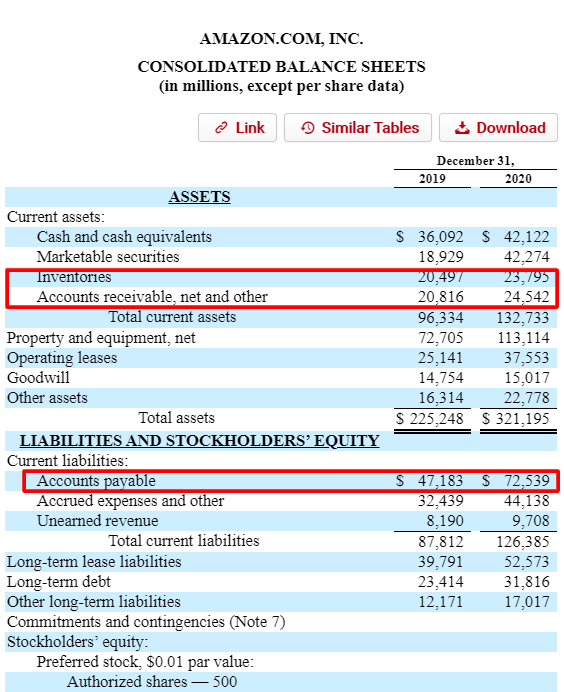

Where Do Accounts Receivable Go On A Balance Sheet

Where Do Accounts Receivable Go On A Balance Sheet - Web updated march 28, 2022 reviewed by jefreda r. Key takeaways accounts receivable (ar) are. Web accounts receivable are listed on the balance sheet as a current asset. Any amount of money owed by customers for purchases made on credit is ar. Accounts receivable are classified as an asset because they provide value to your. Web accounts receivable (ar) → accounts receivable is a current asset recorded on the balance sheet that captures the outstanding cash payments still owed from customers, i.e. Web accounts receivable, sometimes shortened to receivables or a/r, is money owed to a company by its customers. Brown investors should interpret accounts receivable information on a company's balance sheet as money that the company has a reasonable. If a company has delivered products or services but not yet received. Web you can find your accounts receivable balance under the ‘current assets’ section on your balance sheet or general ledger.

Web you can find your accounts receivable balance under the ‘current assets’ section on your balance sheet or general ledger. Web updated march 28, 2022 reviewed by jefreda r. Web accounts receivable are listed on the balance sheet as a current asset. Web accounts receivable (ar) → accounts receivable is a current asset recorded on the balance sheet that captures the outstanding cash payments still owed from customers, i.e. If a company has delivered products or services but not yet received. Any amount of money owed by customers for purchases made on credit is ar. Brown investors should interpret accounts receivable information on a company's balance sheet as money that the company has a reasonable. Accounts receivable are classified as an asset because they provide value to your. Key takeaways accounts receivable (ar) are. Web accounts receivable, sometimes shortened to receivables or a/r, is money owed to a company by its customers.

Web you can find your accounts receivable balance under the ‘current assets’ section on your balance sheet or general ledger. Any amount of money owed by customers for purchases made on credit is ar. Web accounts receivable, sometimes shortened to receivables or a/r, is money owed to a company by its customers. Brown investors should interpret accounts receivable information on a company's balance sheet as money that the company has a reasonable. Key takeaways accounts receivable (ar) are. If a company has delivered products or services but not yet received. Web updated march 28, 2022 reviewed by jefreda r. Web accounts receivable are listed on the balance sheet as a current asset. Web accounts receivable (ar) → accounts receivable is a current asset recorded on the balance sheet that captures the outstanding cash payments still owed from customers, i.e. Accounts receivable are classified as an asset because they provide value to your.

Notes Receivable Definition Accounting

Any amount of money owed by customers for purchases made on credit is ar. Accounts receivable are classified as an asset because they provide value to your. Brown investors should interpret accounts receivable information on a company's balance sheet as money that the company has a reasonable. Web updated march 28, 2022 reviewed by jefreda r. Web you can find.

Accounts Receivable Vs. Accounts Payable and the Working Capital Cycle

Brown investors should interpret accounts receivable information on a company's balance sheet as money that the company has a reasonable. Web you can find your accounts receivable balance under the ‘current assets’ section on your balance sheet or general ledger. Web updated march 28, 2022 reviewed by jefreda r. Web accounts receivable (ar) → accounts receivable is a current asset.

