When Was Form 8938 First Required

When Was Form 8938 First Required - Web comparison of form 8938 and fbar requirements. For individuals, the form 8938 due dates, include: Web fatca form 8938 is new and was first introduced on the 2011 1040 tax return, but the fbar has been around since 1970. Web the european union says etias approval will stay valid for three years or until the passport you used in your application expires. Web bank and investment accounts must be reported. Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. Web how do i file form 8938, statement of specified foreign financial assets? Web in this situation, you only need to file a form 8938 when on the last day of the current tax year the fair market value of their asset exceeds $50,000, or the value. The standard penalty is a fine of $10,000 per year. Web failing to file form 8938 when required can result in severe penalties.

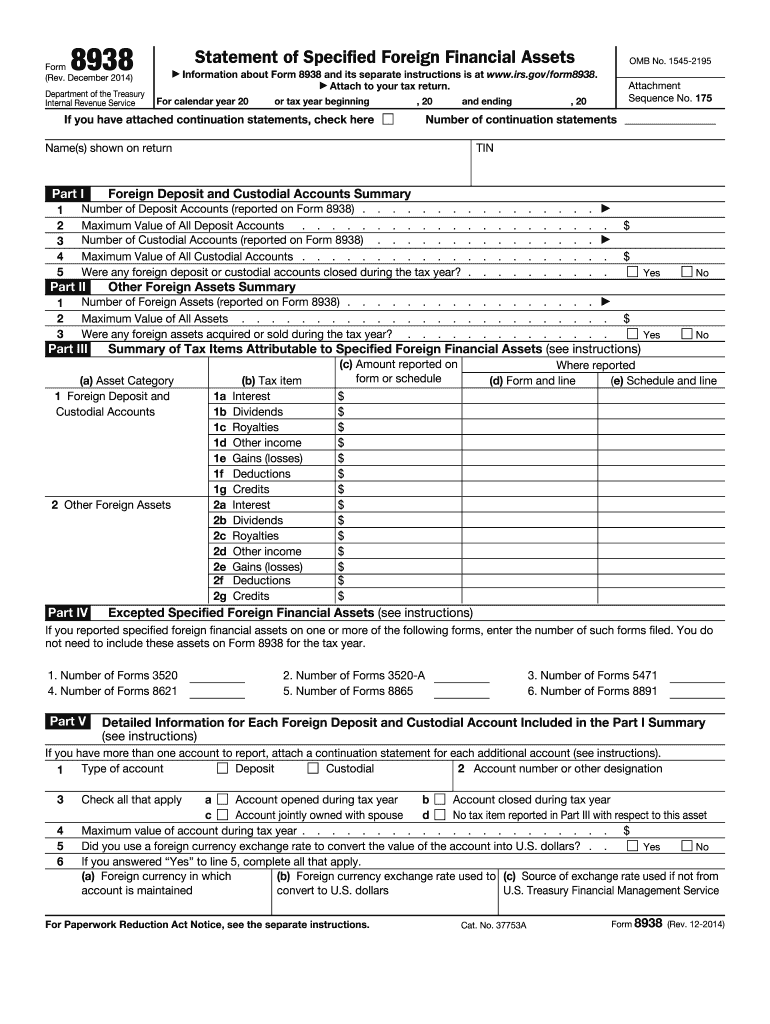

Use form 8938 to report your. Web certain domestic corporations, partnerships, and trusts that are considered formed or availed of for the purpose of holding, directly or indirectly, specified foreign financial. The form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file fincen form 114 (report of. Solved • by turbotax • 965 • updated january 13, 2023 filing form 8938 is only. Web comparison of form 8938 and fbar requirements. The standard penalty is a fine of $10,000 per year. Web summary of fatca & fincen the purpose of this article is to summarize the fbar vs 8938 comparison — and when each form is required by the irs. Web by kunal patel “fatca” (foreign account tax compliance act) requires specified individuals to report ownership of specified foreign financial assets if the total value. Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. Web failing to file form 8938 when required can result in severe penalties.

