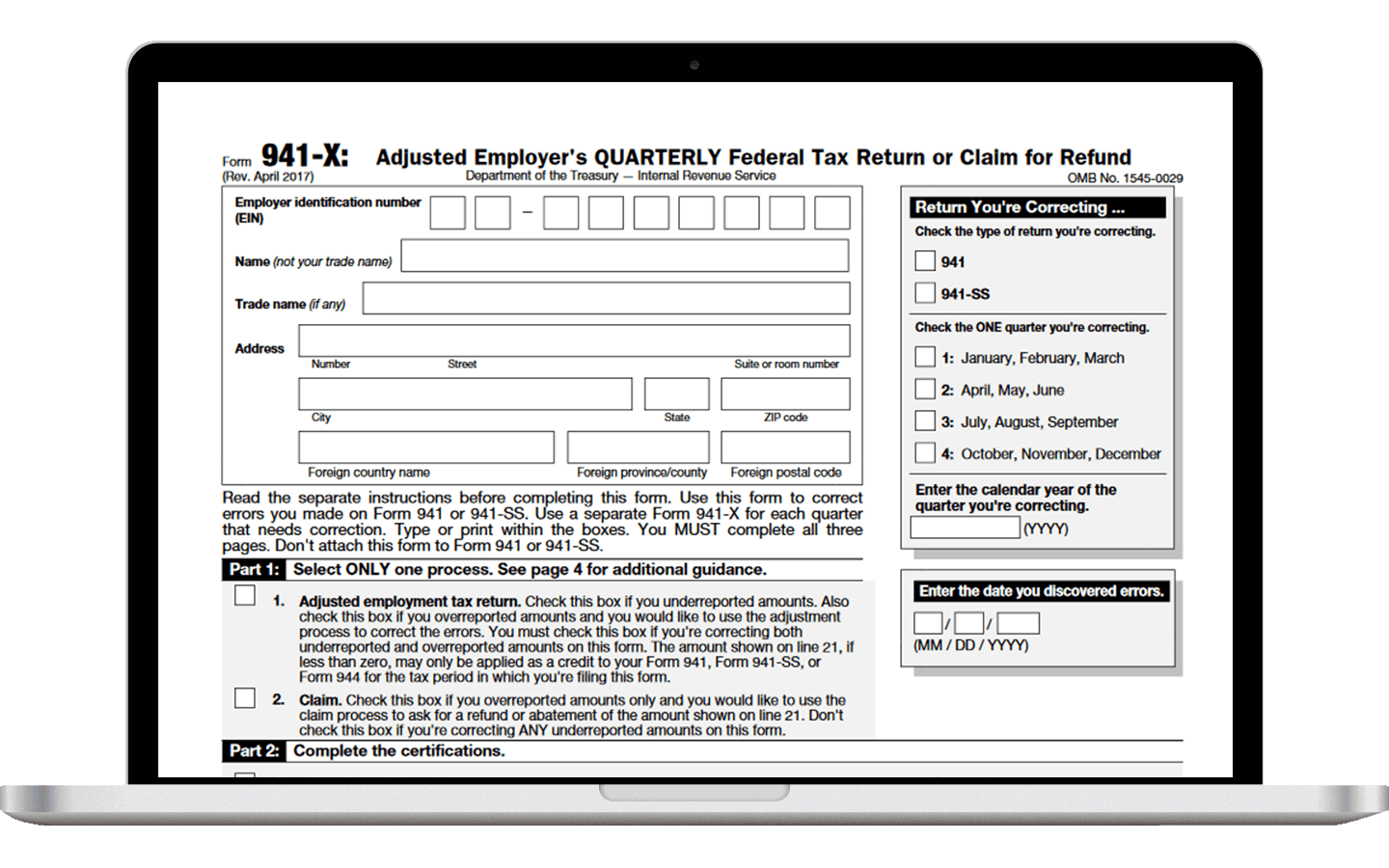

How To Fill Out Form 941 X For Employee Retention Credit In 2020

Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and. How can i file or pay electronically? The mailing address depends on the state your business is in, whether you’re submitting payment with your return and what quarter. Form 941 is the employer’s quarterly tax return that. Web on form 941,.

Form 941 X mailing address Fill online, Printable, Fillable Blank

The mailing address depends on the state your business is in, whether you’re submitting payment with your return and what quarter. What kinds of errors can be. Form 941 is the employer’s quarterly tax return that. Web form 941 mailing addresses are changed | irs encourages electronic filing of employment tax returns the irs announced that, effective immediately, the addresses.

Print Irs Form 941 Fill Online, Printable, Fillable, Blank pdfFiller

How can i file or pay electronically? If you decide to paper file your form 941 return, you must mail a copy of the return to the irs. The mailing address of your form 941. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and. So, if you want a professional.

How to Complete & Download Form 941X (Amended Form 941)?

The mailing address depends on the state your business is in, whether you’re submitting payment with your return and what quarter. Connecticut, delaware, district of columbia, georgia,. What kinds of errors can be. Web form 941 mailing addresses are changed | irs encourages electronic filing of employment tax returns the irs announced that, effective immediately, the addresses where paper. So,.

Form 941 Instructions & FICA Tax Rate 2018 (+ Mailing Address)

Web you can also mail form 941. Web form 941 mailing addresses are changed | irs encourages electronic filing of employment tax returns the irs announced that, effective immediately, the addresses where paper. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and. Where to mail form 941? Web on form.

10 Form Irs 10 10 Secrets About 10 Form Irs 10 That Has Never Been

Web you can also mail form 941. Where to mail form 941? What kinds of errors can be. Web on form 941, you must report things like wages paid to employees, fica (social security and medicare) tax, and federal income taxes. Connecticut, delaware, district of columbia, georgia,.

IRS Fillable Forms 2290, 941, 941X, W2 & 1099 Download & Print

Connecticut, delaware, district of columbia, georgia,. Web mailing addresses for forms 941. Web form 941 mailing addresses are changed | irs encourages electronic filing of employment tax returns the irs announced that, effective immediately, the addresses where paper. The mailing address of your form 941. If you discover an error on.

Employee Retention Credit (ERC) Form 941X Everything You Need to Know

Web you can also mail form 941. The mailing address of your form 941. So, if you want a professional that's successfully prepared and filed payroll tax returns for over twenty years to do it for you,. Web amended irs form 941. The mailing address depends on the state your business is in, whether you’re submitting payment with your return.

Don’t mess with tax code 941. But if you’re late, here’s what to do.

Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and. The mailing address depends on the state your business is in, whether you’re submitting payment with your return and what quarter. How can i file or pay electronically? If you discover an error on. What kinds of errors can be.

If You Discover An Error On.

Web amended irs form 941. How can i file or pay electronically? Where to mail form 941? Connecticut, delaware, district of columbia, georgia,.

Web Form 941 Mailing Addresses Are Changed | Irs Encourages Electronic Filing Of Employment Tax Returns The Irs Announced That, Effective Immediately, The Addresses Where Paper.

The mailing address depends on the state your business is in, whether you’re submitting payment with your return and what quarter. Form 941 is the employer’s quarterly tax return that. What kinds of errors can be. Web you can also mail form 941.

Employee Wages, Income Tax Withheld From Wages, Taxable Social Security Wages, Taxable Social Security Tips, Taxable Medicare Wages And.

So, if you want a professional that's successfully prepared and filed payroll tax returns for over twenty years to do it for you,. Web on form 941, you must report things like wages paid to employees, fica (social security and medicare) tax, and federal income taxes. The mailing address of your form 941. If you decide to paper file your form 941 return, you must mail a copy of the return to the irs.