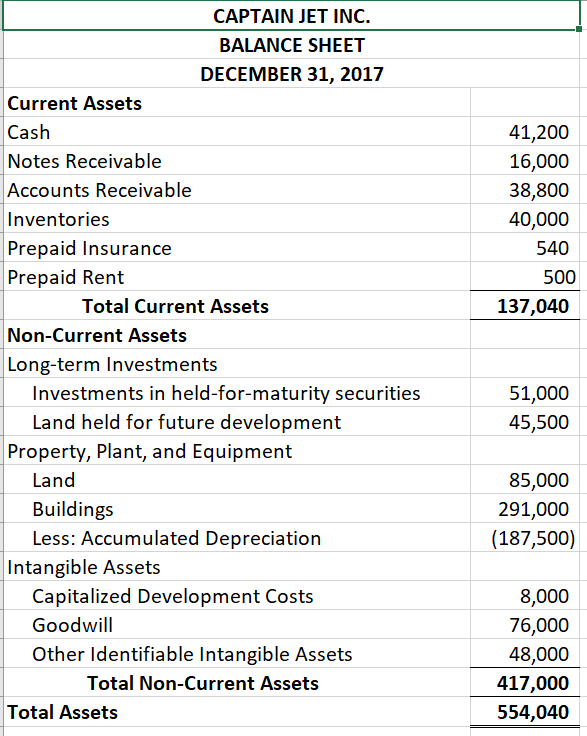

Solved CAPTAIN JET INC. BALANCE SHEET DECEMBER 31, 2017

Brown investors should interpret accounts receivable information on a company's balance sheet as money that the company has a reasonable. Accounts receivable are classified as an asset because they provide value to your. Web accounts receivable (ar) → accounts receivable is a current asset recorded on the balance sheet that captures the outstanding cash payments still owed from customers, i.e..

Accounts Receivable (AR) What They Are and How to Interpret Pareto Labs

Key takeaways accounts receivable (ar) are. If a company has delivered products or services but not yet received. Brown investors should interpret accounts receivable information on a company's balance sheet as money that the company has a reasonable. Any amount of money owed by customers for purchases made on credit is ar. Web accounts receivable, sometimes shortened to receivables or.

Accounts Receivable Are Best Described as

Any amount of money owed by customers for purchases made on credit is ar. Brown investors should interpret accounts receivable information on a company's balance sheet as money that the company has a reasonable. Web you can find your accounts receivable balance under the ‘current assets’ section on your balance sheet or general ledger. Key takeaways accounts receivable (ar) are..

Balance sheet example Accounting Play

If a company has delivered products or services but not yet received. Key takeaways accounts receivable (ar) are. Any amount of money owed by customers for purchases made on credit is ar. Web accounts receivable are listed on the balance sheet as a current asset. Web you can find your accounts receivable balance under the ‘current assets’ section on your.

Accounts Receivable on the Balance Sheet Accounting Education

Web accounts receivable (ar) → accounts receivable is a current asset recorded on the balance sheet that captures the outstanding cash payments still owed from customers, i.e. Web you can find your accounts receivable balance under the ‘current assets’ section on your balance sheet or general ledger. Web accounts receivable, sometimes shortened to receivables or a/r, is money owed to.

The Importance of an Accurate Balance Sheet Basis 365 Accounting

If a company has delivered products or services but not yet received. Accounts receivable are classified as an asset because they provide value to your. Web updated march 28, 2022 reviewed by jefreda r. Any amount of money owed by customers for purchases made on credit is ar. Brown investors should interpret accounts receivable information on a company's balance sheet.

Solved Balance Sheet 2009 2008 Cash Accounts receivable

If a company has delivered products or services but not yet received. Web accounts receivable (ar) → accounts receivable is a current asset recorded on the balance sheet that captures the outstanding cash payments still owed from customers, i.e. Key takeaways accounts receivable (ar) are. Web updated march 28, 2022 reviewed by jefreda r. Any amount of money owed by.

How do accounts payable show on the balance sheet? شبکه اطلاع رسانی

Any amount of money owed by customers for purchases made on credit is ar. Brown investors should interpret accounts receivable information on a company's balance sheet as money that the company has a reasonable. Web you can find your accounts receivable balance under the ‘current assets’ section on your balance sheet or general ledger. Accounts receivable are classified as an.

Web Accounts Receivable, Sometimes Shortened To Receivables Or A/R, Is Money Owed To A Company By Its Customers.

Accounts receivable are classified as an asset because they provide value to your. Key takeaways accounts receivable (ar) are. Any amount of money owed by customers for purchases made on credit is ar. If a company has delivered products or services but not yet received.

Web Accounts Receivable Are Listed On The Balance Sheet As A Current Asset.

Web accounts receivable (ar) → accounts receivable is a current asset recorded on the balance sheet that captures the outstanding cash payments still owed from customers, i.e. Web you can find your accounts receivable balance under the ‘current assets’ section on your balance sheet or general ledger. Brown investors should interpret accounts receivable information on a company's balance sheet as money that the company has a reasonable. Web updated march 28, 2022 reviewed by jefreda r.