Web by kunal patel “fatca” (foreign account tax compliance act) requires specified individuals to report ownership of specified foreign financial assets if the total value. Web the form 8938 is a part of the tax return. Web comparison of form 8938 and fbar requirements. The standard penalty is a fine of $10,000 per year. Use form 8938 to report your. Web 8938 form filing deadline. Web how do i file form 8938, statement of specified foreign financial assets? The form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file fincen form 114 (report of. Web certain domestic corporations, partnerships, and trusts that are considered formed or availed of for the purpose of holding, directly or indirectly, specified foreign financial. It was developed by fincen (financial crimes.

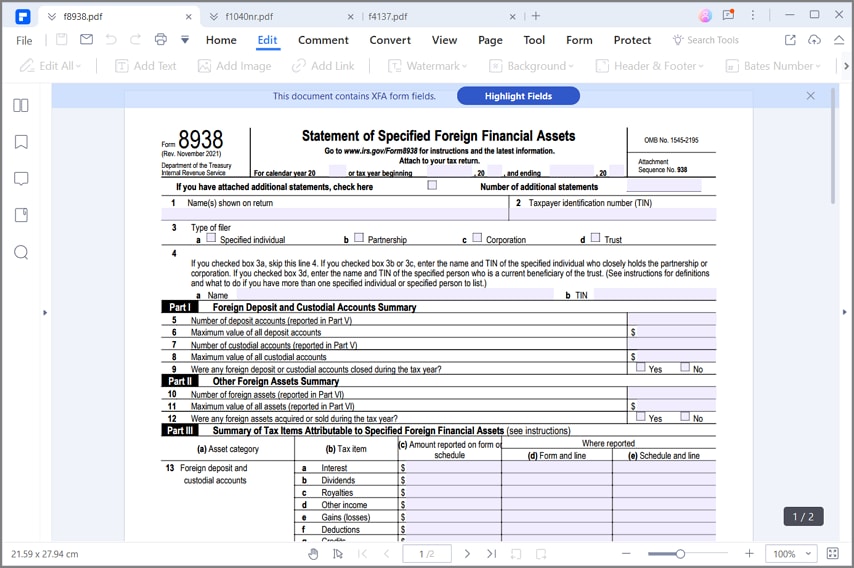

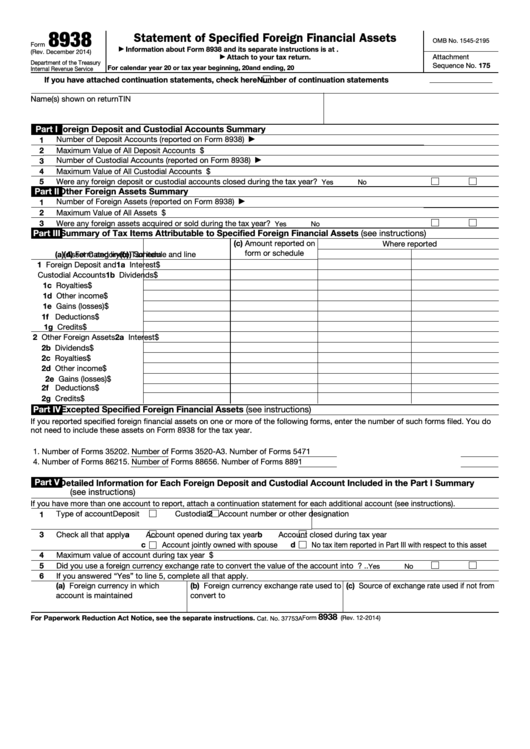

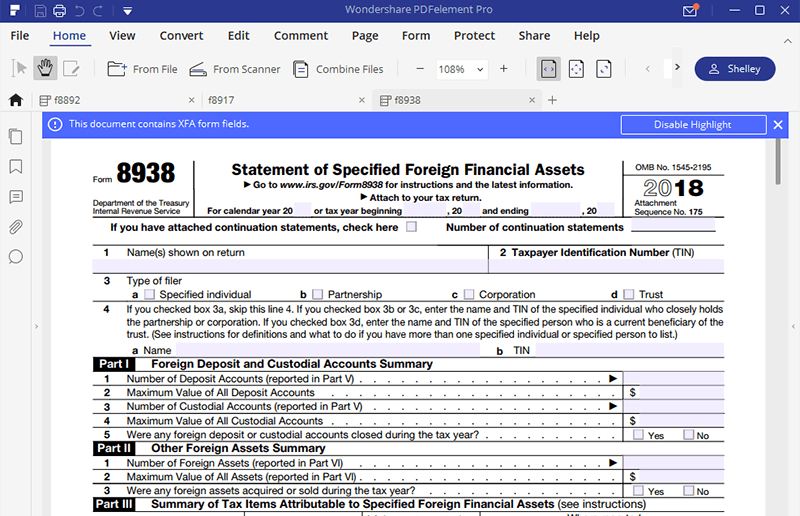

IRS Form 8938 How to Fill it with the Best Form Filler

Web failing to file form 8938 when required can result in severe penalties. Solved • by turbotax • 965 • updated january 13, 2023 filing form 8938 is only. Web certain domestic corporations, partnerships, and trusts that are considered formed or availed of for the purpose of holding, directly or indirectly, specified foreign financial. For individuals, the form 8938 due.

Fillable Form 8938 Statement Of Specified Foreign Financial Assets

Web how do i file form 8938, statement of specified foreign financial assets? Use form 8938 to report your. Web taxpayers generally have an obligation to report their foreign asset holdings to the irs on form 8938, statement of specified foreign financial assets, and to the. Web certain domestic corporations, partnerships, and trusts that are considered formed or availed of.

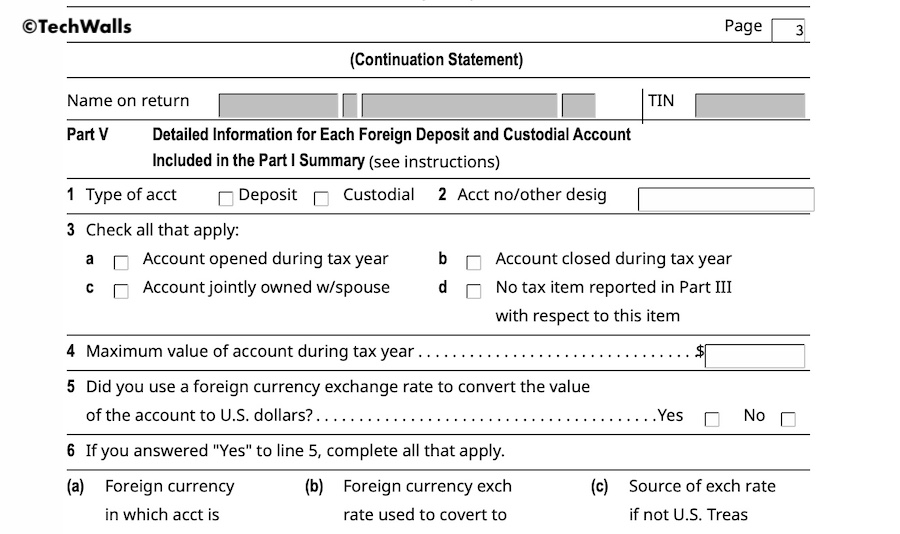

How to Add Continuation Pages with Form 8938 in H&R Block (Reporting

Web in this situation, you only need to file a form 8938 when on the last day of the current tax year the fair market value of their asset exceeds $50,000, or the value. The standard penalty is a fine of $10,000 per year. Web fatca form 8938 is new and was first introduced on the 2011 1040 tax return,.

Form 8938, Statement of Specified Foreign Financial Assets YouTube

Web certain domestic corporations, partnerships, and trusts that are considered formed or availed of for the purpose of holding, directly or indirectly, specified foreign financial. Solved • by turbotax • 965 • updated january 13, 2023 filing form 8938 is only. If the irs notifies taxpayers that they are delinquent, they. The standard penalty is a fine of $10,000 per.

Form 8938 Who Needs To File The Form And What's Included? Silver Tax

Naturally, you'll also need to. The form 8938 instructions are complex. The standard penalty is a fine of $10,000 per year. Web how do i file form 8938, statement of specified foreign financial assets? Taxpayers to report specified foreign financial assets each year on a form 8938.

IRS Form 8938 How to Fill it with the Best Form Filler

Instructions for form 8038 created date: Web fatca form 8938 is new and was first introduced on the 2011 1040 tax return, but the fbar has been around since 1970. Web bank and investment accounts must be reported. Naturally, you'll also need to. Web 8938 form filing deadline.

Form 8938 Fill Out and Sign Printable PDF Template signNow

Naturally, you'll also need to. Solved • by turbotax • 965 • updated january 13, 2023 filing form 8938 is only. If the irs notifies taxpayers that they are delinquent, they. Web certain domestic corporations, partnerships, and trusts that are considered formed or availed of for the purpose of holding, directly or indirectly, specified foreign financial. For individuals, the form.

Is Form 8938 Reporting Required for Foreign Pension Plans?

Web fatca form 8938 is new and was first introduced on the 2011 1040 tax return, but the fbar has been around since 1970. Web taxpayers generally have an obligation to report their foreign asset holdings to the irs on form 8938, statement of specified foreign financial assets, and to the. Web certain domestic corporations, partnerships, and trusts that are.

2011 Form IRS 8938 Fill Online, Printable, Fillable, Blank pdfFiller

It was developed by fincen (financial crimes. Web 8938 form filing deadline. Naturally, you'll also need to. Web bank and investment accounts must be reported. The due date for fatca reporting is the date your tax return is due to be filed.

Form 8938 Meadows Urquhart Acree and Cook, LLP

Use form 8938 to report your. Web certain domestic corporations, partnerships, and trusts that are considered formed or availed of for the purpose of holding, directly or indirectly, specified foreign financial. Web certain domestic corporations, partnerships, and trusts that are considered formed or availed of for the purpose of holding, directly or indirectly, specified foreign financial. It was developed by.

It Was Developed By Fincen (Financial Crimes.

Web comparison of form 8938 and fbar requirements. For individuals, the form 8938 due dates, include: Web form 8938 and fbar filing requirements. Use form 8938 to report your.

Solved • By Turbotax • 965 • Updated January 13, 2023 Filing Form 8938 Is Only.

The form 8938 instructions are complex. Web fatca form 8938 is new and was first introduced on the 2011 1040 tax return, but the fbar has been around since 1970. Web certain domestic corporations, partnerships, and trusts that are considered formed or availed of for the purpose of holding, directly or indirectly, specified foreign financial. Web in this situation, you only need to file a form 8938 when on the last day of the current tax year the fair market value of their asset exceeds $50,000, or the value.

Instructions For Form 8038 Created Date:

Web taxpayers generally have an obligation to report their foreign asset holdings to the irs on form 8938, statement of specified foreign financial assets, and to the. Naturally, you'll also need to. Web bank and investment accounts must be reported. Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file.

The Form 8938 Filing Requirement Does Not Replace Or Otherwise Affect A Taxpayer’s Obligation To File Fincen Form 114 (Report Of.

When and how to file attach form 8938 to your annual return and file by the due date (including extensions) for that return. Web the european union says etias approval will stay valid for three years or until the passport you used in your application expires. Web 8938 form filing deadline. Web summary of fatca & fincen the purpose of this article is to summarize the fbar vs 8938 comparison — and when each form is required by the irs.